May 16th, 2023 | 09:20 CEST

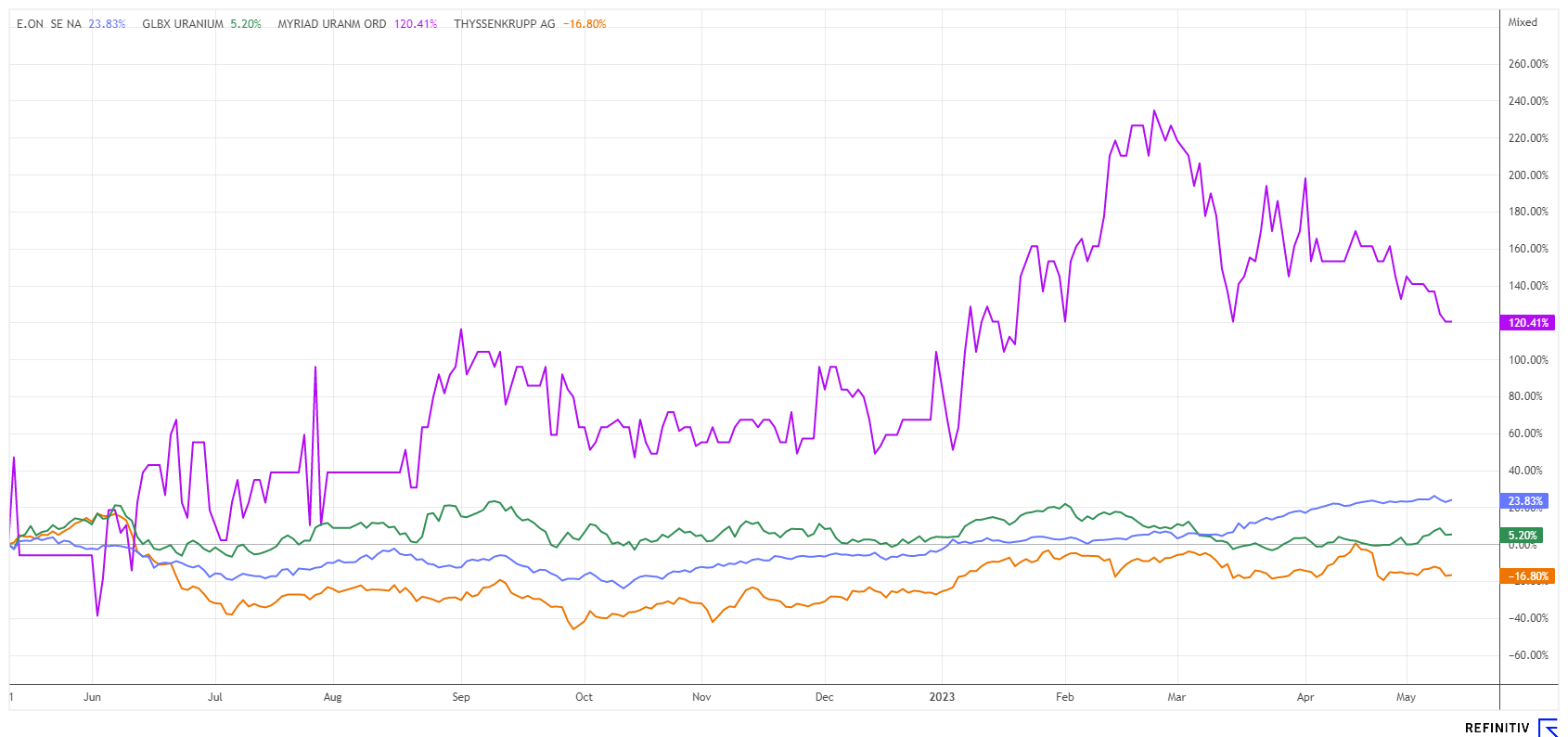

Heat pump, wind power and solar energy, is this the electricity mix of the future? E.ON, Myriad Uranium and ThyssenKrupp in focus

Germany is rapidly moving away from fossil fuels and has removed nuclear power from its energy mix. This makes us the forerunner of a new-thinking society that wants to switch energy production entirely to renewable sources. But there are a few problems because, by abandoning nuclear power, we are forced to extend the lifetimes of coal and natural gas-fired power plants. From a CO2 point of view, this is madness, and there is another point: the supposedly more environmentally friendly versions of energy production, such as wind or solar power, are not nearly as environmentally friendly as advertised by politicians because of current production practices. We will analyze these aspects objectively and in more detail.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

E.ON SE NA O.N. | DE000ENAG999 , MYRIAD URANIUM CORP | CA62857Y1097 , THYSSENKRUPP AG O.N. | DE0007500001

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

E.ON - A political setup for billions in profits

The E.ON Group is one of Europe's largest operators of energy networks and infrastructure and a provider of innovative solutions for around 48 million customers. With 72,000 employees, the electricity provider is one of the market leaders in energy consulting, forward-looking products and decentralized solutions. The Company has been positioning itself strongly in renewable energies for years and focuses on sustainability and climate protection in accordance with its marketing strategy.

"E.ON is launching a comprehensive growth and investment offensive to build a CO2-free, digital energy world. In 2030, E.ON will be bigger and greener, more digital and more diverse," said CEO Leonhard Birnbaum. For the full year 2023, the group confirmed its planned investments of around EUR 5.8 billion and plans to invest as much as EUR 33 billion in new energy networks and customer solutions by 2027.

In the first quarter of 2023, E.ON's business performance was clearly positive, with adjusted Group EBITDA at around EUR 2.7 billion, up EUR 627 million year-on-year. In the segments, the network business generated EUR 1.9 billion, and the customer solutions business doubled its operating profit to around EUR 800 million. The good earnings development was driven by investment-related growth, the recovery of the energy market environment and catch-up effects in the grid business.

Adjusted net income reached around EUR 1 billion, driven primarily by strongly increased margins in the electricity business. That is because E.ON is a major buyer on the electricity markets and, at the same time, one of the largest basic suppliers in Germany. It currently charges over 40 cents per kilowatt hour. The environment could not be better because, given the political situation, high electricity prices can be justified by consumers. Shareholders rejoice and trade the share price to new highs of over EUR 12. The annual general meeting is on May 17, when the Company will pay a dividend of almost 5%. Germany's tragic energy story should provide E.ON with many more years of unbridled growth.

Myriad Uranium - On the threshold of becoming the next uranium supplier

Nuclear power plants are facilities that can technically last decades longer than solar or wind farms. That is why many countries rely on this technology. A full 51.8% of the nuclear electricity generated in the EU in 2021 came from France, by far the largest producer. Germany was in second place with a share of 9.4%, followed by Spain (7.7%) and Sweden (7.2%). Germany is now phasing out nuclear power, but Poland is following suit with new investments. Worldwide, China, Russia and India, in particular, want to expand strongly with more than 70 projects.

There are many expert opinions on the world's future uranium demand. In the mix of different scenarios, the demand is probably between 88,000 and 102,000 tonnes for the year 2030. In 2021, about 50,000 tonnes of uranium were produced worldwide, and about 40% came from Kazakhstan. In Africa, Namibia, Niger and South Africa are emerging as producers, with a combined global market share of about 15%. Currently, there are only a few new producers. Especially North America is pushing its exploration activities for strategic reasons. The uranium price was able to move back above USD 50 in the last few weeks, but the global demand cannot be met in a few years.

This turns the spotlight on some important deposits in Africa. In Niger, the French state-owned company Orano has secured an important source, and Global Atomic has settled as a neighbour. With a 7% market share, the country is the sixth-largest uranium producer in the world. Smaller explorers also occupy important sections of land, e.g. Myriad and GoviEx Uranium. Myriad Uranium is very interesting because the 1,800 sq km property is directly adjacent to properties being mined. So why shouldn't the high mineralization be found there?

Today's Orano is the successor company to Areva, which was fundamentally restructured in 2017 due to high losses on various projects and recapitalized by the French state with EUR 2.5 billion. The state-owned energy company is investing over USD 115 million in formal in-situ recovery (ISR) tests at its Imouraren project in the fertile Tim Mersoi Basin. Imouraren is Africa's largest uranium deposit, with 384 million pounds of U3O8, and the second largest globally. This is precisely where Myriad Uranium has pitched its tents.

Niger is increasingly becoming a global uranium producer and could soon be the second-largest uranium producer in the world. Exploration and permitting costs in the Tim Mersoi area are a fraction of those in many other uranium-bearing regions, while the potential for both low- and high-grade discoveries remains promising. Myriad Uranium's shares have taken a bit of a pause after a stellar start but should be able to follow the rallying uranium price again quickly.

ThyssenKrupp - When is the Nucera IPO coming?

For several months, the stock market has been puzzling over the IPO of ThyssenKrupp's subsidiary Nucera. The profitable hydrogen subsidiary should have been on the stock exchange list long ago. After all, the alternative energy carrier H2 offers a wealth of environmentally friendly applications to promote the climate and mobility turnaround.

But instead of positive news, the stock market has to deal with the resignation of acting CEO Martina Merz and poor quarterly results. Caused by high write-downs in the unprofitable steel division, the Company posted a significant loss of EUR 223 million in Q2. Added to this is a weak order intake of EUR 10.2 billion after EUR 13.6 billion in the same period last year. Not a good omen for the Duisburg-based conglomerate. Perhaps the successor, Miguel Angel Lopez Borrego, can finally make things happen and execute the long-awaited Nucera IPO. The inflow of billions would provide ThyssenKrupp with the necessary funds for a sustainable restructuring and finally put the innovative hydrogen division on its own feet. From a chart perspective, the share should no longer slip below the EUR 5.80 line. Keep watch!

Berlin's decisions favouring a green future are not exactly open to technology. Those who want to solve the energy question have to play all options and produce a good energy mix that helps private and industrial consumers. E.ON is one of the primary beneficiaries of the current misguided policy, while ThyssenKrupp has to get on its feet first. Those who want to play the nuclear power card have a strong trump card in Myriad Uranium.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.