February 28th, 2024 | 08:00 CET

E-mobility versus combustion engines: Tesla and BYD stumble, Mercedes-Benz and Globex Mining in Vogue!

The Tesla plant in Brandenburg is discharging polluted wastewater into the canals. Permissible limits for phosphorus and nitrogen are exceeded by up to six times. Elon Musk has not yet reacted to the accusations, as he is busy planning the expansion of his production facility. If the authorities were to take action here, the plant could also be subject to a production stop until the harmful sources are eliminated. Once again, environmental protection and the climate debate clash with the self-interest of foreign producers seemingly not on the radar of existing EU regulations. The water debate is nothing new. Since the plant in Grünheide went into operation, local communities have had to contend with a drop in the groundwater level because the plant draws an impermissible amount of water. For those finding Tesla unsympathetic due to these issues, look for other opportunities in the automotive sector!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

TESLA INC. DL -_001 | US88160R1014 , BYD CO. LTD H YC 1 | CNE100000296 , MERCEDES-BENZ GROUP AG | DE0007100000 , GLOBEX MINING ENTPRS INC. | CA3799005093

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

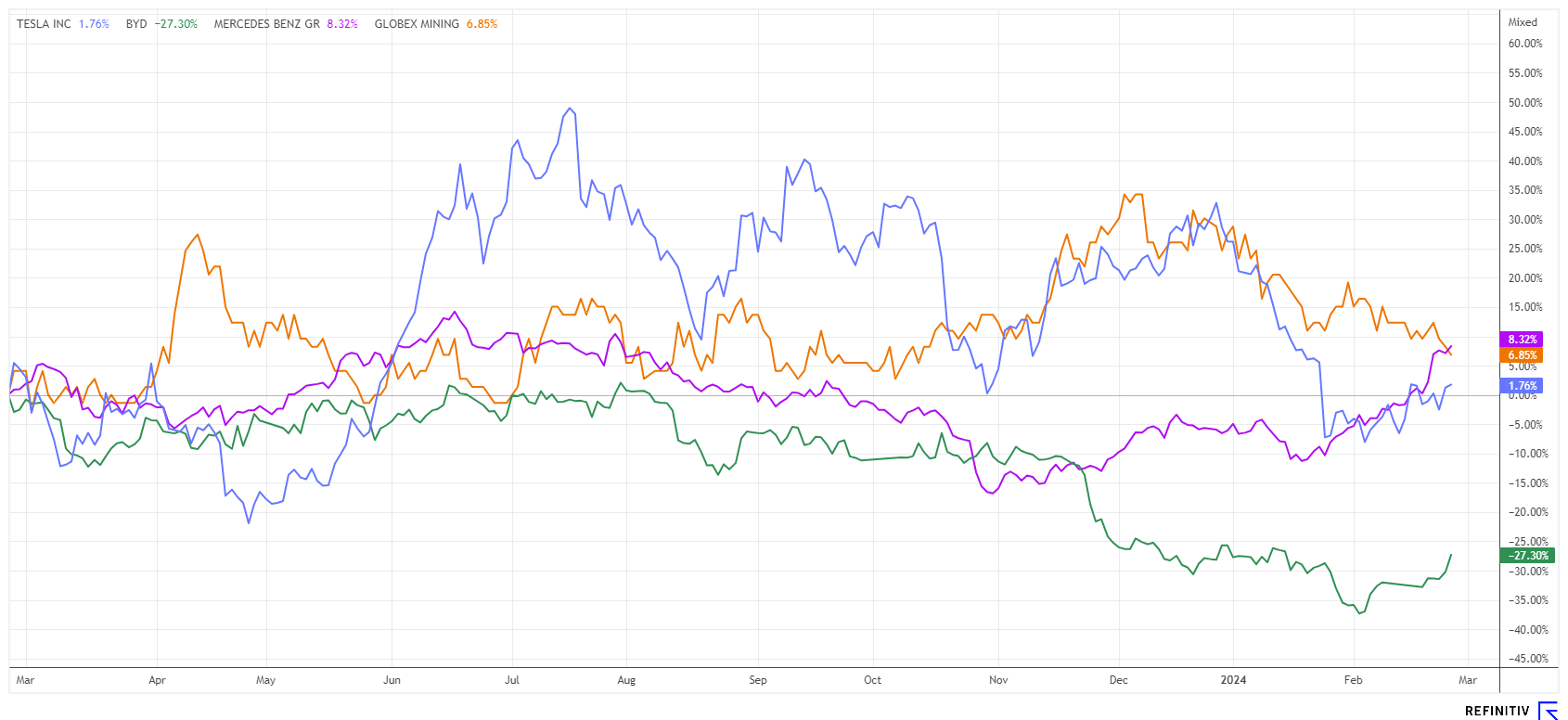

Tesla versus BYD - The acid test ahead

When it comes to e-mobility, the last word has not yet been spoken. Over the past 12 months, Tesla's much-loved shares have moved sideways and are currently down by as much as 5%. During the upward trend, the shares could have been sold at a price of around USD 260, as they have accumulated gains of over 1000% in the last 10 years. The Chinese market leader BYD is also in the red after a challenging year with a 27% loss, although sales of e-vehicles have recently doubled.

What both shares lack is growth potential because after the implementation of many legal requirements and announcements on the abolition of combustion engines, consumers have decided to rely on the old technology for the last few years, especially as the e-vehicles are fast and dynamic, but in terms of sustainability and economy they have to be in operation for more than 8 years to achieve positive environmental effects. The two market leaders in new mobility are, therefore, currently on the sidelines.

While BYD has already corrected by 50% from the top, the sell-off at Tesla is likely still pending. However, the next figures are not expected until April 17, so there is still some time for investors to avoid the supposedly disastrous figures for the first quarter. BYD will report on March 27 for 2023, with earnings expected to be around CNY 10.50 per share, while the consensus estimate for 2024 is still for a 25% increase in sales and a 30% rise in profits. If Tesla and BYD disappoint with their outlook, there is a risk of a share price disaster for these highly valued stocks.

Globex Mining - Rare earths are also in the portfolio

The Canadian explorer and asset manager Globex Mining from Quebec is well ahead of automotive production. Founder and CEO Jack Stoch has been building up his properties since the 1970s, amounting to around 230 as of mid-2023. Periodically, new agreements are made for the exploration of claims and the optioning of metal production on company-owned properties. Globex generates revenue streams from equity investments, the sale or lease of mining rights, and the pro-rata receipt of minerals sold.

In February, Globex released an update on the geology and mineralization of its 192.28-hectare Virgin Mountain project in the US. The rare earth and beryllium property is located in the Arizona portion of the Virgin Mountains chain, approximately 120 km northeast of Las Vegas. Previous exploration for uranium and later rare earth elements (REE) began in the 1940s and ended in 1991. Globex conducted geologic mapping and collected a total of 25 rock samples. The main rare earth mineralization, referred to as the Hummingbird Zone, was traced over a distance of 250 m. All seven channel samples taken from the Hummingbird structure returned high grades of light (LREE) and heavy (HREE) rare earth elements plus or minus thorium and uranium. The total rare earth oxide (TREO) content varies between 0.328% and 1.24%. Uranium could be a by-product of REE mineralization; higher grades below the oxidation stage are expected.

With further investigation, Globex could once again find a pearl in its portfolio. The share is currently trading between CAD 0.78 and 0.98, depending on the news. Interested investors currently have a good basis for entry, as Jack Stoch and his portfolio are ideally positioned should gold and industrial metals get back on track in 2024. In addition, the Company has a war chest of almost CAD 20 million ready for the next deals and has done well with its assets so far.

Mercedes-Benz - Electric mobility on the retreat

The Stuttgart-based automotive manufacturer Mercedes-Benz regularly surprises with unconventional decisions, often achieving significant success. The German premium manufacturer has scaled back its plans in electromobility, following suit with other European traditional manufacturers. According to the latest news, the Company intends to offer vehicles with combustion engines well into the 2030s.

In 2021, Mercedes-Benz announced far-reaching plans to switch to all-electric vehicles by the end of the decade, albeit with the addition "if market conditions permit". With the saloon and SUV versions of the EQS and EQE models and the EQB electric SUV, Mercedes now offers an electric vehicle in every segment. Fossil-powered engines will continue to be available, and the commitment to gas-powered combustion engines will also be increased.

Since the beginning of the year, the share has already gained 20%, and yesterday, it was again among the day's winners. Analytically, the Stuttgart-based company is currently trading at a P/E ratio of 6.2 and on top of that, there is a dividend of just under 7%. On the Refinitiv Eikon platform, 16 of 26 analysts are positive on the stock, with an average price expectation of EUR 76.60. The figures for the first quarter could come as a positive surprise; they will be published on April 30.

The automotive business could develop differently this year than many expect. While e-mobility is weakening due to a lack of tax incentives, German premium manufacturers are stepping on the gas with their conventional products. VW, Mercedes, BMW and Porsche have clearly been on the upswing since the beginning of the year. In addition to gold, Globex Mining also owns a number of properties with industrial metals. There could be a noticeable shake-up soon.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.