September 3rd, 2024 | 07:30 CEST

Artificial intelligence as a winning model! 200% return with Super Micro Computer and BlockchainK2, Caution with Intel and Aixtron!

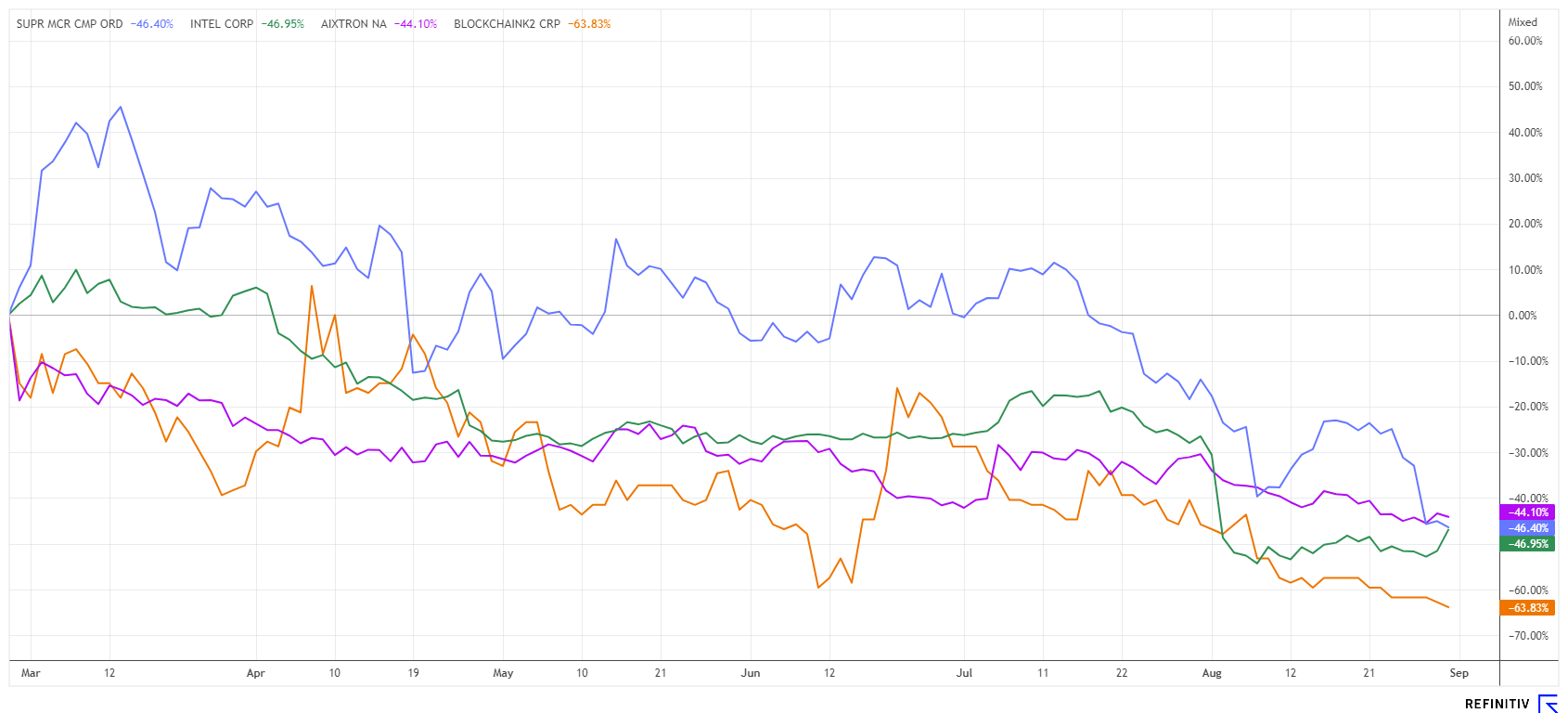

The high-tech wave has been quite pronounced so far in 2024. Even the correction in July had little impact on the strong trend, which is now continuing upward. However, investors now clearly differentiate between the business models. Pure hardware manufacturers like Intel and Aixtron are coming under increasing scrutiny. On the other hand, Nvidia, the industry leader, is now earning just as much money with data centers as with its ultra-fast graphics chips. In the small-cap segment, highly interesting companies are already successfully using artificial intelligence to streamline business processes and thus achieve enormous cost savings. We analyze a little deeper and look to identify the yield drivers.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

SUPER MICRO COMPUT.DL-_01 | US86800U1043 , BLOCKCHAINK2 CORP | CA09369M1077 , INTEL CORP. DL-_001 | US4581401001 , AIXTRON SE NA O.N. | DE000A0WMPJ6

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Super Micro Computer - A good story, but will it continue?

Experts expect the use of artificial intelligence (AI) in digitally designed processes to lead to double-digit productivity gains over the next few years. Not since the introduction of industrial robots have there been such leaps. The major Internet companies have long since prepared themselves for these developments. High computing power, automated sales processes and a pool of trillions of user data points play into the multinationals' hands. The expansion of generative AI, which saw exponential growth in 2023, is set to continue this year, potentially unlocking trillions of dollars in value as companies move from pilot projects to broader implementation.

Super Micro Computer designs and manufactures high-performance server and storage solutions based on a modular and open architecture, as well as matching cooling equipment. The stock has been on a three-month slide, and now there are delays in filing important regulatory data with the SEC. The news follows a report by Hindenburg Research, an investment firm specializing in activist short selling. They claim to have received evidence of accounting deficiencies and export control failures.

This is an explosive matter that can hopefully be dealt with quickly through proactive public action by SMCI management. If this does not happen soon, the share price will remain under pressure. We already advised selling when the price fell below the USD 850 line and are currently standing on the sidelines. Only when the USD 700 mark is overcome will there be technical buy signals again, but this will first require a rebound of a good 60% to the upside. Wells Fargo recently lowered its price target for the share from USD 650 to USD 375. Nevertheless, keep the "Fallen Angel" on your close watchlist.

BlockchainK2 Inc - Intelligent software for asset managers

Experts estimate that the market for generative AI will grow at around 60% per annum and reach USD 37 billion by 2028. This development will be driven by the widespread introduction of AI technologies in areas such as healthcare, finance, and the service sectors. AI enablers such as Nvidia, Microsoft and Google are already valued in the trillions. Now, however, the focus is on small service providers expanding their product range with AI features and thus helping their customers make savings.

The Canadian company BlockchainK2 Inc. is the listed holding company of RealBlocks, which was founded in 2017 in New York City. RealBlocks' main focus is on its white-label online platform, which develops the most advanced functions for alternative investment managers and their investors. RealBlocks is a pioneer in utilizing Web3 blockchain technology as well as traditional, cutting-edge technologies to provide a fully digital white-label solution for global fund managers looking to manage and grow their investor base. The aim is to deliver the complete onboarding and administration process cost-effectively and efficiently from a single source, which is why artificial intelligence is already being used here.

The RealBlocks team has decades of experience working with some of the world's largest asset management and distribution companies. RealBlocks clients have over USD 77 billion in assets under management and are generating their first recurring revenues through long-term contracts. The Company's SaaS platform is designed for global use and uniquely combines all front, middle, and back office functions in an easy-to-use online interface.

Considerable funds have been invested in the development process of the software in recent years, which were realized with share placements at CAD 0.40. Over 30% of the capital is still in the hands of management and founders. The market capitalization is currently a very low USD 5 million. In our view, the up-and-coming company will likely be taken over quite quickly by a large financial institution, as this could save them years of costly development. The shares of the holding company BlockchainK2 are also liquidly tradable in Germany at prices of around EUR 0.12. A prime example of favorably valued followers in the area of financial software and applied AI. A rapid doubling would not surprise us in the current environment.

Intel and Aixtron - Is a turnaround opportunity on the cards after lows of EUR 17?

A real drama is unfolding with the well-known tech stocks Intel and Aixtron. Unlike industry leader Nvidia, Intel, the former number one in the chip business, is currently going through a severe crisis. The announced cost-cutting measures also threaten the politically highly celebrated chip factory near Magdeburg, which was due to start up in 2027. Following the publication of disastrous quarterly figures, Intel now wants to cut 15,000 jobs worldwide and thus save around USD 10 billion. Expenditure will be cut by over 20%, and the dividend will also be slashed. Overall, the Intel share price has now fallen by around 60% since the beginning of the year, while the industry index has risen by 20%. A demerger of the Group is also being considered. Only 4 out of 45 analysts on the Refinitiv Eikon platform are still in favor of a "Buy" with an average target price of USD 25.40. Keep watch!

Aixtron has also taken a beating. The share price has lost over 50% in the last 12 months. There has been repeated speculation on the market that the US group Wolfspeed, an important customer of the Herzogenrath-based company, could order fewer machines from the specialist for semiconductor production systems. When presenting its latest figures, the US chip manufacturer announced that it would be investing less in the coming financial year. The planned construction of the world's largest chip factory, which the Americans wanted to build in Saarland, could also be on the brink of collapse. The experts are surprisingly optimistic about the Aixtron share. As many as 11 out of 18 analysts are calling for an entry and expect share prices of around USD 28.50. We remain on the sidelines!

High-tech stocks are once again in high demand on the NASDAQ. Nevertheless, some stocks are still undergoing a pronounced correction. Super Micro Computer, for example, has now lost over 60% from its peak. After the buying frenzy at the beginning of the year, reality is likely returning here. Intel and Aixtron also still need some time to turn their business models around. On the other hand, SaaS specialist BlockchainK2 appears to be very promisingly positioned in the large concert of global asset managers.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.