July 31st, 2025 | 07:25 CEST

Defense remains number one – another 200% with Heidelberger Druck, Almonty, Hensoldt, and DroneShield?

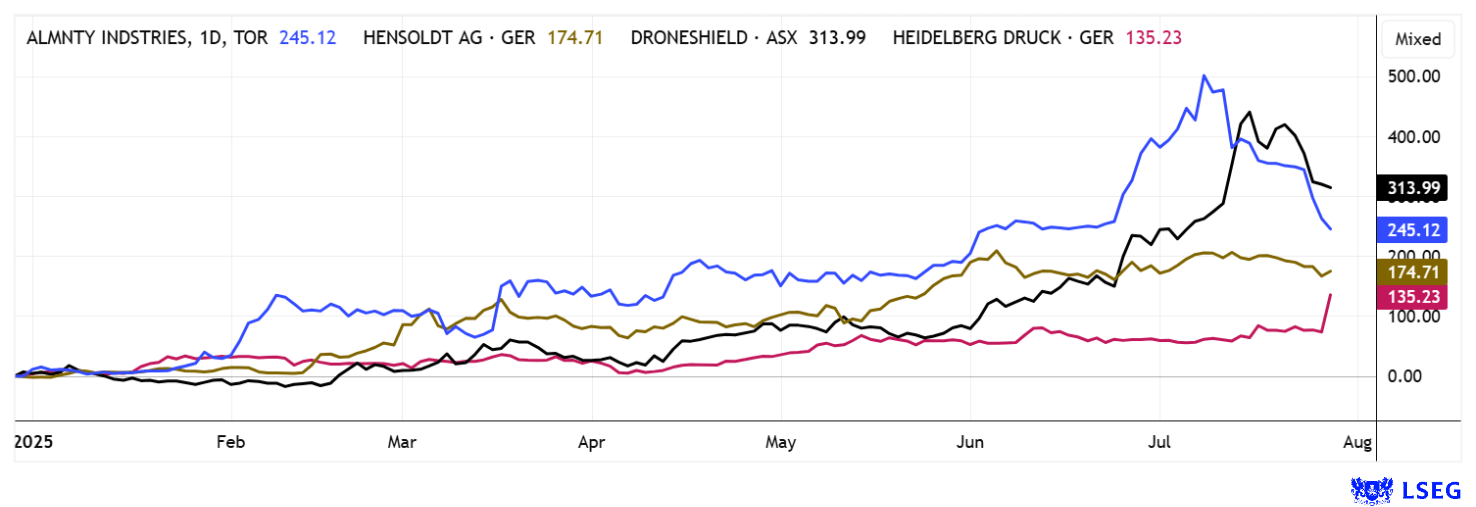

When the word "defense" is heard on the trading floor, investors' hearts beat faster. This was recently evident in an 80% rally by Heidelberger Druck in just 48 hours. Who would have thought it, given that Germany has benefited from the "peace dividend" for over 25 years and virtually eliminated its defense capabilities. Today, with conflicts and threats lurking around every corner, weapons and defense technology are back in the spotlight. From an economic perspective, it is encouraging that Germany can reestablish an industrial foothold in this field, especially as the automotive sector is facing headwinds. However, a detached view of the context reveals that profits and prosperity for shareholders are now being generated from the construction of machines that are directed against human life. This is a novelty in the German political potpourri, where the sector has been regulated for years, and the left wing tends to have the say. Where are the opportunities for investors?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

HEIDELBERG.DRUCKMA.O.N. | DE0007314007 , ALMONTY INDUSTRIES INC. | CA0203987072 , HENSOLDT AG INH O.N. | DE000HAG0005 , DRONESHIELD LTD | AU000000DRO2

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Heidelberger Druckmaschinen – The next arms race

What a phenomenal rise! While traditional printing technology is becoming increasingly irrelevant in the digital age, Heidelberger Druckmaschinen is consistently setting a new course. Revenue has declined significantly over the decades, and a comeback with the traditional core business seems impossible. However, a strategic change of course is providing fresh impetus: the machine manufacturer is now focusing more on growth areas such as energy supply and defense technology. The long-term cooperation with Vincorion, a supplier of military energy systems, sends a particularly strong signal in the current environment. There is more to the announcement made at the beginning of the week than a single order. Heidelberger Druck believes it is well on the way to concluding further industrial partnerships in the coming months. Details are still under wraps, but the new direction is well-received by the capital market, with the share price rising from EUR 1.60 to EUR 2.85 within 48 hours. The defense sector in particular offers long-term opportunities thanks to massive investments in Europe: billions are currently flowing into defense technology and infrastructure, and Heidelberg is entering the market at the right time. With estimated total revenues of EUR 2.2 billion in 2025, the projected EUR 100 million from the defense sector is still manageable. But at least in terms of marketing, the Company is benefiting from the transformation. Whether this justifies the EUR 300 million increase in valuation is left to the speculators!

Almonty Industries – After the correction comes the rebound

Whether in defense, aviation, or high-tech, many key industries rely on strategic metals such as tungsten. According to a recent NATO report, this extremely heat-resistant metal is one of the twelve most important raw materials for security and defense technology. China currently controls around 70% of global production, but quotas have recently been significantly reduced, marking a strategic turning point. Unlike rare earths, tungsten is not only rare but also difficult to source reliably. This is where Almonty Industries (Canada: AII / US: ALM) comes into play. The Canadian company has a fully controlled processing chain, active mines with cash flow, and the key Sangdong project in South Korea, which is nearing completion.

Given the extremely favorable conditions, CEO Lewis Black would certainly have hoped for more from the start on the Nasdaq. Nevertheless, USD 90 million was raised, which is as much as the entire company was worth in mid-2024. Even after the recent correction, the market capitalization is still a good CAD 1 billion. The relocation of the headquarters to the US, initial supply contracts with US defense contractors, and a newly appointed CFO from the US round out the picture. The new man on board is Brian Fox, who played a key role in strategic growth initiatives and post-merger integration as CFO at renowned auditing firm CBIZ Marks Paneth. He is the perfect fit for Almonty's industrial positioning, as merger speculation is now also coming into play.

Yesterday, it looked like a trend reversal was underway in Germany, but then more selling pressure hit the market. Following the sharp consolidation move, AII shares are now heavily oversold in the short term. Therefore, the imminent end of the quiet period following the US IPO could force US-based short sellers to cover their positions quickly. Research firm Sphene Capital recently raised its price target from CAD 5.40 to CAD 8.40 in July. Bet on a strong rebound expected in the coming days—long term, this stock belongs in every dynamic commodity portfolio.

Attached is the latest interview by GBC analyst Matthias Greiffenberger with Stockhouse.

DroneShield and Hensoldt – Minor corrections in the buying frenzy

Investors should keep their eyes open when it comes to DroneShield and Hensoldt, as the current valuations are difficult to understand from a balance sheet perspective. They are currently the result of absolute "defense euphoria"; from an analytical point of view, there is only the possibility of the valuations growing in the long term. Because the expected revenue and profit growth is likely to materialize more slowly than quickly, potentially stretching until 2030, it remains questionable why, amid so many daily uncertainties, P/S ratios of 5 to 12 are already being applied today.

Hensoldt, with a P/S ratio of 5, is currently valued at almost EUR 11 billion, but will not reach the EUR 5 billion revenue mark until 2029. In other words, the stock market is already trading for the years 2029 and beyond. DroneShield's valuation is equally astronomical, but here we are seeing revenue growth of over 100% from quarter to quarter. In the first half of the year, the Company achieved revenue growth of 210% year-on-year to AUD 72.3 million, meaning that the original annual forecast of AUD 94.4 million is likely to be exceeded soon. The DroneGun Mk4 defense device and other stationary systems are running like clockwork. Significant investments are currently being made to enable revenues of over AUD 500 million to be achieved in the future. Although the Australian company is already valued at AUD 2.5 billion, if growth continues at this pace, it will also "grow into" this valuation. In 2024, revenue of AUD 57 million was achieved, and according to analysts, this figure is expected to rise to AUD 200 million by 2025, with a current P/S ratio of around 12. While Hensoldt is likely to make a profit of around EUR 170 million (P/E ratio 53), DroneShield's surpluses will remain modest for a long time due to high investments (P/E ratio 82). Anyone who plays here is betting on a bright future for global defense investments. However, a surprise agreement in Ukraine would put considerable pressure on the charts. Caution at the platform edge!

The favorites are being reshuffled across the entire defense sector. While Almonty and DroneShield are currently correcting, Hensoldt is also finding itself in increasingly difficult waters. After a brief jump above EUR 100, not much has happened here. Heidelberger Druckmaschinen is a newcomer to the club, with gains of 80% in just 48 trading hours. A fascinating sector!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.