July 29th, 2024 | 06:30 CEST

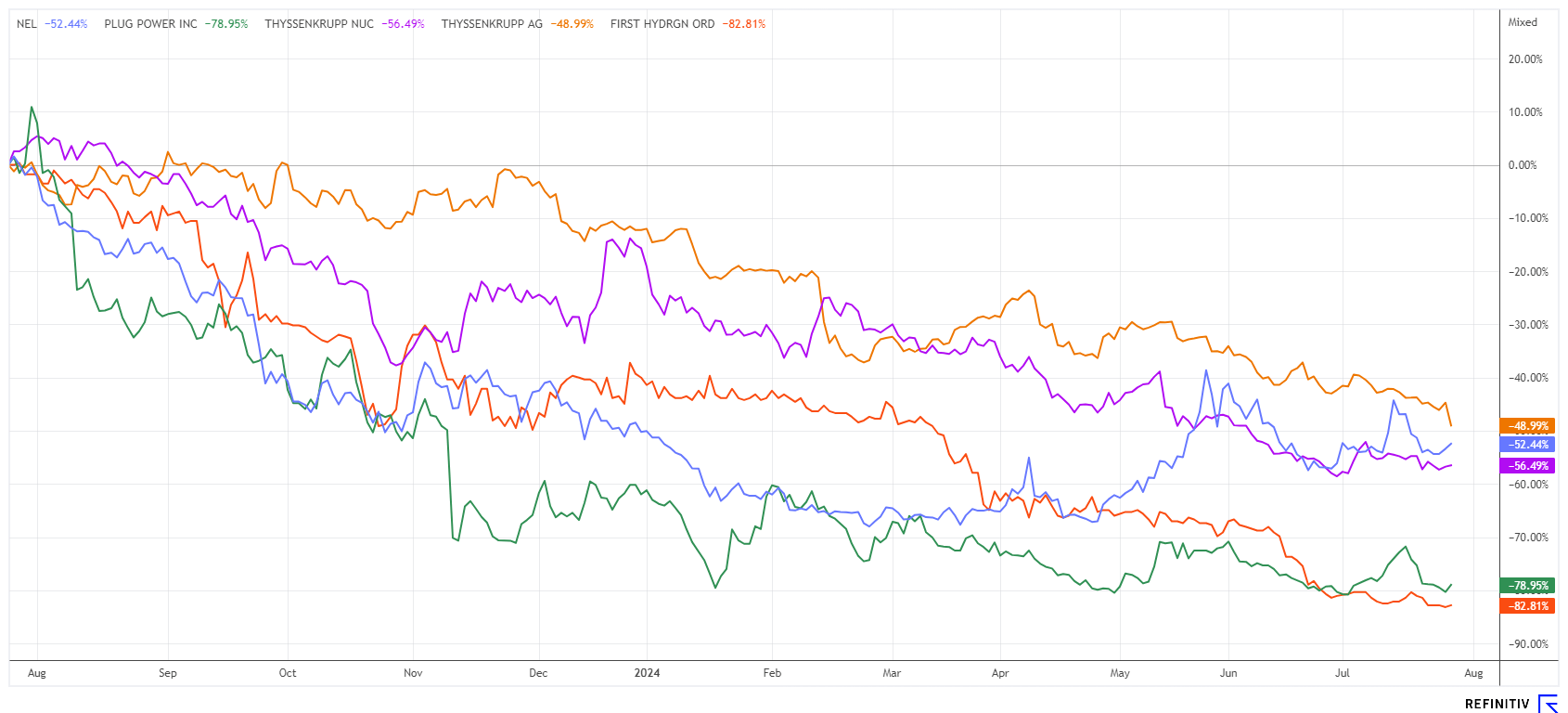

Here we go! Olympic 250% with hydrogen! Nel, Plug Power, First Hydrogen, thyssenkrupp and nucera

Olympia goes Hydrogen! Japanese car manufacturer Toyota is providing a fleet of 500 Mirai hydrogen vehicles, 10 hydrogen buses, and 1,150 electric vehicles for the Olympic Games in Paris. Although hydrogen vehicles, such as the Toyota Mirai, produce virtually no emissions, 96% of the hydrogen produced worldwide still comes from fossil fuels such as methane gas. As a result, most hydrogen vehicles currently cause significantly more pollution than battery-powered electric vehicles and are only marginally cleaner than conventional combustion engines. However, there are notable exceptions: First Hydrogen is demonstrating how things could work in the future with the EU's 'Net Zero 2050' target!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020 , First Hydrogen Corp. | CA32057N1042 , THYSSENKRUPP AG O.N. | DE0007500001 , THYSSENKRUPP NUCERA AG & CO KGAA | DE000NCA0001

Table of contents:

"[...] We can convert buses and trucks to be completely climate neutral. In doing so, we take a modular and incremental approach. That means we can work with all current vehicle types and respond to new technology and innovation [...]" Dirk Graszt, CEO, Clean Logistics SE

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA and Plug Power - Need for more funds again?

The second quarter was not impressive for either Nel ASA or Plug Power. The Norwegian hydrogen pioneer reported a negative EBITDA of NOK -79 million and 10% lower revenue of NOK 332 million following the spin-off of its refuelling subsidiary Cavendish. At the end of the quarter, the order backlog still totalled NOK 2.1 billion. The Company currently has a comfortable NOK 2.28 billion in cash, which provides a certain degree of security for the next four quarters. The second 500 MW production line at the Herøya plant was completed and went into commercial operation in Q2, bringing the total annual production capacity for alkaline to 1 GW. In addition, the expansion program for the Wallingford plant went according to plan. Nel ASA currently has no financial concerns, but there is a lack of new orders.

The situation is worse for the American competitor Plug Power. It is alarming that the shareholders are being asked to pay up again before the quarterly figures are published, and this is not far from the share's all-time low. CEO Andy Marsh is obviously concerned that no one will want to subscribe to new shares after the report, which is expected to be poor. Plug Power was able to place just under 79 million shares at a price of USD 200 million in a quick action. The quarterly report is now expected on August 6. Both Nel ASA and Plug Power should only be considered by risk-conscious investors. Chartwise, the shares are still in the middle of bottoming out.

First Hydrogen - Now very well positioned in Europe

The Canadian hydrogen specialist First Hydrogen has good news in the pipeline. The Quebec-based company is building a compound site for the assembly of hydrogen-powered delivery vehicles (FCEV) and the associated refuelling station infrastructure. Extensive tests have already been successfully completed in Europe, and significant enquiries have already been made from Amazon and a logistics provider from Mexico. The British gas supplier Wales & West Utilities (WWU) was also impressed by the future-oriented vans after the test series. Following the four successful tests of the green hydrogen-powered fuel cell commercial vehicle (FCEV) in the UK, the Company will provide a left-hand drive model and thus expand its global market presence.

The European Commission has approved four waves of hydrogen Integrated Projects of Common European Interest (IPCEI) in its 'Net Zero 2020' forward plan, which aims to raise EUR 43 billion to support more than 120 projects involving around 100 European companies. The UK has similar objectives. The projects cover the hydrogen ecosystem from production to import, transport, and end-use. The Commission will also intensify its cooperation with international partners on the deployment of clean hydrogen and the development of hydrogen markets.

CEO Balraj Mann of First Hydrogen commented: "Green hydrogen offers sustainability and zero emissions, reducing the carbon footprint and contributing to decarbonization targets. Our FCEVs fuelled by green hydrogen are free of greenhouse gas emissions, the only by-product is water."

FHYD shares are currently trading at around EUR 0.33 with good volume. This low price is not understandable, as First Hydrogen is making good progress. Should the EU award a major H2 contract, the share will likely soar. There are thousands of starting points for shaping a zero-emission future, the clock is ticking to 2050.

thyssenkrupp and subsidiary nucera - The rocky road

This was unexpected by the market. The technology and steel company thyssenkrupp has to revise its figures again, for the third time in 2024. CEO Miguel Lopez is now expecting a slump in revenue of between 6% and 8% for the 2023/24 financial year compared to the previous year, and the Company's long-established steel division is planning to reduce its workforce as a result. Steel boss Bernhard Osburg wants to save as many of the approximately 27,000 employees as possible. However, there is considerable overcapacity in Duisburg. Around 11.5 million tons could be produced, but actual sales were recently only 9.5 million tons. In a rescue attempt, CEO Lopez wants to transfer the steel business into a 50:50 joint venture with the energy holding company of Czech billionaire Daniel Kretinsky. According to the trade association Wirtschaftsvereinigung Stahl, there is still a lack of urgently needed demand stimulus from the important steel processing industries, and business is simply performing poorly. In addition to a significant decline in revenue, thyssenkrupp now expects adjusted EBIT to be above EUR 500 million. Until now, a high three-digit million EUR figure had been expected in Duisburg. The share price plummeted to a 5-year low of EUR 3.52.

Things are not going smoothly for the electrolysis subsidiary nucera either. Based on preliminary figures, the Company generated around EUR 236 million in Q3 of the 2023/24 financial year, a good quarter more than in the previous year. However, with an EBIT of EUR 6 million, the Company was still just in the black operationally. A revenue and profit warning for the alkaline water electrolysis (AWE) segment was also issued for 2024/2025. Following this news, the share landed at EUR 9.48, just above the all-time low of EUR 9.06. The full report will not be available until August 13. Analyst sentiment for nucera is still relatively positive: 9 out of 13 experts recommend the share as a "Buy" with an average 12-month price target of EUR 18.

Poor quarterly figures and capital requirements again. Investors should keep an eye on their H2 watchlist! Highly liquid stocks like Plug Power, Nel ASA, and thyssenkrupp are prone to surprises. First Hydrogen, with the introduction of left-hand drive, now has the best chances of being considered for the EUR 43 billion EU hydrogen projects. The entire sector, due to the devastated share prices, encourages gradual accumulation.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.