October 20th, 2025 | 07:20 CEST

DAX volatility and dream profits with gold at USD 4,300! Barrick Mining, Kobo Resources, Rheinmetall, and DroneShield

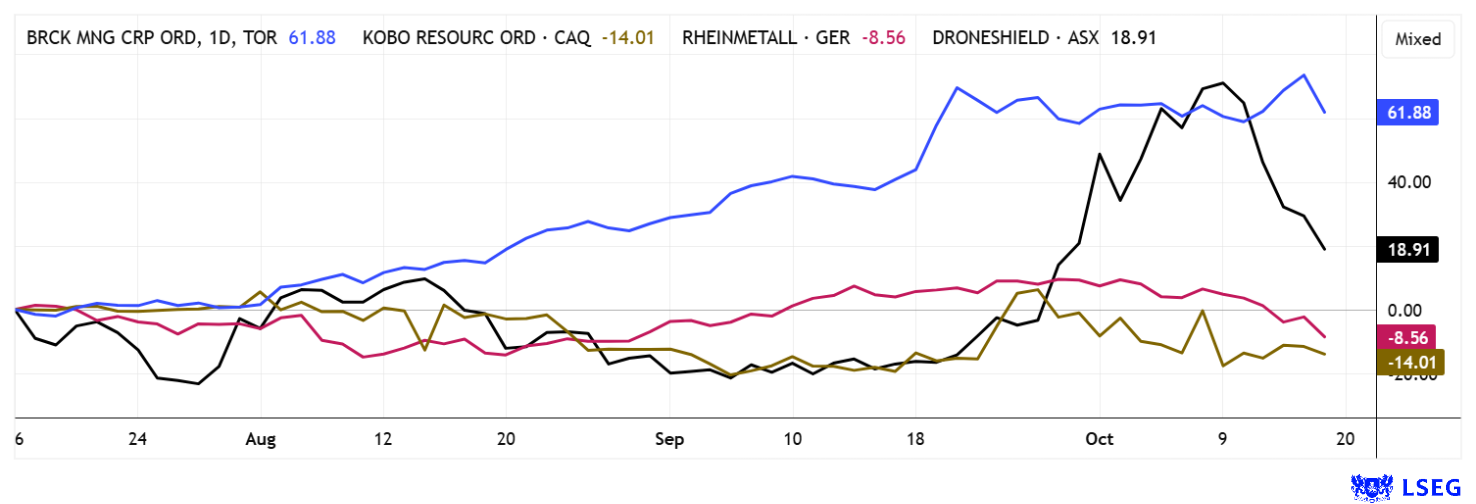

Despite its stable upward trend, gold remains a volatile asset, as last week clearly demonstrated. Short-term fluctuations of 3 to 5% were not uncommon, but they offer speculative investors attractive entry and profit opportunities. Following the trend, major US investment houses have raised their forecasts for the yellow metal: Goldman Sachs forecasts around USD 4,900 per ounce by the end of 2026, while Bank of America has mentioned the USD 5,000 mark for the first time. It will be interesting to see how small and large gold stocks such as Kobo Resources and Barrick Mining perform. Rheinmetall and DroneShield did not have a good week recently. Although they continue to benefit from the global arms race, their share prices came under heavy pressure. What to do now?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BARRICK MINING CORPORATION | CA06849F1080 , KOBO RESOURCES INC | CA49990B1040 , RHEINMETALL AG | DE0007030009 , DRONESHIELD LTD | AU000000DRO2

Table of contents:

"[...] Our SMSZ project is the largest contiguous land package of any exploration company in the region at 400km2 and overlays a 38km portion of the prolific Senegal Mali Shear Zone. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Barrick Mining – New prospects in Mali

It took a long time, but now the first successes are becoming apparent. Barrick Mining has recently made significant progress in Mali with the restart of operations at the Loulo underground mine. After four months under court administration, regular mining operations are set to resume in mid-October. The court-appointed provisional administration in Bamako had previously permitted only the processing and removal of existing ore. Now that blasting work is set to resume, Barrick's share price has recently benefited greatly.

The delays stemmed from overdue claims related to the production stoppage in January. The conflict was related to the new Malian mining law, which provides for significantly higher taxes and greater state participation. Barrick holds an 80% stake in the Loulo-Gounkoto mine, making it one of the largest foreign investors in the country. Under the supervision of former Health Minister Soumana Makadji, 1.07 tons of gold were recently extracted from old stocks. With the resumption of regular operations, production is now expected to ramp up gradually. Nevertheless, open-pit mining will remain suspended for the time being until all outstanding bills have been paid.

The ongoing talks between Barrick and the military government are complex and accompanied by parallel arbitration proceedings at the World Bank court. A ruling is expected in October and could have a decisive impact on future investment security. According to the Ministry of Mines, Mali's gold output fell by a full 32% to 26.2 tons by the end of August, a decline that Barrick's restart is now likely to partially offset. The government also wants to expand the state's share in the gold sector by awarding seven new licenses. This could bring great relief to all local mining companies. Barrick Mining is broadly diversified and is currently producing at full capacity. With a price of EUR 28.70, the share has already gained over 50% in 2025, and the P/E ratio has fallen to 13.3 due to strong profit growth. The figures for the third quarter will be released on November 10. With gold prices rising, investors should continue to buy!

Kobo Resources – West Africa shows its strength in the gold rush

West Africa is currently one of the most exciting growth regions on the African continent and is considered one of the most resource-rich zones in the world. Côte d'Ivoire in particular has established itself as an economic powerhouse in recent years, with stable growth rates of around 6% and a gross domestic product of around USD 94.5 billion expected for 2025. In addition to cocoa and oil, the gold sector is becoming increasingly important there and is attracting international exploration companies. One of them is the Canadian company Kobo Resources. The focus is on the largely untapped potential of the Kossou Gold belt. With over 18,000 meters of drilling and clearly identifiable gold anomalies, the project is now delivering promising results. Recent drilling in the Road Cut Zone yielded an impressive 17 meters at 3.87 g/t AU, including a 9-meter section at 6.84 g/t AU, indicating high-grade and continuous mineralization. Kobo has also identified gold deposits at depths of over 240 meters in the neighboring Jagger Zone. These advances increase the likelihood that Kossou could develop into a significant new gold deposit in West Africa.

In August, Kobo successfully raised CAD 3.9 million through a private placement to further advance exploration activities at Kossou and the nearby Kotobi project. The goal is to expand the known gold zones, start metallurgical investigations, and intensify the geochemical program. At the same time, a comprehensive drill program of 12,000 to 15,000 meters is underway, which will form the basis for the first mineral resource estimate (MRE) in 2026. The management team, led by CEO Edward Gosselin, is convinced that the current drill results clearly underpin the continuity and strength of the mineralization. While neighbors such as Barrick, Endeavour, and Perseus are already established producers, Kobo still offers considerable upside potential with its early project phase. Against this backdrop, the current market capitalization of around CAD 31.5 million appears comparatively low. The stock has also been tradable in Frankfurt since Friday. Kobo promises plenty of upside potential in the current bull market!

Rheinmetall and DroneShield – Have they peaked?

Rheinmetall and DroneShield saw sharp price corrections last week. Although the Düsseldorf-based defense group did not report any negative news, investors initially entered a realization phase due to the ceasefire in Gaza, as there is now hope that some progress will be made in Ukraine. Although these peace tendencies are unlikely to dissuade NATO from its trillion-euro investment plan, a temporary sideways phase is to be expected after a twentyfold increase in the share price in three years. Another technical burden is that Rheinmetall was unable to sustainably break through the EUR 2,000 mark after three failed attempts. The setback continued on Friday to EUR 1,645, with the latest financial figures due on November 6. Here, management must back up the hoped-for growth for the next 10 years with real figures. Long-term investors are staying the course, while speculators are betting on dips!

DroneShield is one of the most hyped defense stocks on the German stock exchange. For months, it climbed sharply on high trading volumes, gaining an impressive 500% before peaking at EUR 3.80 in early October. From there, the stock has now sharply consolidated to EUR 2.27 as of Friday. Some call it a correction, others a necessary normalization — but in our opinion, a 40% drop in just seven trading days looks more like a trend reversal. Figures are expected at the end of November. It will be interesting to see where the stock will stand with a 10-fold revenue valuation as of 2024.

Persistent inflation fears are driving interest in gold among many investor groups, most recently including institutional investors. Last week, the precious metal reached a new all-time high of USD 4,330. This means that many investment banks' price targets for 2025 have already been exceeded. The strong momentum and unchanged buying dynamics show no signs of weakness so far. In addition to industry giants such as Barrick Mining, smaller explorers such as Kobo Resources are increasingly gaining attention, while the defense sector appears to be slowly leaving its high-flying days behind.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.