November 4th, 2025 | 06:55 CET

Critical metals plus gold equals returns! Another 100% with Power Metallic, BYD, Mercedes, thyssenkrupp, and TKMS

Is it good or bad news that the US government is not supplying Tomahawk missiles to Ukraine? It is hard to say, especially if you live in Central Europe. The perceived threat from Russia has seemingly tripled within just a few months, as have the share prices of defense technology providers and suppliers of critical materials. Investors recognize that everything is interconnected these days. Artificial intelligence is boosting certain industries while simultaneously creating millions of unemployed people over the next few years, on top of an already shrinking economy. Those who are still able to consume happily will likely be the fortunate shareholders who bet on the right horses in this complex mix. We have a few examples in store for risk-conscious investors.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

POWER METALLIC MINES INC. | CA73929R1055 , BYD CO. LTD H YC 1 | CNE100000296 , TKMS AG & CO KGAA | DE000TKMS001

Table of contents:

"[...] China has become the manufacturing capital of the World, and because of its infrastructure, expertise and capabilities, Silkroad Nickel has strategically positioned itself to partner with Chinese companies in the Stainless Steel and EV industries [...]" Jerre Foo, Corporate Development Executive, Silkroad Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

TKMS: thyssenkrupp can be satisfied with the outcome of the IPO

The marine subsidiary of the thyssenkrupp Group, TKMS, has been listed since October 20. Existing thyssenkrupp shareholders received a spin-off dividend at a ratio of 20:1, resulting in a free float of 49% for the new TKMS shares after the transaction. The remaining 51% of the share capital remains with the parent company, giving thyssenkrupp a valuable asset of around EUR 5.2 billion on its balance sheet. This relieves some of the pressure that has built up in recent years from rising debt and substantial pension obligations. Important for thyssenkrupp is the restructuring of the revenue guarantees for the subsidiary, which are now fully reflected in the investment and thus automatically improve the credit rating for the parent company. These guarantees amount to roughly EUR 10 billion. After an initial wave of enthusiasm, the TKMS share price has stabilized between EUR 70 and EUR 85. The net value of the spin-off, around EUR 3 per thyssenkrupp share, has been factored into thyssenkrupp's market price. Based on the current market capitalization, the thyssenkrupp Group - excluding its 51% stake in TKMS worth EUR 2.6 billion - is now valued at only EUR 3.1 billion. While management at the Essen headquarters appears relieved by the successful spin-off, shareholders are left somewhat disappointed. The TKA share price had already climbed to EUR 13.30 in the run-up to the deal, and the subsequent decline to EUR 9.30 corresponds precisely to 80 divided by 20 - that is, a EUR 4 drop in value with one split share added to the portfolio. Many investors had probably hoped for more.

Power Metallic Mines: The clear message is independence

Amid global commodity market turbulence, Canadian exploration company Power Metallic continues to advance steadily. Since its founding, CEO Terry Lynch has pursued a clear growth strategy with a focus on critical metals such as nickel, copper, lithium, and platinum group elements (PGEs). Through the acquisition of 313 new concessions from Li-FT Power around the NISK project in Québec, Power Metallic has significantly expanded its land position and secured long-term exploration rights. With its stable framework conditions and strong government support, Québec is regarded as one of the world's most attractive mining regions.

The latest drill results from the Lion Zone delivered exceptionally high metal grades, confirming the deposit's outstanding potential. Geological studies also show that copper occurs primarily in chalcopyrite and cubanite, which suggests a high recovery rate. At the same time, valuable PGEs such as froodite and merenskyite are present, further strengthening the project's economic profile. Metallurgical tests are currently underway at SGS Canada in Québec City and Lakefield to determine the recovery of copper, nickel, gold, silver, and PGEs. These analyses are crucial for the project's economic evaluation and are expected to be available in early 2026.

In summary, Power Metallic impresses with a strong project pipeline, solid financial footing, and growing institutional interest. Analysts at Roth Capital Partners rate the stock as a "Buy" with a 12-month price target of CAD 3.00, while Red Cloud is similarly positive with a target of CAD 2.50. The latest capital increase of CAD 50 million has significantly increased the Company's reach, as all necessary work can now be completed without financial pressure. Although the long-term mine development plan will still take several years, Power Metallic Mines is positioning itself as a potential key player in North America's push toward self-sufficiency in critical metals. On November 4, management will publish a major update on recent activities. New investors, or those increasing their positions, are currently paying around CAD 1.25 per share, compared with the February high of CAD 1.95 - suggesting that additional purchases could pay off in the medium term. Very exciting!

CEO Terry Lynch discusses the current status of exploration work in Québec in an interview with Lyndsay Malchuk.

BYD versus Mercedes-Benz: E-mobility is where the action is

Chinese technology wonder BYD has now definitely gained a foothold in Europe. With state-of-the-art battery technologies that are perfectly tailored to vehicle use in China, thanks to vertical integration, the Company, which was initially financed by Warren Buffett, has become an Asian export hit. In stark contrast to European manufacturers, who are still at least two years behind in terms of technology, BYD can also definitely tap into the Chinese supply chain for critical metals. What is accessible to some seems increasingly denied to Western industries following export bans on strategic raw materials.

BYD currently has a market share of around 8 to 10% in the electric vehicle sector in Europe for new registrations in countries such as Spain, Italy, and the UK, with Germany still lagging. From January to July 2025, the Company sold around 84,400 vehicles in Europe alone, with particularly outstanding registration figures in the UK, where BYD registered 14,807 vehicles from January to May alone, representing a 570% increase over the previous year. Germany is also showing accelerated growth, with over 11,818 new BYD registrations by September. The Chinese have now exceeded a 1% market share in the overall European market for electric vehicles, relegating their competitor Tesla to second place.

Competitor Mercedes-Benz remains under pressure, with the group's profits slumping by more than 50% to EUR 3.87 billion after nine months. The main reasons for this are declining sales in key markets, high tariffs, and costs resulting from a comprehensive cost-cutting program. China and the US, in particular, performed weaker than expected, while competition from Asia is growing stronger. In addition, delivery problems at chip manufacturer Nexperia are causing uncertainty throughout the industry. Mercedes aims to reduce overall costs by 10% by 2027 in order to reestablish its lost margin. Despite the current crisis, CEO Ola Källenius is cautiously optimistic, pointing to new models such as the all-electric CLA and GLC, which are expected to boost sales again soon.

BYD shares have already corrected by over 40% in 2025, while Mercedes-Benz is slowly leaving its lows below EUR 50 behind. If analysts' current estimates for 2026 materialize, Mercedes-Benz is currently trading at a P/E ratio of 8.2, while BYD is trading at 11.4. Investors should expect higher momentum in China, but Mercedes-Benz is still one of the leading automakers and will eventually emerge from the crisis. BYD will release its third-quarter figures tomorrow, October 31! Exciting!

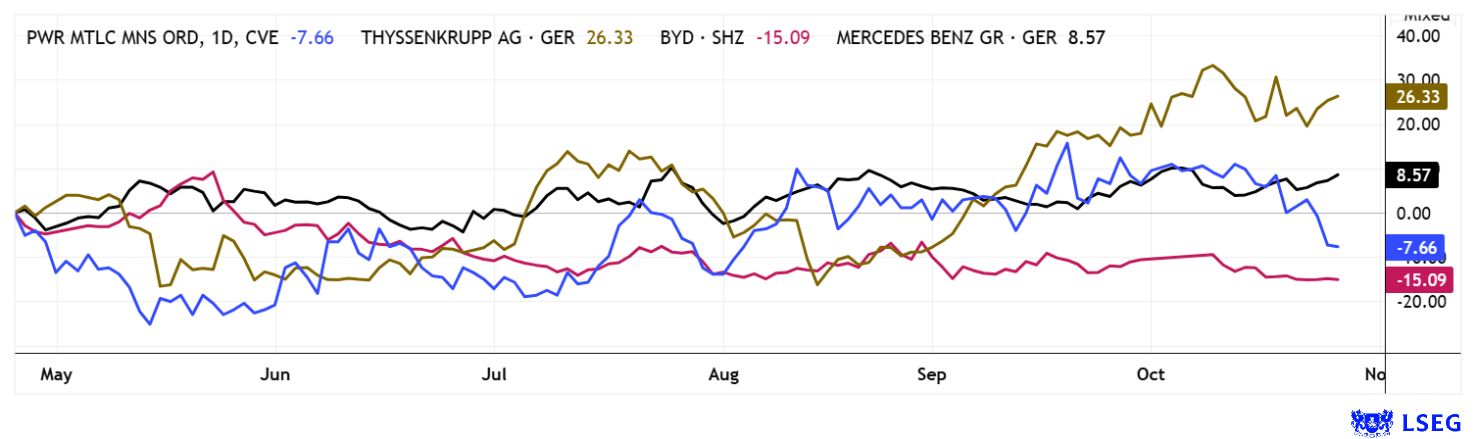

**Since Russia's invasion of Ukraine, defense stocks and suppliers of critical metals have seen particularly strong demand. Auto stocks like BYD and Mercedes-Benz have experienced different market cycles. In China, the trend for e-mobility is strongly upward, and the Stuttgart-based carmaker must adapt to this environment accordingly. Power Metallic presents clear buying opportunities; after doubling in price since the beginning of the year, the stock is now consolidating somewhat.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.