April 12th, 2023 | 10:34 CEST

Attention, biotech is back! Bayer, Defence Therapeutics, BioNTech - These stocks are breaking out!

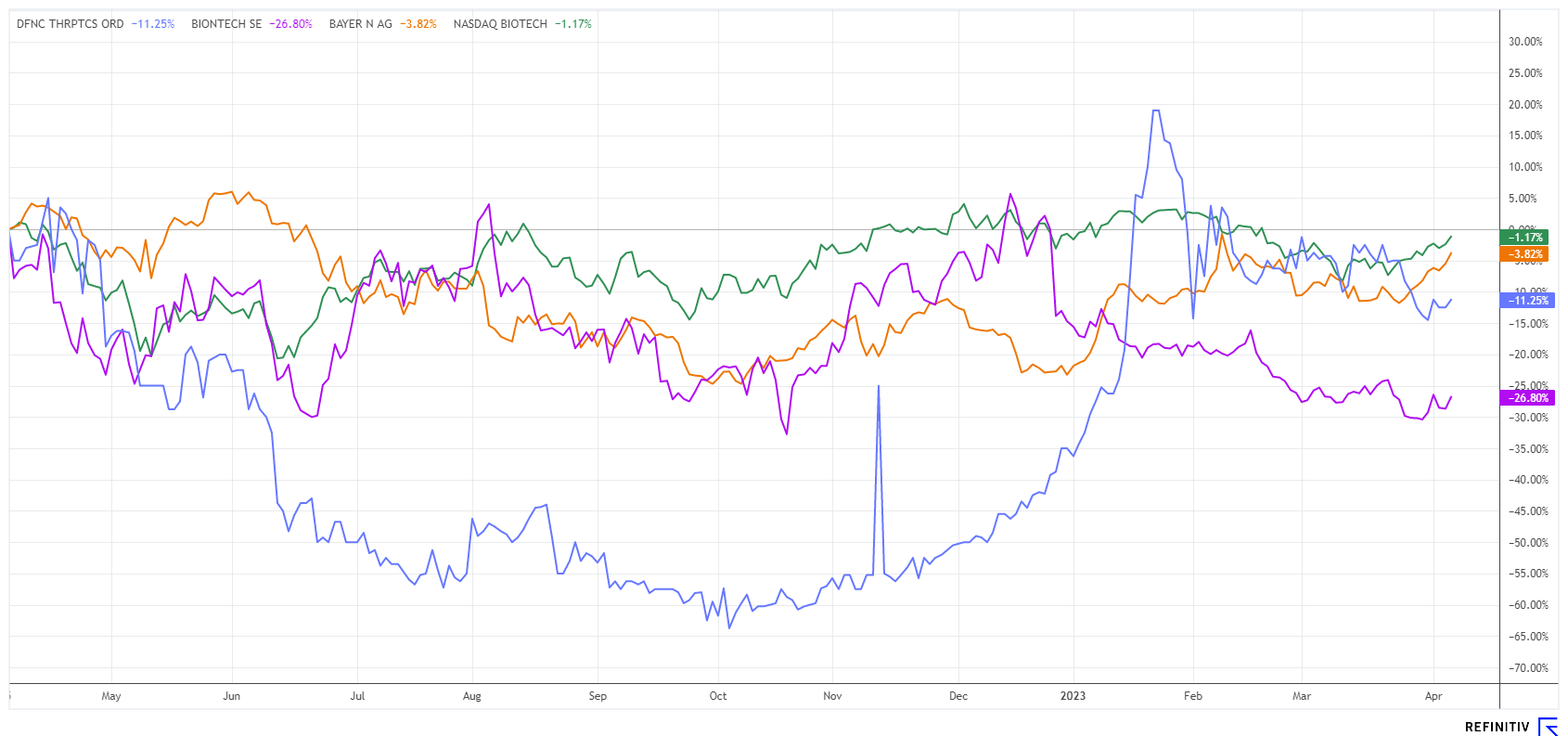

For months the market did not care about biotech stocks. But now technical bottoms have been reached, and a rise is likely. In this context, the capital market interest rate is important: if it falls due to increased fears of recession, there is no stopping the biotechs because refinancing costs fall. Sentiment measurements over Easter showed that the risk bias of investors has also returned. If not now, then when, the moment is favorable! Shortlist the following stocks.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BAYER AG NA O.N. | DE000BAY0017 , DEFENCE THERAPEUTICS INC | CA24463V1013 , BIONTECH SE SPON. ADRS 1 | US09075V1026

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Bayer - New board, no split planned

Pharmaceuticals and agrochemicals specialist Bayer is one of the best DAX stocks in 2023, making up for lost ground with the partial settlement of the glyphosate lawsuit and gaining a good 27% since the beginning of the year.

At the beginning of June, the designated Bayer CEO, Bill Anderson, will succeed CEO Werner Baumann, who worked for Bayer in various positions for 35 years. Even though there are high expectations on the capital market, there will be no quick fixes under him: After all, the chemical engineer, who is now moving from Roche to Bayer, has accompanied a successful transformation process there. Investors suspect a realignment of the group, which floundered after the USD 66 billion Monsanto takeover in June 2018. As a reminder: Bayer is worth less on the stock market today with Monsanto than it put on the table for the acquisition at the time.

The future Bayer CEO wants to take his time to understand the pharmaceutical and chemical group. At a press conference, he left it open to when exactly he would present plans for Bayer's future. A split-up, as demanded by some investors, is not likely to happen under Anderson any time soon. The new strategic guideline with which Bayer will position itself is also bound to be exciting. The Crop Science Division will invest EUR 60 million in its corn seed processing plant in the Ukrainian village of Pochuiky - a good sign of solidarity towards the new EU member-to-be. Bayer shares were able to crack the EUR 60 mark and will hold their annual general meeting on 28 April. After that, a dividend of EUR 2.43 will be due. With a 2023 P/E ratio of 8.4, the share is by no means expensive.

Defence Therapeutics - This could mean a breakthrough

The Canadian biotechnology company Defence Therapeutics has developed the ACCUM™ platform, a patented technology that offers great hope in current cancer research. The core of the DTC platform consists of the ACCUM™ technology, which enables the precise transport of vaccine antigens or ADCs in the intact form to the target cells. As a result, improved efficiency and efficacy against serious diseases such as cancer and infectious diseases can be achieved. In March 2023, Defence partnered with French state-owned Orano to enter the radiopharmaceuticals market. The parent company Orano is an industrial company around nuclear applications, which includes radio-medicine. Defence Therapeutics has succeeded in placing its patented ACCUM™ technology as a radionuclide-antibody conjugate with Orano. In this process, the proven carrier technology ACCUM™ delivers a radioactive emitter near the nucleus of tumour cells instead of a conventional drug. The aim is that the well-placed radioactive emitter damages the cell nucleus of the cancer cell and thus induces cell death.

With this deal, Defence Therapeutics underlines its flexibility in the use of its proprietary ACCUM™ technology. Head of Research, Dr. Moutih Rafei, is convinced that ACCUM™ could help in many areas to effectively deliver drugs into affected cells and thus reduce the drug dose requirement. Breakthrough news has just revealed that Defence has developed a strategy to conjugate mRNA molecules with ACCUM™. The efficacy of this modified product is now being compared to naked mRNA administered as vaccines in immunocompetent mice. The field of mRNA vaccination is very promising compared to other vaccination modalities. mRNA delivered to target cells is susceptible to harsh intracellular conditions, such as depleting acidity and enzymatic reactions found within endosomal lumens. As such, the captured mRNA molecules can be destroyed even before they reach the cytoplasm, where they are normally translated into proteins or long polypeptide chains. In tests on mice, administration of a naked mRNA molecule encoding the ovalbumin protein triggered weak to moderate antibody titers.

"Although it is a promising technology, mRNA vaccines have not yet reached their full potential. By conjugating mRNA with ACCUM™, we expect to improve the immunogenicity of the vaccine, resulting in a strong immune response," said Dr Rafei, Vice President Research and Development at Defence. Defence has now completed developing and synthesizing the ACCUM™ mRNA vaccine and plans to develop its own ACCUM™-linked mRNA vaccines for various cancer indications. In parallel, the Company is actively building partnerships with companies currently developing mRNA vaccines for both immuno-oncology and infectious disease indications.

According to Precedence Research, the market for mRNA therapies is expected to reach approximately USD 128 billion by 2030, growing at a compound annual growth rate of roughly 13% from 2022 to 2030. DTC shares have started the new year like a rocket and were included in the CSE 25 Index in March due to their achieved market capitalization of CAD 150 million. With the latest news, the current upward mode should intensify. Note: Large pharmaceutical companies have long put Defence Therapeutics on their target list!

Please also read our latest update on www.researchanalyst.com. Dr. Moutih Rafei, Vice President R&D, will answer questions on the current developments at the upcoming International Investment Forum on 10 May 2023. Participation in the online event is free of charge. Click here to register.

BioNTech - Cooperation in China attracts attention

The German company BioNTech is aggressively expanding its pipeline of cancer therapies. Just three weeks ago, the Mainz-based company inked a multi-million dollar deal with the US cancer specialist OncoC4, and now the next mega deal is reported from the Company's headquarters. This time, it is a billion-dollar partnership with the Chinese biotech company DualityBio. BioNTech has secured two potential cancer drugs for the treatment of tumours and is paying an initial sum of USD 170 million for them. This also includes the right to success-based payments of potentially more than USD 1.5 billion and staggered licence fees for future product sales. BioNTech receives the worldwide marketing rights to the two compounds with the exception of China, Hong Kong and Macau.

Both acquired compounds belong to the class of so-called antibody-drug conjugates (ADCs), which are designed to specifically destroy mutated cells while avoiding damage to healthy tissue. The long-term strategy is to replace conventional chemotherapy in a few years. Pharmaceutical companies such as the British Astra Zeneca or the Japanese Daiichi Sankyo are also betting on this new technology. The US pharmaceutical giant Pfizer had only recently announced the takeover of the biotech company Seagen, one of the pioneers in the field of ADC research, for a whole USD 43 billion.

The BioNTech share had reached lows of EUR 111 in the first quarter. Compared to the NASDAQ index, this is an underperformance of an astonishing 40%. Analytically, the 2023 P/E ratio has slipped to 17.4, but the cash position is still a good EUR 20 billion. A technical bottom in the EUR 110-120 range is expected to form.

The biotech sector is returning to the watch lists of investors. In the medium term, a sector rotation should therefore take place and generate new momentum. While BioNTech is still sleeping, Bayer is slowly crawling upwards, and Defence Therapeutics can already show over 40% profit for 2023. The latest news could further fuel the outperformance versus the sector.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.