July 2nd, 2025 | 07:25 CEST

1600% with Bitmine and Circle Internet – The next opportunities are lurking at Plug Power and naoo!

The stock market has surprises in store every day, with crypto- and AI-related business models currently causing a stir. Stocks such as Galaxy and Mara Holding are still among the harmless ones, with gains of 200 to 400%. Things really got going with Bitmine Immersion and Circle Internet. While Bitmine posted a 1,000% rally on Monday, Circle Internet took a whole month to increase its value sixfold. However, it is not necessarily the business model that determines whether stocks take off or not. Often, all it takes is a wave of discussion on the internet or social media channels and the wave breaks. Plug Power and naoo could be the next candidates for a rise. We analyze why.

time to read: 6 minutes

|

Author:

André Will-Laudien

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , NAOO AG | CH1323306329 , BITMINE IMMERSION TECHNOLOGIES INC | US09175A2069 , CIRCLE INTERNET GROUP INC | US1725731079

Table of contents:

"[...] Most of all we were on a mission to MAKE CRYPTOCURRENCY ACCESSIBLE [...]" Justin Hartzman, CEO, CoinSmart Financial Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

1000% plus 600% with Bitmine and Circle Internet

Earning solid returns could be so simple. There was a spectacular 1000% jump in the share price of Bitmine Immersion Technologies (BMNR) at the beginning of the week. The Company sells space in its own data centers and operates mining farms for third parties. The key feature is state-of-the-art immersion cooling technology, in which the mining hardware is immersed in liquid, increasing efficiency and extending the service life of the equipment. This technology is also expected to reduce energy consumption by up to 95%, significantly reducing both costs and environmental impact. The business model is based on revenue from hosting, electricity, and cooling services for mining customers. Bitmine leverages economies of scale in infrastructure and services to position itself as a sustainable provider in the crypto mining market. Growth drivers include planned expansion in North America and the Caribbean, where low-cost electricity providers are being sought. The increasing demand for specialized mining services, combined with energy efficiency, forms the backbone of the investment thesis. With only 6.16 million shares, the valuation jumped from around USD 5 to over USD 50 in this week alone - a 1,000% increase. Interestingly, more than 10 times as many shares change hands every day as are actually issued. Yesterday, the stock was initially suspended at the opening, then rose another 30% to USD 65. A perfect playground for traders!

Circle Internet (CRCL) is also enjoying a strong rally. Circle is the issuer of the stablecoin USDC, which is backed 1:1 by USD reserves and generates investments in short-term US government bonds. The core business earns almost all of its revenue from interest income from these reserves, which accounted for around 99% of revenue in 2024. Circle also sells software services via its platform, which includes stablecoin payments, APIs, and B2B infrastructure such as cross-border transfers and compliance tools. Its main customers are fintechs, banks, and digital companies that integrate USDC into their products and services. Circle undergoes monthly reserve coverage audits and is now seeking a trust bank license to strengthen institutional confidence. Strategically, the Company is expanding through partnerships with Binance, Fiserv, and others to drive its growth target of becoming a global payment and programming platform. Circle is expected to generate USD 1.9 billion in revenue in 2025 and is profitable, but its price-to-sales ratio of over 20 is clearly too high. After halving from its high, the stock could become interesting due to its strong growth. The annual high was almost USD 290 in June, of which 35% has now melted away in just one week. The IPO price on June 5 was still USD 31. The wonderful world of money multiplication!

naoo AG – Kingfluencers surges ahead

naoo AG has been listed in Germany since December 2024. The up-and-coming technology company from Switzerland is entering the global stage with a newly developed social media platform, challenging established industry giants such as Meta, Microsoft, Tencent, and ByteDance. The development team is specifically targeting the weaknesses of traditional networks to create a more user-friendly and transparent offering. At the heart of this is a new platform concept that specifically promotes active user participation and rewards it visibly. The basis for this is high-quality content and customizable, in-depth user profiles. The specially developed points system rewards interactions and contributions not based on reach, but on quality and engagement. The points collected can be converted into vouchers for products or services, depending on availability, and in some cases even into cash.

With the acquisition of Kingfluencers AG in Zurich, the Company has reached the next stage of its development. Important milestones have now been announced for the first half of the year. The subsidiary Kingfluencers AG is once again generating positive operating cash flow. The legacy liabilities of CHF 1.2 million arising from the acquisition are fully covered by naoo, with a large portion already paid in the form of a contribution of CHF 0.75 million, and the remainder to follow by the end of the year. This means that the financial restructuring is almost complete. The turnaround achieved is the result of a targeted performance program that has been in place since the end of 2024. Focused restructuring, a 15% reduction in team size while strengthening growth areas, and cost reductions in offices and administration will result in annual savings of around CHF 0.6 million. At the same time, new business has also developed strongly, with sales to major customers in the FMCG, retail, and food industries picking up and order intake increasing by 5.3% to CHF 5.93 million.

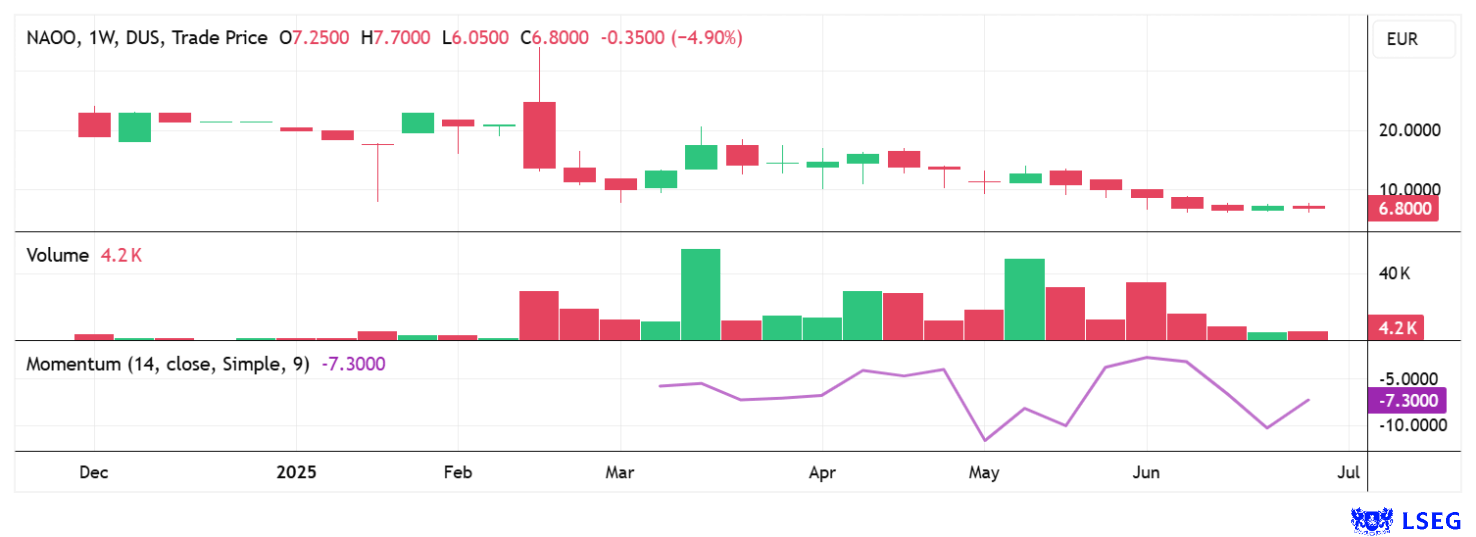

In the future, the focus will be on companies with the strongest advertising presence in Switzerland. The market potential is enormous, as studies show that the influencer market in the D-A-CH region is growing by up to 15% annually. Kingfluencers is now firmly integrated into the naoo ecosystem and delivers data-driven campaign performance via global networks. The naoo share is currently trading at EUR 6.80, valuing the Company at EUR 29.1 million. The consolidation of recent weeks could now come to an end with this announcement, as the potential for significant growth in the coming years is more than evident! Exciting!

Plug Power gains new momentum

That was quite a jump. At the end of June, Plug Power flexed its muscles once again, jumping from around 90 cents to USD 1.57. The New York-based electrolyzer specialist is likely at a decisive turning point for several reasons. While geopolitical tensions and energy insecurity are increasing worldwide, the US government, now under the Trump administration, is also pushing ahead with the expansion of green hydrogen technologies. Plug is benefiting directly from this: the Company has already received a billion-dollar DOE loan commitment in 2024 and has access to a flexible financing framework of USD 1 billion. This secures the financing for the Company's ambitious growth plans. The focus is particularly on the explosive growth in the electrolyzer business, which grew by over 580% in 2024 alone. It is hard to believe, but CEO Andy Marsh now seems to be delivering.

New production facilities such as the one in Ohio are expected to reduce production costs by up to 30%, a decisive advantage in global competition. At the same time, major customers such as Amazon, Walmart, Toyota, and Renault are increasingly turning to Plug technologies. The strategic shift from a pure supplier to a complete "Hydrogen-as-a-Service" solution is progressing. The "Project Quantum Leap" program could bring some surprises. Plug aims to save up to USD 200 million annually while increasing operational efficiency. Added to this is a remarkably high short ratio of around 25% for PLUG shares – if there is ever a time to cover, it is now! With the price approaching the USD 1.50 mark, things are getting exciting! Speculative investors are snapping up shares at the current price of USD 1.37 and hedging at USD 1.15. Plug Power is a hot potato!

The constant ups and downs on the NASDAQ are setting the pace for other stock exchanges. Significantly lower interest rates would be important for the ailing US economy. However, with currency depreciation of over 20% in five years and the ongoing devaluation of the US dollar against all major currencies, the FED is finding it challenging to take expansionary steps. Individual stories such as Bitmine, Circle Internet, or Plug Power are suitable for speculators, while naoo AG's medium-term prospects should lead to strong figures.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.