August 4th, 2025 | 07:10 CEST

Correction or Crash? Gold and these stocks are holding their ground – Heidelberger Druck, Desert Gold, and DroneShield

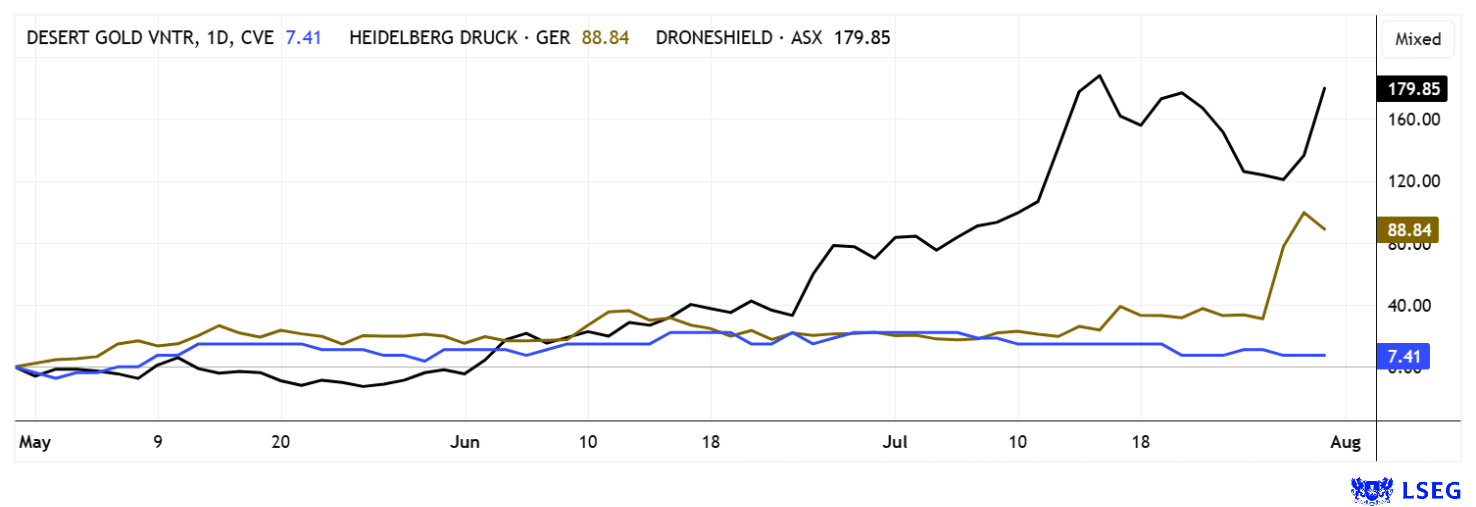

A new round of tariff chaos involving Donald Trump is sending the overbought markets into a tailspin. The CNN Fear & Greed Index plummeted by a full 32 points last week. After total euphoria, the markets are now back in neutral territory. Some sectors that had performed well, such as defense, AI, and high tech, also had to give up a few percentage points from their recent highs. But it is not all bad news, now investors have the chance to re-enter or top up at more favorable prices. Alternative investments such as Bitcoin and gold corrected slightly, but precious metals quickly rebounded after a brief consolidation. We take a look at some interesting stocks in a challenging market environment and ask: How can investors navigate the summer slump?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

HEIDELBERG.DRUCKMA.O.N. | DE0007314007 , DESERT GOLD VENTURES | CA25039N4084 , DRONESHIELD LTD | AU000000DRO2 , BARRICK MINING CORPORATION | CA06849F1080

Table of contents:

"[...] We quickly learned that the tailings are high-grade, often as high as 20 grams of gold per tonne; because they are produced by artisanal miners, local miners who use outdated technology for gold production. [...]" Ryan Jackson, CEO, Newlox Gold Ventures Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Heidelberger Druck – Market value doubles with EUR 100 million defense contract

Last week, Heidelberger Druckmaschinen shares temporarily climbed by over 80% from EUR 1.50 to EUR 2.80, triggered by the Company's entry into the defense segment via a strategic partnership with Vincorion. The agreement stipulates that Heidelberg will develop and build energy control and distribution systems for Vincorion's Eurofighter generators. This expansion into a crisis-proof, high-growth segment came at exactly the right time, as NATO is once again pumping billions into defense technology. In Q1 2025/26, Heidelberg increased revenue by 16% to EUR 466 million, up from EUR 403 million. At the same time, adjusted EBITDA climbed from –EUR 9 to 20 million, and the operating loss narrowed to -EUR 11 million from –EUR 42 million. Order intake amounted to EUR 559 million, slightly below the previous year's figure of EUR 701 million, but still solid after the drupa trade fair. European and Asian regions performed particularly well, while North America was weaker due to political uncertainties. Heidelberg confirmed its full-year forecast of EUR 2.35 billion in revenue and an EBITDA margin of up to 8%. CEO Jürgen Otto emphasized that the new technology and defense projects, together with efficiency measures, could significantly transform the Company. The joint venture with Vincorion marks the entry into a segment with long-term demand, high margins, and secure government orders. Analysts expect Heidelberg to generate around EUR 100 million in revenue in the defense segment alone by 2028. The mechanical engineering company is moving away from traditional printing solutions toward technology-oriented precision manufacturing with long-term potential. However, the high price premium is due to short-term euphoria. After a correction to EUR 1.80-2.00, new investments could prove successful in the long term.

Ivory Coast – Desert Gold in the spotlight

Desert Gold Ventures is developing promising terrain with its new Tiegba project in the resource-rich Birimian Belt of Ivory Coast. The 297 km² area is located in close proximity to production projects such as Agbaou, Bonikro, and Yaouré, which bodes well for further discoveries. At the same time, the country is focusing on the massive expansion of mining, with plans to double gold production to around 50 tons by 2025. This is being driven by projects such as Lafigué, which is expected to deliver 200,000 ounces annually starting in 2025. Established companies include Endeavour Mining, which operates the Ity, Lafigué, and Agbaou mines, and Barrick Gold with the Tongon mine. Perseus Mining operates the important Yaouré gold mine. The government is currently introducing stricter regulations, which should lead to greater professionalization among artisanal miners. External investors stand to benefit from these efforts, as the "natural losses" are expected to decline.

Desert Gold is one of the newer explorers in the area, but is already in the spotlight because its recently acquired Tiegba Gold project has not yet been drilled but shows surface anomalies of up to 900 ppb gold over a trend length of more than 4 km. The political and infrastructural situation is stable, investor-friendly, and well developed. Desert expects rapid approvals and low operating costs and is already looking for additional land parcels. This could ultimately turn out to be a really strong opportunity, as Côte d'Ivoire is pursuing a clear path and actively supporting its foreign investors. The Company is currently transforming itself from a small explorer into a regionally relevant player. The stock is still largely under the radar, but with a market value of just CAD 18.5 million, a multiple upside is possible. Analysts at research firm GBC rate it a "Buy" with a 12-month price target of CAD 0.43. Exciting!

DroneShield – Strong rebound and second peak

Another defense stock has been making waves in recent months: DroneShield. The Company is one of the stock market winners of the year, with its share price increasing sixfold at times in 2025, but it has recently experienced a significant correction. After reaching an all-time high of EUR 2.32 in mid-July, profit-taking pushed the share price down to EUR 1.65. DroneShield can report strong growth figures, with the Australian company achieving revenue growth of 480% in Q2 2025 alone. For the year as a whole, over AUD 176 million has already been secured through completed orders. This provides exceptional planning security, with production capacity set to triple to over AUD 500 million by the end of 2026, thanks to an investment of AUD 13 million.

**Despite the growth story, the valuation remains ambitious: The price-to-sales ratio for 2025 is around 16, so investors continue to expect strong revenue jumps. According to forecasts, margins will rise to a good 8% in 2025 and 11% by 2027, but any delay in large orders would likely hit the stock hard. Analysts point to the strong order pipeline, but also urge caution: DroneShield gained a whopping 136% in just three months, so short-term setbacks are likely. The stock chart is currently forming a second peak.

However, the medium-term outlook remains positive: the global market potential for anti-drone technology continues to grow at double-digit rates, and DroneShield is considered an innovation leader in this field. Experts anticipate revenue of nearly AUD 300 million by 2027, with profitability continuing to rise. Short-term investors should consider taking profits ahead of the upcoming quarterly figures. Long-term investors are betting on technological leadership and hoping that the Company will "grow into" its highly advanced market valuation.

The financial markets are becoming increasingly volatile, triggered not least by ongoing geopolitical uncertainties, which are putting defense stocks in particular in the spotlight. In this environment, Canadian commodity explorer Desert Gold is at a key inflection point. Given its low market valuation of around CAD 18 million, which is equivalent to only about USD 12 per ounce of gold in the ground, the Company could become the focus of potential buyers. The current year, therefore, promises not only operational progress but also possible strategic developments.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.