August 1st, 2023 | 09:00 CEST

Biogen, Cardiol Therapeutics, Evotec - The acquisition wave is rolling

The biotechnology industry has seen a significant increase in acquisitions and mergers in recent months. Large pharmaceutical companies are looking to expand their portfolios to provide innovative solutions for unmet medical needs. At the same time, despite an increase in value in recent months, acquisition targets are still attractively valued due to the sell-off over the past year.

time to read: 3 minutes

|

Author:

Stefan Feulner

ISIN:

BIOGEN INC. DL -_0005 | US09062X1037 , CARDIOL THERAPEUTICS | CA14161Y2006 , EVOTEC SE INH O.N. | DE0005664809

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Biogen - 60% above market price

After years of stagnation in terms of major acquisitions in the biotechnology sector, this topic has gained significant momentum since the beginning of the year. The reasons for this are evident. On the one hand, the pharmaceutical giants are sitting on substantial cash reserves, while on the other hand, due to expiring patent protection, the industry is required to acquire new technologies and preparations in order to be able to compensate for possible future sales losses.

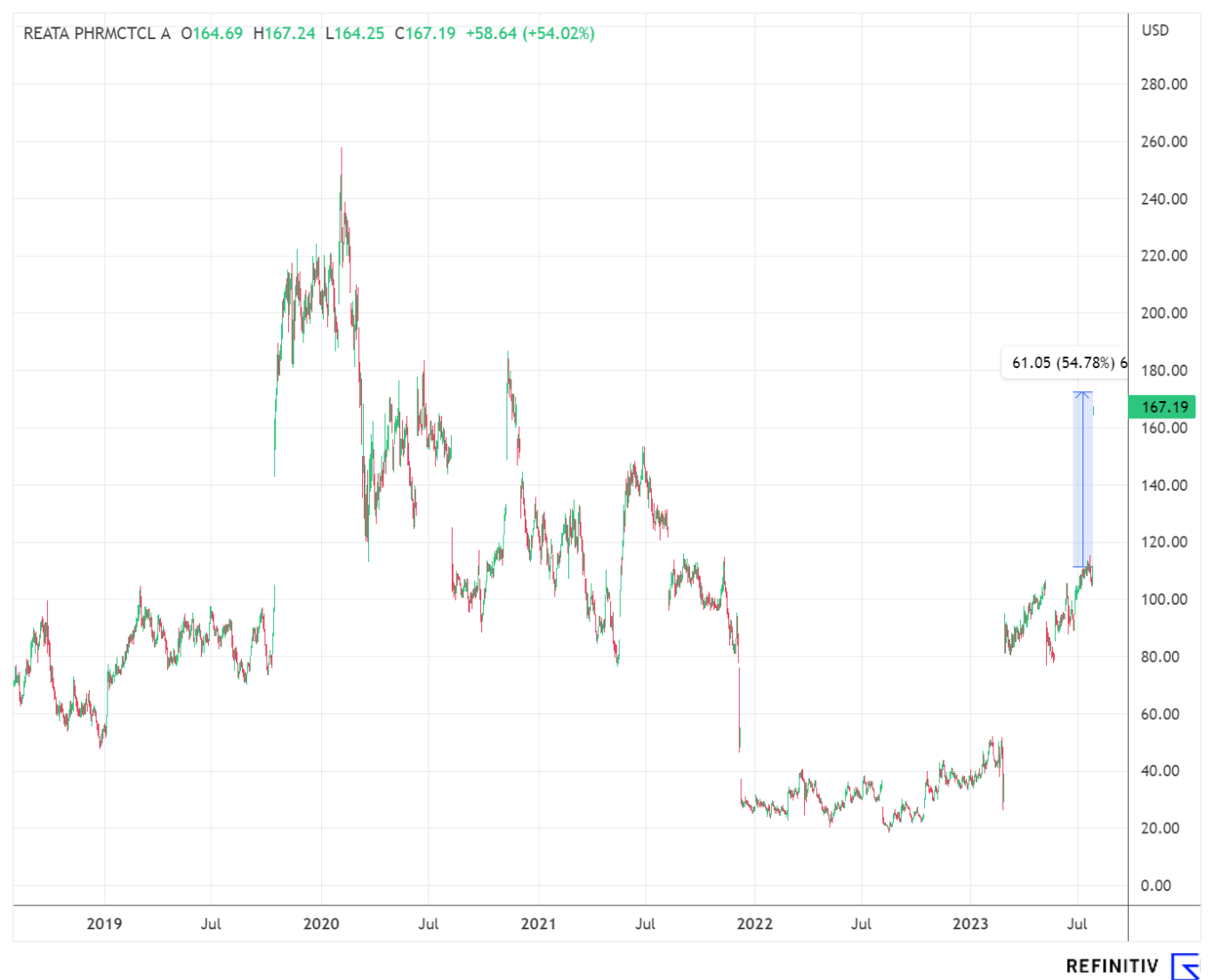

The latest blockbuster deal was made by Biogen, a US biotechnology company based in Cambridge, Massachusetts, with a broad portfolio of drugs for treating multiple sclerosis, spinal muscular atrophy and Alzheimer's disease with the blockbuster drug Leqembi. To strengthen its position in the field of neurological disorders, Biogen agreed to acquire Reata Pharmaceuticals for USD 172.50 per share in cash, representing a premium of about 55% over last week's share price. Including debts, the total enterprise value amounts to around USD 7.3 billion, according to the information provided.

According to Biogen, the reason for the acquisition is that Reata Pharmaceuticals has made significant progress in developing therapies that regulate cell metabolism and inflammation in serious neurological diseases. Reata's Skyclarys is the first and only drug approved in the US for the treatment of Friedreich's ataxia and is currently entering the market. Approval is under review in Europe.

Cardiol Therapeutics - Market recognizes undervaluation

According to experts, small and medium-sized biotech companies, in particular, are currently attractive takeover targets due to financial difficulties and lower valuations. Financial bottlenecks are not the reason for the Canadian biotech company, which specializes in anti-inflammatory therapies for heart diseases. At the end of the first quarter, the Company had around CAD 49.5 million in cash, which means that Cardiol Therapeutics could finance its current research activities on its own until 2026.

Cardiol Therapeutics is considered an attractive takeover target because the stock has, at times, traded below its current cash ratio. Slowly, investors seem to be coming around to the Company's potential. The share price has risen by more than 110% since the beginning of the year to CAD 1.43.

The main focus of the Canadians is on CardiolRx, an oral compound being tested in Phase II trials for recurrent pericarditis as well as myocarditis. Phase II studies have been initiated following strong preclinical data. Analysts expect new data as early as this year. The Phase II study with a total of 25 patients is being conducted at several renowned cardiology centers in the US.

Analysts are optimistic about this innovative biotech stock. While the North American broker Canaccord called out a price target of USD 6.00 with a buy rating, the experts at analyst firm First Berlin Equity Research forecast a 12-month price target of USD 3.60.

Evotec - Strong profit warning

Developments at biotech company Evotec, which operates in the field of pharmaceutical drug discovery, are less optimistic. As a result of a hacker attack, the Hamburg-based company had to issue a drastic revenue and profit warning. "Lower productivity during the second quarter has significantly impacted our financial results for the first half of 2023," said Group CEO Werner Lanthaler.

Full-year sales are expected to reach between EUR 750 million and EUR 790 million. The original forecast was EUR 820 million to EUR 840 million. EBITDA has been revised to a range between EUR 60 million and EUR 80 millionafter the MDAX-listed company's management previously advised between EUR 115 million and EUR 130 million.

After Evotec had to delay its audited annual report for 2022 due to a cyberattack, the Company temporarily left the MDAX but was able to return soon after. However, the attack had a significant financial impact on Evotec, amounting to approximately EUR 25 million. Although operations resumed at the end of April, the Company recently lagged in terms of productivity. However, the long-term targets until 2025 were said to be unaffected.

As a result of the profit warning, Evotec shares temporarily lost about 15% to EUR 21.11 but stabilized at just under EUR 23 at the close of trading. Following the publication, analyst firm Warburg Research reiterated its price target of EUR 30 and continues to see the stock as a buy candidate.

The acquisition wave rolls on. Biogen has now acquired Reata Pharmaceuticals for USD 7.3 billion. Cardiol Therapeutics is also a potential candidate due to its undervaluation. Evotec had to revise its revenue and profit forecasts.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.