July 24th, 2025 | 07:15 CEST

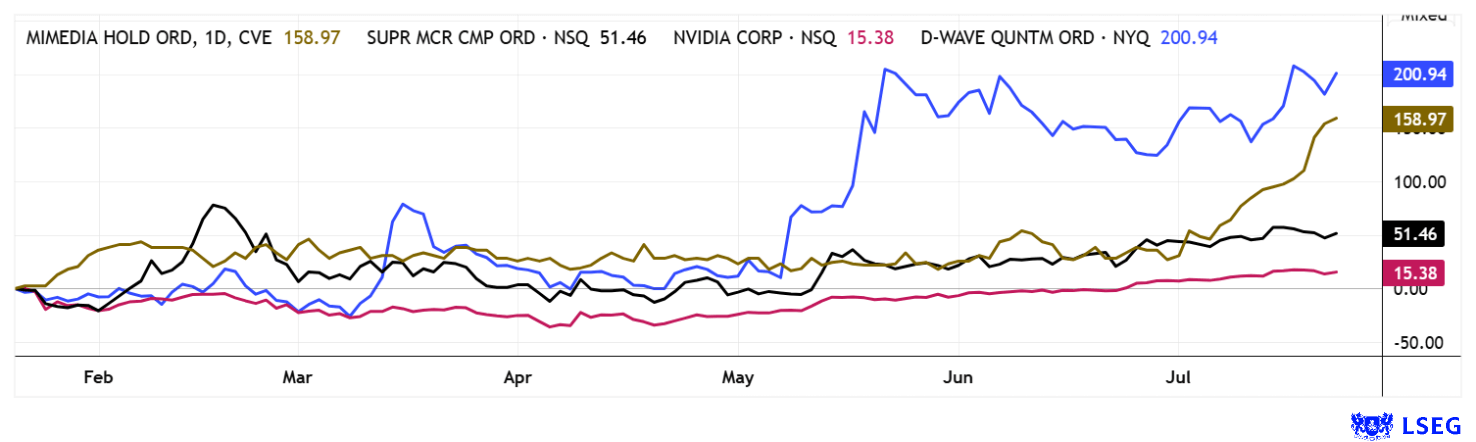

Buying frenzy on the NASDAQ – Another 200% with D-Wave, MiMedia, and Super Micro Computer?

New record highs every day – a joy for investors, but a source of stress for fund managers. Time and again in history, stock markets have risen unchecked, only to be followed by an equally unexpected correction. This usually happens when there is a high degree of complacency. One indicator of investor sentiment is the so-called Fear & Greed Index. With values above 75 out of 100, it has been in the "Extreme Greed" zone for weeks now. But as a famous quote from the 1987 movie "Wall Street" said: "Greed is good!" We examine a few stocks with promising prospects and are betting on a continuation of the remarkable rally.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

D-WAVE QUANTUM INC | US26740W1099 , MIMEDIA HOLDINGS INC | CA60250B1067 , SUPER MICRO COMPUT.DL-_01 | US86800U1043

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

D-Wave – Quantum computing at its best

D-Wave Systems is one of the pioneers in the field of quantum computing and pursues a clearly differentiated approach: Instead of focusing on universal quantum computers, the Canadian company concentrates on so-called quantum annealers, which have been specially developed for optimization problems. This technology allows highly complex problems, such as those in logistics, financial modeling, and materials research, to be solved faster and more efficiently than with traditional systems. A strategic milestone was the introduction of the "Leap" cloud platform, which gives customers worldwide access to D-Wave's quantum processors. The Company is thus democratizing access to quantum power and creating a commercially viable ecosystem for developers, researchers, and companies.

Particularly noteworthy is the ability to translate real-world business problems into quantum formats – an area in which D-Wave cooperates with industry partners such as Lockheed Martin, Volkswagen, and NEC. Unlike IBM and Google's gate-based systems, which tend to focus on long-term basic research, D-Wave pursues an application-oriented business model. By combining specialized hardware and scalable cloud access, the Company is positioning itself as a link between classic IT and next-generation quantum computing. Given growing computing requirements and the global trend toward edge optimization, interest in hybrid solutions is growing, and D-Wave is at the forefront of this development. D-Wave shares are one of the shooting stars on the Nasdaq, with a performance yesterday reaching 1,400% since fall of 2024. With estimated revenue of USD 25 million in 2025, a market capitalization of just under USD 5 billion is already impressive!

MiMedia – How an AI-based cloud platform is becoming a global growth driver

MiMedia is positioning itself as an innovative provider in the cloud segment and is pursuing a high-growth niche model. The innovative platform enables Android users to intelligently store, organize, and access their personal media content across devices. Unlike traditional cloud providers, MiMedia focuses on an AI-powered user experience that offers not only storage space but also real added value through personalization and seamless media integration. This offering clearly sets it apart from standard pre-installed cloud solutions and creates emotional loyalty through a consistent and intuitive user experience.

A key driver of growth is direct integration into new smartphone models. MiMedia has gained a partner in US manufacturer Orbic, which will ship its robust devices worldwide with the MiMedia app as the standard gallery solution starting in 2025. This opens up new user groups for the Company, particularly in application areas such as construction, emergency services, and tourism. At the same time, the Company is expanding into emerging markets such as Africa, where it supports telecommunications providers in monetizing their customer bases.

Increased presence at conferences such as the Mobile World Congress in Barcelona and direct OEM partnerships are leading to greater visibility and increased reach. Currently, over 35 million app installations have been agreed for the next 24 months. In addition, MiMedia is focusing on recurring revenues from storage subscriptions and in-app advertising with attractive margins of over 80%. Thanks to continuous platform optimizations, including faster uploads and enhanced security, customer loyalty is also improving steadily. With investments of over CAD 50 million over six years, MiMedia is now focusing on global scaling. The combination of AI, mobile lifestyle, and strategic OEM networking positions the Company as a serious challenger to established cloud providers, especially in untapped markets. Recently, CAD 3.872 million was raised through a private placement to support upcoming growth. The MIM share price already reflects high momentum and has gained 150% since the start of the year. As stock market traders like to say: "The trend is your friend!" – With the topic at the center of all high-tech discussions, MiMedia has a bright future ahead.**

SMCI – Strong partnership with NVIDIA

Two Nasdaq protagonists are currently gaining momentum hand in hand. These are Super Micro Computer (SMCI) and the world's most expensive publicly traded company, NVIDIA. Their long-standing partnership marks a key alliance in the high-tech sector that is shaping the global AI and data center market. SMCI provides highly specialized server solutions that are perfectly matched to NVIDIA's GPU-based accelerators. This combination enables companies to handle AI workloads more efficiently, faster, and more cost-effectively. The integration of state-of-the-art NVIDIA chips, such as the H100 and Grace Hopper, into SMCI systems creates high-performance platforms that set new standards for training and inference in AI models, as well as in GenAI and edge applications.

This opens up groundbreaking application possibilities, especially in hyperscale and enterprise environments.

SMCI benefits from its first-mover advantage and its ability to deliver customized, energy-efficient complete solutions extremely quickly. NVIDIA, in turn, gains a reliable hardware partner in SMCI that brings innovation to a wider audience. This synergy not only drives technological developments, but also creates strong market momentum. This enables companies worldwide to accelerate their AI strategies and make digital transformation a reality. At USD 52 and a market capitalization of USD 28 billion, SMCI still has strong upside potential relative to NVIDIA, with experts estimating a 2026 P/E ratio of around 18. NVIDIA's P/E ratio is 38.5 – more than twice as high.

The performance game starts anew every day. There is no end in sight for high-tech stocks, as the whole world is currently gearing up with AI and cloud services. MiMedia is rolling out its technologies in the smartphone sector and has excellent growth prospects in this environment. The rally at SMCI is likely to continue unabated, while the movement at D-Wave is fascinating.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.