July 19th, 2023 | 08:00 CEST

Cannabis 3.0 - will profits be made now? Canopy and Tilray under pressure, Cantourage Group positioned superbly

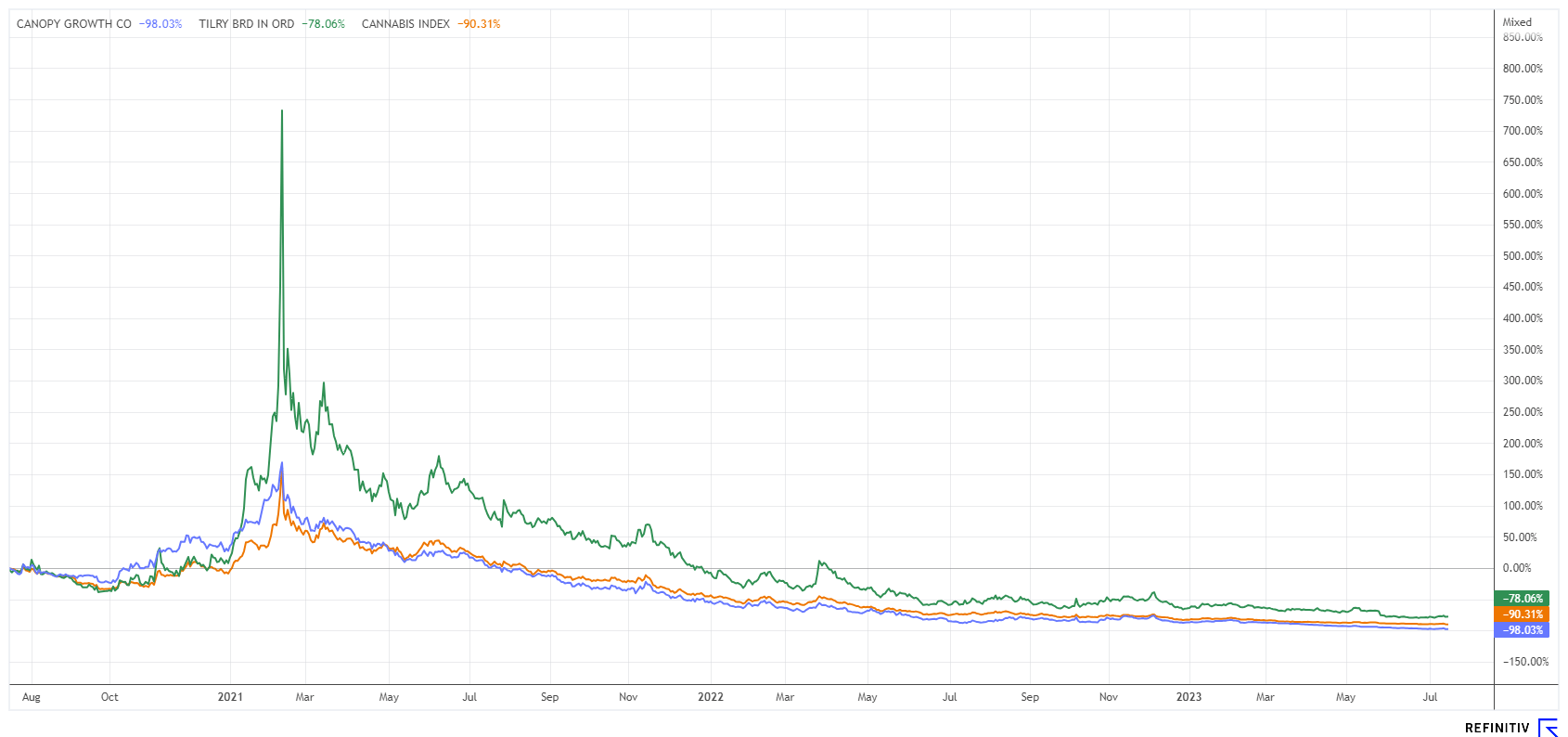

For a few days now, a long-neglected stock market segment has been attracting attention again: the cannabis industry. The North American industry protagonists Canopy and Tilray have recently attracted some stock market turnover again, but skepticism remains high. For those investors who did not exit in time, they had to write off around 95% of their investment in the last 2 years, and experts suspect that the revaluation of the former high-flyers is not yet complete. We take a look at the nebulous scenery of hemp speculation.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

CANOPY GROWTH | CA1380351009 , TILRAY INC. CL.2 DL-_0001 | US88688T1007 , CANTOURAGE GROUP SE | DE000A3DSV01

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

The Cannabis Market 3.0 - This is what matters now

The listed cannabis sector had its heyday between 2018 and 2021. Hundreds of young companies aspired to the North American stock exchanges, and an unprecedented eldorado of business models and funding seekers met for the hip cannabis party. At that time, listed and yet-to-be-listed companies were able to collect a total of USD 3 billion. The hope of the young founders and investors was a rapid opening and legalization of the markets for the medical use and, later, the free consumption of marijuana (THC). But things turned out differently than many expected.

Cannabis has been decriminalized in several countries to date, but it is legalized in only a few states. Currently, Portugal, the Netherlands, Spain, Switzerland, Russia, the Czech Republic, Belgium, and Jamaica have adopted regulations that punish both the use and the possession and cultivation of cannabis in small quantities as misdemeanours at most. In the US, cannabis is fully legalized in some states, such as California, but outright prohibited in others, such as Texas. While medical use is slowly catching on, use as an intoxicant and cultivation for personal use remains controversial.

For the protagonists of the cannabis industry, it really could not get any worse because, in addition to the heavy investment in production facilities, the industry had become fixated on a quick release of the issue. Never-ending public debates and a remaining uncertain legal situation ultimately destroyed many business models and wiped out over 90% of the invested capital.

Canopy Growth and Tilray - Big investments, horrendous write-offs

The best-known representatives from overseas are Canopy Growth Corp. and Tilray Brands Inc. They are down 85% and 56%, respectively, on a 12-month performance basis. While Canopy has plummeted from nearly EUR 20 billion to about EUR 200 million in valuation, Tilray is still close to a billion in market value at EUR 970 million.

Both companies are currently making major changes to their corporate and investment structure. While Canopy is swapping outstanding loans for more and more outstanding shares, Tilray recently acquired competitor Hexo for around USD 56 million. While Canopy is more active on the producer side, Tilray is focused on the downstream consumer markets. Canopy, according to expert estimates, could achieve sales of around CAD 350 million in 2023, while Tilray's could be around USD 600 million. If the companies were not so heavily indebted and constantly forced to write off expensively purchased investments, one could expect better times after years of restructuring. However, the patient investor will forego the first 30% increase because of the high residual risks and will buy in when the industry gains regulatory ground. There are currently no technical entry signals.

Cantourage Group SE - Well-considered at the right time

Looking to Germany, Cantourage Group SE came forward in November 2022 as a newcomer to the stock market with an initial valuation of around EUR 70 million. Founded in 2018, the Berlin-based company can now be described as a leading European company for the production and distribution of cannabis-based medicinal preparations and drugs. The founders Norman Ruchholtz, Dr. Florian Holzapfel and Patrick Hoffmann, along with their predecessor companies, are among the pioneers of the German cannabis scene.

The business model is simple and complicated at the same time. With the "Fast Track Access" platform launched in mid-2021, Cantourage enables producers from all over the world to enter the European market for medical cannabis more quickly and easily. To this end, they process cannabis raw materials and extracts and distribute them via pharmacies and Apo online stores. Cantourage always ensures compliance with the highest European pharmaceutical quality standards. Operationally, the Berlin-based company generated a homeopathic profit of EUR 0.1 million for the first time in the first quarter with sales of around EUR 4.8 million; in the full year 2022, it still incurred a loss of over EUR 2.4 million. Improved purchasing processes and a good conditions policy supported the positive development.

After 6 months on the stock market, Cantourage shows that it is already possible to operate profitably with medical cannabis and is not dependent on the possible legalization of cannabis. Nevertheless, its strong market presence would quickly create enormous sales potential if the recreational market were to be opened up by law. Estimates currently suggest a total market of 200,000 to 400,000 cannabis patients in Germany who can access Cantourage products alongside many other providers. Patients still have to pay for their prescriptions, with exceptions only for palliative cases or certified chronic conditions. In the leisure sector, it would probably be possible to address around 5% of the population in Germany.

The management is still holding back on the forecast, but with the current set-up, full two-digit growth is possible. An expansion into Switzerland and Austria is envisaged for the future. The research experts at NuWays AG expect sales of EUR 30.7 million in the current year, after EUR 14 million in 2022, and to climb to EUR 56.1 million in 2024. This leads to smaller earnings of EUR 0.01 and EUR 0.15 per share, respectively. Analysts last rated the Company as "Buy" with a 12-month price target of EUR 12.

The stock should be added to the watchlist as soon as possible, as the traffic light government that took office in 2021 has announced the legalization of cannabis during its term. The new draft bill regarding an omitted classification under the Narcotics Act would support Cantourage's business model. A small capital increase without existing shareholders' participation could boost the limited free float. Because of low turnover at the moment, it is advisable to place a limited order.

An investment in the cannabis sector is characterized by high volatility. The well-known stocks Canopy and Tilray, often fluctuate daily at double-digit rates under high turnover. However, this observation does not apply to Cantourage, which is still dormant. Those who invest here participate in a functioning business model with good future prospects and should bring a long-term investment approach because of the sluggish legislation process in the cannabis industry.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.