October 24th, 2024 | 07:30 CEST

Biotech – Are takeovers looming amidst curious prices? Evotec, Bayer, Vidac Pharma and BioNTech in the spotlight

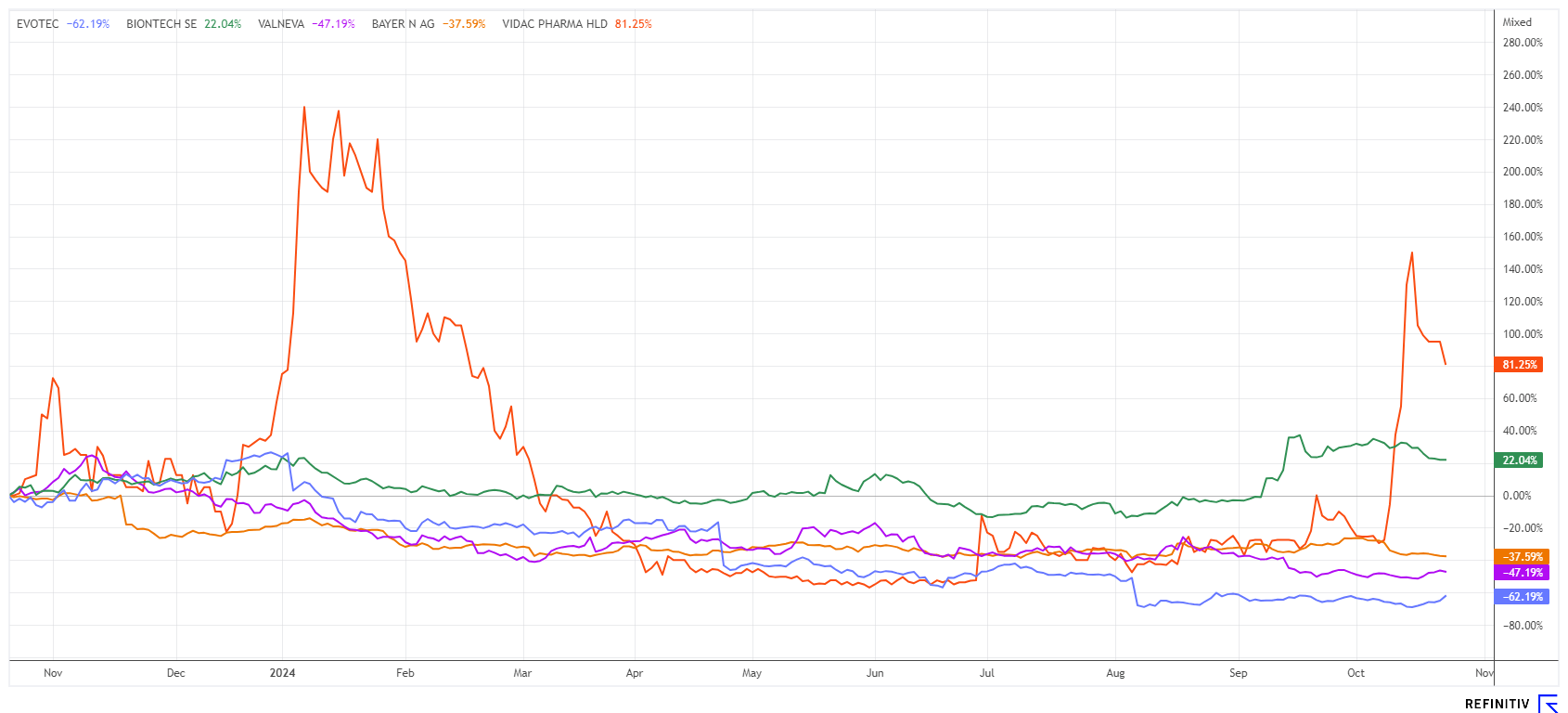

The biotech sector is once again in the spotlight. Since the acquisition of MorphoSys at the beginning of the year, the speculation carousel is turning again. Is Evotec next, or maybe Vidac Pharma? The Hamburg-based drug specialist came under fire from short-sellers after the resignation of long-standing CEO Lanthaler, who had shorted over 4% of the capital by mid-September. However, the price stubbornly held above the EUR 5 mark, and yesterday saw a 10% rise to EUR 6.60. What is behind this? Last week, it was Vidac Pharma that surged 300% from a standing start with enormous trading volumes. The thought processes of market participants are evident: interest rates are falling, making refinancing attractive again for upcoming financial investors. We shed light on the key players.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , BAYER AG NA O.N. | DE000BAY0017 , VIDAC PHARMA HOLDING PLC | GB00BM9XQ619 , BIONTECH SE SPON. ADRS 1 | US09075V1026

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec – Tension is rising

Yesterday, Evotec made a significant market entry with a big surprise. The Hamburg-based company announced progress in its strategic partnership with Bristol Myers Squibb, which focuses on building a pipeline of molecular glues. Scientific breakthroughs support the development of molecular glue degraders in non-oncology therapeutic areas, triggering a previously agreed milestone payment of USD 50 million to Evotec. Additional program-related achievements will thus further increase the value of the collaboration. The partnership, which has been in place since 2018, is beginning to pay off in tangible ways. The goal of the collaboration remains to establish a leading position for high-value therapeutic targets outside of oncology.

Dr. Cord Dohrmann, Chief Scientific Officer of Evotec, commented: "We are pleased to extend our successful partnership with Bristol Myers Squibb into areas of major unmet medical need outside of oncology. Molecular glue degraders offer a promising therapeutic option due to their unique mode of action, similarity to drugs and the possibility of oral administration." Thanks to positive news, the jump over the EUR 6 mark seems to have succeeded. It leads us to revisit the short positions, which might soon be closed. Speculative investors can act now, while conservative investors wait for the Q3 figures and outlook on November 6. Very exciting!

Vidac Pharma – Investors applaud the latest progress

This is slowly turning into a long-term story. We have reported on Vidac Pharma plc several times in recent weeks. There has been tremendous interest in the stock recently, and even with a premium of 300% at the peak, there are now further potential buyers. Last week, the price briefly reached EUR 1.30, which seems a bit excessive in such a short time. At the peak, around 4 million shares changed hands. Since the last report on the granting of a patent for extensive protection of the mode of action of its cancer drug candidates, there have been no new insights. Presumably, expectations are high for further progress in the Israeli research program at the upcoming medical conferences in Q4, particularly regarding the drug candidates VDA-1102 and VDA-1275.

It is also conceivable that the current analysis from Sphene Capital has fallen into the right hands and that a decent position has been built up in the market. Vidac Pharma's last capital increase was some time ago. Perhaps this level will now be used to top up the coffers a little. In June, we pointed out the share's attractiveness at EUR 0.19. This is especially true now, as the market is clearly aiming for a rapid revaluation.

Bayer and BioNTech – Progress is visible

A development comparable to Vidac's would mean a multi-billion-dollar revaluation for Bayer and BioNTech. But in the case of Bayer, patience is still required, as there is a constant stream of bad news from the US glyphosate litigation front. Although the share price briefly crossed the EUR 29 mark in September, it has now fallen again by 10% to EUR 25.70. CEO Bill Anderson expects savings of up to EUR 2 billion from next year onwards due to streamlining management levels, with the restructuring plan to be completed by mid-2025. Since the restructuring began, 3,200 jobs have already been cut worldwide, and Anderson expects the same number to follow by the end of 2025.

The balance sheet for the last 6 years resembles a horror movie. Before the 2018 acquisition of Monsanto, the share price was still around EUR 120 per share. If you include Monsanto's market capitalization in this calculation, the fair value per Bayer share would currently be just over EUR 160, around 500% above the current price. So much for the analysis! Meanwhile, hopes at Bayer are pinned on the new cancer drug Nubeqa. An application for approval extension has now also been submitted in Europe for this drug. The financial community is at the ready and hoping for quick improvements. The Q3 report is expected on November 5. Exciting!

BioNTech has seen a gratifying 30% increase in the last six weeks. The good mood is based on the buzzword "artificial intelligence." BioNTech held an event on this topic in London at the beginning of October. Last year, the Mainz-based company acquired the service provider InstaDeep for USD 500 million. The aim is to build an AI-powered, personalized immunotherapy platform. This should help in the discovery and development of therapies and mRNA cancer vaccines. Investors have high expectations for the new developments, with more news coming on November 4 with the Q3 report. Chart-wise, the value should not drop below EUR 97. This is also where we set the stop for the most recent follow-up purchases in the EUR 78 to 86 range. BioNTech is enticing, with cash of EUR 17 billion and a market capitalization of only EUR 23.5 billion.**

Speculation is reviving! Low interest rates and bombed-out prices are inviting investors to buy beaten-down biotech stocks, as seen with Vidac Pharma and Evotec. If declining inflation causes central banks to cut interest rates further, the doldrums in the entire sector should soon be a thing of the past. A healthy diversification strategy can help reduce portfolio risk.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.