December 10th, 2024 | 07:00 CET

Biotech Acquisitions in 2025: Several 100% Gains Expected – Evotec, Vidac Pharma, BioNTech, and Pfizer

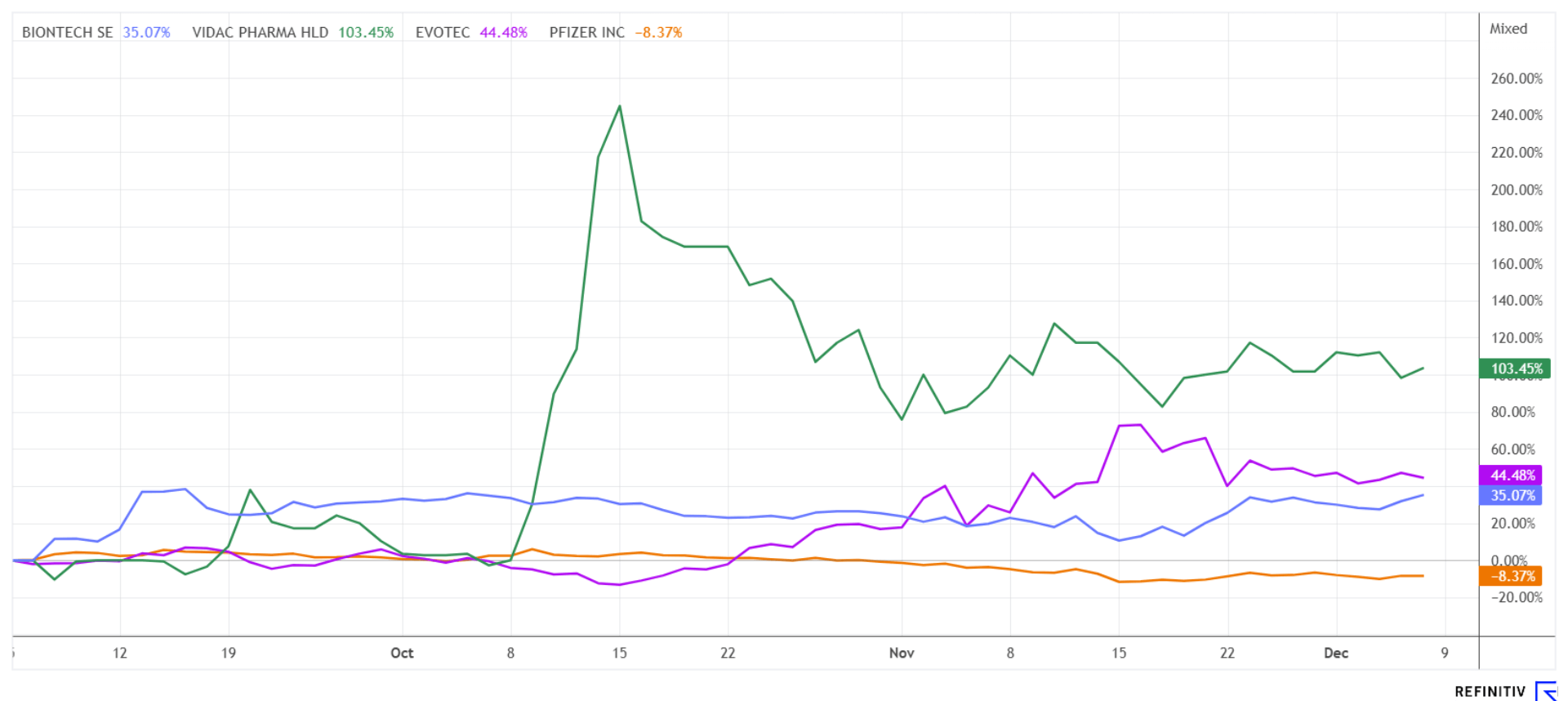

There have already been two attempts, but the story continues! Evotec speculators were confronted with a rumor mill and a takeover bid in November. This is what happens when a stock plummets and languishes for a long time. The management wisely rejected Halozyme's undervalued offer, and thus, the bidding war for the Hamburg-based company began anew. In the biotech sector, eyes should now be on the future, as the first movements have already taken place. In our stock selection, there are three outliers with price increases of more than 30% in the last 3 months. However, the big moves will only take place in 2025. Here is an analytical look at a long-neglected sector.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , VIDAC PHARMA HOLDING PLC | GB00BM9XQ619 , BIONTECH SE SPON. ADRS 1 | US09075V1026 , PFIZER INC. DL-_05 | US7170811035

Table of contents:

"[...] We are working closely with the University of Miami's Department of Psychology. [...]" Evan Levine, CEO, PsyBio Therapeutics

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec – Takeover speculation continues!

The discussion around Evotec continues after it was announced last Wednesday that the Hamburg-based pharmaceutical research group will return to the MDAX on December 23, 2024. While wild takeover rumors and surprising changes in the management board of the Hamburg-based science group drove the discussion among investors in recent weeks, this week it was the index change driving interest. Will institutional investors replicating the index need to increase their holdings in Evotec again? Perhaps…

Despite the many rumors, the Company's long-term growth prospects remain promising. Although the past three years have been characterized by a continuous downward trend, part of the misery was the departure of former CEO Lanthaler and a cyber attack in 2023. In addition, the sudden resignation of COO Craig Johnstone added to the uncertainty. This change in leadership is viewed critically by many market observers because it occurred at a time when stability and strategic leadership were critical. Despite the recent setbacks, Evotec remains a significant player in the biotech sector, with its proprietary drug development platform generating over EUR 800 million in annual revenue. New strategic alliances could very quickly enable a return to profitable growth. With a successful entry below EUR 7.50, Evotec has secured its spot on the 2025 biotech shortlist. Analysts on the Refinitiv Eikon platform expect an average price target of EUR 11.80 over the next 12 months. However, we believe this should only be a stepping stone toward a full revaluation.

Vidac Pharma – Promising and with a full program into 2025

One of the top performers last year was the biotech small-cap Vidac Pharma, with a share price increase of over 100%. Founded in 2012, the Company is led by Prof. Max Herzberg, one of the founding fathers of the Israeli life sciences industry. Vidac Pharma develops drugs that help cancer patients by reversing the abnormal metabolism of cancer cells, thus stopping the proliferation of cancer cells. Despite its modest size, the Company is already in the clinical development phase. The best-known product, VDA-1275, is the focus of interest because this drug candidate for the treatment of solid tumors has achieved impressive results in preclinical studies. As a monotherapy, VDA-1275 has already shown significant efficacy. Even more remarkable are the synergistic effects observed when VDA-1275 is used in combination with conventional cancer therapies. The first-in-human clinical trials are planned for Q1 2025. These tests mark a critical step in the development of VDA-1275 and could catapult Vidac Pharma into a new era of cancer treatment options.

In November, the Company raised more than EUR 600,000 in additional capital from existing investors and management to develop the two novel cancer drugs. Vidac will use the funds to advance a series of clinical trials, including a second Phase 2b clinical trial for VDA-1102 in advanced actinic keratosis (AK), an early form of skin cancer that can develop into cutaneous squamous cell carcinoma (CSCC). Vidac Pharma has been granted a broad and exclusive patent by the United States Patent and Trademark Office (USPTO) that provides comprehensive protection for the mode of action of the two oncology and onco-dermatology drug candidates VDA-1275 and VDA-1102. The analyst firm Sphene Capital has since reaffirmed its initial rating from the summer of "Buy" and a target price of EUR 4.90. Vidac Pharma could even top its 2024 success next year with successful clinical results.

BioNTech and Pfizer – Significant potential remains

BioNTech and Pfizer remain on our 2025 watchlist. The partners in COVID-19 vaccines are also successfully collaborating on new batches for the current flu season. For BioNTech, however, progress in oncology is the primary value driver. In mid-November, BioNTech announced the acquisition of its Chinese partner Biotheus, whereby the Mainz-based company intends to secure all rights to the bispecific antibody BNT327/PM800. The main focus of the development of BNT327 is on solid tumors. The next step in the clinical development of the potential cancer drug is already on the horizon, with the first pivotal trials scheduled for 2025. The stock remains a solid investment even after an interim gain of almost 40% since its initial allocation at EUR 82.

By contrast, the situation at US partner Pfizer is tense. After strong years during the pandemic, the pharmaceutical giant is now struggling with declining revenues, patent expirations, and unenthusiastic analysts. The Company aims to get back on track through a renewed focus on digital transformation and strategic realignment. Since the beginning of the year, the share price has fallen by over 40% and is currently at a 10-year low. Experts warn that despite the drop in share price, Pfizer is still characterized by uncertainties. By using modern technologies, the Company hopes to accelerate the development of new drugs and reduce costs. Pfizer faces significant revenue losses as several key drugs, including the blockbuster Xeljanz, lose their patent protection in the coming years. On the bright side, Pfizer still pays a 5% dividend yield, making the current entry point below EUR 25 a potentially attractive long-term opportunity.

The first signs of a turnaround in the biotech sector have emerged. Evotec and Vidac Pharma are benefiting from ongoing takeover speculation, while BioNTech's progress in cancer research and a bulging cash position make a compelling case. When Pfizer's recovery will begin remains uncertain, but the worst appears to be over. With upcoming interest rate measures in 2025, the life sciences sector holds significant potential for further growth.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.