July 25th, 2025 | 07:05 CEST

Biotech turns to gold: Who is swallowing whom - or what? Evotec, BioNxt, Valneva, and Formycon are on the list!

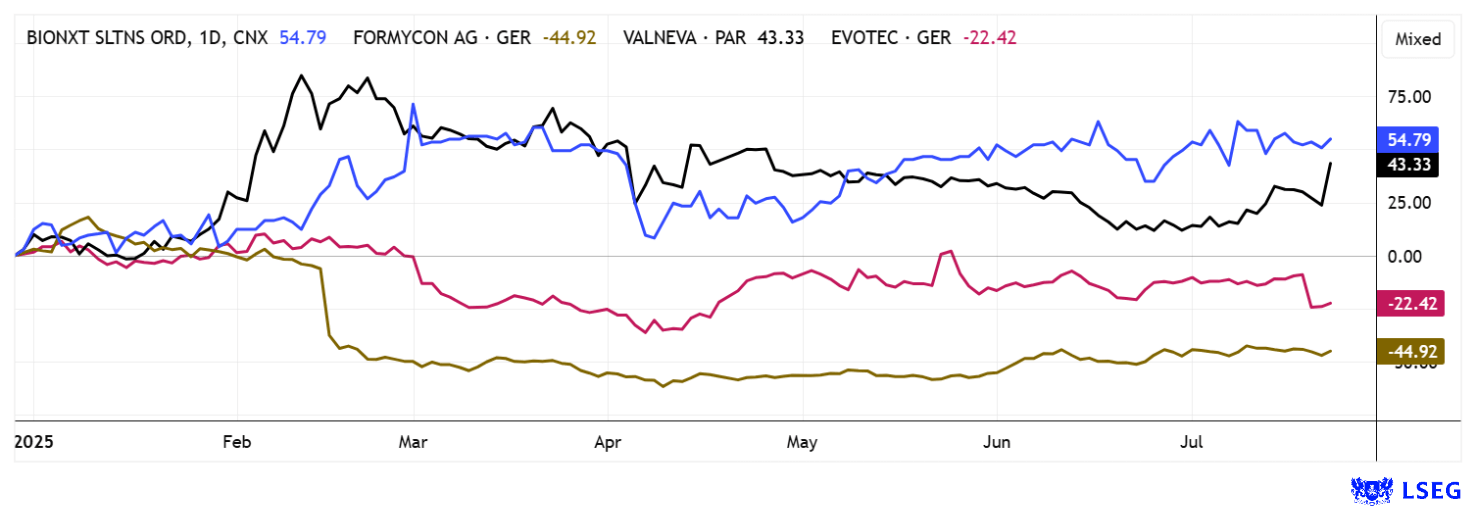

The biotech sector is closely monitoring central bank interest rates. At present, however, inflation still seems a little too high to expect significant cuts. Accordingly, the European Central Bank left its key interest rates unchanged yesterday. Investors are now looking to Wall Street for signals on where rates might head in the second half of the year. However, due to the sharp price increases on the Nasdaq and existing undervaluations, takeover rumors are starting to circulate - and could materialize at any time. BioNxt, Evotec, and Valneva are on our watchlist. Where do the opportunities lie for investors?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , Bionxt Solutions Inc. | CA0909741062 , VALNEVA SE EO -_15 | FR0004056851 , FORMYCON AG | DE000A1EWVY8

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Valneva – Vaccine against the Chikungunya virus gives wings

Things are getting exciting at Valneva. The biotech company's shares rose in mid-week trading following the announcement by the European Medicines Agency (EMA) that it intends to lift the age restriction on the Chikungunya vaccine, IXCHIQ. The EMA had previously given the active ingredient a positive review, causing the stock to rise by 15% on the Euronext Paris last week. However, two new aspects make the EMA's decision more significant than the share price initially suggests: Firstly, Chikungunya is increasingly affecting Europe as a result of the climate-driven spread of the tiger mosquito, and secondly, IXCHIQ is currently the only vaccine approved worldwide against the virus. This unique selling point could enable high licensing and distribution revenues if approvals are granted in other regions. After successfully breaking through the EUR 3.15 mark, Valneva could quickly rise to EUR 3.90. The 12-month target of analysts on the LSEG platform averages EUR 7 – very high in the short term, but achievable in the long term if the milestones are reached.

Evotec – Another profit warning

Another blow for Evotec. The Hamburg-based drug developer's shares came under massive pressure after the Company significantly lowered its revenue forecast for the current fiscal year. Instead of the originally targeted EUR 840 to 880 million, revenues are now expected to be between EUR 760 and 800 million, a setback that could ultimately even fall below the previous year's figure of EUR 797 million at the end of the year. Evotec cited the challenging market environment in the shared R&D business, which has recently suffered from declining orders, as the main reason for this. However, the forecast for adjusted EBITDA remains within a range of EUR 30 to 50 million, which is significantly above the previous year's figure of EUR 22.6 million. The unchanged R&D expenses, between EUR 40 and 50 million, demonstrate that Evotec is sticking to its innovation strategy even in economically challenging times. CEO Christian Wojczewski views this as confirmation of the Company's long-term orientation: demand for high-margin business areas is increasing, which underpins the competitive strength of the platform technologies. Nevertheless, the market reacted with shock and punished the Hamburg-based company, resulting in a 15% drop to EUR 6.12, despite the share price having risen to EUR 6.82 yesterday. Was this ultimately another buying opportunity? Analysts at RBC have given the Company an "Outperform" rating and a target price of EUR 11.90, while Deutsche Bank has downgraded it to "Hold" with a target price of EUR 6. Flip a coin!

BioNxt Solutions – Innovative delivery technology paves the way for a market breakthrough

BioNxt shares are back on track, with a string of positive operating reports hitting the market in quick succession. After a slump at the beginning of the year, the share price in Canada is now back above the CAD 0.50 mark, while in Germany the stock is trading at EUR 0.35. The Company focuses on innovative drug forms such as sublingual thin films and orally soluble medications for the treatment of a wide range of indications. The focus is on the proprietary compound BNT23001. This cladribine thin film formulation is intended to offer patients a simpler, more comfortable alternative to existing MS therapies, especially for people with swallowing disorders (dysphagia). The technology used promises faster absorption of the active ingredients, higher bioavailability, and better therapy adherence. Another growth area is the lucrative anti-aging market: BioNxt is developing gastro-resistant tablets with active ingredients that promote fertility and healthy aging. Here, too, thin-film technology is used, providing a clear competitive advantage in a market that is forecast to reach over USD 90 billion by 2027.

There is cause for celebration in Vancouver, where the European Patent Office has confirmed the positive international test results, strengthening the property rights surrounding the administration of cladribine. The cladribine active ingredient was recently used by BioNxt's European drug development partner, Gen-Plus GmbH & Co. KG, based in Munich, to develop and manufacture prototypes of orally disintegrating films (ODFs). These initial formulations showed promising properties in terms of drug loading, film uniformity, and disintegration time, confirming the suitability of cladribine for thin-film drug delivery. This formulation milestone strengthens the foundation for clinical batch manufacturing and further optimization, which will continue as part of BioNxt's strategy to initiate a human bioequivalence study in the second half of 2025.

"The successful formulation of the first cladribine-containing thin film prototype is a critical step in the clinical development of BNT23001," said Hugh Rogers, CEO of BioNxt Solutions. "It also underscores the strength of our drug delivery platform as we move toward human studies and ultimately, commercialization."

With a recently placed convertible loan of CAD 1.2 million, the Company is solidly financed for the coming months. The new momentum in the stock has attracted the interest of both institutional and private investors, and the psychologically significant EUR 1 mark appears to be within reach. The BioNxt pipeline, with a clear focus on patient benefit, IP protection, and market readiness, offers enormous upside potential. Buy!

Formycon – Full speed ahead in cancer research

German biosimilar hope Formycon is back. The Munich-based company recently announced the successful completion of patient recruitment for the clinical phase of the Dahlia study on the biosimilar candidate FYB206. A total of 96 patients were enrolled in the pharmacokinetic study. The aim is to demonstrate the comparability of FYB206 with the original cancer drug Keytruda (pembrolizumab). Formycon has decided not to conduct a comprehensive Phase III study following approval of its adjusted development strategy by the US Food and Drug Administration (FDA). This decision not only saves significant costs but also significantly shortens the development time. The first patients have already completed the full treatment with 17 therapy cycles, and results for the primary endpoint are expected in the first quarter of 2026.

FYB206 is now expected to enter the US market in 2029 and the EU market in 2030, following the expiry of the original product's exclusivity rights, subject to regulatory approvals. Technically, the EUR 30 range is very important. The Strüngmann Athos family office still holds just under 24%, and Hungary's Gedeon Richter is another strategic investor. Slowly but surely, the battered biotech stock is coming back to life.

**Global stock markets are jumping from one high to the next. Starting with Bayer and BioNTech, sentiment in the biotech sector has finally improved. Those who take a selective approach can once again achieve double-digit returns. From today's perspective, BioNxt and Valneva continue to impress, while Formycon and Evotec are likely to undergo another round of consolidation. A surprise takeover cannot be ruled out among the selected stocks.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.