February 27th, 2025 | 07:50 CET

Attention – Biotech is taking off! Evotec, Vidac Pharma, BioNTech, and Novo Nordisk in focus

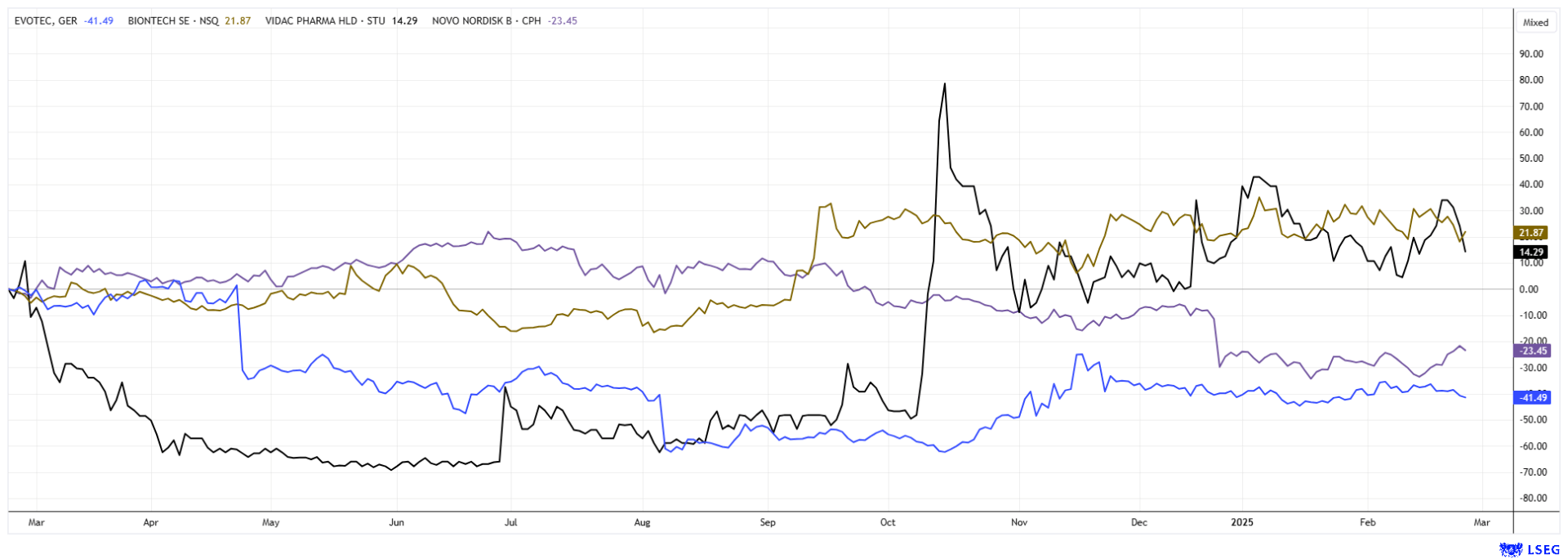

With new index highs and huge daily trading volumes, the biotech sector has been back in the spotlight for several weeks. At Evotec, the personnel merry-go-round continues, while BioNTech has announced an acquisition in the oncology field. After the big crash in Novo Nordisk shares, the first share buybacks are now taking place, but growth rates have been revised downwards. Vidac Pharma has just completed a roadshow and will present its latest progress at the Sachs Health Science CEOs Forum in Zurich. Share prices across the sector appear to have turned in the last quarter. It is now time for investors to take a closer look again. We offer a few insights.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , VIDAC PHARMA HOLDING PLC | GB00BM9XQ619 , BIONTECH SE SPON. ADRS 1 | US09075V1026 , NOVO NORDISK A/S | DK0062498333

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec – Another change in personnel

As announced in the last few days, Evotec is hiring a new CFO. As the Company reported, Laetitia Rouxel will step down as CFO on February 29. She cited the reason as wanting to "focus on other opportunities". The Hamburg-based company has already found a suitable successor, with the Supervisory Board appointing Paul Hitchin as the new CFO, effective March 1, 2025. Hitchin has more than 20 years of experience in senior finance roles. Most recently, he was CFO at Dutch healthcare company Mediq, prior to which he held various CFO positions at General Electric. Evotec now needs strict and experienced leadership; the restructuring is draining its resources.

Rouxel's resignation is the latest in a series of changes at the top of the Company. At the beginning of 2024, long-standing CEO Werner Lanthaler unexpectedly resigned due to irregularities in insider transactions. However, the rapid personnel changes are currently causing great uncertainty around the Company on the stock market, and investors continue to exercise restraint. After the announcement of the personnel changes, the share price lost a good 7% again in the middle of the week. It will be exciting with the annual figures on March 27. Was the EUR 800 million revenue threshold sustainably exceeded in 2024? Use prices of around EUR 8 for a cautious, medium-term positioning; it should not go much lower than that now.

BioNTech – Progress in oncology

As heard from Mainz, BioNTech has now completed the acquisition of Biotheus, thereby expanding its oncology research capabilities. The purchase price includes an initial USD 800 million plus additional performance-related milestone payments of up to USD 150 million, depending on the degree of achievement. With the integration, BioNTech gains worldwide rights to BNT327, a bispecific antibody candidate currently in clinical development. BNT327 is to be established as a pan-tumor technology platform in the future. The acquisition of the Chinese company makes sense, as it improves BioNTech's position in the field of bispecific antibodies and the development of innovative combination therapies for cancer.

BioNTech's annual figures for 2024 are also approaching. They are scheduled to be released on March 10. Analysts, in consensus, estimate a quarterly result of EUR 0.323 per share, but the full year is expected to result in a loss of EUR -3.23. The Mainz-based company is currently only earning from new COVID vaccines, which are receiving little attention due to low vaccination rates in the population. The cash position of around EUR 16.5 billion remains impressive. However, with a market capitalization of EUR 25.3 billion, this is well paid. Wait and see!

Vidac Pharma – Groundbreaking progress

Vidac Pharma is one of the biotech shooting stars on the German stock market, with a share price increase of over 120% in the last 6 months. The Israeli company has a long history and is a pioneer in biopharmaceutical research. At the center of its oncology research is the Warburg effect, a phenomenon in which cancer cells metabolize glucose in large quantities. Vidac has developed a method that aims to inhibit hyperglycolysis and restore apoptosis in malignant cells. This targeted intervention could not only reduce the side effects of conventional chemotherapy but also make the tumor microenvironment adaptable to immune responses, increasing the effectiveness of other therapies.

Vidac recently attracted attention with an exclusive roadshow in Frankfurt and Munich, where the latest advances in cancer therapy were presented to interested investors. The focus was on Vidac's innovative approach to reversing the Warburg effect, which targets the misplacement of the enzyme hexokinase 2 in cancer cells. By integrating preclinical successes into large-scale oncology strategies, the Company hopes to treat a wide range of cancers more effectively. These developments could revolutionize cancer treatment and create new opportunities for combination therapies.

Yesterday, February 26, marked the start of the Sachs Health Science CEOs Forum in Zurich. This renowned conference regularly attracts a lot of attention among investors and is an excellent platform for partner discussions. The Vidac share could soon take off again; in October, the price was already above the EUR 1 mark.

Novo Nordisk – Finally on the rise again?

We briefly examine the shares of the Danish obesity expert Novo Nordisk. After a dramatic crash of over 50% by mid-February, investors are now regaining hope that the decline in growth may be smaller than feared. In December 2024, Novo Nordisk published data on its experimental obesity drug CagriSema. The study showed an average weight reduction of 22.7%, which was below the expected 25%. The main competitor, Eli Lilly, achieved slightly better results with its similar drug, Zepbound, which further put pressure on Novo Nordisk's market position. The Annual General Meeting on March 27 should provide clarity on whether the Company's expert estimate of a 20% increase in revenue from DKK 290 billion to DKK 353 billion this year is realistic or even surpassable. Investors currently appear to be jumping back on the bandwagon.

Interest in biotech stocks has finally returned. In the coming weeks, many companies will report their figures and present outlooks. This is likely to increase volatility in the sector significantly. Evotec remains critical, but we find BioNTech and Novo Nordisk promising. Vidac Pharma stands out with its consistently strong pipeline and should soon rise to new price highs.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.