December 4th, 2025 | 07:00 CET

Gold & silver with a record year – 100% in 2026 too? Barrick, Kobo Resources, First Majestic, and Endeavour Silver

Gold and silver remain the surprise of 2025. Despite many prophecies of doom, both precious metals have so far managed to hold on to their record highs of USD 4,350 and USD 58.50, respectively. After a brief correction at the end of last week, the highly volatile silver price quickly rose back to the USD 58.00 mark. Experts warn of an approaching pain threshold for short sellers and futures speculators. They had hoped to be able to close their uncovered positions at a favorable price before the approaching settlement date on November 28. Far from it, because on Friday, metals took off again. According to traders, it is currently almost impossible to procure sufficient quantities of physical silver to cover the many derivative transactions. This is leading to unusual behavior on the market. So where should investors pay close attention now?

time to read: 6 minutes

|

Author:

André Will-Laudien

ISIN:

BARRICK MINING CORPORATION | CA06849F1080 , KOBO RESOURCES INC | CA49990B1040 , FIRST MAJESTIC SILVER | CA32076V1031 , ENDEAVOUR SILVER CORP. | CA29258Y1034

Table of contents:

"[...] Our SMSZ project is the largest contiguous land package of any exploration company in the region at 400km2 and overlays a 38km portion of the prolific Senegal Mali Shear Zone. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Barrick Mining – Split-up of mining giant sparks imagination

Barrick Mining is considering spinning off its most profitable North American mines into a new company and floating a minority stake on the stock market. The aim is to narrow the valuation gap with competitors such as Agnico Eagle, while retaining strategic control at the parent company. These considerations follow a year of upheaval and major problems in Mali, which are now gradually being resolved. Mark Bristow's departure in the middle of the year came as a surprise and led to organizational adjustments in the North American team. Among other things, the new entity will include the stake in Nevada Gold Mines, the large Pueblo Viejo mine, and the Fourmile project. These assets account for more than half of the group's production and are considered particularly stable and cost-efficient. Investors could thus invest specifically in high-quality North American projects without taking on risks from more politically fragile regions. Barrick naturally reserves the right to sell further shares on the stock exchange or to divest the subsidiary completely if this proves advantageous. The Executive Board intends to decide on this by early 2026 and inform the capital market of the status in February.

At the same time, the new major shareholder Elliott Investment is increasing pressure on management to sharpen capital allocation. Observers interpret the IPO review as an attempt to accommodate Elliott without immediately initiating far-reaching sales. Barrick has been struggling with a valuation discount for years because problems in countries such as Mali, Pakistan, and Papua New Guinea have weakened confidence. Analysts expect that a separate North American unit could unlock significant value if, after a successful spin-off, it is valued similarly to Agnico Eagle, for example. Analysts on the LSEG platform expect an average target price of CAD 64 in 12 months, with Cormark standing out at CAD 78 – Barrick is currently trading at around CAD 57. Plenty of upside potential and a 2.5% dividend yield – stay invested!

In the shadow of the majors – Kobo capitalizes on momentum in the Birimian Belt

West Africa is increasingly becoming the preferred playground for major gold producers. Thanks to stable conditions, a growing economy, and comparatively good infrastructure, Côte d'Ivoire is at the center of attention. Junior company Kobo Resources is positioning itself with its Kossou project in the middle of a gold-producing neighborhood in the productive Birimian Belt and not far from the capital, Yamoussoukro. Drilling programs covering several tens of thousands of meters have revealed a contiguous, deep-reaching gold system in the Road Cut and Jagger zones, with high-grade intervals supporting the thesis of a robust ore system. In particular, sections several meters long with gram grades well above the typical open-pit level at the site suggest economically interesting zones and justify the current follow-up program with a further 12,000 to 15,000 meters of drilling. The goal is to prepare an initial resource estimate.

At the same time, the regional environment is becoming increasingly important because some of West Africa's most important gold mines are concentrated around Kobo. Mining giants such as Perseus Mining, Endeavour Mining, and Barrick have had a firm grip on the areas for years, but are regularly looking for meaningful expansions. This is Kobo's opportunity, as Perseus Mining's Yaouré mine, which has been in production since the end of 2020 and delivers over 200,000 ounces of gold annually, borders directly on Kossou. It is an established facility with existing infrastructure that opens up strategic options for future developers in the immediate vicinity. Endeavour Mining, in turn, has firmly established itself in Côte d'Ivoire with several projects and mines and is investing hundreds of millions in further exploration. Barrick is also represented with large-scale projects in West Africa, underscoring the fact that the region has long since become a core area of global gold production.

The current scenario suggests potential exit scenarios in the form of earn-in deals, joint ventures, or acquisitions. If the ongoing drilling at Kossou confirms the continuity of mineralization over several kilometers, the project could meet the criteria that producers apply for acquisitions in politically stable jurisdictions in the medium term. In addition, Kobo has a second, little-explored project in its portfolio, Kotobi, where several gold anomalies have already been identified in the soil, and initial trenches indicate continuous mineralization in the bedrock. A recently completed financing round ensures that the Company can finance both the resource definition at Kossou and metallurgical studies and further exploration on the satellite projects without having to return to the capital market in the short term. Against this backdrop and following a significant price correction to a market value of CAD 27 million, Kobo shares appear to be highly interesting from a speculative perspective.

First Majestic and Endeavour Silver – The cash machines in the silver sector

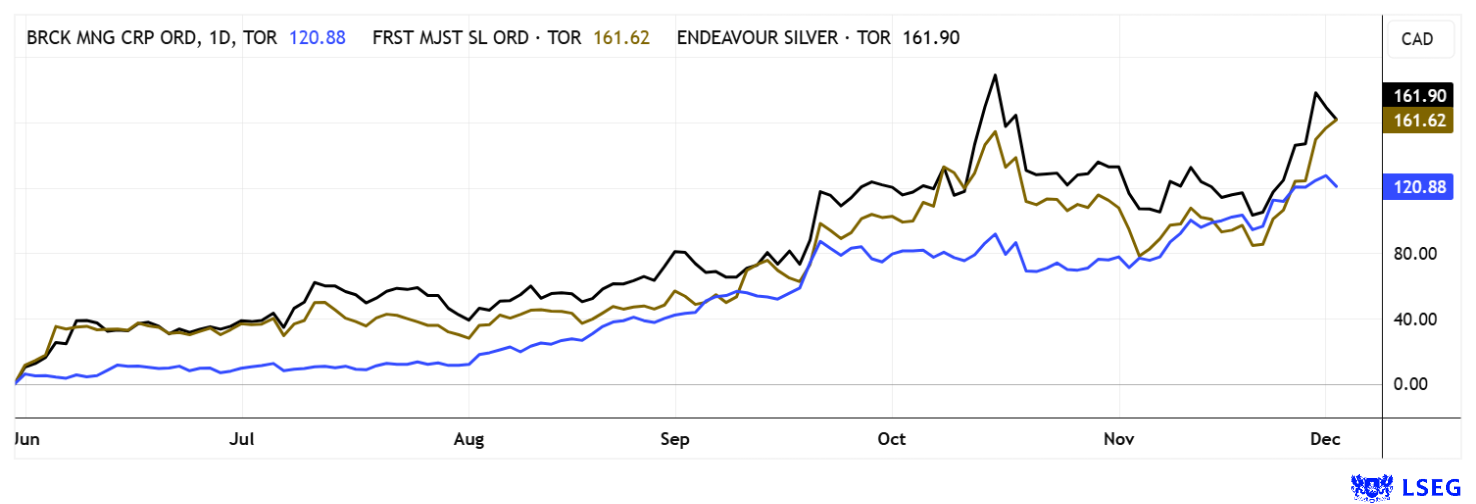

Silver, once considered highly speculative, now provides interesting return components for a risk-aware portfolio. Stable profit generators can be found in the producer sector. First Majestic Silver is at the forefront. The Company is growing very dynamically and has once again significantly expanded its production base with the acquisition of Gatos Silver. Together with the core operations, San Dimas, Santa Elena, and La Encantada, this creates a portfolio of high-performance mines that are expected to deliver 14.8 to 15.8 million ounces of silver in the current year. The new strength was already evident in the third quarter: production jumped by almost half to 7.7 million ounces of silver equivalent. Over USD 170 million in new investments are being poured into expansions, technical modernization, and exploration campaigns. The cash flow driver, Los Gatos, is also likely to prove a margin booster. Analysts on the LSEG platform see 12-month potential of CAD 21.30, which is even below the current price due to delayed updates to the studies. The highest rating puts the target price at CAD 26, which is still impressive, given that the stock has already performed very well!

Industry competitor Endeavour Silver is undergoing a phase of strategic realignment in 2025, but with significantly more positive momentum than in 2024. In the third quarter, total costs (AISC) rose by 18% to USD 30.53 per ounce, but the parallel appreciation of the silver price kept profitability on track. With more liquidity, increasing cash flows, and new projects such as Terronera, which is expected to reach full capacity in mid-2025, Endeavour is systematically expanding its mining landscape. Together with the Guanaceví, Bolañitos, and Kolpa properties, this will create a diversified platform that could enable production volumes of up to 20 million ounces of silver equivalent by 2027. Analysts therefore expect rising EBITDA margins, growing net income, and stable long-term value appreciation. This makes Endeavour one of the fastest-growing players in the silver sector. **The revaluation should continue. CIBC Capital voted "Outperform" for the first time in December and set a 12-month price target of CAD 16. The average on the LSEG platform is CAD 14.25. There is still room for growth!

The precious metals markets currently have a lot of external circumstances to deal with. On the one hand, there are the large waves of government debt, which are likely to really pick up speed from 2026 onwards. Inflation and geopolitics are already ongoing issues, leading to increased investment in gold and silver. Now, companies are also highly profitable and are paying out generous returns to shareholders. Those who like to use leverage are focusing their attention on well-positioned juniors such as Kobo Resources.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.