September 18th, 2023 | 08:00 CEST

Automotive stocks surging - Nikola, First Hydrogen, Volkswagen AG

While BMW faced a setback due to a downgrade by the British investment bank Barclays from EUR 107.50 to EUR 92.50 and the new rating "Underweight", other automotive stocks celebrated significant price gains. Especially in the field of alternative propulsion, there are companies with substantial growth potential that, despite the prevailing market correction, continue to hold promise for sustainable growth.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

NIKOLA CORP. | US6541101050 , First Hydrogen Corp. | CA32057N1042 , VOLKSWAGEN AG VZO O.N. | DE0007664039

Table of contents:

"[...] We are committed to stay as the number one Canadian and global leader in the Hydrogen-On-Demand diesel technology [...]" Jim Payne, CEO, dynaCERT Inc.

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Nikola continues its roller coaster ride

Since hitting its lowest point on June 6, 2023, at USD 0.56, Nikola investors may have felt dizzy due to its high volatility. Initially, the stock, once considered a rival to Tesla, surged by a whopping 612% to USD 3.71, only to collapse to USD 0.82 over the following 4 weeks for the manufacturer of hybrid trucks. However, the latest news-driven momentum saw it heading back north with nearly a 63% increase within two trading days.

The reason for the week's USD 1.19 surge was the announcement that Nikola plans to start selling its hydrogen fuel cell trucks at the end of the month. The main investor concern in recent weeks has been the communicated withdrawal of more than 200 battery-powered trucks, prompted by a coolant problem in the core of a battery that is believed to have led to a vehicle fire in June. Steve Girsky, who took over the leadership of Nikola in early August, emphasized that the Company's team is working tirelessly to source matching components from their partners. "Any correction made will undergo intensive reviews before being released. Details on timeframes and financial implications will be shared soon. Our primary commitment is to ensure the safety and satisfaction of our clientele," Girsky explained.

Regarding production and delivery challenges, the CEO noted that while deliveries of the battery electric trucks were paused, he stressed to shareholders that this was irrelevant for the hydrogen fuel cell trucks, which use an alternative battery unit from another supplier. Production of these vehicles began in late July, with the first deliveries to distribution partners scheduled for late September and early October. The official presentation is scheduled for September 28. Girsky believes these deliveries will give Nikola a considerable advantage over its competitors of at least two years.

First Hydrogen - Test drives inspire

Continuing a news flow that has been consistently positive for months, the developer of hydrogen fuel cell-powered light-duty commercial vehicles was also able to deliver. After achieving a best-in-class range of 630 km on a single refueling in real-world driving weeks ago, First Hydrogen received its results report from its first test partner, Rivus, a fleet management provider responsible for managing over 120,000 light commercial vehicles and trucks annually. The report was published under the title "First Hydrogen LCV Trial".

Rivus highlighted that the vehicle performed very well during testing and appeared much more robust than a BEV, considering the extent to which vehicle efficiency was affected by different loading factors. The refueling process takes between 5 and 7 minutes, comparable to a fossil fuel vehicle, while Stromers must spend hours at the energy pumps. Rivus covered around 6,000 km on various terrains both inside and outside the city. The consensus fuel consumption of the LCV was analyzed to be below 2 kg/100 km and even below 1.5 kg/100 km in urban traffic. The range was estimated at well over 500 km.

With the second test company, SSE, still in the testing phase as part of the Aggregated Hydrogen Freight Consortium (AHFC), in which a total of 16 partners are putting First Hydrogen's prototypes through their paces, the Canadians are looking to open up the fleet trials to further commercial opportunities due to growing interest. There is brisk demand for "light commercial vehicles," especially from parcel delivery companies looking to use First Hydrogen's hydrogen-powered fuel cell vehicle for express deliveries. To date, First Hydrogen's focus has been primarily on industry participants such as utilities that require zero-emission vehicles capable of traveling longer distances and carrying heavier payloads.

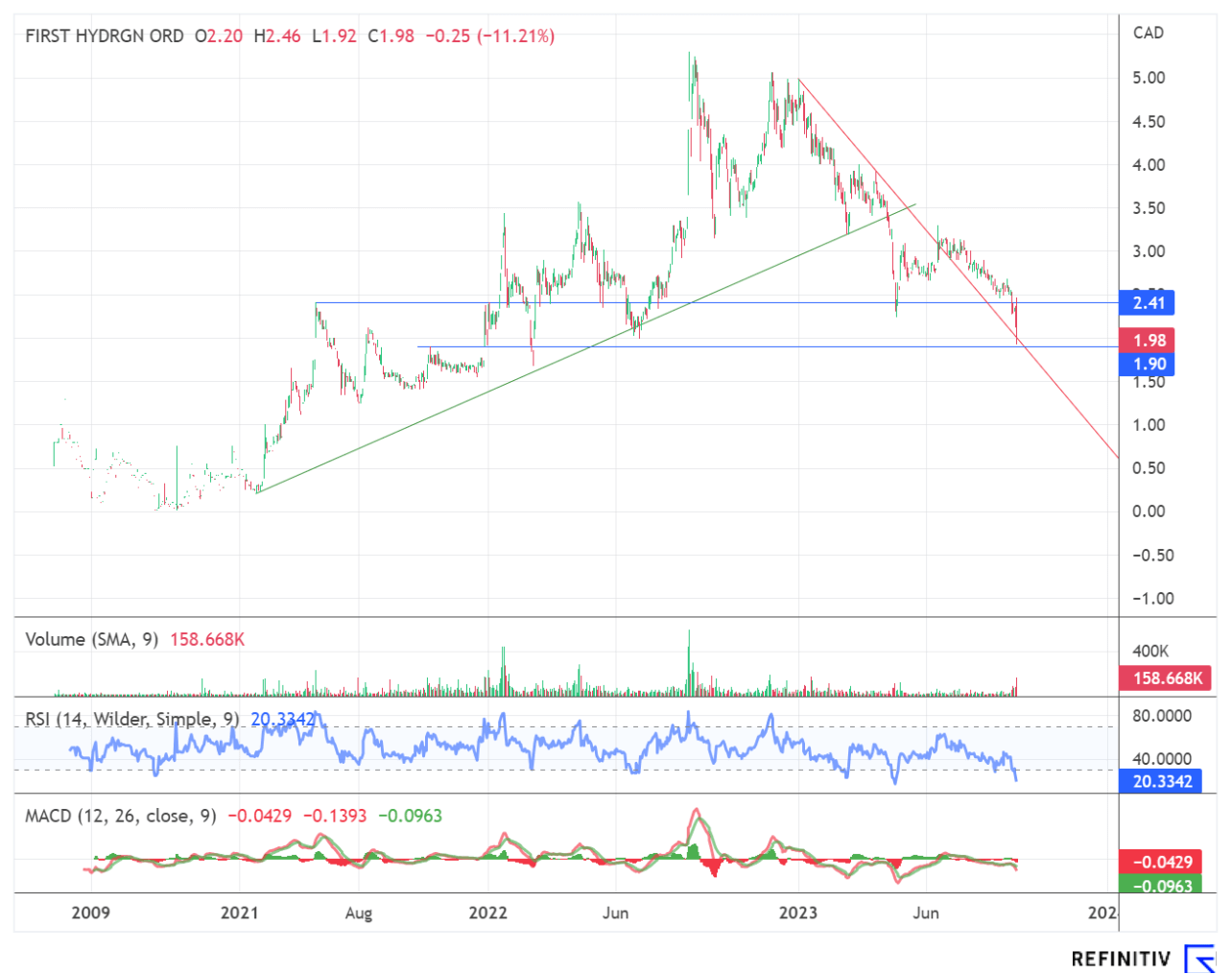

Despite the successes surrounding its latest generation vehicles, First Hydrogen's stock has lost about 60% of its value since the beginning of the year due to weakness in the hydrogen sector. However, if testing continues to be positive and commercialization approaches, the current consolidation should provide a good long-term entry opportunity.

Volkswagen AG - Class action lawsuit dismissed

Volkswagen AG, based in Wolfsburg, has continued its positive trend since hitting its yearly low on September 8. The stock has risen by nearly 6% since then, reaching EUR 109.80. One of the reasons for the continued positive sentiment was the fact that Swiss owners of Volkswagen diesel vehicles suffered a setback in the emissions scandal.

The collective action filed by 2000 owners in Germany based on the manipulated engines was dismissed. The consumer protection association from western Switzerland, Fédération Romande des Consommateurs (FRC), commented Saturday evening on a report by French-language broadcaster RTS. According to FRC, the plaintiffs had hoped for reparations in the range of EUR 1600 to 5000.

On the other hand, the shortage of parts, which is due to a lack of engine parts from Slovenia due to the current flood, had a negative effect. As a result, Volkswagen must also adjust production at its main plant in Wolfsburg. "Starting Monday, September 11, isolated shifts will be cancelled at the Wolfsburg plant," a company spokesman said. Production has also been scaled back in Emden and Osnabrück. The Portuguese plant in Palmela near Lisbon had even announced that it would completely halt assembly for up to two months starting this Monday. Purchasing director Dirk Große-Loheide said the bottleneck should be resolved relatively quickly. Thus, a plan should be presented at the end of the current month. "By the end of the year, the issue will be over," the manager said.

Nikola continues to ride a roller coaster. First Hydrogen could report further positive developments. Wolfsburg-based Volkswagen AG scored a success based on a class action lawsuit in Switzerland.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.