December 20th, 2022 | 11:43 CET

Analysts optimistic for oil stocks - TotalEnergies, Saturn Oil + Gas, BP

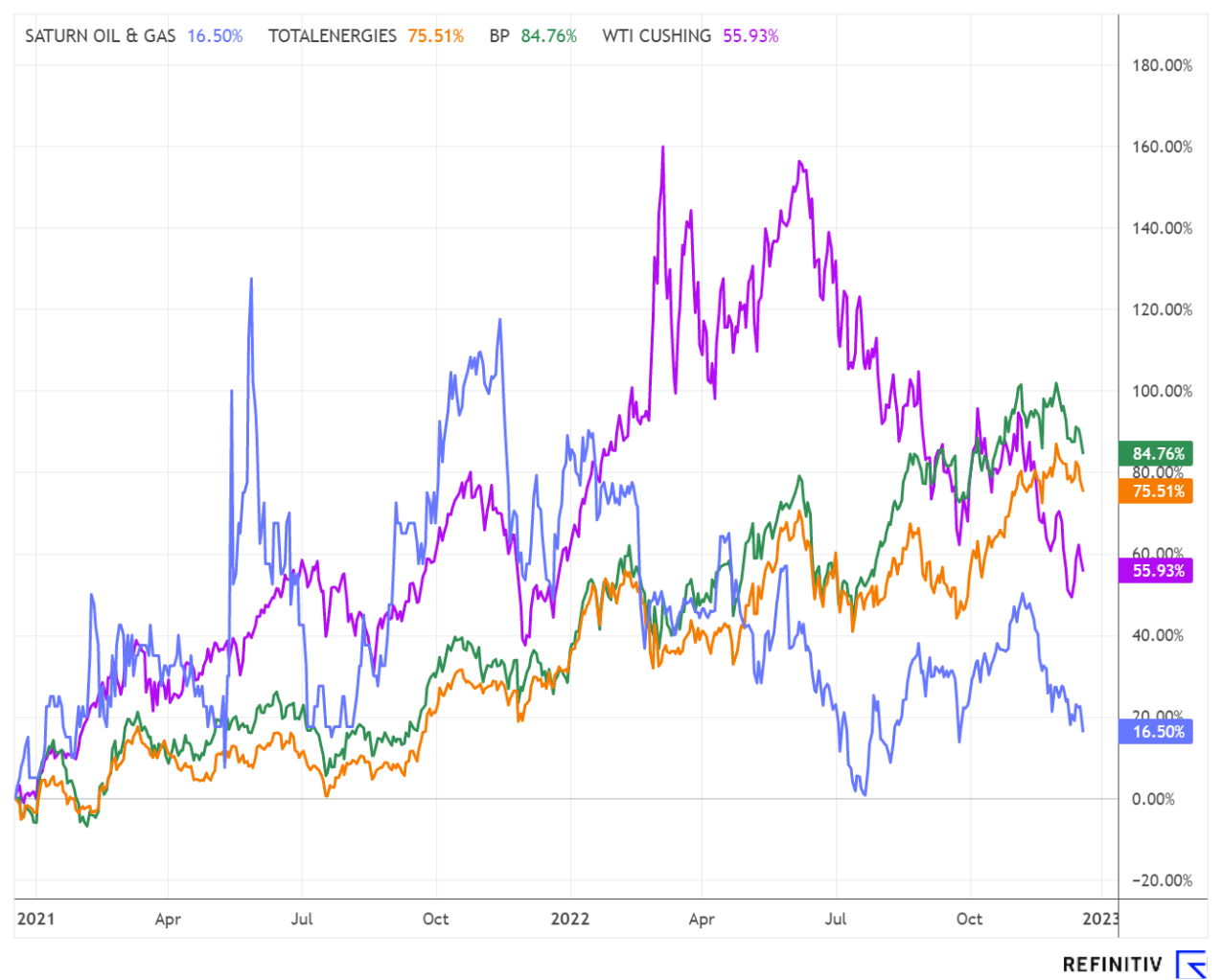

High volatility characterized the oil markets in 2022, a stock market year that will soon come to an end. While oil prices for West Texas Intermediate, WTI, reached over USD 130 per barrel after the outbreak of the Ukraine conflict, the black gold subsequently corrected by more than 40% due to heightened fears of recession. In the long term, analysts agree that oil prices will likely rise significantly due to increased demand and tight supply.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

TOTALENERGIES SE | FR0000120271 , Saturn Oil + Gas Inc. | CA80412L8832 , BP PLC DL-_25 | GB0007980591

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Oil price hike expected

Extremely positive voices for the oil price are coming from the US. The US investment bank JPMorgan expects the WTI price to rise to USD 90 per barrel in 2023. The analysts see the current correction as an exaggeration due to the Zero-COVID strategy in China. According to the financial site "ForexLive", the experts at JPMorgan also see a "normalization of Russian production to the level before the start of the war of aggression." Accordingly, the oil price for 2023 has a potential of USD 90 per barrel, and for 2024 a price of USD 98 is estimated.

Colleagues from Goldman Sachs are much more bullish. In an interview with the news channel CNBC, Jeff Currie, Global Head of Commodities, continues to assume high fluctuations but expects prices to be around USD 110 per barrel by the end of the coming year. The price decline that has taken place in recent weeks is due to the strict Corona strategy and the weak USD. In addition, Russia has ensured a higher supply before the expiry of the deadline for the export ban. However, all these negative effects should return to normal in 2023.

Saturn Oil & Gas - Share with catch-up potential

Analyst consensus is not only unanimous on the base price; the experts also see enormous catch-up potential in smaller and medium-sized oil producers. Thus, First Berlin Equity Research initiated initial coverage of Saturn Oil & Gas and placed the Calgary-based company on "buy" with a price target of CAD 7.00. That results in a price potential of around 230% in relation to the current share price.

Analyst Simon Scholes noted that Saturn's production has increased more than 50-fold in less than two years to 12,000 barrels of oil equivalent (BOE/d) per day thanks to two transformative acquisitions in the Oxbow and Viking areas of Saskatchewan. He said that production, currently split about 60:40 between Oxbow and Viking and more than 95% oil, is extremely lucrative in both areas. Going forward, Saturn plans to drill 35-40 new wells annually in the Viking area and 40 new wells in Oxbow. Analysts expect Saturn to reach a production rate of more than 15,400 BOE/d by 2025 (approx.+ 50% compared to 2022) and to turn its current net debt of about CAD 220 million into a net cash position of more than CAD 200 million.

Other analyst houses also see a significant undervaluation compared to the peer group. Analyst firm Velocity Trade Capital sees the Canadians as an "outperformer" with a price target of CAD 7.19, while Eight Capital gives the emerging oil producer a "buy" rating and a price target of CAD 7.50.

TotalEnergies - Further with relative strength

In contrast to the base price of oil, the shares of the French energy company are extremely strong. After the high at the beginning of December, the price lost just 5% and is currently fighting to defend the annual high of 2019 at EUR 56.82. If the level is undershot, there is a threat of a relapse to the upward trend formed since August 2021 at around EUR 49. The freshly formed sell signals in the MACD and RSI make a test of the trend likely.

For the future, the French are planning a petrochemical plant with an investment volume of the equivalent of EUR 10.4 million together with partner Aramco. The plant, to be operated by a joint venture, is expected to start production in 2027, according to the Company, and will enable the conversion of gas and condensate into higher value-added chemicals. In the long term, other facilities will be built around the complex to produce carbon fibers, lubricants, specialty fluids, auto parts and tires.

Canadian bank RBC recently raised its price target for TotalEnergies from EUR 65 to EUR 70 and left its rating at "Sector Perform".

BP - Price target lowered

Canadian bank RBC also gave the British petroleum company BP an "outperform" rating, but the price target was lowered from GBP 600 to GBP 550. Although the oil and gas industry has been buoyed by positive earnings revisions over the past two years, it still holds upside potential, analyst Biraj Borkhataria wrote. It is becoming increasingly apparent that the energy transition will not be linear or orderly, and the sector is well positioned to benefit when the cost of capital normalizes, he added.

At the current price, this still means a price potential of almost 18%. From a chart perspective, the share faces a difficult task with resistance at GBP 476. If the sound barrier is not sustainably broken, the value will likely correct once again in the direction of its upward trend formed since February 2021 at GBP 426.15. A successful break of the prominent resistance zone would mean prices beyond the GBP 500 mark to the upside.

Despite the current ongoing correction, analysts are optimistic about a further increase in the oil price due to the expected rise in demand. According to analysts, the Saturn Oil & Gas share has a price potential of over 200%.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.