June 16th, 2025 | 07:15 CEST

Gaza, Iran, Ukraine – Conflicts are driving up metal prices! Rheinmetall, European Lithium, Hensoldt, and RENK

The problem is getting bigger! Strategic metals are currently having a massive impact on the geopolitical balance of power, as they play a decisive role in determining the economic and military capabilities of countries. Conflicts such as those in Gaza, Ukraine, and, more recently, Iran are exacerbating shortages because long-standing trade relationships can be terminated overnight. The concentration of metal production in a few countries makes supply chains vulnerable to political influence. Export restrictions, embargoes or targeted shortages imposed by China or Russia can lead to bottlenecks in consumer countries and severely affect the economy. We describe the current situation and offer solutions for dynamic investors.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , EUROPEAN LITHIUM LTD | AU000000EUR7 , HENSOLDT AG INH O.N. | DE000HAG0005 , RENK AG O.N. | DE000RENK730

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

European Lithium – Strategic metals in the melting pot of geopolitical conflicts

The debate on strategic metals has recently intensified significantly, not least due to the growing importance of copper, uranium, and rare earths. Together with lithium, they are considered key raw materials for the energy transition and digital transformation. While the discussion about Greenland's resource wealth continues to make waves, new technological and political developments are providing ongoing talking points on the capital markets and creating additional price momentum.

News about the Greenland asset is currently available from the Australian raw materials company European Lithium. The explorer owns a flagship lithium property in Austria, three further deposits in Ukraine and Ireland, and the Tanbreez rare earth project in Greenland. Thanks to new technologies for more efficient extraction and processing, the Greenland project could now be implemented faster than expected. Historical figures are available for the first time, revealing the results of eleven deep diamond drill holes drilled between 2007 and 2013 in the Fjord deposit. The Company recently announced a mineral resource estimate of approximately 45 million tons with grades of 0.38% TREO for the eudialyte component and 180 million tons for the industrial mineral by-products feldspar and arfvedsonite. The figures, together with the robust economic results of the Tanbreez scoping study, which demonstrate a net present value of USD 2.4 to 3.0 billion at a discount rate of 10% or 8% and a pre-tax IRR of 162%, demonstrate high economic potential. Through its 63% interest in Critical Metals (CRML), European Lithium shareholders are very well positioned here.

Tony Sage, Executive Chairman of the Company, commented on the survey results: "I am further encouraged by the latest results from the deep diamond drill holes, which show exceptional survey results over a broader and deeper mineralization. Tanbreez continues to deliver consistent high-grade drill results, providing the Company with a compelling opportunity to increase our current maiden resource with our upcoming 2024 results and 2025 drill programs commencing next month. Our exploration and field teams are currently on-site at Tanbreez organizing the upcoming field season and preparing for resource and exploration drilling."

European Lithium's current focus thus adds up to a unique and promising portfolio for the future. This positions the Company as a key player in the global raw materials landscape, particularly in the critical metals sector. Analysts are doing the math: if the estimated metal resources are added together, the "options portfolio" could be worth several billion, but the ongoing war and the increasingly harsh rhetoric toward Greenland from US Vice President JD Vanz are likely to cause lasting uncertainty among investors. The bold can, therefore, purchase European Lithium shares at prices around AUD 0.044. There is already a large investor community for this stock in Germany, with 7-digit numbers sometimes changing hands. It is a complete mystery why the entire portfolio is only valued at EUR 34.7 million. A dramatic revaluation is, therefore, likely!

Rheinmetall – Just follow CEO Papperger!

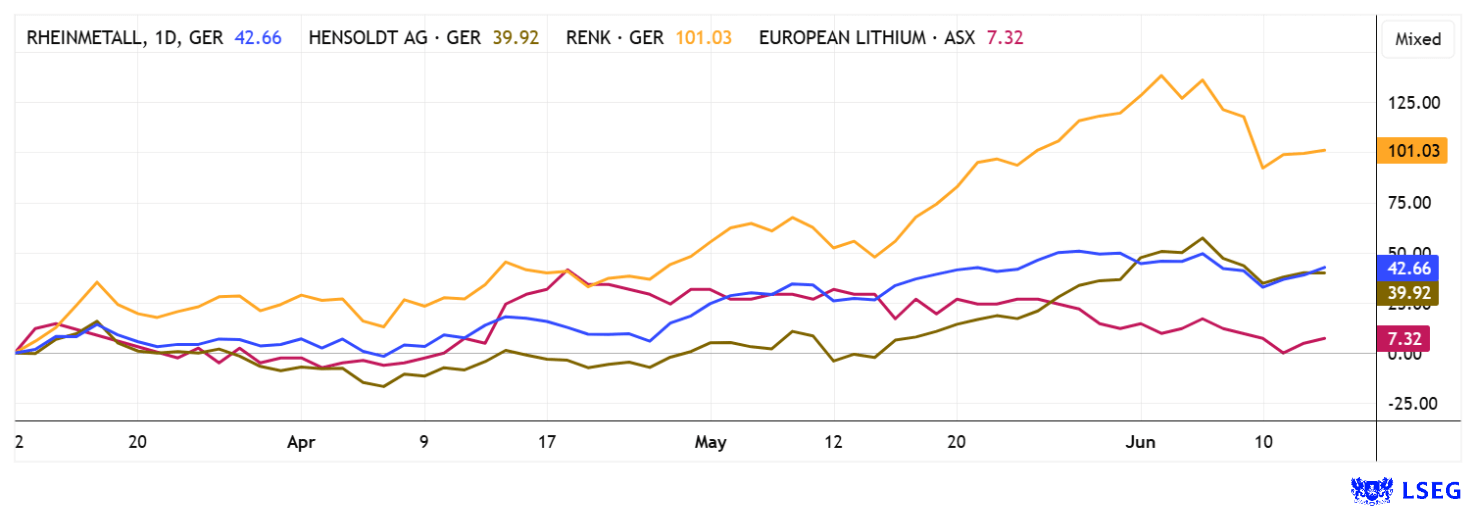

The rally of Rheinmetall shares has been breathtaking recently. It started with the outbreak of war in Ukraine, and since then, the stock has been virtually unstoppable. In January, it averaged around EUR 600, and last week, it reached a preliminary high of EUR 1,942, an increase of over 200% in 2025 alone. Can this continue? CEO Armin Papperger believes so and is betting on it. According to AdHoc, the manager struck again last week with EUR 512,830 at a purchase price of EUR 1,654. Papperger has already made two moves in the Donald Trump-style tariff crisis. For a moment, it looked as if the global stock market could be shaken. At that time, he invested EUR 402,156 in Rheinmetall at a price of EUR 1,058 and a further EUR 308,850 at a price of EUR 1,065. In mathematical terms, that is 980 shares, which reflected a closing price of EUR 1,795 on Friday. The total increase in value of these three purchases to date is approximately EUR 535,000, or a performance of over 30%. So, if you are looking for an investment advisor, Papperger Insider Trades is obviously a good choice. Morgan Stanley sees the price rising to around EUR 3,000 by 2030, provided that European defense spending actually reaches the 3% of gross domestic product target. Analysts on the LSEG platform expect an average 12-month price target of EUR 1,925. Well, then!

Hensoldt and RENK – The valuation seems somewhat peculiar

Things are just as crazy at Hensoldt and RENK at the moment. At the beginning of the week, JPMorgan sent Hensoldt shares skyrocketing with a "Buy" recommendation up to EUR 110. On the same day, the share price rose from EUR 87.50 to EUR 108.80. This means that the target was narrowly achieved. Immediate profit-taking in the following days caused the share price to fall to EUR 84. Anyone who bought at that level must have miscalculated the 2026 P/E ratio, which stood at a staggering 65. Now, with the share price at EUR 94, things have returned to something resembling normality. On the LSEG analyst platform, only 4 out of 12 ratings are positive, with a "Buy" recommendation up to EUR 68.50. "Plenty of room to fall!" – would probably be the more accurate assessment. Let's see what happens in the coming week.

Augsburg-based special gear manufacturer RENK expects the defense share of its business model to grow dramatically in the coming years. In 2024, it was around 70%. Because the stock recently conjured up a multiplier on the trading floor, Bank of America and BNP Exane took advantage of the high prices to downgrade their ratings. The average expected price target is currently EUR 56.20, which is 22% below Friday's closing price. Since ground vehicles will certainly not be used in the Iran-Israel conflict, defense investors should reconsider whether a 2025 P/E ratio of 52 is justified here.

The capital markets currently have many trends to price in as the world is becoming increasingly unpredictable. Strategic metals are once again the focus of commodity price formations on the futures markets. If industrialized countries were suddenly cut off from critical resources from Asia, a production standstill would loom. Shareholders of European Lithium are increasingly looking to rare earth deposits in Greenland - but so is Donald Trump! Perhaps there will even be a paid settlement for these vital resources.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.