September 29th, 2025 | 07:20 CEST

Attention: Acquisitions! Biotechs like Evotec, PanGenomic Health, Pfizer, and BioNTech in focus

The biotech industry is in turmoil! With the expiration of blockbuster patents, there is a threat of sharp declines in revenue, which must be strategically compensated for. Driven by economic pressure and a growing focus on innovation and technology, the industry is increasingly turning to acquisitions of biotech companies with promising drug candidates, new technologies, and digital expertise. Not only are entire pipelines being acquired, but key players from the fastest-growing segments are also being targeted, particularly in the field of obesity therapies, where billions are being paid for drug candidates. Several examples illustrate this wave of transformation. Companies are restructuring, focusing their activities, and rapidly preparing for a phase of sustainable growth. The pace is picking up! Here are some promising investment ideas!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , PANGENOMIC HEALTH INC | CA69842E4031 , PFIZER INC. DL-_05 | US7170811035 , BIONTECH SE SPON. ADRS 1 | US09075V1026

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Pfizer and BioNTech - The big players are on the hunt

There is movement in the biotech sector as big pharma seeks new areas of activity with new revenue prospects. With full coffers, they are pushing into the innovative areas of smaller companies and making irresistible offers! The most prominent example is Pfizer's acquisition of weight loss specialist Metsera for up to USD 7.3 billion. This gives Pfizer access to four clinical programs for innovative GLP-1 and amylin therapies and repositions it in the global race for effective weight loss drugs, which Novo Nordisk and Eli Lilly have dominated until now. Demand for obesity drugs is exploding and is estimated to reach a market volume of around USD 150 billion by the early 2030s.

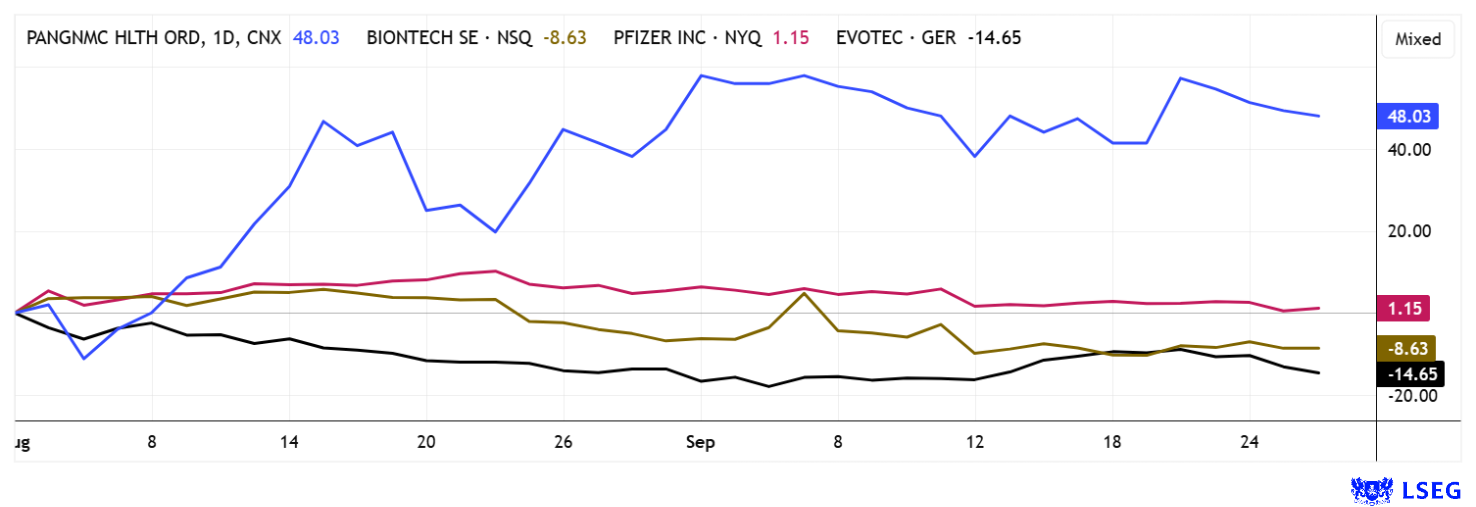

BioNTech is leveraging its enormous cash reserves to strategically position itself for the post-pandemic era and secure growth beyond the COVID-19 business. A key element of this is the acquisition of CureVac for around USD 1.25 billion, which will enable BioNTech to expand its mRNA expertise in oncology. At the same time, the Company is strengthening its pipeline potential through a comprehensive development and commercialization partnership with Bristol Myers Squibb around the bispecific antibody BNT327, for which a payment of USD 1.5 billion is expected in the short term. Further acquisitions, such as the takeover of Biotheus in early 2025, will further expand the portfolio with innovative platform technologies and global rights to promising candidates. With a liquidity base of around EUR 16 billion, the Mainz-based company has ample scope for further targeted acquisitions and partnerships. **Analysts on the LSEG platform are once again giving Pfizer and BioNTech the thumbs up. For Pfizer, there are 11 out of 25 positive votes with a 12-month price target of USD 29.30, while for BioNTech, the bias is even stronger at 17 out of 23, with the stock expected to rise to USD 136.50, representing a potential gain of 40%.

PanGenomic Health – AI pioneer revolutionizes digital natural medicine

Since the COVID-19 pandemic, PanGenomic Health (NARA) has impressively evolved from a niche provider of digital wellness solutions to an innovator in the field of AI-driven preventive medicine. The Company focuses on user-friendly, self-directed programs that combine evidence-based, naturopathic approaches with modern technology. In the summer of 2025, PanGenomic announced a key growth step with its new NaraCare.AI platform, integrating the features of NARA, Mindleap, and MUJN into a holistic ecosystem for body and mind. Users receive personalized, AI-based recommendations for alternative treatments and can purchase personalized health products via the connected online store. This approach is particularly attractive in the North American market, providing cost-effective prevention and diagnostics - a truly unique selling point in the booming field of nature-based, digitally supported self-care.

With Mindleap Health, PanGenomic is currently driving forward its next major strategic project: the introduction of a real-world evidence (RWE) platform for complementary and alternative medicine (CAM). This platform will have an international focus, collecting and analyzing health data from Western and Asian sources and utilizing state-of-the-art large language models and Asian AI research. The Mindleap RWE platform is intended to create a recognized evidence base for alternative therapies in the future, both for consumers of NaraCare.AI and for manufacturers, retailers, or therapists on a subscription basis. The project is supported by its own Health AI Hub in Hong Kong, which provides PanGenomic with targeted access to Asian research capacities, multicultural patient groups, and market-oriented know-how.

PanGenomic Health consistently combines the trends of AI, personalization, and the global fitness trend in a platform strategy. It takes social change into account, focuses on evidence-based naturopathy, and uses innovative technologies. As a first mover, the Company benefits from liberal market access, a strong position in the field of "digital self-care," and the dynamic expansion of forward-looking AI infrastructure. Its own stock (NARA) has already quadrupled in value since May. With a market capitalization of less than CAD 35 million, there remains enormous potential for investors who are betting on rapid value appreciation in a transforming healthcare market. Collect!

Evotec – Something has got to give!

The share price of Hamburg-based drug developer Evotec is on a rollercoaster ride again. In the last three months, it rose to over EUR 8, but has now fallen back below EUR 6, all without any news. Meanwhile, the Company's executives are taking advantage of the freedom to wait until November to release the nine-month figures. CFO Paul Hitchin purchased shares for around EUR 73,875 at a price of EUR 5.91, following in the footsteps of CEO Christian Wojczewski. Nevertheless, the rise in the share price has not yet been enough to break the overall downward trend. The decisive technical hurdle remains in the range of EUR 6.25 to EUR 6.40; a break above this level could provide fresh buy signals and open the way to higher marks such as EUR 6.60 or EUR 7.00. The Chaikin Money Flow, which has been negative for weeks, continues to signal investor caution and highlights the ongoing skepticism in the market. Canadian bank RBC has slightly lowered its price target for Evotec from EUR 11.90 to EUR 11.20, but has left its rating at "Outperform." The all-important market recovery is uncertain, wrote analyst Charles Weston. At the same time, the drug researcher is receiving a lot of confirmation from large pharmaceutical companies and is rapidly implementing its change in strategy. Weston sees immense hidden value potential in the medium term. He considers the recent deal with Sandoz to be fair. Taking the average price target on the LSEG platform as a benchmark, EUR 9.26 would be achievable for the next 12 months. This represents a premium of over 50% on prices around EUR 5.90. But caution is advised: Evotec is a risky bet due to its high volatility!

The biotech sector is experiencing a decisive turning point in 2025, driven by innovation, strategic partnerships, and a new wave of targeted M&A activity. BioNTech exemplifies how combining internal research strength with external expansion can secure a leading role in personalized medicine. Pangenomic Health, with its data-driven platform and still-low valuation, highlights the enormous potential of emerging specialists poised to become sought-after takeover targets. Evotec is strengthening its position as an indispensable partner through a broad technology and collaboration network, while Pfizer continues to signal its leadership aspirations in future fields such as mRNA and cell therapy.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.