December 22nd, 2025 | 07:15 CET

Mega rally in 2026 with artificial intelligence, chips, and storage solutions: Oracle, Graphano Energy, Broadcom, and Infineon

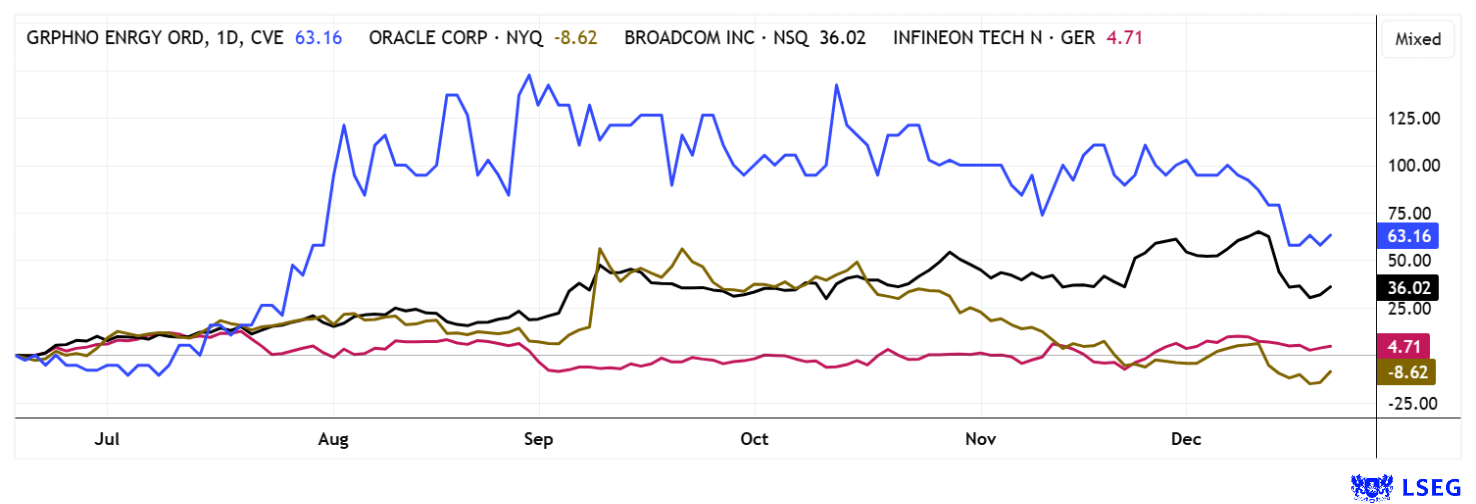

The year 2025 is drawing to an end. This year, the focus was clearly on the shares of AI providers in the areas of storage solutions, infrastructure, and databases. Investment banks see this sector as a potential driver of rising stock markets in 2026 as well. Will there be a correction in the first quarter? No one knows, because apart from the minor customs uncertainty in April 2025, there has been no serious decline in the international capital markets so far. This is surprising, because inflation remains high, interest rates are rising, and commodity prices are galloping away. These are all indications of higher input prices and falling margins. Which stocks are still making good money?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

Graphano Energy Ltd. | CA38867G2053 , BROADCOM INC. DL-_001 | US11135F1012 , INFINEON TECH.AG NA O.N. | DE0006231004

Table of contents:

"[...] When we acquire something, we want to make sure that the acquisition fits with our strategy and has the potential to be successful for our shareholders. [...]" John Jeffrey, CEO, Saturn Oil & Gas Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Oracle – TikTok US under new management

45% decline since September! Back to square one: After a spectacular consolidation, database specialist Oracle is back to a zero return. But now things are getting exciting, as the Company is taking over TikTok's US business as part of a new joint venture, ending years of political controversy over the platform's Chinese origins. For Oracle shares, Friday's 7% ad hoc rise ended months of selling. The deal will become legally effective on January 22, and the new company will operate under the name TikTok USDS Joint Venture. Oracle, together with Silver Lake and Abu Dhabi-based investor MGX, holds 50% of the shares, while ByteDance retains a 19.9% stake and ByteDance's existing shareholders hold the remaining 30.1% of the shares. An exciting mix of US tech, Arab investment, and the vibrant founding company.

The core of the agreement is that all US user data will in future be stored exclusively on American servers and managed under the supervision of Oracle. The TikTok algorithm will also be retrained specifically for the US market, while moderation and security controls will be entirely the responsibility of the US. ByteDance will have no access to data, content, or decision-making processes. The value of the US business is estimated at around USD 14 billion, and US citizens now hold the majority of seats on the board. This means that the regulatory requirements have been met, and app operators from China can breathe a sigh of relief.

The sale is the result of massive political pressure from Washington after repeated threats to ban the app. With the new structure, TikTok is now considered to be under security control in the US. Small and medium-sized companies in particular, which use TikTok intensively for marketing, are relieved. For European users, however, nothing will change, as TikTok will remain wholly owned by ByteDance outside the US. For Oracle, the deal could mean a real windfall. Analysts on the LSEG platform expect a 12-month potential of just under 54% to USD 295. A risk-aware entry at USD 193 appears attractive.

Graphano Energy – Focus on security of supply for critical metals

In addition to the enormous energy requirements for the use of artificial intelligence, the ramp-up of electromobility also requires a secure supply of battery raw materials, with graphite playing a central role. The Canadian company Graphano Energy is working consistently in Québec to build a diverse project pipeline in order to position itself as a future supplier to the North American battery industry. The focus is on the Lac Aux Bouleaux project, which is directly adjacent to Northern Graphite's producing Lac-des-Îles mine and offers significant cost and time advantages through an agreement to share the processing plant. The portfolio is complemented by the Standard Mine project, whose high grades have already been confirmed by metallurgical tests.

Graphite itself is often underestimated in the market, even though it is indispensable as an anode material for lithium-ion batteries. Forecasts predict a massive increase in demand by 2030, while China continues to dominate the market today. Against this backdrop, officials in the US and Canada are specifically promoting domestic projects, which is providing political tailwind for exploration companies such as Graphano. The location in Québec is also attractive due to its excellent infrastructure, tax incentives, and access to clean hydroelectric power.

Graphano has recently made visible progress in the development of its projects. A high-resolution airborne geophysical survey has been launched for the Black Pearl area to provide detailed insights into the underground structures. The data obtained will be linked to existing geological information in order to precisely define new drill targets. At the same time, the Company is preparing to take large samples at the Lac Aux Bouleaux and Standard projects, including obtaining permits, planning infrastructure, and developing environmental concepts. These steps mark the transition from exploration to possible future development. A definitely consistent path to the next stage of development.

Financially, Graphano recently strengthened its position through a completed private placement of CAD 375,000. Given the high strategic importance of graphite, the Company offers speculative leverage on the growing battery raw materials market with a comparatively modest market capitalization of CAD 3.6 million. The stock could quickly rise to the top of the starting list in 2026!

First-hand information is provided by CEO Dr. Luisa Moreno in an interview with IIF correspondent Lyndsay Malchuk:

Infineon and Broadcom – Key players in data centers and edge applications

At the center of the AI storm are the two chip manufacturers Infineon and Broadcom. Both companies have invested heavily in AI-related technologies in recent years, with a focus on data centers and edge solutions. German high-tech stock Infineon focuses on energy-efficient power semiconductors and specialized chips that accelerate AI workloads or make them more efficient. This focus positions Infineon as a driver of AI infrastructure in data centers and industrial applications, where energy efficiency plays a central role. Broadcom, on the other hand, defines its focus in the AI semiconductor sector and supplies key components for AI platforms in data centers, networks, and storage solutions. Broadcom's broad portfolio enables the Company to benefit from economies of scale and integrated solutions in the AI ecosystem.

Both companies are benefiting from the seemingly endless growth in demand for AI, but face challenges such as semiconductor shortages, supply chain stress, and price pressure, which require high investment in R&D and extensive partnerships. Analysts see AI as a key long-term theme that will continue to position Infineon and Broadcom as relevant players in the global AI ecosystem. As a result, the stocks often appear on the selection lists of asset managers and industry gurus. On the LSEG platform, 23 out of 27 analysts recommend an active position in Infineon shares. The weighted 12-month price target is EUR 42.93, representing around 20% potential for the coming year. For Broadcom, the bar is set even higher at USD 456, which is 34% above the current price of USD 340. All in all, these are good ideas for a diversified growth portfolio.

New year, new luck! Assuming that the losers of 2025 could become the winners of 2026, Oracle does not look too expensive with a 2026 P/E ratio of 26. Infineon even has a profit ratio of only 22, while Broadcom takes the cake with 34. Explorer Graphano Energy also appears attractive – on the one hand because of its interesting strategic positioning in the critical raw materials sector, and on the other because of its still negligible total value of less than CAD 5 million. Exciting!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.