March 3rd, 2025 | 07:35 CET

Biotech: Takeover candidates for 2025! Things are heating up at Evotec, BioNxt, Bayer, and Formycon!

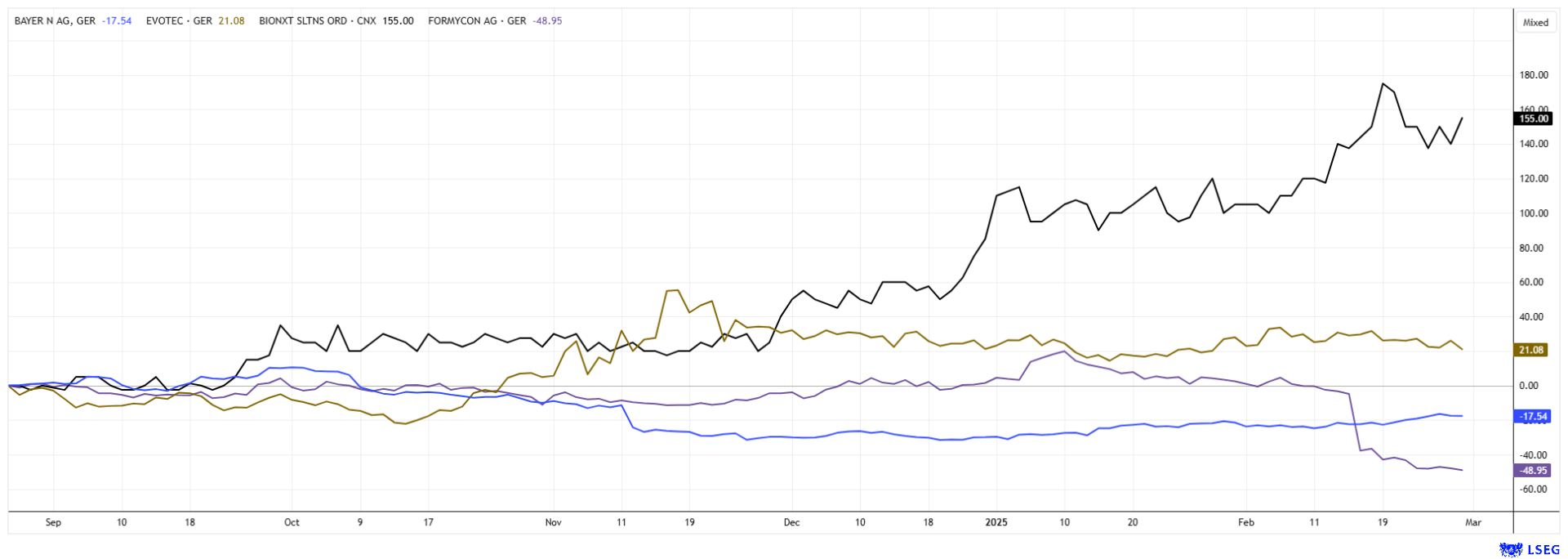

The DAX 40 index is hitting new highs, following a gigantic wave of buying from the US. The rally is already well advanced, but due to ongoing geopolitical upheavals, high-tech and defense stocks are still performing well. In recent weeks, the positive trends have also spread to the biotech sector again. Stocks such as BioNxt have already gained over 150% in the last six months. What is driving this? Formycon has seen a severe price drop, while Bayer and Evotec are slowly getting back on track. Are we going to see takeovers now? What are the triggers for dynamic investors?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , Bionxt Solutions Inc. | CA0909741062 , BAYER AG NA O.N. | DE000BAY0017 , FORMYCON AG | DE000A1EWVY8

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Bayer and Evotec – Have We Already Passed the Lowest Point?

The situation is now becoming tense for Evotec because the stock again failed to break through the EUR 9 hurdle last week and has since been on the decline. Chart-wise, the Hamburg-based company should now not fall below EUR 7.85. There are positive signs on the personnel side. The previous Chief Financial Officer, Laetitia Rouxel, will leave voluntarily at the end of February. She had been in office since April 2023. The successor has already been found. Paul Hitchin will take over as CFO on March 1. According to the Company, he has over 20 years of experience in various management positions, most recently as CFO of Mediq. The personnel change did not impress the market, as there was no upward movement in the share price. Technically, caution is advised: The 100-day moving average is calculated at EUR 8.06, and the 200-day moving average is not far away at EUR 7.85. The figures for 2024 will be published on March 27. Should Evotec CEO Christian Wojczewski deliver a positive surprise, perhaps even with a reliable medium-term forecast, the share price would have plenty of upside potential. However, the short sellers are likely to be on the lookout again.

Bayer stock is also currently attracting a lot of interest. The Leverkusen-based company has established a low at the EUR 19 mark for now; the share price is currently above EUR 22.50. The annual figures for 2024 are expected on March 5. The progress in agrochemicals will be important, and the restructuring of the Life Science division has now been going well for nine months. Several hundred million are likely to be set aside for the payment of severance offers in middle management. The German pharmaceutical giant recently made an important breakthrough in the US. This is not related to the legal disputes surrounding the 2018 Monsanto acquisition but to the development of the product pipeline. Specifically, it concerns the subsidiary AskBio, which has now been granted "Regenerative Medicine Advanced Therapy" status by the US Food and Drug Administration for the development of the new Parkinson's therapy called AB-1005. This status will enable a significant acceleration of the approval process and, ultimately, the treatment of Parkinson's disease. Analysts remain cautious. Only 3 out of 22 estimates are "Buy", and the weighted 12-month price target remains at EUR 26.50. The coming week will be very interesting.

BioNxt Solutions – Good news and fresh funds

BioNxt shares have staged a fantastic turnaround on the trading floor in the last 6 months. After bottoming out between EUR 0.11 and EUR 0.13, the share is now trading again at an appealing EUR 0.32 to EUR 0.37. BioNxt focuses on drug formulations and delivery systems of the next generation. In recent months, the main focus has been on transdermal and orally dissolvable preparations. The current patent series covers the sublingual administration of cancer drugs for the treatment of autoimmune and neurodegenerative diseases. BioNxt's leading development program is its proprietary sublingual cladribine product for the treatment of multiple sclerosis (MS). Here, things could really pick up in 2025 with a production partner.

BioNxt provided an update at the end of February on several key milestones for the next 90 days, including filing for national patents, completing a human bioequivalence study for its leading multiple sclerosis (MS) drug, and developing its longevity and anti-aging product. It also confirms that all national patent applications under the Patent Cooperation Treaty (PCT) have been finalized in the key jurisdictions. The Company's national filings are based on the positive international examination report issued by the European Patent Office (EPO) in Q3 2024 for the sublingual administration of anti-cancer drugs to treat autoimmune neurodegenerative diseases such as MS.

BioNxt's lead product, BNT23001, is a proprietary sublingual thin-film formulation of cladribine for the treatment of MS. Preclinical studies, as reported in internal research data and third-party evaluations, have demonstrated high absorption rates and bioequivalence to existing oral therapies. The first clinical study is planned to begin within the next 90 days. The bioequivalence study is relatively short and is expected to be completed in less than 30 days. The successful completion of the bioequivalence study is an important milestone and a proof of concept for the lead product and pipeline of sublingual products for treating autoimmune diseases. In the next 90 days, BioNxt also plans to enter the rapidly growing anti-aging sector, which Statista predicts will reach USD 93 billion by 2027. The Company is developing thin-film preparations and enteric-coated tablets with pharmaceutical active ingredients that have been shown in early-stage testing to slow ovarian aging, extend fertility, and promote healthy aging.

The longevity and anti-aging programs represent a further strategic and diversified investment in a large and rapidly growing global market. In order to finance the projects, a convertible loan of CAD 2.5 million was placed in the last few days. Interest in the BNXT share has recently been reawakened, and with rising trading volumes, a quick jump over the EUR 1 mark could be achieved, with old highs well above EUR 2. Collect!

Formycon – What happened here?

Formycon, the German biosimilar hopeful, is under pressure. The announcement of high write-offs has raised doubts about the Company's strategy. The focus is currently on the first product, FYB201, the Company's Lucentis biosimilar, which is expected to be temporarily withdrawn from the US market. It is reported that Formycon wants to protect the value of the biosimilar, as it has been selling rather sluggishly and only at high discounts of late. The Munich-based company also has to scale back its Stelara biosimilar. CEO Stefan Glombitza is talking about write-downs in the low triple-digit millions. The press conference for the last year is scheduled for March 27. Investors assume that Formycon will take all impairment issues into account in its balance sheet in 2024, allowing the value to start its recovery in 2025. Early investors will likely still be in profit, although the stock fluctuated between EUR 40 and EUR 90 from 2021 to 2024. Technically, the range around EUR 25 is very important. The Strüngmann brothers' family office, Athos, still holds just under 24%, and the Hungarian company Gedeon Richter is another strategic investor. Stand by, as there have already been initial insider purchases.

Global stock markets have recently experienced some correction, particularly affecting the overheated high-tech stocks on the NASDAQ. The biotech sector is increasingly gaining strength from the resulting shifts. Some charts, such as BioNxt and Bayer, have already turned, and the market now seems to be broadening again. From a purely cyclical point of view, a sector rotation in favor of biotech companies is long overdue.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.