July 6th, 2023 | 07:00 CEST

Battery revolution in Germany: BYD, BASF, Altech Advanced Materials

Negative electricity prices? Last weekend, it happened again. In the meantime, 1 megawatt-hour of electricity costs minus EUR 500. It is a pity that there are no large-scale energy storage systems - YET. Altech Advanced Materials is working together with Fraunhofer IKTS on the next-generation battery, and it is "Made in Germany." The next milestone is due this year, and the FAZ sees room for improvement in the share price. Analysts see no room for improvement in BASF shares and recommend "sell". However, the DAX-listed company has just commissioned a battery factory, and demand is said to be high. BYD is also benefiting from high demand. Will the Chinese company soon be producing their e-cars in Germany?

time to read: 5 minutes

|

Author:

Fabian Lorenz

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , BASF SE NA O.N. | DE000BASF111 , ALTECH ADV.MAT. NA O.N. | DE000A31C3Y4

Table of contents:

"[...] The collaboration with CVMR offers two primary advantages for Power Nickel: We can cover a larger portion of the value chain in the future, and despite the extensive cooperation with all its positive outcomes, we have remained significantly independent. [...]" Terry Lynch, CEO, Power Nickel

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

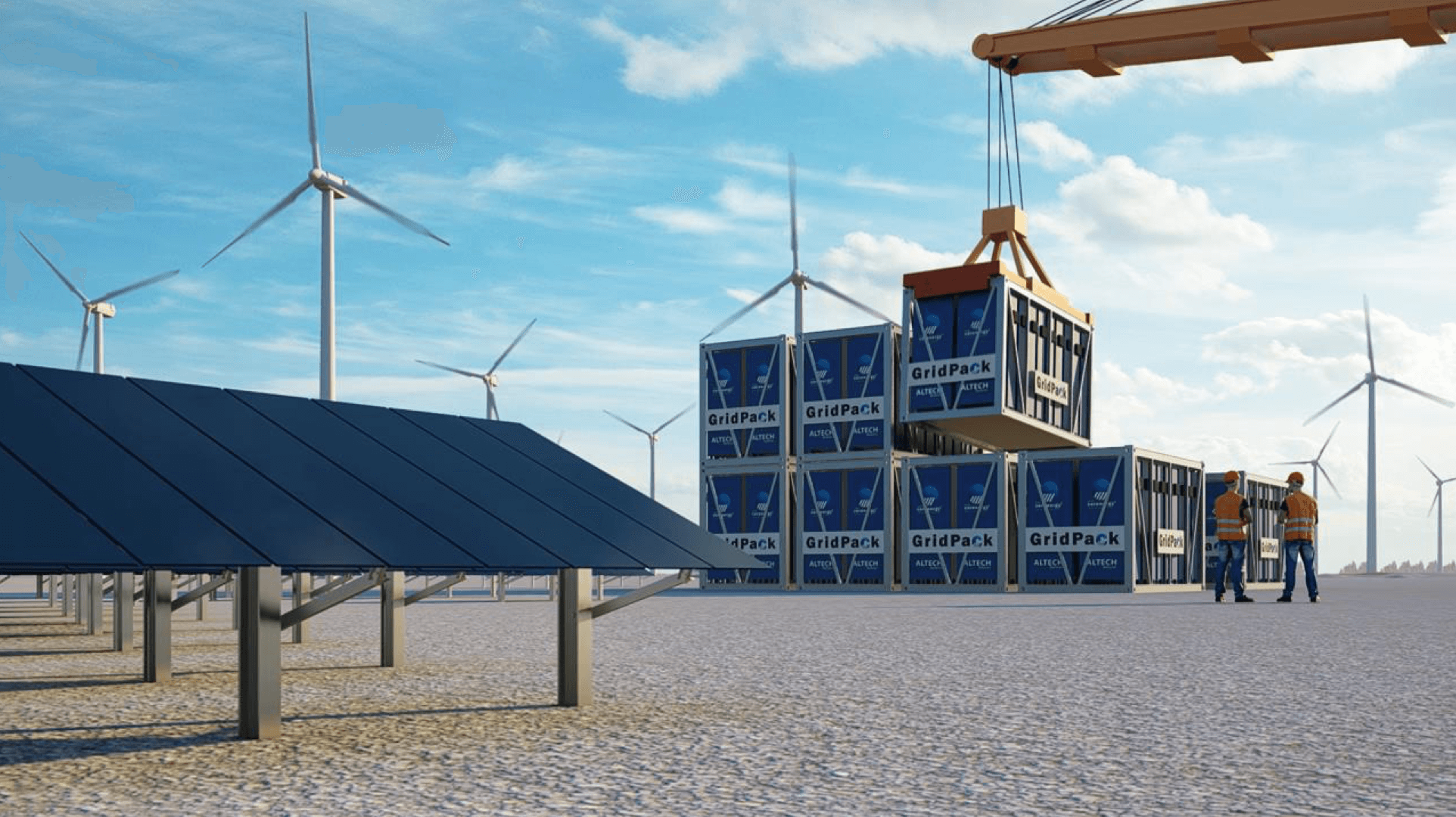

Altech: Finally taking advantage of negative electricity prices

The figure is frightening: in 2021 alone, Germany threw away EUR 2.3 billion worth of electricity. The grids were simply full. With the expansion of renewable energy, this tendency is increasing because wind and sun do not produce electricity continuously or at the push of a button. Thus, alternating between electricity imports and electricity surpluses is also currently a daily occurrence in Germany. The solution is efficient electricity storage. Then the energy transition in Germany can succeed. For stationary grid storage, the listed company Altech Advanced Materials is working on an alternative to lithium-ion batteries. Together with Fraunhofer IKTS, the Company is developing the CERENERGY® sodium chloride solid state battery (SCSS). This is essentially based on common salt and nickel. The advantages are numerous: the battery technology uses common salt and is free of critical raw materials such as lithium, cobalt, graphite and copper. Instead, the raw materials required can be sourced from Europe. In addition, the solid-state battery scores with a service life of more than 15 years without any loss of performance, as well as fire and explosion safety.

The potential for Altech is huge: the global market for battery energy storage systems is expected to explode from USD 4.4 billion in 2022 to USD 15.1 billion in 2027 - and the trend is rising. The pilot plant in Dresden is in place, and prototypes have been developed. The feasibility study for mass production is to be completed this year. In parallel, preparations for series production in Saxony are underway. "We have built a dynamic and fast-moving project team that includes staff from Altech, Fraunhofer and various leading German engineering firms and industrial companies. The progress we have made in such a short time on the final designs of the 60 kWh battery pack is outstanding. I am very pleased with the progress", said Uwe Ahrens, CEO Altech Advanced Materials. The first production line is expected to have a production capacity of 100 MWh. Then the "throwing away" of electricity in Germany should finally come to an end. "All major utilities are planning battery parks in the gigawatt range," Uwe Ahrens stated at an investor conference in the spring.

The share is currently trading at an all-time high of EUR 14.90. With a jump above EUR 15, the way to the top would be open**. As a small-cap stock, there are always consolidations, but the chart is in a picture-perfect uptrend.

BASF: With new factory against dependence on China

When it comes to battery production, there is more going on in Germany. While Altech is working on the next-generation battery for large-scale energy storage, BASF has commissioned the first large-scale battery cathode factory in Europe in Brandenburg. The project cost around EUR 550 million and received EUR 175 million in funding. The cathodes produced there are intended to reduce the large dependence on China for the production of lithium-ion batteries. The quality of the cathode materials is extremely important for a battery's charging speed and range.

BASF plans to produce cathodes for 400,000 e-cars a year at the new factory. The Company said it is already sold out for the next two years, so it is talking to customers about expanding the plant. BASF also plans to build another prototype plant for battery recycling at the site.

UBS analysts are not impressed by the new factory. They continue to recommend the BASF share with a "sell" rating. The price target was even reduced from EUR 43 to EUR 40. The analysts expect only a slight recovery in demand in the second half of the year. Therefore, EBIT estimates have been reduced. UBS is also pessimistic about the soon-to-be-published Q2 figures. The bank's analyst estimates are below consensus. BASF is expected to report Q2 and full first-half 2023 results on July 28.

BYD: Production in Germany? First in Brazil

Speculation that there will soon be a new production site for e-cars in Germany has persisted for weeks. BYD is a hot candidate for the purchase of the Ford plant in Saarlouis. In the future, models such as the ATTO 3 or HAN from the Chinese e-car specialist could roll off the production line there. It has yet to be determined whether BYD will take over the plant. However, a buyer seems to have been found. Handelsblatt reported that Ford and the Saarland government had signed a concrete letter of intent with an interested party. It is not yet known who the buyer is.

We will find out sooner or later whether it is BYD. It is well known that the Chinese are investing massively worldwide. The latest investment is currently taking place in Brazil. In the largest country in South America, BYD is investing over USD 620 million. In a gigantic complex, three factories are to be built at once: for e-commercial vehicles, e-cars and battery components. "This is an extremely important moment for BYD in the Americas region", said Stella Li, Executive Vice President CEO of BYD and CEO of BYD Americas. "These new factories in Bahia will bring innovation and the highest technological standards. They will enable the adoption and acceleration of electric mobility in the country, a key movement to combat climate change and truly improve people's quality of life."

Operationally, BYD is also doing well. It reported record sales for the second quarter. According to the report, the Chinese automaker sold a total of 700,244 all-electric and hybrid vehicles between April and June.

Battery technology is the future - and not just in cars. Developments in the German electricity market show how great the need and opportunity for electricity storage is. Altech seems to be in a very attractive position to benefit from this in the coming years. The stock looks promising. BASF is also getting involved in the battery market, but for a corporation, this area is just one of many. With BYD investing billions worldwide along the electromobility value chain, it is enough to make you dizzy. So far, it looks like a success story.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.