May 30th, 2024 | 07:00 CEST

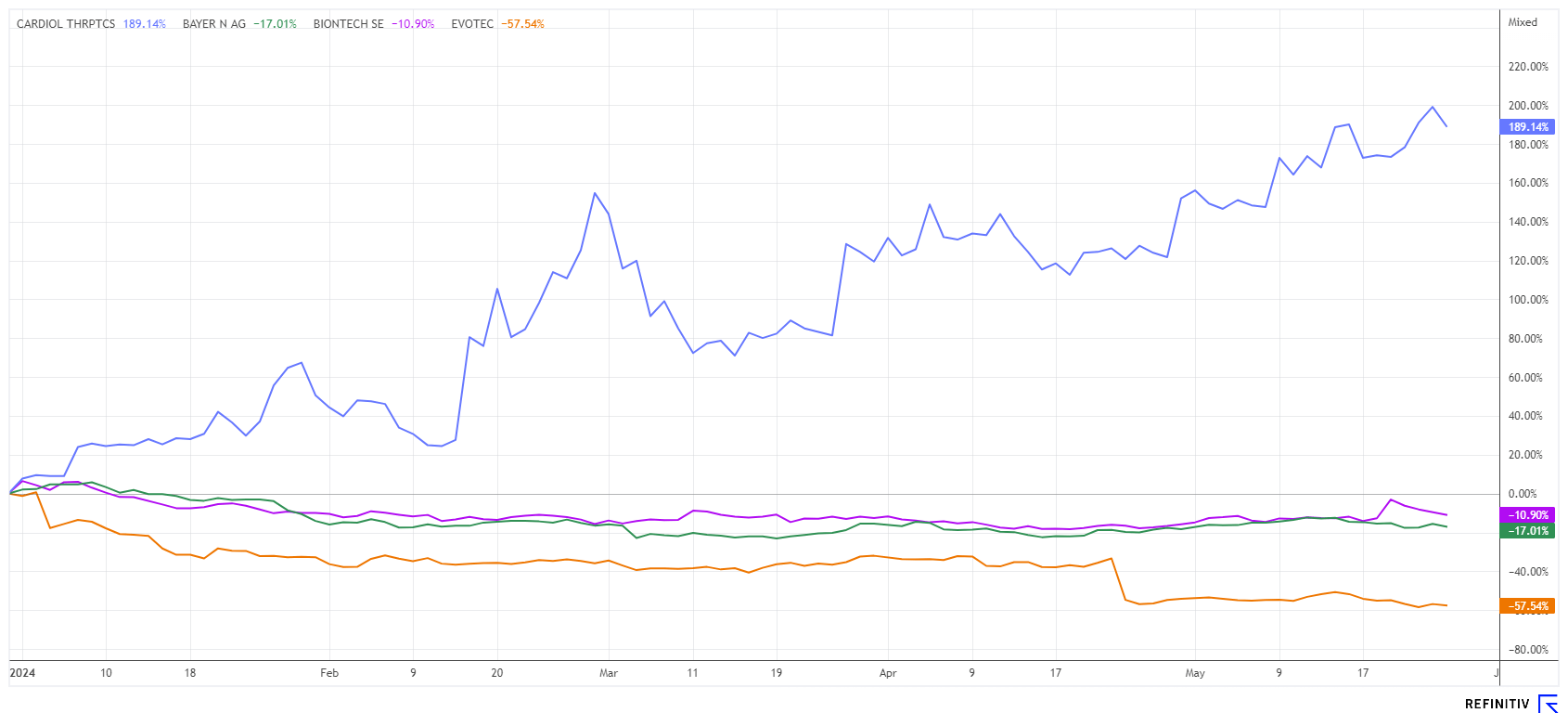

Already up 180% in 2024 - Who offers more? BioNTech, Bayer, Cardiol Therapeutics, or Evotec?

For investors in the biotech sector, 2024 has been a very rocky year. Everyone is waiting for the big breakthrough, which has yet to appear. In a sector where there is no longer a pandemic and cancer research is still stuck, selection has become very important. Complicating matters is the investor-unfriendly capital market interest rate, with hopes resting on support from central banks quarter by quarter. This makes it all the more important to identify and follow the most innovative business models. BioNTech does not currently have a blockbuster but still has a good EUR 17 billion in its coffers. Pharmaceutical giant Bayer has seen its share price drop to a fifth of its 2019 value, and Evotec also resembles a disaster. Cardiol Therapeutics has performed well so far - what is next for them?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BAYER AG NA O.N. | DE000BAY0017 , CARDIOL THERAPEUTICS | CA14161Y2006 , BIONTECH SE SPON. ADRS 1 | US09075V1026 , EVOTEC SE INH O.N. | DE0005664809

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec - Back on track operationally, but still with problems

Despite good operating news from the cooperation side, Evotec's shares are once again under pressure because, in addition to the uncertainties surrounding the change in the Management Board, problems with the Nasdaq listing following the hacker attack last year also weigh on the Company. The Company is behind schedule with mandatory disclosures, but the new Management Board wants to rectify the problems by mid-July. The stock exchange board in the US has not yet commented on the investigations into the machinations of ex-CEO Werner Lanthaler. On a positive note, Evotec was able to extend its 20-year collaboration with the CHDI Foundation, a non-profit biomedical research organization supported exclusively by private investors. Its focus is on the joint development of therapies to significantly improve the lives of people affected by Huntington's disease.

Despite some negative aspects, there are also glimmers of hope for Evotec's shareholders. Although the business model is not without risk, it can become a profit generator again in the future. Evotec is already benefiting from the increasing outsourcing of research activities by large pharmaceutical and biotech companies. This is particularly evident in the substantial increase in revenue. Since 2017, revenues have increased from EUR 250 million to over EUR 780 million thanks to numerous collaborations, including with Bayer. Analysts estimate a figure of EUR 876 million for 2024. With a market capitalization of EUR 1.6 billion and prices below EUR 9.00, the Company is currently very affordable. The company has called for its annual general meeting on June 10th, where there will be more news.

Cardiol Therapeutics - The biotech shooting star of 2024

Cardiol Therapeutics Inc. has been able to convince market participants of its capabilities over the last 12 months. Due in part to its listing on the Nasdaq, the stock price has tripled from CAD 0.90 to 3.30. The promising drug candidate CardiolRx™ has been successfully launched. With the pharmaceutically produced oral solution formulation, Cardiol is well on the way to helping people with myocarditis and pericarditis. For years, therapeutic options have been sought to alleviate the suffering of those affected.

In February, the Canadian company was granted orphan drug designation by the US Food and Drug Administration (FDA). The Company has now announced that its randomized, double-blind, placebo-controlled Phase II study to assess the effects of CardiolRx™ on myocardial regeneration in patients with acute myocarditis ("ARCHER") was the subject of a presentation at the World Congress on Acute Heart Failure in Lisbon. At the same time as the presentation, the journal ESC Heart Failure, which is dedicated to advancing knowledge of heart failure worldwide, accepted for publication the manuscript describing the rationale and design of the ARCHER study.

"We anticipate that the results of the ARCHER study will contribute to a better understanding of the therapeutic potential of CardiolRx™ and complement our already advanced Phase II MAvERIC-Pilot study in patients with recurrent pericarditis. Here, we expect topline results in early June 2024," commented CEO and President David Elsley.

CRDL shares are currently responding to every new release with further price increases. The market is convinced that Cardiol has developed an effective treatment for myocarditis. At a current price of around CAD 3.20, the Company is now worth just under EUR 150 million. When the corresponding topline results are available in June, there should be no stopping the share price.

Bayer and BioNTech - Back to square one

Analysts worldwide are currently struggling with the ratings of Bayer and BioNTech. Both shares have been under massive pressure for several years and reach new lows almost every month. Bayer shares have now quintupled in real terms since 2019. The lawsuits against the acquired Monsanto are never-ending, especially in the US. As a keen observer, one gets the impression that the entire wave of lawsuits began only after Bayer paid over USD 70 billion for Monsanto. Bayer CEO Bill Anderson sees the wave of lawsuits surrounding the widely used weedkiller Roundup as an "existential threat" to the Company. Bayer has set aside provisions of USD 16 billion to settle the Roundup lawsuits. Around USD 10 billion of this has already been spent. Only 5 of 24 analysts on the Refinitiv Eikon platform are still backing the Company, with an average target price of EUR 31.20, around 10% above the current price.

The BioNTech share saw some technical buybacks last week, which pushed the price back above EUR 94. The extraordinary commitment of the Mainz-based company to the further development of mRNA vaccines in Rwanda, Africa, was positively received. Together with the organization Coalition for Epidemic Preparedness Innovations (CEPI), local research and development, as well as the clinical and commercial production of new vaccines in Africa, are to be driven forward. CEPI is providing up to USD 145 million to expand the production facility in Kigali to achieve global standards for the manufacture of pharmaceutical products. BioNTech and CEPI want to work together to contribute to equitable access to selected vaccines so that they are also available at affordable prices in low- and middle-income countries. Unfortunately, the brief upswing in the share price quickly evaporated again, and BioNTech moved back to its established support zone of EUR 84 to 86. Only 8 out of 19 experts on the Refinitiv Eikon platform still give a "Buy" recommendation with an average price expectation of EUR 109. For us, BioNTech is currently only a watchlist stock with a breakout trigger of EUR 94 to 98!

The stock market is swinging from one high to the next. However, after an extended rally in May, the influx of capital has slowed, making stock selection paramount for investors. With the expectation of an interest rate cut in the summer, biotech stocks should also come back to life. Cardiol Therapeutics continues to rise unabated, while Bayer, BioNTech, and Evotec will likely need more momentum for a rebound.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.