July 18th, 2025 | 08:10 CEST

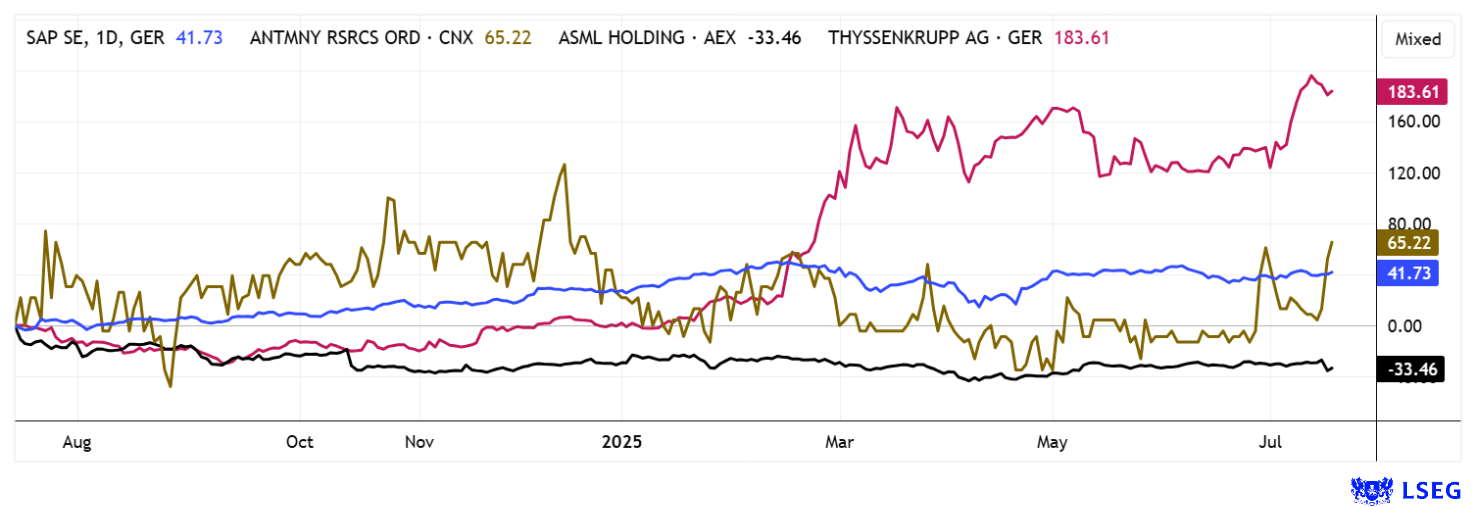

Hard to believe: thyssenkrupp going public? New DAX highs with SAP, ASML, and Antimony Resources

With geopolitical tensions escalating with each passing day, it is becoming increasingly clear that reliable supply chains for industry and manufacturing are a thing of the past. German and European industry, in particular, are feeling the effects more and more as supply routes are increasingly restricted or even shut down completely as a result of growing sanctions. This scenario of scarcity is leading to increased sensitivity on the capital markets: long-term interest rates are rising, and risk parameters are skyrocketing. How are companies responding to this uncertain environment, and is there still hope for a revival of global trade? Which fundamental trends should investors pay particular attention to in light of this situation? There is a lot to be gained!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

THYSSENKRUPP AG O.N. | DE0007500001 , SAP SE O.N. | DE0007164600 , ASML HOLDING EO -_09 | NL0010273215 , ANTIMONY RESOURCES CORP | CA0369271014

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Antimony Resources – A strategic metal moves into the geopolitical spotlight

In light of China's export restrictions on certain strategic metals, Western industrial groups are facing increasing pressure to tap into alternative and secure sources of supply. A particularly prominent example is antimony (Sb), which is indispensable in numerous industrial applications, from flame retardants for plastics and electronics to catalysts in PET production. China, Russia, and Tajikistan together dominate around 90% of the global antimony market, and with the latest export restrictions, EU imports have also been affected since spring 2025. There is currently no domestic production in the US. Demand from the defense sector is skyrocketing, as antimony is a key component in bulletproof equipment, electronic devices, and night vision technology.

Explorer Antimony Resources from Canada offers promising prospects: The Company has secured the full option on Globex Mining's well-known, high-grade Bald Hill antimony deposit and plans to further develop the deposit with its first-class ore grades. Twenty-five drill holes have already been completed by previous owners since 2008, and the Company is now publishing its own exploration results. The first drilling phase, covering over 3,150 meters, has been successfully completed with impressive results: antimony-bearing stibnite was discovered in 70% of the drill holes, including over 20 meters of massive mineralization in drill hole BH-25-05. These discoveries confirm the potential for a high-grade deposit at depth and at surface, where additional occurrences have already been identified.

CEO Jim Atkinson is enthusiastic about the progress and expects the first laboratory results soon. However, it is already suspected that the geological structure indicates a robust and widely branched ore vein, ideal for long-term, economically viable mining. Historical data already indicates deposits of up to one million tonnes with grades between 4% and 5.3% antimony. With excellent infrastructure and year-round drillability, Bald Hill is a strategically perfectly positioned project. Antimony Resources is positioning itself as an attractive, Western-oriented exploration company with pioneering potential. The recently distributed stock options, with an exercise price of CAD 0.15, demonstrate management's confidence in the Company's future. Market capitalization remains low at EUR 4.6 million. A review of other commodity stocks in the "Critical" segment has revealed dramatic price gains in recent days, for example, at Almonty Industries and Critical Metals. Time is of the essence!

thyssenkrupp – Are submarines now coming to the stock market?

The rumor mill is in full swing again! The planned listing of thyssenkrupp Marine Systems (TKMS) is currently the subject of intense discussion. It is scheduled to take place on the Frankfurt Stock Exchange in the fall of 2025, but the key issue is a security agreement with the German government. The Berlin control center will receive control rights if 25% or more of TKMS shares are sold in the future. It will also retain a subscription right if thyssenkrupp plans to sell 5% or more of its shares and will be entitled to a seat on the supervisory board. Carlyle, which had previously been interested in a takeover, withdrew in October 2024. Since then, thyssenkrupp has been exploring alternative options, including an IPO or a strategic partnership. A sale to an industrial group is being considered, but is not favored by the thyssenkrupp Foundation.

CEO Oliver Burkhard describes an IPO as the preferred financing option for future growth, albeit more complex than a spin-off through sale. The scenarios currently under discussion include classic private equity investments, a minority stake by the German government via KfW, or possible limited partnership models to hedge risks. Ultimately, thyssenkrupp is aiming for controlled independence for TKMS with the parent company retaining a majority stake and strategic support from the government or partners. The full legal agreement is expected to be finalized by the end of September. Analysts estimate the value of TKMS to be up to EUR 2.3 billion, based on its substantial order backlog of approximately EUR 18 billion and growth opportunities in the global naval shipbuilding market, particularly within NATO. According to experts on the LSEG platform, a fair valuation would be around EUR 9. However, the current share price is already 20% higher!

ASML and SAP – A mixed reporting season

There is currently a lot of movement in the high-tech sector. This week, it was the turn of crowd favorite ASML. The chip supplier delivered strong figures in Q2, with revenue of EUR 7.7 billion and profit of EUR 2.3 billion. At 53.7%, the gross margin was well above expectations, as sales of high-NA and EUV systems reflect continued strong demand from the AI and logic segments. ASML is likely to maintain its leading position with its products. Nevertheless, the share price was punished because management was unable to announce any further improvements for 2026. Instead, it pointed to possible tariffs, higher investments, and macroeconomic risks. At a share price of EUR 648, the 2025 P/E ratio is 27, falling to as low as 18 by 2028. 24 of 36 analysts on the LSEG platform recommend a "Buy" rating and assign an average price target of EUR 759 to the high-tech company.

SAP is set to publish its figures for the second quarter of 2025 on June 22. The market continues to expect strong momentum from the cloud business, with earnings per share expected to average EUR 1.44. Particular focus will be on order intake and how far the current cloud order backlog can climb above EUR 18.2 billion. The Company is benefiting from the growing demand for cloud-based ERP and AI solutions, consistently expanding its market position as a leading European software provider. The outlook remains promising, thanks in part to rising margins, increasing resilience to competition, and a strong partner network. After a 15% gain since the April slump, the share price is once again targeting its previous high of EUR 283. With Q2 results exceeding expectations, this could happen very quickly.

The ongoing challenges in global supply chains are leading to a continuous increase in the price of strategic raw materials, which in turn is putting pressure on the margins of many industrial companies. In turn, this is opening up opportunities for companies such as Antimony Resources. In North America, for example, there are currently almost no production facilities for the critical metal antimony that show potential for rapid mine start-up. Customers are nervous, and investors are rubbing their hands with glee.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.