April 6th, 2023 | 09:47 CEST

Blackrock Silver, Amazon, FREYR Battery - Is now the time to get in?

The increasing demand for lithium in the fast-growing market for electric vehicles and electronic devices is helping to make the US state of Nevada a leader in the lithium industry with its abundant lithium deposits and favourable business climate. The exploration company Blackrock Silver has secured a lithium site there and is thus well-positioned for the unbroken demand for this raw material. The recently launched lithium-ion battery plant of FREYR Battery also proves the high demand. Another advantage for investors at FREYR Battery is already the more than 98% CO2-free production. This is exactly where Amazon seems to have a problem with its data centres in Oregon.

time to read: 3 minutes

|

Author:

Juliane Zielonka

ISIN:

Blackrock Silver | CA09261Q1072 , AMAZON.COM INC. DL-_01 | US0231351067 , Freyr Battery | LU2360697374

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

FREYR Battery - Unusually high trading volume - is lithium demand the trigger?

Last week, FREYR Battery shares saw an unusually high trading volume. Institutional investors and hedge funds have been buying and selling company shares recently. Jennison Associates LLC raised its holdings in shares of FREYR Battery by 1.1% in the 3rd quarter. Barclays PLC raised its holdings in shares of FREYR Battery by 11.8% in the 3rd quarter. Barclays PLC now owns 86,278 shares, worth USD 1.12 million, after acquiring an additional 9,102 shares in the last quarter. During midday trading, 1,689,012 shares changed hands.

The share was last able to hold its ground at EUR 7.89 and had previously closed at EUR 7.63. This is a good signal for investors and shows the dormant potential of FREYR Battery. Analysts at Bank of America rate the share as a "buy" and forecast a price target of USD 11.98.

Recently, FREYR Battery announced strategic partnerships with Siemens, Glencore, Caterpillar and Nidec to build planned supply chains in a stable manner. The advantage of FREYR Battery is clear for investors. Over 98% of the electricity generated in Norway comes from renewable energy sources. FREYR has access to an abundant supply of CO₂-emission-free electricity, putting it far ahead of other competitors in the energy poker.

But there is still a lot of water flowing down the Norwegian fjords before that happens. However, it is good news for lithium lovers that FREYR Battery is inaugurating an industrial-scale production line for 24M Technologies' SemiSolidTM manufacturing platform ("24M") on a GWh scale at its Mo i Rana site in Norway. 24M's lithium-ion battery cell manufacturing process is a simple, space-saving, low-cost and modular approach to lithium-ion battery production.

Blackrock Silver Corporation: Lithium acreage the explorer's next asset

Lithium is an essential ingredient in many industries, particularly in the manufacture of batteries used in electric vehicles, smartphones, laptops and other electronic devices.

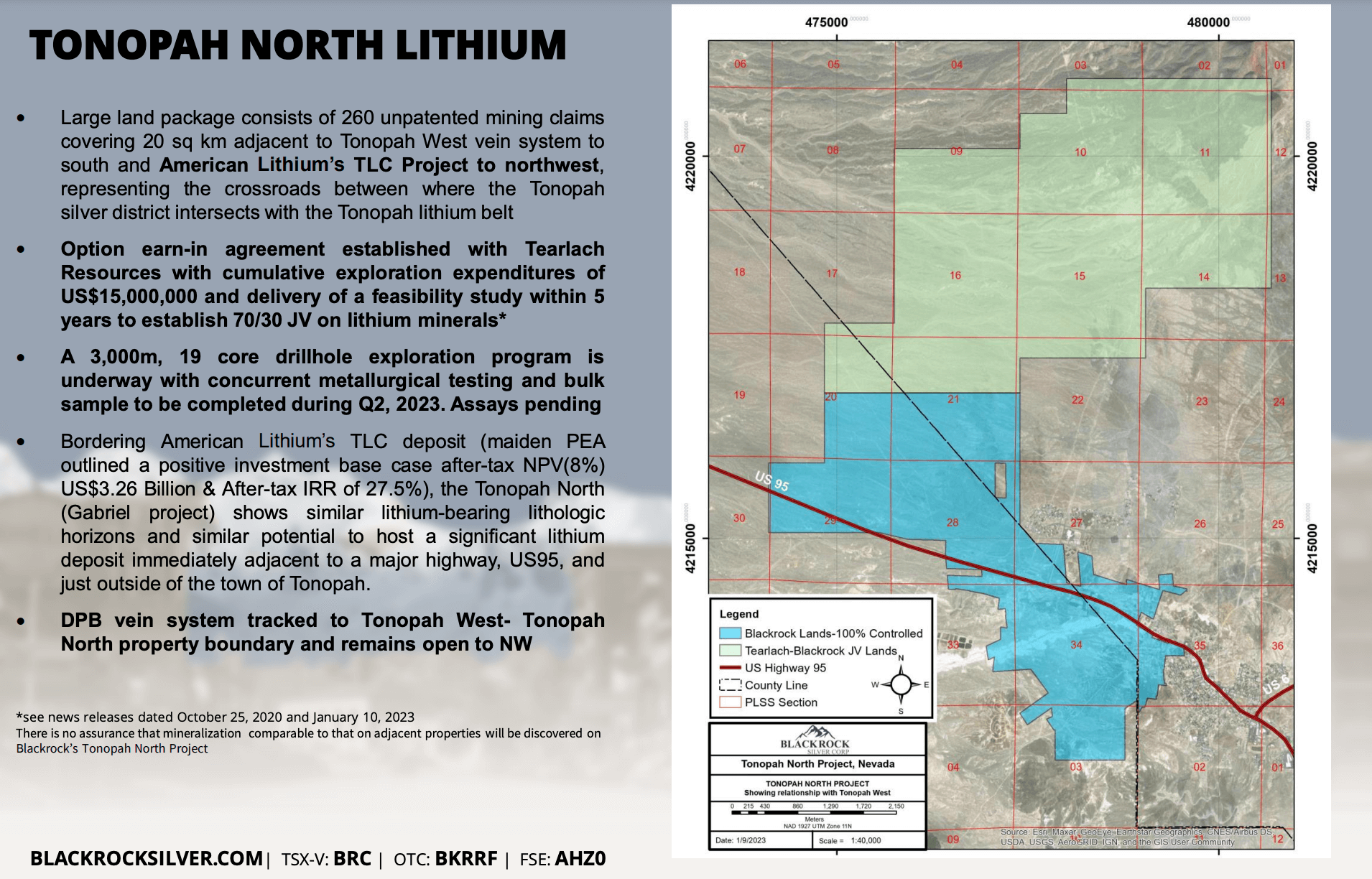

Blackrock Silver Corporation is a young exploration company that specialises in the exploration of precious metals, preferably gold, silver and also lithium. The Company is already showing its first successes: in its Tonopah West project in the US state of Nevada, where 2.97 million tonnes with a grade of 446 g/t silver equivalent have already been found.

The US state of Nevada is a leader in lithium production because it has a favourable regulatory environment and abundant renewable energy resources. In addition to its precious metals projects, Blackrock Silver has one lithium exploration, the Tonopah North project.

Andrew Pollard, President and CEO of Blackrock Silver, comments: "Tonopah is widely recognised as one of North America's great silver deposits. Our adjacent lithium discovery is rapidly gaining prominence as a global player in the lithium space, because our strategic land holdings at Tonopah are located at the intersection of the Tonopah Silver District and the Tonopah Lithium Belt, underscoring the potential of our portfolio to one day form a silver, gold and lithium mining complex in the heart of west central Nevada."

Lithium-ion batteries are popular due to their high energy density, long life and relatively light weight. Blackrock Silver Corporation's broad portfolio offers great potential for future growth.

Amazon votes against climate bill in Oregon - Implementation plan missing

In the US state of Oregon, Amazon lobbyists have lobbied to prevent a climate bill from passing the Senate and being overturned. Amazon operates its large data centres in Oregon.

The bill stipulates that large energy consumers must reduce their CO₂ emissions by 100% by 2040. The consequence: to regulate industries with a particularly high carbon footprint, such as cryptocurrency mines and data centres. In particular, they want to prevent Amazon from building three more data centres in the state that run on fossil fuels.

Although the bill would have coincided with the timeline of Amazon's own "climate pledge," which promises net-zero carbon emissions by 2040, the Company has helped block the bill, said Oregon State Representative Pam Marsh.

Amazon spokesman David Ward, in turn, argues that "a number of organisations, including Amazon, oppose it because the bill does not address the electrical infrastructure upgrades needed to bring more clean energy onto the grid."

Once again, the vast gap between politics and business is revealed. What good are bans and climate targets if one or more solutions are neither pointed out nor, if necessary, financed with public money?

Investors need staying power to profit from the energy transition. With Blackrock Silver in the portfolio, there is unimagined long-term potential to cover the rising global demand for lithium. Those who back tried-and-tested equity giants like Amazon should closely examine the Company's CO₂ footprint. Here, progressive companies in the Nordics like FREYR Battery have a clear advantage: their production chains are almost CO₂-neutral.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.