June 7th, 2023 | 08:00 CEST

Commodity shares with price potential: Bayer, K+S, and Almonty Industries in the analyst check

There are no signs of a deep recession in the US at the moment, which is positive for commodity prices and the corresponding companies. What do analysts say? They see a price potential of over 170% for tungsten producer Almonty Industries. With the commissioning of the flagship mine in South Korea, revenues and profits should increase strongly from 2024. After K+S earned brilliantly last year, there is a lack of positive impulses this year. Several analysts have spoken out. Can the DAX-listed company make gains again? At Bayer, the euphoria surrounding the change in the board of directors has faded, and the share price is almost back to where it was at the beginning of the year. But analysts see significant upside potential.

time to read: 4 minutes

|

Author:

Fabian Lorenz

ISIN:

BAYER AG NA O.N. | DE000BAY0017 , K+S AG NA O.N. | DE000KSAG888 , ALMONTY INDUSTRIES INC. | CA0203981034

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Almonty Industries: The countdown to a 170% share price opportunity is on

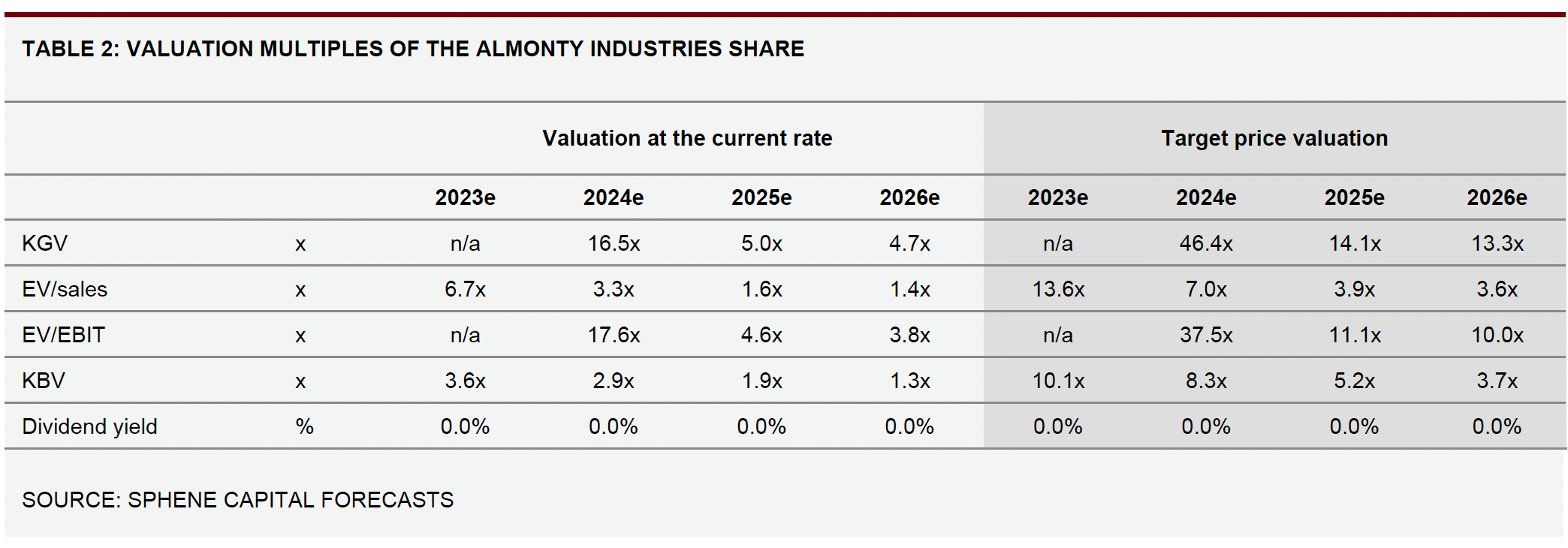

The analysts of the German Sphene Capital have renewed their buy recommendation for the shares of Almonty Industries after the latest quarterly figures. The price target was raised slightly from CAD 1.59 to CAD 1.69. The tungsten producer's shares are currently trading at CAD 0.61 and thus have a good 170% upside potential. But where does the optimism of the analysts come from? The answer: the Company, which is currently valued at around CAD 169 million, wants to put the largest tungsten mine outside China into operation this year and become one of the leading tungsten producers in the coming years. And tungsten is in demand. Among other things, it is urgently needed for next-generation batteries. It replaces the controversial cobalt and is supposed to improve charging performance, endurance and safety through a higher energy density. In addition, tungsten is important as a hardening metal in alloys for the defence and high-tech industries. The problem is that the mining areas for this critical metal are largely located in China and Russia. This will make it difficult for Western companies to ignore Almonty in the future.

Almonty already operates three smaller mines on the Iberian Peninsula. The focus is clearly on the development of Sangdong in South Korea. It is to be developed into the largest tungsten mine outside China. With the commissioning, sales and earnings are expected to increase strongly from 2024 onwards. Sphene Capital expects sales in 2024 to almost double to CAD 63.7 million compared to 2023. By 2025, revenues are expected to exceed CAD 100 million. Earnings are also expected to increase significantly. EBITDA is expected to climb to CAD 23.2 million in 2024 and CAD 47.7 million in 2025. Analysts expect a net income of CAD 8 million in 2024 and CAD 26.3 million in 2025, so it should only be a matter of time before the stock, valued at CAD 169 million, takes off. The countdown is on (for the complete Sphene study, visit http://www.more-ir.de/d/27013.pdf)

K+S: Analysts reduce price targets

The K+S share has little momentum at the moment. From its long-term high of over EUR 35 in April 2022, it has since lost more than half and is currently trading at EUR 15.30. Analysts have recently reduced their price targets. Baader Bank downgraded the share of the salt and fertiliser producer from "Buy" to "Add". At the same time, the price target was reduced from EUR 26 to EUR 18. The analysts pointed to low demand from farmers and correspondingly high inventories in Asia and Latin America. The experts do not see a significant improvement in the environment at present. Therefore, they expect K+S to reach only the lower end of their own forecasts.

UBS has also reduced its price target for the K+S share from EUR 19 to EUR 17. With a view to the next 52 weeks, the share is fairly valued. The analysts do not expect any increases in the price of potash and have therefore reduced their estimates for K+S earnings.

After all, K+S has used the high prices in 2022 to reduce debt and seems to be solidly financed. Standard & Poors has upgraded K+S to investment grade. The rating agency sees the salt and fertiliser producer's credit rating for senior unsecured bonds at BBB - with a stable outlook. S&P expects K+S's leverage to remain low over the next two years. Despite declining potash prices, debt to adjusted EBITDA should remain below 0.5. Despite the industry's cycles and the Company's vulnerability to potash price fluctuations, the leverage ratio should be less volatile. With the stable outlook, S&P signals that the potash market will remain favourable over the next 12 to 18 months.

Bayer: EUR 89 in the bag?

The Bayer share is also currently lacking positive momentum. The euphoria over the change of management board has faded, and the share has fallen back to around EUR 52. This is only 5% above the level at the beginning of the year. But analysts are quite optimistic. DZ Bank recently renewed its buy recommendation for the DAX group. However, the target price was reduced from EUR 75 to EUR 66. The agricultural business is doing well overall, but the decline in sales of glyphosate is a burden. At least the provisions for the legal disputes surrounding glyphosate should decrease. Nevertheless, analysts have reduced their profit estimates for the full year after the relatively weak start.

Bernstein Research is much more positive about the potential for Bayer shares. Their target price for the Leverkusen-based group is EUR 89. Bayer's pipeline is broad and promising. With a price target of EUR 80, Barclays is similarly optimistic. The analysts particularly praise Bayer's positioning in the agricultural business. Innovations are needed to secure the food supply for the growing world population. Therefore, Bayer shares offer long-term upside potential.

The closer the commissioning of the Sangdong mine gets, the more attention should be paid to Almonty's stock. Sphene Capital's estimated revenue and earnings growth suggests the share is undervalued. K+S is currently lacking impulses for rising prices. Perhaps this could change with a dry summer in Europe. At Bayer, the euphoria surrounding the change in the management board has faded, and there is currently no reason to buy.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.