January 29th, 2026 | 07:35 CET

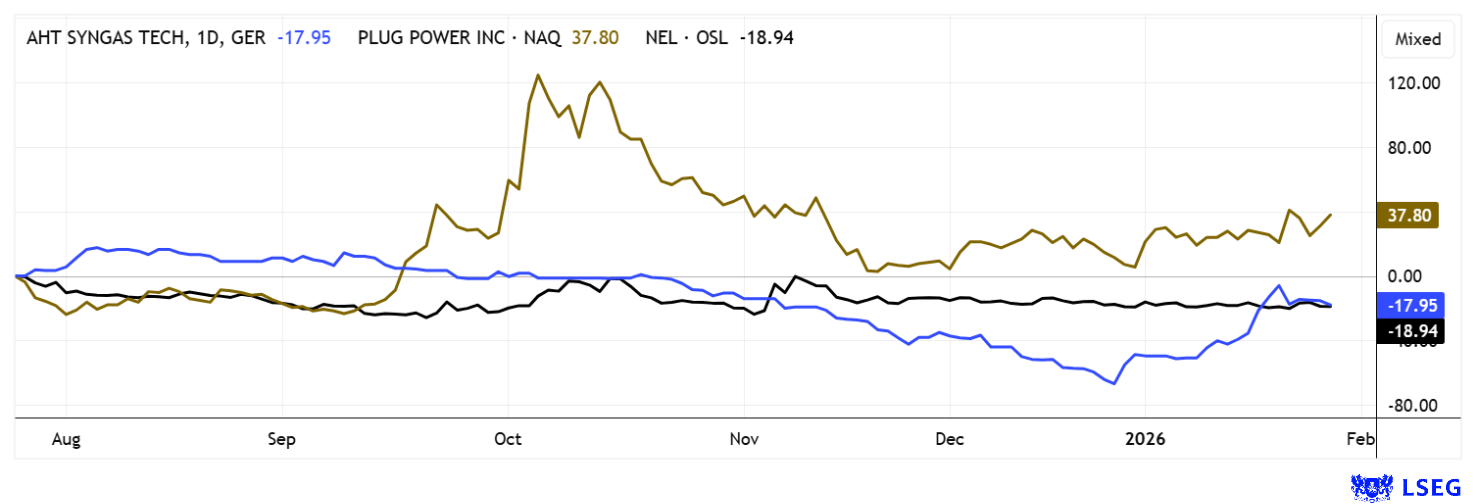

Iran conflict and oil prices at USD 100? Caution advised for Nel ASA, A.H.T. Syngas, and Plug Power

The stock markets are in absolute stress mode! The US dollar has been depreciating for days, silver, gold, and copper are skyrocketing, and yesterday oil also started to rise. The threatening gestures from Washington are slowly making it clear that the number of geopolitical conflicts could even expand to include Iran in the short term. The Pentagon has sent an armada of ships to the Persian Gulf. Just another Donald show? Maybe, but maybe not! On platform X, he makes it unmistakably clear that an intervention in Iran's sovereignty could be imminent at any time. This means absolute "panic mode" for the commodity markets, as Iran produces over 4 million barrels of oil per day, and Western industries fear for their supply chains. We take a look at a few scenarios that are related to this situation in extended mode.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , A.H.T. SYNGAS TECH. EO 1 | NL0010872388 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] Recovery rates of more than 90% rare earths are another piece of the puzzle on the way to the economic viability of our project. [...]" Craig Taylor, CEO, Defense Metals

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Plug Power – Out of the shadows and into the light

At US hydrogen expert Plug Power, the order book is moving on the stock market as well as in its operating business. Plug Power is symbolic of the extreme cycles in industry. A euphoric high in 2021 was followed by a massive revaluation in 2025, triggered by capital requirements, operational setbacks, and a harsher funding environment in the US. However, the picture is currently brightening. At the end of last week, Plug Power announced that it had reached another milestone. The hydrogen specialist reported the installation of electrolysers with a total capacity of 100 MW at the Sines refinery of Portuguese energy group Galp. Plug Power had already announced the first delivery of the new 10 MW modules in October, and installation has now been completed. The US company has thus managed to complete another major order in the EU, a significant milestone for further large-scale projects in Europe. After several rounds of financing at low share prices, the situation now appears to be stabilizing technically as well. Even though there is still a long way to go before sustainable profitability is achieved, initial operational and technical signals indicate that the bottom has been reached, which puts Plug Power back on the radar, especially for high-risk-tolerant investors. The USD 1.95 to 2.55 zone is technically important. Investors should take a closer look at the price movements again - with their reading glasses on!

A.H.T. Syngas Technology – From plant manufacturer to integrated clean energy provider

Another greentech provider is making a name for itself in Germany. Although A.H.T. Syngas Technology NV is a Dutch company, it is listed on the German stock exchange. The Company has positioned itself as a specialist provider of decentralized, climate-friendly energy generation based on biomass and syngas. The European market for syngas is considered a dynamic growth market, which, according to industry studies, is likely to expand significantly faster than traditional gas demand by 2035. Technologically, A.H.T. relies on a patented double-fire gasification system that can flexibly process different biogenic feedstocks. This technology enables combined power, heat, and hot gas applications and is particularly suitable for decentralized industrial projects. Through the consistent standardization of its plants, the Company has been able to increase its response speed while reducing costs.

At the same time, A.H.T. is undergoing a strategic transformation from a pure plant manufacturer to an operator of its own energy plants. This contracting model extends the value chain and creates predictable, recurring revenues. Following project-related setbacks in Asia, the operational focus is now clearly on Europe, where several projects are being prepared or are already underway. The Company's website emphasizes its commitment to offering comprehensive energy solutions, including operation, maintenance, and optimization. With its combination of technological expertise, market standardization, and operator approach, A.H.T. addresses key requirements for industrial decarbonization.

The Company started the 2026 financial year in a strong financial position with a fully placed convertible bond of EUR 2 million, giving it scope for ongoing projects and strategic development. The focus is on solutions for substituting natural gas and on low-greenhouse-gas energy directly at the point of industrial consumption. Despite the Company's current low valuation of around EUR 7 million, the capital market sees considerable catch-up potential. The share price is currently still fluctuating between EUR 3.70 and EUR 4.50, but this does not appear excessive according to the latest research from GBC. They have set a 12-month price target of EUR 8.50. Well then - let's get to it!

Nel ASA – This could open up new dimensions

Nel ASA is currently pursuing a comparatively stringent course and stands to benefit from Europe's long-term hydrogen agenda. Thanks to a still comfortable liquidity position and cautious investments, the Company is better able to coordinate innovation and growth. The focus is on a new generation of electrolysers based on pressure-driven alkaline technology, which is clearly aimed at reducing costs and increasing efficiency. The expansion of production in Herøya with a capacity of up to one gigawatt is intended to create economies of scale and make green hydrogen more economically attractive. This would make projects that previously relied on massive subsidies financially viable. This new technology could give Nel a decisive competitive advantage in the H2 market.

At the same time, Nel is still in a significant phase of weakness in terms of operations and stock market performance, with declining revenue, high operating losses, and a share price below book value. The hydrogen market is developing more slowly than hoped, but the structural conditions for future growth remain intact. Tailwinds are coming from the EU Innovation Fund and the industrialization of the new technology. If a breakthrough is achieved here, Nel could regain relevance in the medium term and become a positive surprise for patient, risk-aware investors. Analysts on the LSEG platform remain divided. Price targets range from NOK 1.20 to NOK 4.20 (around EUR 0.35). This wide range reflects the uncertainty, but also the opportunity for bold investors. Keep an eye on the EUR 0.21 line; the Norwegians are currently trading at EUR 0.195. But it feels like they have been there for weeks.

The year 2026 holds a few surprises. While commodity stocks continue to boom, some of the popular technology stocks are experiencing sharp downward movements. The focus continues to be on the unresolved energy issues that the EU, in particular, is struggling with. The current state of energy policy on the old continent shows more twists and turns than unity. In this environment, A.H.T. Syngas Technology, Plug Power, and Nel ASA could unexpectedly gain new strength.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.