September 9th, 2024 | 07:00 CEST

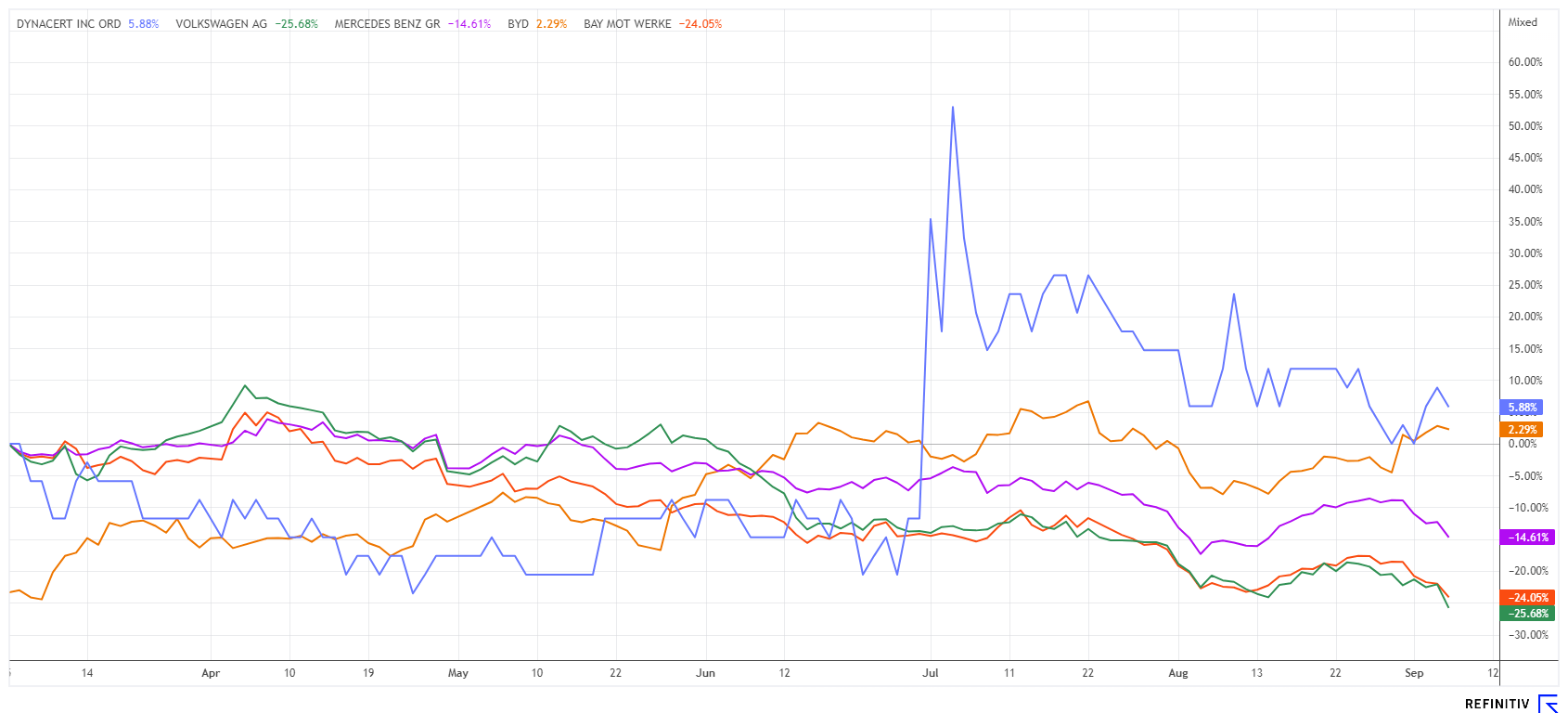

100% gains with auto stocks! BYD and dynaCERT are already on the launch pad. Are VW, BMW and Mercedes low enough yet?

Growing market shares through progress and innovation. While Chinese e-mobility is vehemently pushing into Europe, local manufacturers face a strategic dilemma. After all, combustion engines are currently still in demand, but what will things look like in 10 years? European car manufacturers currently have to pursue an expensive dual strategy in order to generate revenue. This means that they must not lose pace with developments in the electric vehicle sector while the combustion engine business continues to run at full throttle. While BMW will start series production of fuel cell cars in 2028, the Canadian hydrogen specialist dynaCERT is already in full swing. Where are the opportunities for resourceful investors?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , DYNACERT INC. | CA26780A1084 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , BAY.MOTOREN WERKE AG ST | DE0005190003 , MERCEDES-BENZ GROUP AG | DE0007100000

Table of contents:

"[...] dynaCERT's HydraGEN™ device offers a retrofit solution for diesel engines designed to protect the environment while providing economic benefits. [...]" Bernd Krueper, President & Director, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD - Arrived in Europe to stay

At this year's Automechanika after-sales trade fair in Frankfurt, there will be a hall dedicated to Chinese vehicle brands for the first time, and BYD will be among them. Ahead of the industry event, taking place from September 10 to 14, the Asian automaker announced that it plans to use its extensive product lineup, premium brand Denza, and innovative technologies to raise awareness among industry professionals about the shift towards electric mobility. According to the information provided, the BYD Seal U DM-i will make its official debut in Germany at the event. The plug-in hybrid version of the all-electric Seal U has been available in Germany since the beginning of September; depending on the version, the SUV achieves an all-electric range of 70 to 125 km.

BYD is currently one of the biggest challengers among German manufacturers. Since entering the market at the end of 2022, the Company has launched six all-electric models. They are small, chic, and affordable and attract curious customers. In addition to BYD, other vehicle brands from China are also expected to attend, including Geely, Avatr, JAC, and DFSK. It is easy to see that automotive technology "Made in China" has arrived in Europe and continues expanding. BYD's share price has increased tenfold since 2018, and its market capitalization of almost EUR 80 billion now outstrips every German manufacturer. The BYD share price is currently nibbling at the technical barrier of EUR 28 to 30, while the valuation is not too high, with a 2025 P/E ratio of 14.5.

VW, BMW and Mercedes - The pressure to innovate is increasing

The German automotive sector has to contend with many burdens. In addition to high energy prices, other locational disadvantages are having an impact, so investments tend to be made abroad. VW is investing EUR 10 billion in a battery plant in Spain, which is hardly surprising given that a kilowatt hour of electricity costs only a third of the price there. Despite all the burdens, one should nevertheless keep an eye on the gems of German industrial history, as pronounced crisis years often lead to a repositioning. VW has announced a major cost-cutting program and is relaxing its in-house wage agreements. The Wolfsburg-based company also no longer rules out the possibility of completely eliminating sites in Germany at some point. VW also plans to terminate the job guarantee previously set until 2029.

VW boss Oliver Blume describes the seriousness of the situation as follows: "The economic environment has become even tougher; new suppliers are pushing into Europe. Germany is falling further behind in terms of competitiveness. In this environment, we as a company must act consistently." The core Volkswagen brand has been struggling with high costs for years and lags far behind companies such as Skoda, Seat, and Audi in terms of returns. The savings program launched in 2023 aims to improve earnings by around EUR 10 billion by 2026.

A completely different tone is coming from Stuttgart. At the Mercedes-Benz Group, employment has been secured until 2029, which is to be extended until 2035, according to Works Council Chairman Ergun Lümali. Plans for the future have emerged from the Munich headquarters of Bavarian competitor BMW. The BMW Group is planning to launch its first series-produced fuel cell electric vehicle (FCEV) in 2028. Together with its technology partner Toyota, the Company will offer an additional all-electric and locally emission-free drive option. German automotive shares are currently out of favor. Although valuations for 2025 are in the range of 2.5 to 5.3, this does not yet include all restructuring expenses. Nevertheless, the shares are unlikely to become much cheaper, with VW already trading below its book value.

dynaCERT - Successful pilot projects and rising revenues

The Canadian company dynaCERT is already thriving with its hydrogen application. For several years now, this Toronto-based company has been a technology supplier for the transportation industry across all sectors. For example, all diesel combustion processes can be optimized with the Company's H2 add-on device called HydraGEN™. Depending on the type of use, fuel savings of between 8% and 20% can be achieved. In addition, the proportion of soot and nitrogen is reduced, making the exhaust gases cleaner. The technology is particularly suitable for public transport companies, freight carriers, and the mining industry, helping them to achieve ESG guidelines and reduce the carbon footprint of entire fleets. The Company also offers telematics systems that monitor fuel consumption. These systems serve as the basis for emission credits, which can be obtained as a further benefit for operating a CO2 reduction module after the VERRA certification is granted.

Last week, CEO Jim Payne announced the delivery of dynaCERT's patented HydraGEN™ technology to three large open-pit mining operations in Brazil and Peru. The sale of a total of 119 HydraGEN™ units, including the two flagship models, HG1 and HG2, is part of a large order received through one of the Company's distributors and will be paid for in several stages. New orders for eight additional units have been received from Mexico and Australia. These orders for HydraGEN™ technology follow the positive results of several pilot projects conducted over the course of two years.

Jim Payne, Chairman and Chief Executive Officer of dynaCERT, added: "The growing global acceptance of our products, driven by successful pilot projects and repeat orders, reaffirms our commitment to reducing fuel consumption and carbon emissions from diesel engines worldwide. Our mission to drive the reduction of greenhouse gas emissions on a global scale is stronger than ever." The dynaCERT share price is currently trading actively between CAD 0.17 and 0.20. The current order pipeline should give the share price a significant boost.

The European automotive sector is facing huge challenges: pressure to innovate amid rising costs, along with the worst industrial policy conditions in recent decades. It is no wonder that shareholders are seeing substantial negative returns. BYD is also consolidating, but this share has increased sevenfold since 2019. A buying wave could soon set in for dynaCERT, as important events are on the horizon.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.