March 11th, 2024 | 07:00 CET

Bitcoin USD 70,000 - High-tech and artificial intelligence - a perennial favorite! Nvidia, Defense Metals, AMD and Super Micro Computer

It happened over the weekend: USD 70,000 - and no end in sight for Bitcoin? A never-ending rally seems to be taking its course after the cryptocurrency turned upwards at USD 25,000 last September. Will the upswing continue unabated? Due to the upcoming halving in April, this could continue for a few more weeks, with the crypto following growing daily. Suppliers in the high-tech sector are riding the same wave: fast computers, graphics cards, big data and artificial intelligence. Almost infinite growth is expected behind these megatrends. However, valuations are already very advanced. Where are the opportunities for newcomers now?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NVIDIA CORP. DL-_001 | US67066G1040 , DEFENSE METALS CORP. | CA2446331035 , ADVANCED MIC.DEV. DL-_01 | US0079031078 , SUPER MICRO COMPUT.DL-_01 | US86800U1043

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nvidia - Surpassing Amazon, now in 3rd place among the blockbusters

Nvidia shares ran from around EUR 200 to EUR 888 without any significant stops. In the course of the appreciation, a market capitalization of USD 2.4 trillion was reached. This means that the share has moved into the top league of titans, securing 3rd place within just 3 months. Amazon had to give way with a "mere" USD 1.8 trillion valuation.

Now rumors of a stock split are doing the rounds and former star investor Cathie Wood is speaking out. She is no longer comfortable with the whole thing. "We would not be surprised to see a pause in spending on graphics processors," the fund manager said in a monthly letter to her clients. The problem is the current overcapacity, which is only justified if software sales in the AI sector continue to explode. Wood also pointed out that, unlike Cisco during the dot-com boom, Nvidia has some competitors that could weigh on margins in the medium term. However, Cathie Wood sold her entire Nvidia position last year, and since then, the stock has gained around 500%. Nvidia is already up 90% this year, while the ARK Innovation Fund is lagging with a 4% decline.

According to the analysts on Refinitiv Eikon, 52 out of 56 experts still recommend buying the stock. However, the expected price target of USD 853 is in line with the last price on Friday after a sharp consolidation of over 10%. If that is not a sign of caution.

Defense Metals - First rare earth carbonates shipped

**When thinking about high-tech products, one should not lose sight of the producers of rare earths, who supply the manufacturers of multi-intelligent machines with essential metals. To date, China has been the world market leader in these resources, but the Western world is developing its own mining sites in order to reduce its dangerous dependence.

Canadian company Defense Metals operates the 8,301-hectare Wicheeda Rare Earth project in British Columbia. A NI 43-101 report from 2023 confirms a 6.4 million tonne resource at 2.86% (TREO), as well as 27.8 million tonnes inferred and 11.1 million tonnes inferred at grades of 1.84% and 1.02% (TREO). Now, there is news from British Columbia. Defense Metals has sent samples of mixed rare earth carbonate (MREC) to two major rare earth element companies. These are samples collected as a concentrate by SGS Canada Inc. in Lakefield during hydrometallurgical pilot testing in 2023. They have now been sent to almost all known rare earth separators worldwide. The recipients have already independently confirmed the high quality of the REE product and established Defense Metals' Wicheeda REE project as a major future North American source of rare earths.

CEO Craig Taylor commented: "Defense Metals continues to advance the Wicheeda project and establishes it as one of the few rare earth projects in the Western world with the key attributes required for a viable rare earth project." It has an outstanding location, good logistics, proven mining science and metallurgy, mine life and good mineralization grades. With the operation of a pilot plant, Defense Metals has already demonstrated its ability to produce a rare earth product. The Company has an excellent relationship with the McLeod Lake Indian Band to define the social cornerstones. Management, therefore, firmly believes that Wicheeda will play a key role in building North American REE supply chains. Defense Metals shares (DEFN) are currently trading at a high volume between CAD 0.22 and CAD 0.27 and attracted much attention at this year's PDAC conference in Toronto.

Super Micro Computer versus AMD - Is it still worth getting in?

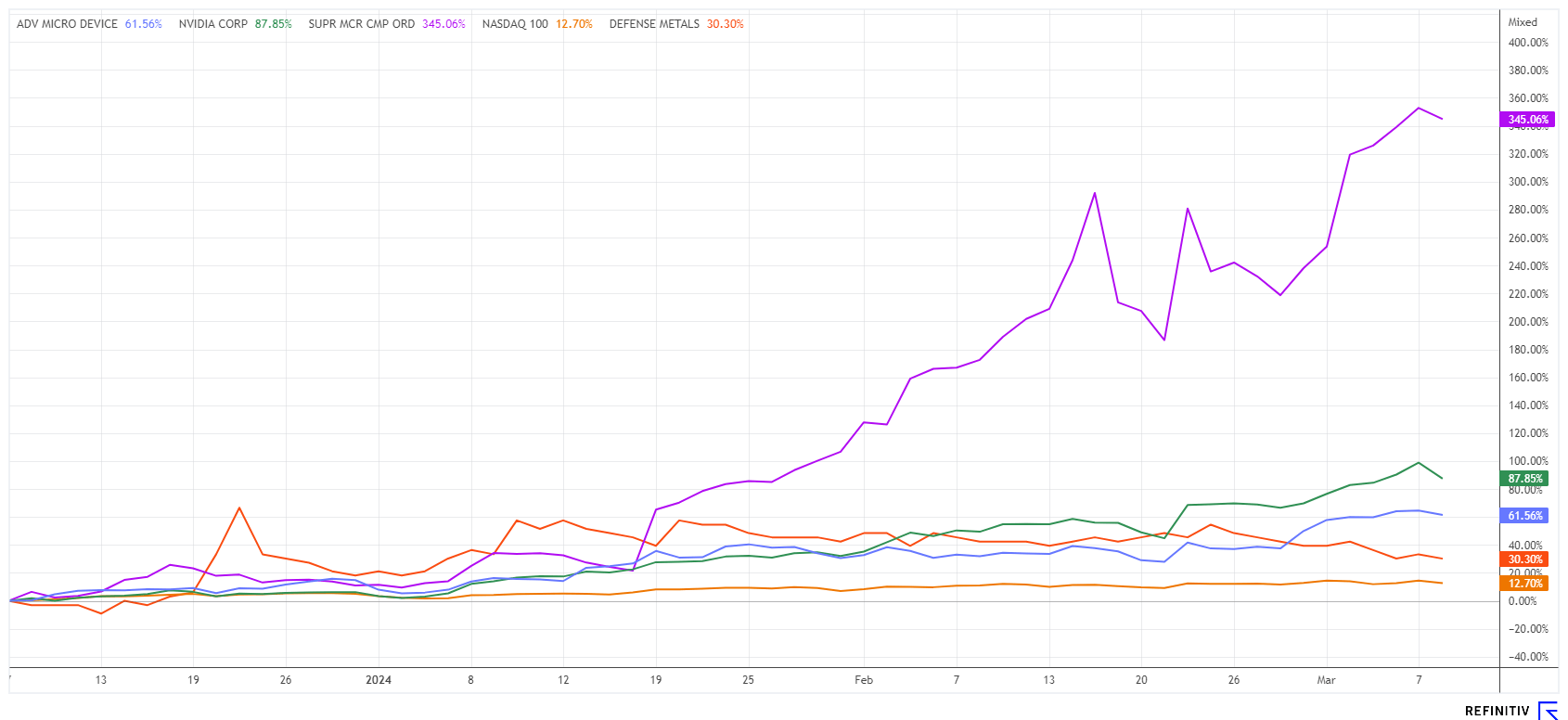

Courageous investors are sitting on dream gains with high-tech specialists Super Micro Computer or Advanced Micro Devices (AMD). In just 12 months, these stocks have outperformed all indices worldwide. But can the rally continue at this pace?

A look at the fundamentals is worthwhile. In the case of AMD, the boom in the field of artificial intelligence has led to a jump in demand for high-performance chips. AMD shares reached a new all-time high of USD 227 last week. According to analysts on the Refinitiv Eikon platform, however, sales are only expected to grow by around 10% in the current year and 20% in 2025. With a market capitalization of USD 335 billion, 13 expected sales are now being paid, and current earnings per share in 2024 are expected to reach USD 3.70 and could rise to USD 5.50 in 2025. This puts the current P/E ratio at 55.5, which decreases to 37 next year. None of this seems to be a problem, as 37 out of 49 analysts still recommend buying the stock. However, the average price expectation of USD 193 has already been exceeded. Caution is advised!

The figures for Super Micro Computer are similarly fantastic. With a valuation of USD 64 billion, the 2024 turnover is only priced at a factor of 4.5, but the current P/E ratio is also 51 and 37 next year. Revenues are expected to double to USD 14.5 billion in 2024. 11 out of 15 experts vote "Buy", but even here, the 12-month price expectation of USD 872 has already been exceeded by 30%. The stock market obviously knows better than the number crunchers and adds a few percent to the share price every day. As neither resistance nor support can be identified on the chart, investors prefer to hedge their dream returns with tight stops on AMD at USD 185 and Super Micro Computer at USD 950. Every party comes to an end when liquidity seeks other favorites. We will likely return to this topic soon.

Everything is going well so far, NASDAQ investors will conclude. Little could go wrong in the crypto, high-tech and artificial intelligence sectors. The fact that only 19% of equities worldwide have now posted gains obviously does not bother anyone. That is because the meagre broad performance only affects diversified portfolios, which also have to "drag along" the laggards. On the other hand, good diversification reduces the risk considerably. Nvidia, Super Micro Computer and AMD are somewhat overbought, while Defense Metals is attracting more and more interest.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.