December 10th, 2025 | 07:10 CET

E-mobility to hit the roof in 2026? BYD on the rise, Graphano Energy strong and Mercedes-Benz chart breakout!

The black-red federal government plans to launch a new subsidy program for electric vehicles and plug-in hybrids at the beginning of 2026. The support is primarily aimed at people with low or middle incomes to make it easier for them to switch to electric mobility. The basic subsidy is expected to be around EUR 3,000 and can increase to a maximum of EUR 4,000 with child supplements and a bonus for very low incomes. Only vehicles with a net list price not exceeding EUR 45,000 will be eligible for funding, which means that higher-priced models will remain outside the program. Both the purchase and leasing of purely electric passenger vehicles (BEVs) and, according to media reports to date, plug-in hybrids will be eligible for funding. At the same time, the existing motor vehicle tax exemption for fully electric vehicles is to be extended, but for a maximum of 10 years and with a horizon until the end of 2035. The pendulum is therefore swinging in favor of electric vehicle manufacturers and necessary suppliers. Now is the time to get started!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , Graphano Energy Ltd. | CA38867G2053 , MERCEDES-BENZ GROUP AG | DE0007100000

Table of contents:

"[...] We know exactly what we are doing and are implementing what we consider to be a proven technology in an industrially applicable and scalable way. [...]" Uwe Ahrens, Director, Altech Advanced Materials AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD – Unstoppable on its way to Europe

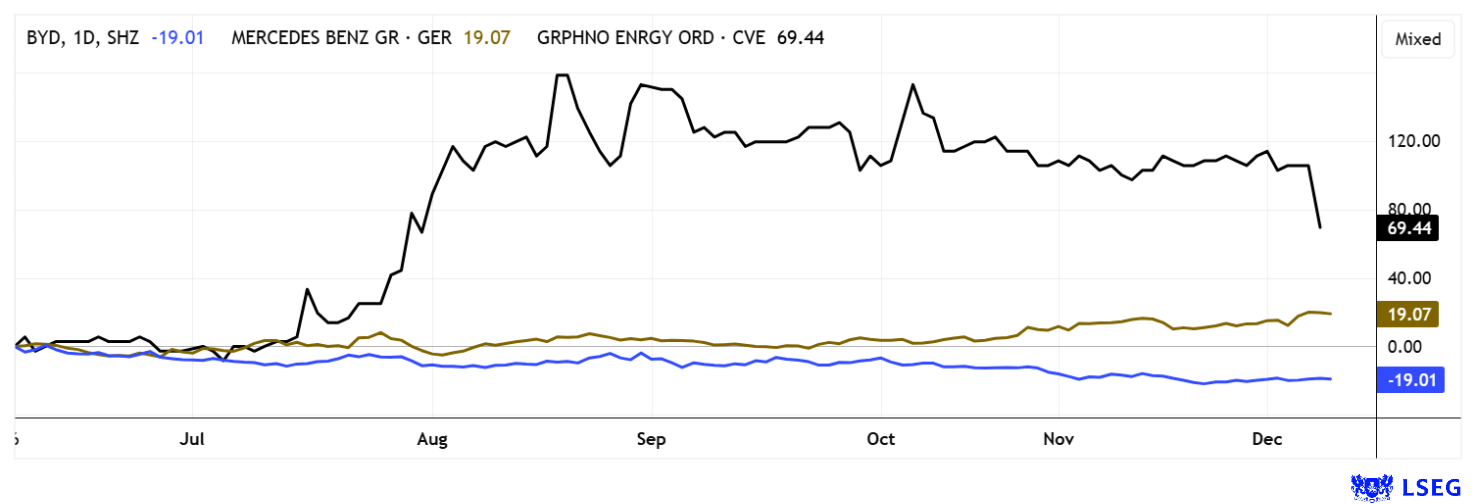

BYD shares are showing negative annual performance for the first time in five years! But with the share price reaching the EUR 10 mark, chart technicians are now taking notice! This is because there is strong support here in the long term. Operationally, the Chinese manufacturer can report significant progress. Production will start in Hungary in 2026, which should further accelerate the speed of expansion on the European continent. Goods manufactured there are exempt from the 17.4% import duties imposed by the EU.

BYD has already exceeded the 1% market share threshold in Europe in the current year, and the number of sales outlets will double again in 2026. Management recently estimated the expected annual sales growth in Europe at more than 20%. That is quite a statement! A certain boost would be necessary, which would also benefit shareholders. This is because BYD shares have undergone a 40% consolidation in 2025. With a current price of EUR 10.95, the 2026 P/E ratio is only 11.1. As a vertically integrated group, BYD is growing at around 12% per annum and currently serves the large mass markets in the mid-price segment. Analysts on the LSEG platform see a good 40% potential, and asset managers are happy to allocate last year's losers if the outlook is right. Very promising for turnaround investors!

Graphano Energy - Progress in exploration, sustainability, and technology

One of the most important raw materials for battery production is natural graphite. There are only a few deposits of pure material worldwide. Graphano Energy, with several exploration areas in Québec, is one of the companies developing such deposits in Canada and has a growing project pipeline. The Company is working to establish itself as a stable supplier for battery and stationary storage system production facilities, which are increasingly dependent on regional security of supply. The focus of its activities is the Lac Aux Bouleaux ("LAB") project, located not far from Northern Graphite's Lac-des-Îles mine, currently the only graphite mining site in Canada. An existing agreement for the possible shared use of the nearby processing plant would potentially ease the transition to the commercial phase for Graphano and provide operational advantages. This is supported by Québec's tax programs, which specifically stimulate critical raw material projects due to the North American supply chain predicament. The second core project, the Standard Mine, is also in advanced exploration and already has defined resource estimates and positive metallurgical results. An updated resource model is expected to be released later this year, followed by a feasibility study in 2026. As North America needs additional production sites to serve the growing value chain in the energy sector, Graphano could play an important role in the medium term.

In addition, the recently delineated Black Pearl zone has had initial drilling prove high-grade graphite mineralization near surface, including peak grades of 11.33% Cg over 8.61 meters and 17.9% Cg in multiple channel samples. CEO Dr. Luisa Moreno emphasized that the available data confirms the existing geological model and represents an important step toward resource expansion. The Black Pearl area comprises 84 claims covering a total of 4,149 hectares and remains largely open beyond the existing drill holes. Together with the Standard Mine, whose known resources currently amount to 950,000 tonnes at 6.27% Cg and 980,000 tonnes at 7.16% Cg, this creates a contiguous, large-scale exploration area of strategic character.

The Company's shares (ticker symbol: GEL) are listed on markets in Canada and Germany, with sufficient daily revenue to allow for positioning. Despite the early stage of the project and a relatively small market capitalization, Graphano considers itself well-positioned thanks to continuous exploration results and the progress of several projects. The energy storage industry is waiting for further exploitable sources. The share price recently consolidated in the range of CAD 0.17 to 0.19. Collect!

Mercedes-Benz fact check – Market pressure, model policy, and transformation

So while Graphano is working on the basis of future energy storage systems and positioning itself within a North American raw materials cluster, a look at Europe shows how differently companies are responding to structural changes in the world of mobility. One example of this is the long-established German premium manufacturer Mercedes-Benz, which is currently facing a number of operational challenges.

Even after nine months, the Company was still recording significant declines: revenues fell by a full 8% year-on-year to EUR 98.5 billion, while adjusted operating profit declined by as much as 35% to EUR 6.63 billion. Taking into account the ongoing costs of the group's restructuring, net profit actually fell by half to EUR 3.9 billion. The main factors weighing on the results were an unfavorable sales mix in the passenger vehicle and van divisions and weaker sales figures in key regions. In the highly diversified Chinese market in particular, Mercedes lost almost 27% of its sales strength from the previous year, with 125,100 vehicles sold. Nevertheless, the high-price segment performed brilliantly with double-digit growth.

CEO Ola Källenius remains optimistic for the coming year and believes Mercedes-Benz is already turning the corner. The group's desirable, technologically advanced models will soon reach new customer groups, he said in an interview. Valuation metrics show a consensus price-to-earnings ratio of around 5.4 and a dividend yield of 7.8% for 2026. Over the past three weeks, the share price has recovered from around EUR 54 to EUR 61. It is now not far from its two-year high of around EUR 78, even though experts on the LSEG platform remain skeptical.

The automotive sector reflects the dynamics of technological progress in energy storage with a delay. Currently, demand for electric vehicles is once again recording strong growth. The trend is likely to intensify at the beginning of the year, as various countries plan to adjust their subsidy programs. Next year should be an interesting one for investors, as the industry is undergoing a phase of realignment. Graphano Energy continues to position itself as an important supplier of modern battery raw materials.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.