June 2nd, 2023 | 08:30 CEST

Is the Artificial intelligence hype already over? Nvidia, Star Navigation and C3.ai with good chances of a correction!

With an eye on rapid technological progress, the EU and the US want to cooperate more in the field of artificial intelligence (AI). "We are determined to make the most of the potential of emerging technologies while limiting the challenges they pose to universal human rights and shared democratic values," the Joint Trade and Technology Council announces. For the accompanying ethics committees, an important issue now comes to the table: what is a machine allowed to do, and what is it not allowed to do? So the current hype could be curbed again somewhat. Have AI values already peaked?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NVIDIA CORP. DL-_001 | US67066G1040 , STAR NAVIGATION SYS GRP | CA8551571034 , C3.AI INC | US12468P1049

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

C3.ai - Shooting star of the AI scene delivers figures

That was a real sell-off. The shares of the American technology company C3.ai rose to EUR 44.15 on the last trading day in May, creating a market valuation of almost USD 5 billion. However, the Company has only made homeopathic sales so far. Not surprisingly, the Company reported figures on May 31 after trading hours and the share price plummeted by 40%. What happened?

As expected, the AI software developer showed little growth in its preliminary figures for the 2022/23 financial year. Revenues in Q4 totalled USD 72.4 million, exactly the same as in the same quarter of the previous year, but still topped Q3. Operationally, there was still a loss, and the net result of minus USD 64.9 million also disappointed the market experts. It is important to look at the cash position because C3.ai has been burning money every month since the IPO. Here the all-clear is given because the balance sheet at the end of the quarter still shows ample cash of USD 284.8 million after USD 311.1 million in the previous quarter. So, according to Adam Riese, there is still about one financial year to go before investors have to be asked for more cash. But maybe by then, the Company will be making a profit, and everything will be going great.

"Our C3 AI platform is increasingly recognized as the gold standard for Enterprise AI (EAI); we have over 40 production EAI applications delivering rapid value to the market," CEO Thomas Siebel commented on the numbers. Investors who have only recently joined the Company welcome the share price tripling in only 4 weeks; after all, the IPO price of USD 42 was reached again for first-time subscribers. All in all, one feels strongly reminded of the year 2000. Short sellers have already taken C3.ai in their stride.

Star Navigation Systems - Further business in West Africa

The technological developments in AI are not leaving the aviation industry unscathed. Thus, especially in this sensitive area, expert groups are to be set up to deal with standards and emerging risks, among other things. Artificial intelligence is entering the mental world of people. The decisive factor is whether the quality of decision-making by the recipients of data-analytical results increases as a result of the new technologies. This does not necessarily have to be the case because machine learning systems only gain their wealth of experience from history. Definitive new achievements and innovative leaps are not to be expected in this world.

The Canadian company Star Navigation Systems Ltd (SNA) is working intensively on these new decision-making worlds. For example, real-time position and movement data have become standard in air traffic control today. They are evolving in leaps and bounds to meet military requirements as well. The use of machines is very purposeful here because many events are reproducible and resemble certain patterns from the past.

Meanwhile, the Company can come up with further deals. For example, it recently signed a letter of intent with Caverton Helicopters Ltd. for the Star ISMS (In-Flight Safety Monitoring System) as a complete solution for the Company's current fleet of helicopters and aircraft. Caverton will also become a distributor and provider of maintenance, repair and overhaul services in West Africa. Parent company Caverton Offshore Support Group is the first fully integrated offshore support company in sub-Saharan Africa, providing high-quality aviation and marine logistics services to companies in the oil and gas industry. Having built an impressive technological asset base in the region, Caverton Group is well positioned in Africa to take advantage of the many opportunities with the highest levels of safety and efficiency. Star Navigation stands to benefit significantly from this partnership in the medium term. SNA shares are trading at around CAD 0.04 in Canada, with some very high turnover. The Company is well-positioned and a forward-looking investment in the current AI environment.

Nvidia Corp - After the rush comes the hangover

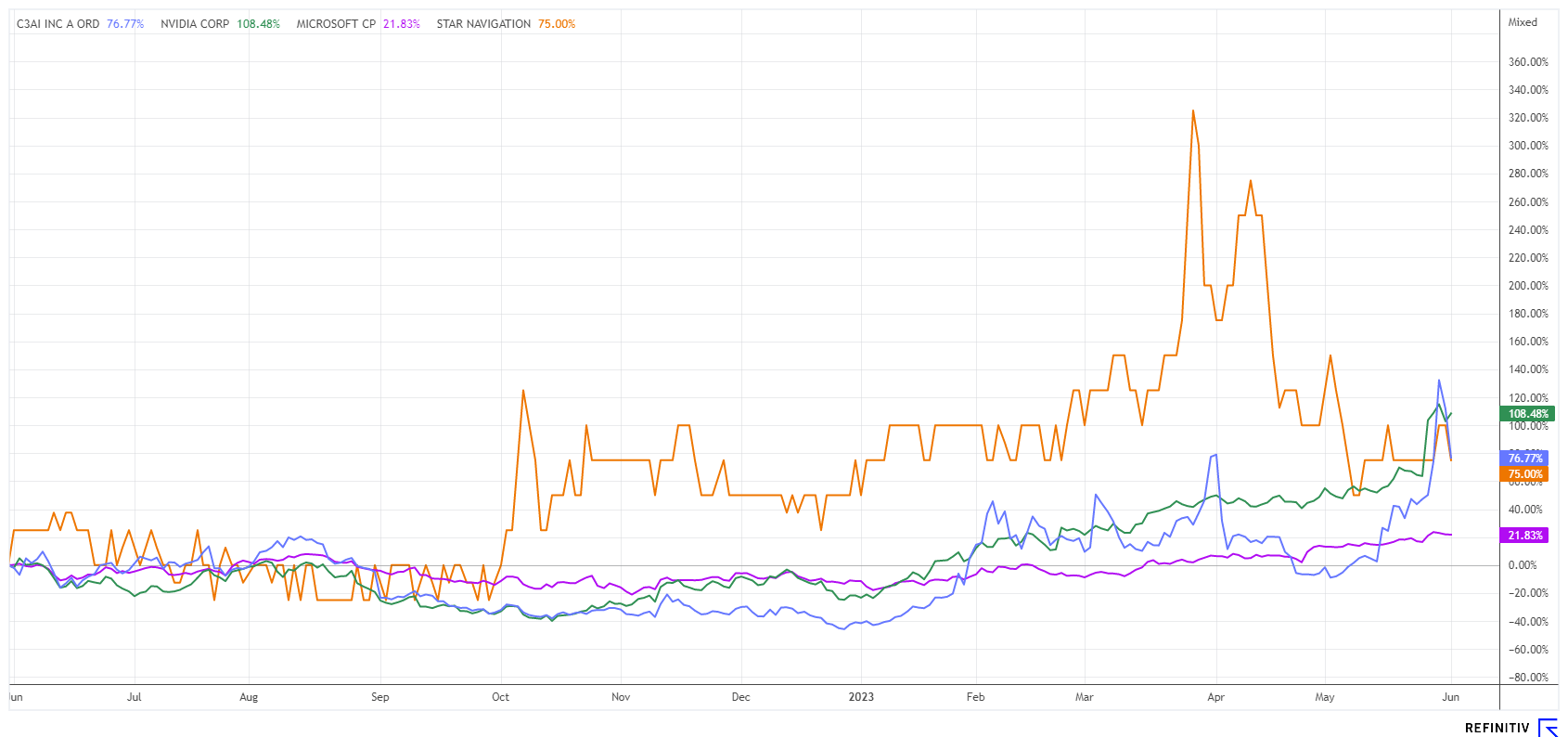

When it comes to AI investing, you need to spot trends early and consistently capitalize on momentum. The Nvidia share is one of the shooting stars in 2023 and has already gained 250% at the peak. This brings back the experiences from the hydrogen hype, but the experts are following suit this time. Numerous positive sector analyses have fuelled the upward trend.

Since March 2023, only upgrades have been visible on the Refinitiv Eikon platform. The experts' opinions are moving in a uniform direction. The US bank JPMorgan, for example, doubled its price target from USD 250 to USD 500 after the last quarterly report but left its rating at "Overweight". JPMorgan analysts believe the first wave of generative AI is coming and will likely get bigger over time. Goldman Sachs does the same as its colleagues and lists a target of USD 440 after USD 275 with a "Buy" recommendation. Analyst Toshia Hary is particularly impressed by the revenue outlook for the data centre business.

On average, the 49 analysts on the Refinitiv Eikon platform expect the stock to reach USD 448.50 in 12 months. Since the share had already reached the USD 420 mark earlier in the week, the price promptly reacted with a small hangover and fell back by 10% to USD 378. But already yesterday, it managed another turnaround to over USD 395. Highly exciting!

The AI sector is still at the beginning of its development. The corresponding shares are experiencing a gold rush similar to the one in 1999. What followed is known, but the melting point may still be years to come - nobody knows. C3.ai is expensive, whereas Nvidia and Star Navigation can report good operational success. To reduce risk in the portfolio, we recommend sufficient diversification across several technology stocks in different sectors.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.