January 15th, 2024 | 06:45 CET

Biotech: Corona is back! The doublers are lurking here: BioNTech, Evotec, Defence Therapeutics and Bayer

We had almost forgotten about Corona and the good old flu, but it is back in full swing. Governments are remaining calm and holding on to their regained liberalism. However, Spain is now resorting to drastic measures again to protect vulnerable population groups. A mask is to be compulsory again in all Spanish healthcare facilities due to the increase in respiratory diseases. Health Minister Mónica García had previously failed to convince the Spanish regions of the need to introduce compulsory masks of their own accord. In some parts of the country, hospital emergency rooms are under severe pressure due to high patient numbers. Biotech stocks are showing the first signs of recovery after the sell-off in 2023. We take a look at a few selected stocks with 100% potential.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BIONTECH SE SPON. ADRS 1 | US09075V1026 , EVOTEC SE INH O.N. | DE0005664809 , DEFENCE THERAPEUTICS INC | CA24463V1013 , BAYER AG NA O.N. | DE000BAY0017

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BioNTech versus Bayer - Who will bounce back sooner?

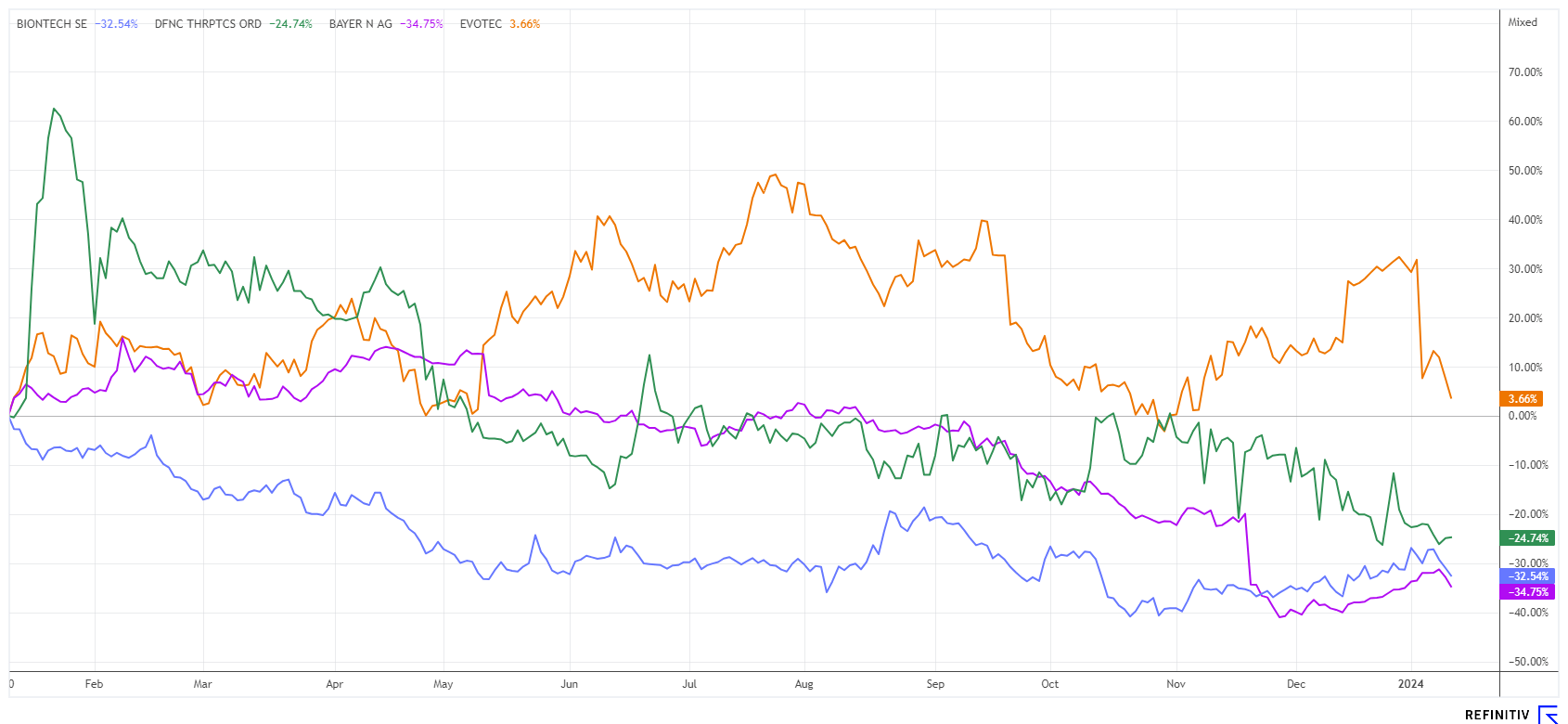

The heydays of BioNTech and Bayer are seemingly over, as both stocks have suffered a severe downturn on the capital markets, although the balance sheet details do not sound so bad. Although BioNTech reported a sharp decline in sales from EUR 18 billion in 2022 to just EUR 4.1 billion in 2023 due to reduced vaccine sales, the Mainz-based company is still sitting on a cash position of a good EUR 17 billion. Bayer's revenue fell by a noticeable 6% from EUR 50.7 billion to EUR 47.6 billion, with the ongoing glyphosate lawsuits in the US still having a negative impact. The Leverkusen-based company share price fell back to EUR 30.25. Since the high of around EUR 140 in 2016, 80% of the valuation has been lost. In addition, the Group's debt has doubled in the same period to currently EUR 92 billion. Despite ongoing challenges, Bayer can maintain its high dividend payout of over 6% thanks to current earnings.

Analysts on the Refinitiv Eikon platform are divided. In the case of BioNTech, there are as many as 8 "Buy" recommendations out of 17 available ratings, but the average price target is only set at USD 120 - 15% above the current price. For Bayer, the experts are even more skeptical, with only 7 out of 24 giving a "Buy" recommendation, but still with a consensus price target of around EUR 45.50. This promises a potential of at least 34% over the next 12 months. In chart terms, overcoming the EUR 115 mark for BioNTech would turn the signal to green, which is only the case for Bayer shares when the EUR 52 mark is conquered.

Defence Therapeutics - AccuTOX® shows efficacy in lung cancer

Canadian biotech specialist Defence Therapeutics has launched another formulation of its successfully tested cancer drug AccuTOX® in the new year. The drug, known as ACCUM-002TM Dimer CDCA-SV40, has proven to be effective in the treatment of lung tumors, thus extending the scope of AccuTOX® to the treatment of solid tumors. AccuTOX® represents an optimization of the Accum™ molecule and platform technology developed by Defence.

In recent studies, the compound was shown to have improved therapeutic properties and a broader range of applications in cancer treatments. It successfully killed more than a dozen murine and human cancer cell lines. Prospectively, such a therapy could be used as an alternative to surgery or chemotherapy. When initially administered intranasally, AccuTOX® showed a strong effect in inhibiting tumor growth of existing lung nodules in mice. Defence used a Kent Scientific Corporation nebulizer to administer its drug in the least invasive way possible. When used as a monotherapy, AccuTOX® significantly inhibited the growth of lung nodules. This effect is further enhanced when combined with the immune checkpoint inhibitor anti-PD1.

According to Precedence Research, the global market for cancer therapeutics is expected to reach around USD 393 billion by 2032, starting from USD 164 billion in 2022. Defence would like to participate disproportionately in the expected growth. To this end, CAD 2.7 million was successfully raised via a capital increase at the end of last week. Since December 19, 2023, the share has also been tradable on the US OTCQB over-the-counter segment under the symbol "DTCFF". With just under 46 million shares, the Company is currently valued at EUR 68.5 million. This is a very low valuation given the advanced stage of development of the ACCUM™ platform. Defence could become a top performer in the immuno-oncology peer group in 2024.

Evotec - Long-time CEO Lanthaler leaves the Company

There is a sell-off mood at the German biotech company Evotec. The resignation of the previous CEO, Werner Lanthaler, continues to weigh heavily. Mario Polywka has now taken over the position of CEO for the time being; he was previously a member of the Supervisory Board and previously active as COO. Meanwhile, the search for a new CEO is in full swing. Apart from personnel matters, there is further news. Evotec has joined an American foundation that focuses on research into inflammatory bowel diseases. The collaboration with the Crohn's & Colitis Foundation IBD Therapeutics Incubator program will leverage Evotec's research and development platforms to advance drug discovery for two innovative targets.

The experts of the Canadian bank RBC have left their rating on Evotec at "Sector Perform" and a price target of EUR 18.60. A milestone payment from the US pharmaceutical company Bristol-Myers Squibb significantly reduces the risk of achieving the next operating targets. Warburg also remains on the buy side with a price target of EUR 29. The annual figures for 2023 will be published on April 24, which is still relatively far away. The fundamental opportunities for the Hamburg-based company, therefore, remain good, but volatility is likely to remain high due to a large number of incoming reports. The recapture of the 200-day line at around EUR 19.70 would provide an initial positive technical signal.

The biotech sector has had a subdued start to the year. Smaller technical consolidations can be seen in Bayer, BioNTech and Defence Therapeutics. Fundamentally, Defence is making good progress in the field of lung cancer, while the departure of CEO Werner Lanthaler leaves a significant gap.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.