August 5th, 2025 | 07:25 CEST

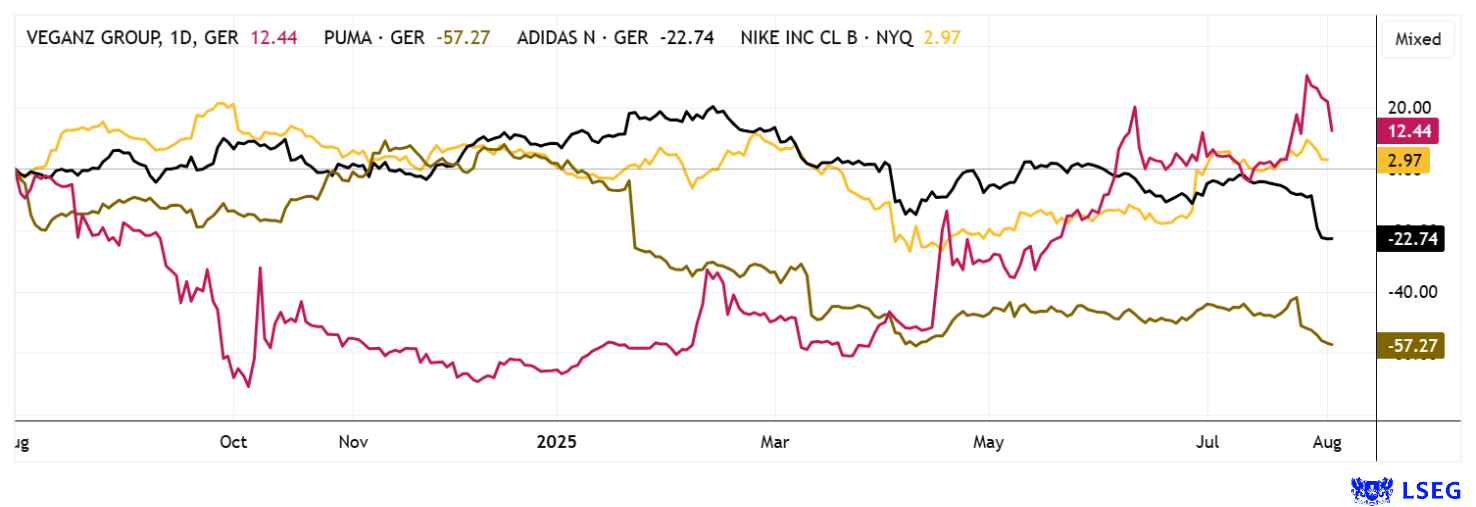

Correction over? The next doublers could be Puma and Veganz, while Nike and Adidas remain under pressure!

After the DAX fell 700 points in just 24 hours, investors are wondering whether last week's correction is already over. Over 60% of all S&P 500 companies have already reported their mid-year results, but the figures have not been enough to push the index higher across the board. This gives pause for thought and suggests that the correction is set to continue. While things are going well for plant-based nutrition specialist Veganz, sports consumers are coming under increasing pressure. US tariffs are becoming a problem for Adidas in the highly competitive sneaker market, and things are also looking tight for the popular Puma models. Nike could benefit from this, but its shares are costly. Who will be able to perform better in the slow summer months?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

PUMA SE | DE0006969603 , VEGANZ GROUP AG | DE000A3E5ED2 , NIKE INC. B | US6541061031 , ADIDAS AG NA O.N. | DE000A1EWWW0

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Veganz Group – Growth plans with new management

Berlin-based plant-based nutrition specialist Veganz is strategically focused on international growth, technology leadership, and sustainable food innovation. Following Jan Bredack's departure from the operating business on September 30, experienced manager Rayan Tegtmeier is taking over the role of CEO. His extensive expertise in business development, M&A processes, and capital market strategies will drive an ambitious realignment, as Veganz is positioned as a high-performance food technology holding company that aims to capitalize on global opportunities in plant-based nutrition.

The focus will be on the profitable scaling of established brand products, the development of new international growth markets, and the rapid expansion of technically innovative concepts such as Mililk® technology. This will be achieved through the efficient interaction of in-house production, licensing, and targeted investments in infrastructure and partnerships, including new production capacities in the US and the expansion of Austrian manufacturing.

Following the recent capital increase and thanks to planned divestments, Veganz is now in a much stronger financial position. The latest restructuring measures have streamlined processes and strengthened the resilience of the business model. Analysts continue to see considerable upside potential, as both the new cash position and the patent strategy reduce operational risks.

Tegtmeier has announced a strong strategic focus on efficient capital allocation and targeted investor relations efforts to attract institutional investors and help address the ongoing undervaluation of Veganz shares on the market. Co-founder and visionary, Jan Bredack, will remain the Company's largest shareholder and will be involved in OrbiFarm's promising indoor farming venture in the future. Following the strong rise in the share price at the end of July, the stock is currently consolidating at around EUR 17. Analysts at mwb Research have set a 12-month target of EUR 21.50, with an upgrade expected after the latest capital increase. Technically, the consolidation corridor of EUR 15 to 18 offers opportunities for additional purchases.

Puma – Deep in restructuring

Game over at Puma – No! The Company issued a drastic profit warning for the 2025 fiscal year and now expects currency-adjusted revenue to decline in the low double-digit range and EBIT to be negative. A far-reaching restructuring process entitled "nextlevel" was quickly launched to initiate the operational turnaround. As part of this, around 500 jobs will be cut worldwide, unprofitable stores will be closed, and one-off costs of up to EUR 75 million will be incurred. In return, strict cost discipline is intended to achieve an EBIT margin of 8.5% by 2027. A key element of the realignment was the change at the top: CEO Arne Freundt, who had led the Company since November 2022, stepped down in April 2025 following strategic differences with the Supervisory Board. Following a transition phase under CPO Maria Valdes, CFO Markus Neubrand, and new CCO Matthias Bäumer, Arthur Hoeld, a former Adidas executive with strong sales expertise, took over as CEO on July 1, 2025.

Under new leadership, Puma is now set to strategically reposition itself. The focus will be on performance products, reorganizing distribution channels, and a brand reset, which is to be presented by October 2025. The Company also plans to raise prices in the US to offset the tariff burden. Due to weak demand, high inventories, and negative currency effects, this will initially result in lower revenue. A heavy loss will therefore be unavoidable in 2025. mwb Research is lowering its rating to "Hold" with a 12-month price target of EUR 22. The consolidation may continue!

adidas versus Nike – Now tariffs come into play

The latest US tariffs on goods from Asia have hit both Nike and adidas hard, as both companies produce the majority of their shoes and sportswear in countries such as Vietnam, Indonesia, and China. Tariffs on Vietnamese imports, which are at the heart of both companies' supply chains, now stand at up to 46% for sporting goods, 32% for products from Indonesia, and 34% for products from China. This significantly increases import costs, which reduces margins and weakens the competitive position in the US market.

As a result, the shares of both companies reacted with double-digit losses in July. At adidas, the new costs are clouding the outlook so much that the Company has decided not to raise its forecast despite solid operational performance and has instead announced price adjustments in the US market. Nike, on the other hand, explicitly expects a significant decline in gross margin in the current quarter, also due to increased tariff costs and difficult production relocations. According to both companies, short-term price increases for shoes and clothing are considered "unavoidable" to compensate for the increased costs. Neither company can quickly relocate production to other countries or the US, as high-performance factories for technical sports shoes are located almost exclusively in Asia. This is where the negative effects of globalization are now becoming apparent.

These effects are already visible in the current quarterly figures: adidas is reporting additional costs of up to EUR 200 million in the US and is talking about clear margin pressure. Nike is pointing to a decline in quarterly margins and sees itself particularly affected by the US punitive tariff policy. Analysts assume that the average tariff burden for the industry in the US market will double and have a massive impact on profitability. The competitive situation remains tense, and the figures for the next few quarters will depend largely on how elastic US demand reacts to the inevitable price increases. The adjustment phase in valuations could therefore continue for several months. At present, we advise against investing in either stock.

The tariff shock is hitting brand-name sports goods manufacturers hard. They are facing several difficult quarters ahead. Alternative food producer Veganz is entering a new phase of expansion starting in the fourth quarter. The Berlin-based company's strategies have good chances of success, partly due to a production facility in the US.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.