June 7th, 2023 | 08:30 CEST

Billions with Artificial Intelligence? Nvidia, Grid Metals, Deutsche Telekom, Apple - Short sellers spotted!

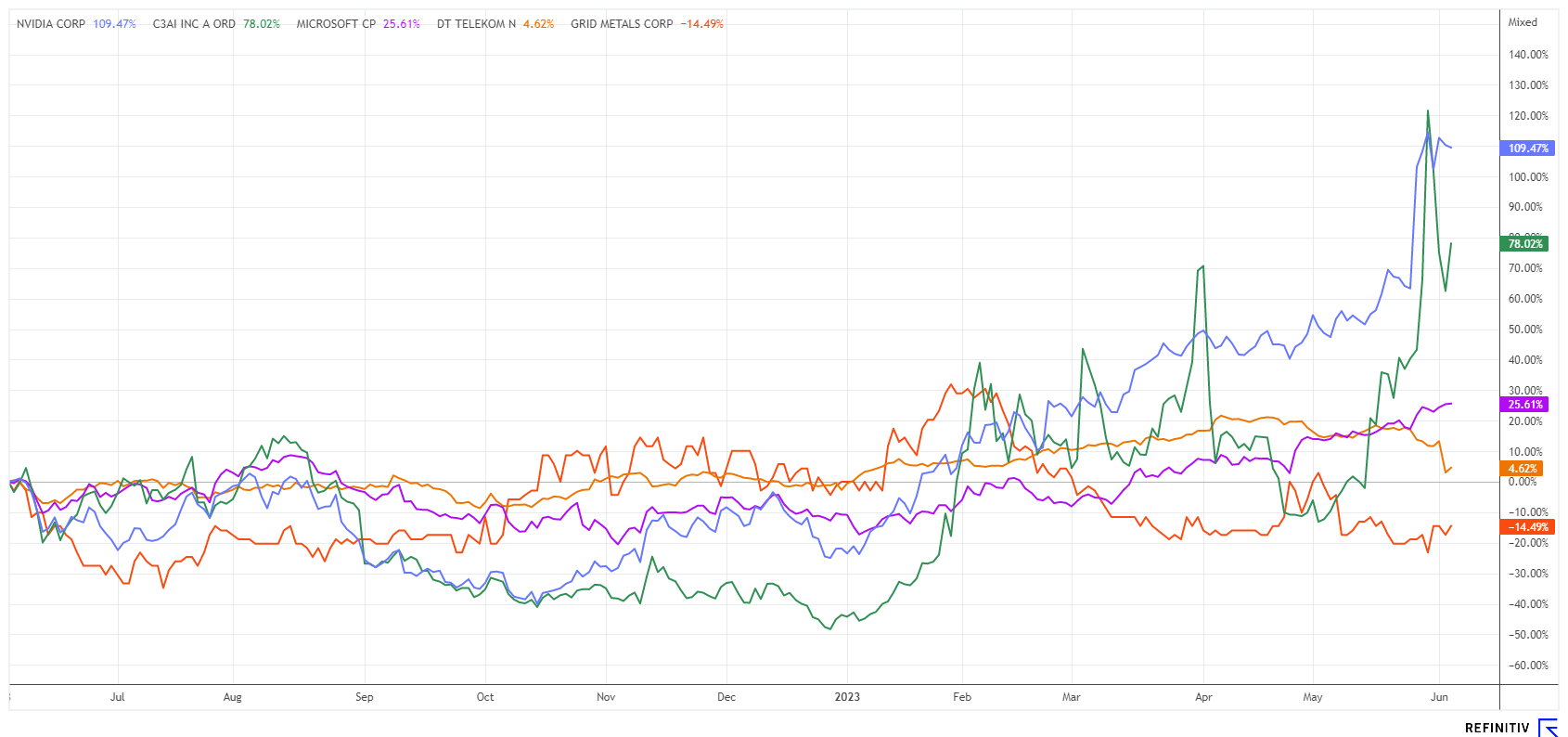

The stock market is not a one-way street. Some investors have recently experienced this firsthand. Because in the "ups and downs" of sentiment, new trends are constantly emerging. The biotech sector, for example, has been falling for more than a year, and the charts keep reaching new lows. In 2020, cannabis stocks made a splash, with the related index, POT, increasing tenfold since 2018 to about 1100 points. However, yesterday it reached a new all-time low with 45.5 points or a 95% loss. Currently, investors are trying to ride the wave of "Artificial Intelligence" (AI), with stocks like C3.ai, Nvidia, Microsoft, and Palantir all performing well in 2023. A new megatrend is underway here that, according to experts, will continue for several years. How long this boom will yield returns is unknown, but these stocks are currently performing strongly.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NVIDIA CORP. DL-_001 | US67066G1040 , GRID METALS CORP. | CA39814L1076 , DT.TELEKOM AG NA | DE0005557508 , APPLE INC. | US0378331005

Table of contents:

"[...] Large tailings piles, such as those created in phosphate production from sedimentary rock, will not exist in our process. [...]" John Passalacqua, CEO and Director, First Phosphate Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Grid Metals - First resource estimate still in the second quarter

Today, anyone looking at high-tech products is encountering a shortage of important metal elements. Due to increased investments in various Greentech solutions such as wind and solar plants, e-mobility or new energy storage systems, a lot of copper and lithium is needed. Both are scarce or can only be extracted regionally and at great expense. Large mining companies are therefore dependent on the help of exploration companies that search for these metals in sometimes remote regions.

The Canadian company Grid Metals (GRDM) has specialized in the exploration of lithium, nickel, copper and PDM metals with its projects Donner Lake, Mayville and Makwa, northeast of Winnipeg (Manitoba). Final drill results have now been released from the completion of the Northwest Dyke winter drill program on the Donner Lake lithium property. Visible spodumene mineralization has been observed in all drill holes within the core area of the dyke, with apparent thicknesses of up to 10 meters at a depth of 185 meters below the surface. Lithium (Li2O) grades vary from 1.13 to 1.60% over lengths ranging from 14 to 262 meters. From these results, management will prepare an initial resource estimate, which is expected before the end of the second quarter of 2023.

Robin Dunbar, CEO of Grid Metals Corp. comments: "The results indicate strong continuity of mineralization in the core area of the dyke, with the pegmatite remaining open at depth and to the south along strike." GRDM's share price is currently hovering between CAD 0.14 and CAD 0.18. With a good resource estimate, it could go high soon.

Nvidia - Welcome to Apple's Trillion Dollar Club

After Nvidia managed to rise to USD 420 by the end of May, the valuation of the popular AI stock reached the trillion-dollar mark. This makes the chip specialist another member of the "Trillion Dollar Club", formed in 2019 by the remarkable rise of Apple's stock. For a while, even Tesla was in on the action. However, the share lost more than 65% of its value at the end of 2022 and had to say goodbye to the club. Currently, Microsoft, Amazon and Alphabet are still in the running.

Nividia has more than tripled in value since mid-2022, leaving the keen observer wondering what the enormous increase in value is all about. Artificial intelligence applications need a huge data analysis platform, and Nvidia can provide just that. The surprising explosion in demand in the data centre segment hit the market like a bomb because this business is likely to grow even faster in the future due to the AI boom. However, other related technologies could also potentially lead to a paradigm shift. Areas such as IoT applications Smart Home, machine learning, and automated driving are gaining prominence.

After a minor correction, the Nvidia share is once again on an upward trajectory, equipped with sufficient dreams of the future. After a low of USD 376, it stood at USD 392 yesterday. On the Refinitiv Eikon platform, there are 49 assessments of the share, with no negative ratings. The median 12-month price target is USD 456 representing a modest 16% increase - not exactly a lot for an outright stock market darling.

Deutsche Telekom - Under the wheels

According to the news channel Bloomberg, Amazon is reportedly working on its own mobile phone offering at bargain prices for its Prime customers. This report brought a 10% plunge to Deutsche Telekom last week, marking the steepest discount since the Corona crash of March 2020.

In terms of customer retention, an attractive contract would indeed make sense. Providers could be the major US network operators Verizon, Dish and even the telecom subsidiary T-Mobile US. It is strange that the US subsidiary wants to torpedo its own business model. Because as a result, the profit margins for mobile phone contracts could come under significant pressure and ultimately also affect the profits of the German "parent". Amazon immediately denied this. The massive sell-off of the Telekom share may also be due to chart price patterns at the turn of the millennium, which recently caused the DTE share to form an SKS formation. This picture would give rise to a correction potential of up to EUR 17.50. Only after that could it return to old highs of over EUR 23.

At the moment, however, the trend is bearish, as the battered price could lead to further selling pressure or even attract short sellers. The experts on the Refinitiv Eikon platform are relatively certain, however, that a target price of EUR 25.60 could be achieved. The share is currently trading at a P/E ratio of 10.8 and offers a dividend yield of 3.7%.

The price fantasy on the NASDAQ is mainly fuelled by high-tech and AI stocks. Since leaving the downward trend at the beginning of 2023, the index has already gained a solid 34%. In nominal terms, it is now only 1,400 points behind the DAX 40. The party will likely continue for a second round.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.