July 17th, 2025 | 07:00 CEST

300% share Almonty Industries: What is next? Strategic partnerships like MP Materials?

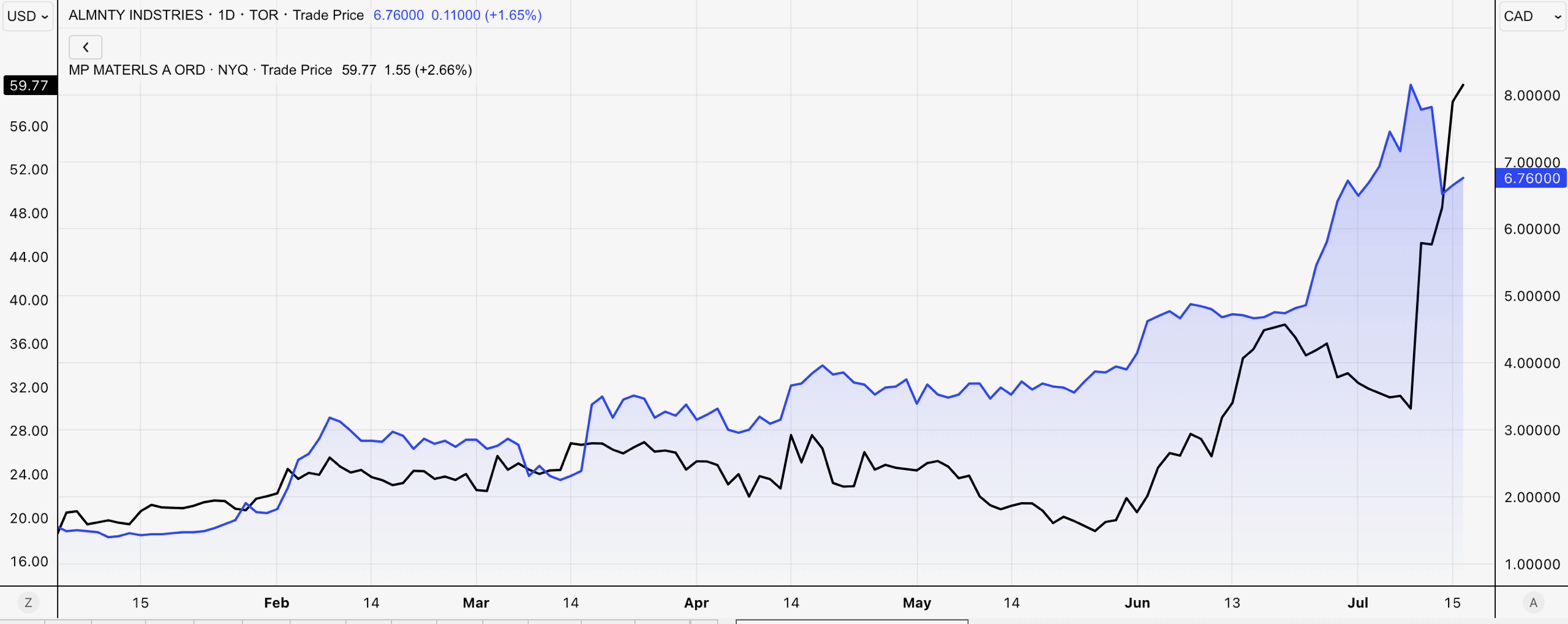

Following its NASDAQ listing on Monday, things have quieted down somewhat for high-flyer Almonty Industries - a healthy pause after a year-to-date rally of over 300%. This may even present a buying opportunity or a chance to increase positions. The tungsten gem is likely to generate significant positive news flow in the coming months, including the production start at its tungsten mine in South Korea, new analyst coverage, and possibly even a strategic partnership, similar to what MP Materials achieved. The latter recently made headlines with a US government investment and a partnership with Apple. Although tungsten is not classified as a rare earth element, it can be considered just as critical for defense and high-tech applications.

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

ALMONTY INDUSTRIES INC. | CA0203987072

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Almonty significantly more affordable compared to MP Materials

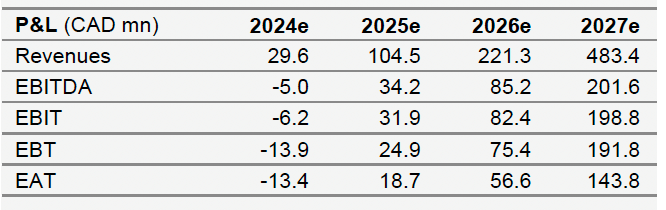

Alongside Almonty, MP Materials is also one of this year's high flyers in the commodities sector. Despite a billion-dollar valuation, the stock doubled again last week and is now worth over USD 9 billion on the stock market. For context, Almonty is worth around USD 1 billion. Analyst estimates for both companies are not that far apart. According to LSG/Refinitiv, analysts expect MP Materials to generate revenue of around USD 650 million and an EBITDA of USD 228 million in 2027. For Almonty, the experts at Sphene Capital expect revenue of CAD 483 million and EBITDA of CAD 199 million for 2027. These figures hardly justify a valuation that is nine times higher.

The latest surge in MP Materials' share price followed initial reports that the US government had acquired a 15% stake in the Company, which specializes in the extraction of rare earths. It was then announced that Apple is investing USD 500 million in a multi-year agreement with MP Materials to source neodymium magnets made from recycled materials in the future. These magnets are designed for use in Apple's hardware, specifically in iPhones.

Both a US government stake and involvement from defense companies are conceivable – if not likely – for Almonty. The US has not mined tungsten since 2015, leaving the entire Western world dependent on supplies from China. Tungsten is therefore classified as a critical metal in both the US and Europe. Due to its extreme hardness and high melting point, it is indispensable for key industries such as defense, aerospace, and high technology.

What is next for Almonty?

While strategic partnerships remain speculative, the opening of the tungsten mine in South Korea is imminent. Initially, around 640,000 tons of ore are to be processed in what will be the largest tungsten mine outside China. In a second expansion phase, production is to be ramped up to 1.2 million tons. The medium-term goal is to process around 4,750 tons of tungsten oxide per year. This is expected to be around 40% of the amount required by the West. Production costs are expected to be relatively low, at around USD 110 per metric ton of tungsten. Costs are higher at the Almonty mine in Portugal, but the mine is still profitable.

With its move to the NASDAQ, Almonty has also raised USD 90 million in fresh capital. Among other things, this will be used to extend the value chain. The Company plans to build a tungsten oxide processing plant in Sangdong. This should further increase the Company's margin.

And then, of course, there is the molybdenum deposit at the Sangdong site. Almonty has already secured a major customer from the aerospace industry. Expansion is also likely in Europe. The Company has previously highlighted expansion opportunities for its mine in Portugal. Mines in Spain could also be reactivated. After all, the EU appears to have acknowledged its reliance on raw materials and has announced the easing of regulations for approvals and financing. The goal is to cover at least 10% of the EU's domestic consumption of various ores and minerals by 2030 in order to reduce dependence on third countries such as China.

Conclusion: The stock remains attractively valued

Overall, the NASDAQ listing appears to have been just another milestone in Almonty's ongoing story. A period of consolidation in the share price is healthy. However, the share does not appear to be significantly overvalued. Attention is now turning back to the Company's operational development, and perhaps there will soon be a big announcement in the form of a strategic partner coming on board. Such a move would hardly be a surprise.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.