October 6th, 2025 | 07:00 CEST

Drone warfare with NATO Europe? DAX soon to reach 25,000 with defense stocks: DroneShield, Volatus Aerospace, thyssenkrupp, and Rheinmetall

Drone warfare in Europe is providing a massive boost to the defense sector, as demand for modern defense and attack systems is rapidly increasing. Companies such as Rheinmetall continue to benefit from public contracts for drone defense systems, including the Skyranger and new laser weapons. DroneShield is positioning itself as a leading provider of drone defense technologies and is currently experiencing an impressive growth phase. Volatus Aerospace is also involved as a service provider offering specialized solutions for drone surveillance and security services. Driven by EU-wide NATO investments in state-of-the-art defense technologies, analysts anticipate cyclical double-digit growth for the entire defense sector well beyond 2030. This historic wave of rearmament is transforming trillions in public debt into dream profits for shareholders, with our grandchildren and great-grandchildren footing the bill. Who are the current winners?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

DRONESHIELD LTD | AU000000DRO2 , VOLATUS AEROSPACE INC | CA92865M1023 , THYSSENKRUPP AG O.N. | DE0007500001 , RHEINMETALL AG | DE0007030009

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

DroneShield and Rheinmetall – The invisible drone threat brings a new flood of orders

With its decision to invest 5% of its GDP annually in defense and security-related infrastructure from 2035 onwards, NATO is heralding a new era of security. Over EUR 320 billion per year is to be invested in state-of-the-art technologies, particularly in air defense, cyber defense, AI, and drone defense. Europe's security will thus no longer be defended at its borders, but in its airspace and cyberspace. At the heart of this new "Fortress Europe" is the construction of a drone defense wall along its eastern flank, which the EU reaffirmed at the summit in Copenhagen. In view of increasing airspace violations by suspected Russian drones and jets, Eastern European countries in particular called for decisive action. EU Commission President Ursula von der Leyen spoke of a "drone wall" to close Europe's protection gap.

The industry responded promptly: Saab, BAE Systems, and Rheinmetall pledged their support. While Saab pointed to the rapidly growing threat to both civilian and military targets, BAE emphasized its role as the "backbone" of European air forces. Rheinmetall highlighted the technical complexity: although drones themselves are easy to shoot down, mini and swarm drones pose new challenges. A combination of different defensive measures is particularly effective, with cannon-based systems taking center stage due to their cost-benefit ratio. At the same time, Australian specialist DroneShield is expanding massively in Europe. With AI-supported mobile and autonomous defense systems, the Company is part of NATO's "Project FlyTrap" and is expected to increase its production capacity fivefold by 2026. With over 300 ongoing projects and a rapidly growing order volume, DroneShield is a key player in the new defense architecture.

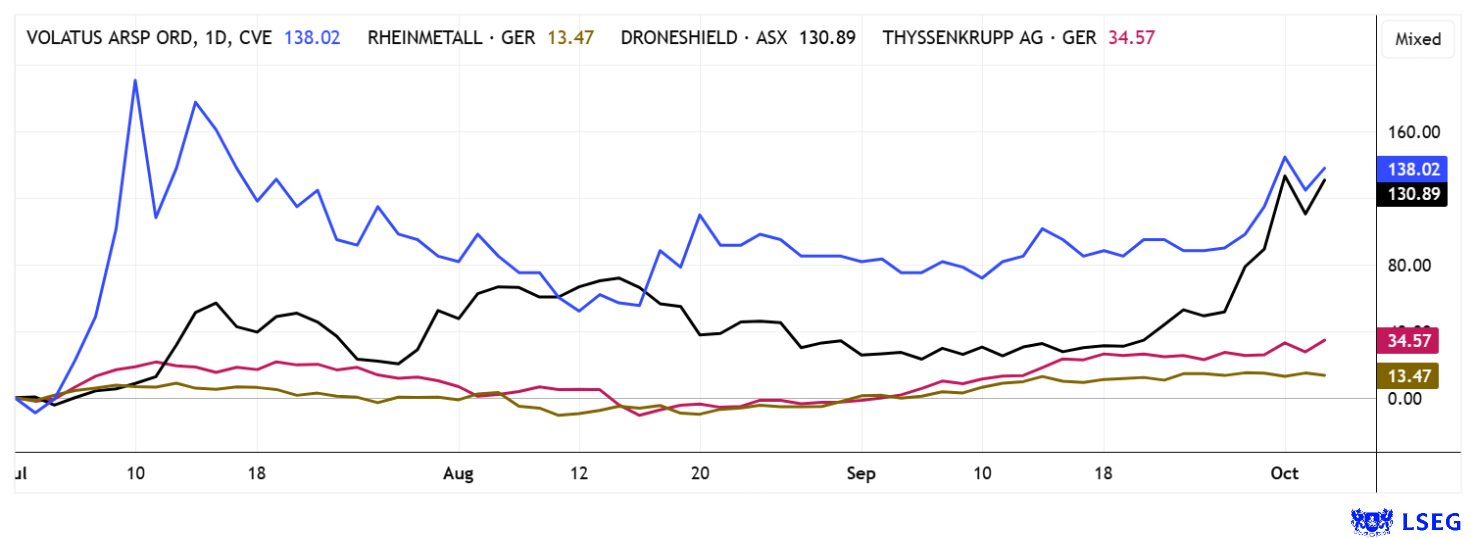

After a price surge, there appear to be new reasons to buy DroneShield and Rheinmetall shares. DroneShield added another 100% in September alone to reach EUR 3.80, and Rheinmetall also marked a new all-time high of EUR 2,005 after three months of consolidation. Anyone buying here is accepting 2027 P/E ratios of 75 and 32. Something for the strong of heart!

Volatus Aerospace – Business is really taking off now

Drones are also available from Canada. System provider Volatus Aerospace has established itself in recent years as a specialist in state-of-the-art, digitized air surveillance, combining advanced sensor technology with AI-supported image analysis for applications ranging from energy and logistics to defense. The Company has already conducted over 1.7 million km of pipeline inspections and completed more than 16,000 transport flights, underscoring the scalability of its technologies. The defense segment is growing particularly strongly, with Volatus recently winning a million-dollar contract for tactical drone systems from a NATO partner. Most recently, Volatus laid the foundation for automated drone-in-a-box networks used in infrastructure monitoring, forest fire prevention, and industrial inspection.

At the end of September, Volatus signed a letter of intent with VoltaXplore, a Nanoxplore subsidiary, to supply Canadian-made lithium-ion battery cells for the next generation of drones. This cooperation is intended to increase product differentiation and supply chain security and strengthen independence from foreign suppliers. The new batteries improve endurance, charging times, and cold resistance and are particularly relevant for use in the Arctic and for border surveillance. CEO Glen Lynch emphasizes that this partnership ensures a fully Canadian value chain.

With the technological and strategic advances shown, the stock has been in high demand recently, and financing at CAD 0.50 was very well received. After a brief correction from CAD 0.96 to CAD 0.50, the share price has risen again to over CAD 0.72 in recent days. However, with a current market capitalization of around CAD 470 million, Volatus remains significantly lower valued than competitors such as DroneShield. Given a growing defense budget and the prospect of over CAD 100 million in revenue by 2027, many observers still see considerable catch-up potential here. Due to high volatility, an entry between CAD 0.65 and CAD 0.75 should be feasible.

thyssenkrupp – Analysts are no longer bullish

thyssenkrupp shares have gained over 260% in the last 12 months. First, the defense sector was boosted by speculation about the naval subsidiary TKMS, and now there are hopes for the struggling steel sector, which has been unable to get back on its feet for a decade. thyssenkrupp and Czech industrial billionaire Daniel Kretinsky have ended their talks about expanding Kretinsky's 20% stake in the steel division. This stake is now being returned, and the purchase price refunded. This clears the way for Indian investor Jindal, as thyssenkrupp recently received a non-binding offer from India to restructure the division, which is under competitive pressure. thyssenkrupp remains Germany's largest steel manufacturer, but is struggling with decarbonization costs and persistently weak demand. Jindal's entry could mark a turning point after years of failed restructuring. Deutsche Bank recently lowered its "Buy" recommendation to "Hold," but raised its price target from EUR 9.00 to EUR 11.50. Jefferies expects EUR 9.50, DZ Bank sees the fair value at EUR 8.80, and JPMorgan at only EUR 6.30. The consensus on the LSEG platform is EUR 10.76, but the share price has long since surpassed this level at around EUR 12.50. Profit-taking should be considered at some point.

A bomb threat disrupted the Munich Oktoberfest, and drones circled the airport several times. The Bavarian Minister President announced a new police law and plans to work with the German Armed Forces to counter unwanted flying objects. Following similar incidents in Poland and the Baltic states, NATO remains on high alert. Defense stocks are once again benefiting on the stock market. Drone stocks Volatus and DroneShield are particularly strong performers, while Rheinmetall and thyssenkrupp continue to make strong progress. Maintaining healthy diversification helps protect against major portfolio fluctuations.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.