May 9th, 2024 | 07:15 CEST

Carbon Done Right, Varta, Siemens Energy - On the road to success with clean energy

The global energy transition requires active measures to tackle current environmental issues. Companies such as carbon credit trader Carbon Done Right are proving how a consistent focus on clean energy through environmentally friendly projects brings environmental and economic benefits. Their innovative use of AI to precisely monitor their tree inventories ensures complete traceability of their carbon credits, which creates trust with investors and buyer companies such as Microsoft. Innovations are urgently needed for economic success at VARTA AG. A large-scale battery research project based on common salt as an energy source is intended to bring the ailing company back into the profit zone. Siemens Energy is already one step ahead. The current balance sheet reflects the ongoing restructuring measures and tough cost-cutting measures to further advance clean energy technologies. But one thing is falling by the wayside...

time to read: 5 minutes

|

Author:

Juliane Zielonka

ISIN:

CARBON DONE RIGHT DEVELOPMENTS INC | CA14109M1023 , VARTA AG O.N. | DE000A0TGJ55 , SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

Investing in the future: Carbon Done Right as a sustainable investment opportunity

Companies such as Palantir use artificial intelligence to automate data analysis. Public spaces in China use facial recognition algorithms to protect passers-by from crime. Carbon Done Right uses AI to protect the environment. The Canadian company specializes in trading carbon credits. It uses AI to monitor its landscape projects by feeding open data from space agencies into its proprietary software system, combined with analytics and machine learning. Carbon Done Right's digital carbon footprint is based on tangible data, where each tree is accurately quantified and monitored This, combined with valid, locally generated data, means that the Company's carbon credits are fully traceable from tree to trade.

Companies such as Microsoft and Meta purchase carbon credits to keep their carbon footprint in check. This swap creates further incentives to reduce emissions through sustainable projects. This is exactly where the Canadian company Carbon Done Right comes in. Carbon Done Right owns and operates environmentally friendly projects that help other companies achieve their greenhouse gas emission reduction targets. Another benefit of Carbon Done Right's carbon credits is the protection of biodiversity in the projects.

The Company is involved in the exploration, restoration and maintenance of land and marine areas. Carbon Done Right either protects existing ecosystems or restores degraded areas so that they become fully functional ecosystems again. This is done through large-scale planting of native tropical trees and mangrove species to restore the areas in question to a wild and natural state. Through partnerships with governments worldwide, for example, in Sierra Leone, Yucatan, Guyana and Suriname, the Company can continue to expand its business and thus make a meaningful contribution to the preservation and protection of the environment. Investors who focus on sustainability are in good hands with Carbon Done Right.

Varta provides a salty innovation in the battery sector

The development of sodium-ion batteries is considered a promising approach to sustainable and resource-saving energy storage. Altech Advanced Materials is already collaborating in this field with the Fraunhofer Institute. Sodium is widely available, especially in Europe, and is inexpensive and environmentally friendly to produce and dispose of. In addition, the supply routes are short and less susceptible to disruption. The task for VARTA AG is to convert this technology into industrially usable, high-performance batteries.

Under the leadership of VARTA, 15 companies and universities have now joined forces in the ENTISE project (development of sodium-ion technology for industrially scalable energy storage) to develop this approach further. The German Federal Ministry of Research and Education is supporting the project with around EUR 7.5 million. The research project was launched on May 2, 2024, and will run until 2027.

The aim of ENTISE is to develop cost-effective, high-performance and environmentally friendly sodium-ion batteries that can be used in industry. The research focuses on the further development of material concepts and processes to improve the storage capacities of the batteries and increase their cycle stability.

Lucrative innovation is urgently needed at VARTA AG. In February of this year, the ailing company had to fend off a cyber attack that paralyzed production for weeks. **This week, the Company appointed industry and restructuring expert Michael Ostermann as the new CEO. Varta announced that the 58-year-old has many years of management experience in the automotive and battery industries, including at Exide Technologies.

Business at the Company from Ellwangen in Swabia has been worse than expected, both with small lithium-ion button cells for headphones and with energy storage units for photovoltaic systems. "I see the challenges. But above all, I see the potential," says Ostermann about his new responsibility. VARTA AG was also excluded from the SDAX as it did not meet the requirements for the prompt publication of audited annual financial statements.

Siemens Energy on course for success after Gamesa restructuring

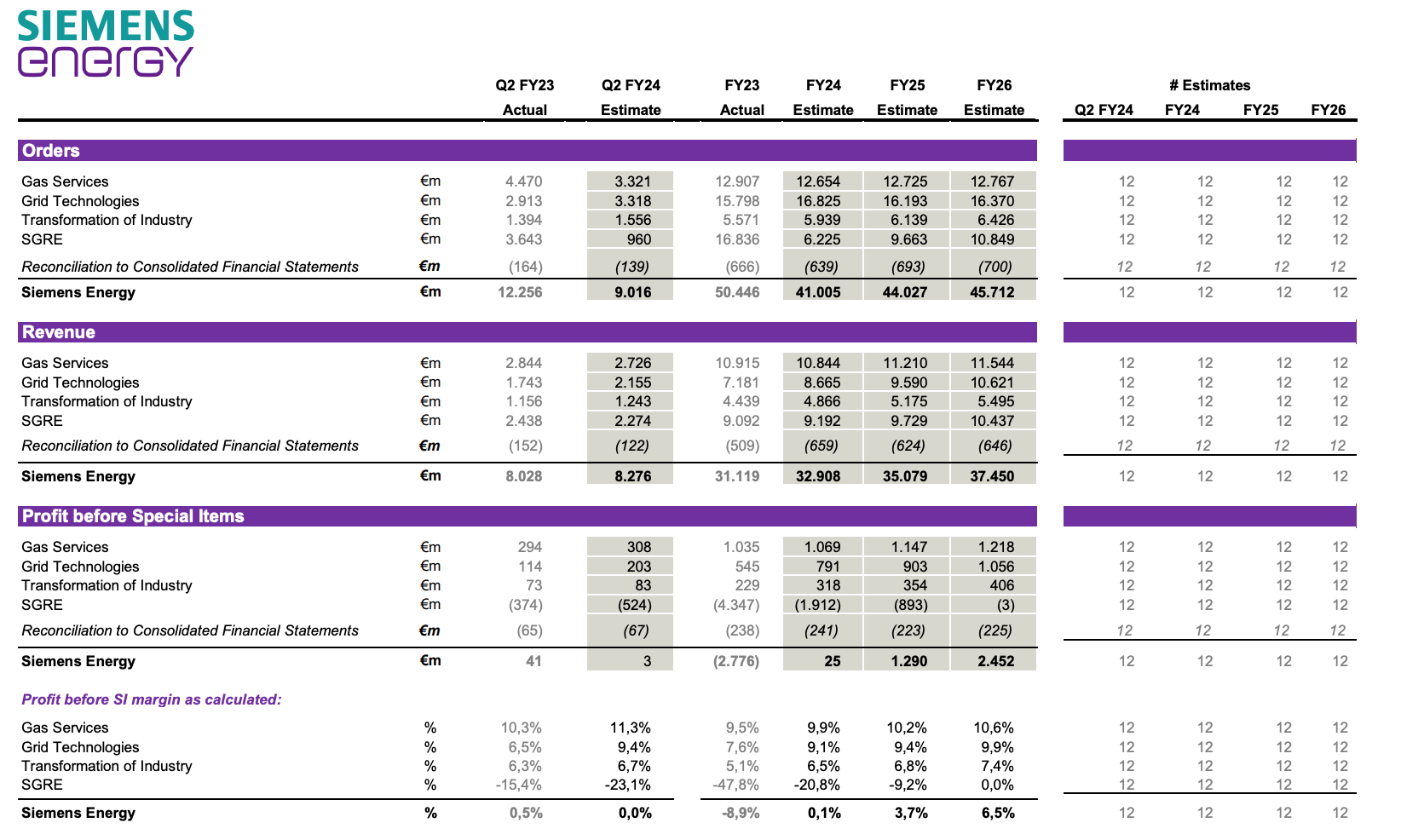

The German energy technology company Siemens Energy reported positive quarterly results and raised its profit forecast for the current year. The Company, which spun off from Siemens in 2020, is struggling with losses in its wind power division, Gamesa. However, the report published this week shows a net profit of EUR 108 million in the first quarter, compared to a loss of EUR 189 million in the same quarter last year. Sales increased by 3% to EUR 8.3 billion.

Siemens Energy now expects revenue growth of 10 to 12% for 2024. The ongoing cost-cutting restructuring at Gamesa is intended to reduce losses and make the division profitable by 2026. The long-term growth strategy for Gamesa focuses primarily on Europe and the US and on adjusting production in the challenging onshore wind business. The restructuring at Gamesa will also include layoffs, although Siemens Energy has not commented on the extent of potential job cuts. However, the author of the restructuring plan will no longer implement it. The current Gamesa CEO, Jochen Eickholt, who has been working for two years to get the faltering company back on track, will step down from his post on July 31. His successor will be Vinod Philip, a Siemens veteran.

The Company Carbon Done Right, which specializes in CO₂ certificates, makes a valuable contribution to environmental protection. The team focuses on the protection and reforestation of natural areas on land and water. Thanks to its unique AI-supported technology, Carbon Done Right is one of the few companies that brings its certificates to the market with data accuracy, from tree to trade. This ensures security on both sides and even more so for investors who are keen to participate in such a long-term oriented company through an investment. VARTA AG has appointed a renovation expert to its Management Board. The Company recently suspended production for weeks due to a cyber attack. Hope for new energy from VARTA is provided by a research project on sodium-ion batteries, which is generously funded by the German Federal Ministry. Siemens Energy also impressed with its radical renovation course. Revenue rose by 3% to EUR 8.3 billion. The forecast for revenue growth in 2024 was raised from the original 3-7% to 10-12%. A strict cost-cutting program and a new CEO are among the transformation measures to expand the successful course further. And so, three investment opportunities in clean energy that investors should take a closer look at.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.