August 25th, 2025 | 07:25 CEST

A bombshell for takeover candidates! 100% share BioNxt Solutions leaves BioNTech and Co. behind!

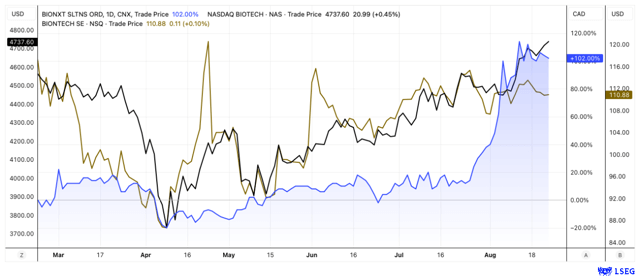

BioNxt shares have finally taken off. At the beginning of July, we last pointed out the opportunities offered by the Canadian-German life sciences company. Since then, the share price has risen by almost 100%, outperforming both the biotech index and investor favorites like BioNTech. However, this is likely to be just the beginning. In a conversation with the editorial team, management hinted at a strong news flow in the coming months. The Company is working flat out on its next-generation platforms to revolutionize drug delivery. For example, syringes and tablets are to be replaced by dissolvable films and transdermal patches. This not only makes BioNxt a prime acquisition candidate, but with a market capitalization of just CAD 100 million, the Company still appears to be anything but expensive.

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

Bionxt Solutions Inc. | CA0909741062 , BIONTECH SE SPON. ADRS 1 | US09075V1026

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Focus on platform for patient-centered drug delivery

Before diving into recent news and the forward outlook, here is a brief overview of BioNxt Solutions. The Canadian-German life sciences company specializes in innovative drug delivery systems. The BioNxt platform encompasses a wide range of delivery methods, including oral dissolvable films, transdermal patches, and advanced tablet formulations. A new approach to chemotherapy is also very promising, in which cancer drugs are delivered directly to the tumor, reducing side effects and improving efficacy. Overall, BioNxt aims not only to enhance bioavailability, but also to increase treatment adherence by making it easier to take medication – an important factor in chronic diseases. With its combination of pharmaceutical innovation, international patent strategy, and clinical development, BioNxt is positioning itself in a market segment that offers significant growth potential in the coming years. In addition, the Company is increasingly being viewed as a potential takeover candidate - a perspective reinforced by a promising flow of news and developments.

July 23: Prototype with cladribine successfully formulated

In July, BioNxt announced the successful development of a prototype of its lead product, BNT23001, a melt film formulation containing the active ingredient cladribine for the treatment of multiple sclerosis (MS). Initial tests showed stable drug loading, consistent quality, and rapid film disintegration—key factors for subsequent approval. For example, MS patients often suffer from difficulty swallowing and therefore have problems with conventional tablets such as Merck's Mavenclad. A dissolvable film formulation could therefore be of great interest. In parallel, BioNxt is working on a comprehensive IP strategy to secure patent protection in Europe, the US and Canada.

August 5: Progress in patent granting in Europe and Eurasia

Just a few weeks later, the next piece of good news followed: Both the European Patent Office and the Eurasian Patent Organization confirmed the core claims of BioNxt's oral dissolvable film technology. This clears the way for early approval in several regions, opening up exclusivity and licensing opportunities for the Company. In addition to the cladribine formulation, the patent also covers the use of chemotherapeutic agents in neurological autoimmune diseases. BioNxt has also entered the national phase of the international PCT application process in key markets such as the US, Japan and Australia.

August 20: Platform patent and accelerated US procedure

Last week, there was a real bombshell in the US: First, BioNxt filed its US patent application for BNT23001 under the accelerated "Track One" procedure. This means that a patent could be granted within a year. This would have a very positive impact on clinical development and subsequent commercialization.

Second, a comprehensive "umbrella patent" at the platform level was confirmed, which secures the oral dissolvable film technology beyond cladribine for a variety of indications and active ingredients. This patent is valid until well into the 2040s, providing BioNxt with extensive protection in a billion-dollar market.

Outlook: Important data and partnerships expected

BioNxt is facing a pivotal few months. In an update meeting with the editorial team, BioNxt management gave a positive outlook. Exciting news is expected in the coming months. This concerns both research results and patents for the platform, in a wide range of countries and for new indications. Among other things, the Company plans to present data from a preclinical pharmacokinetic study before the end of this year. This could be decisive for regulatory submissions and potential partnerships.

Shares still inexpensive and strong chart

Given the positive backdrop, it's no surprise that the stock has gained momentum. In recent weeks, BioNxt has outperformed both the Nasdaq Biotech Index and investor favorites like BioNTech. With a market capitalization of around CAD 100 million, BioNxt remains anything but expensive. This is particularly true when considering the potential value the platform could unlock for Big Pharma.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.