At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories. That it depends thereby less on large names, but on the future potential and whether the market also recognizes these perspectives, was one of its first learnings at the stock exchange.

On these pages, Nico examines current events at listed companies and takes a closer look at companies that are traded under the radar of the market, in addition to well-known securities.

In order to be able to take advantage of speculative opportunities on the stock exchange, Nico not only focuses on a balanced asset allocation of defensive and opportunity-oriented securities, but also on an intact risk management. "In addition to position size and entry in several tranches, investors should also develop a sense of timing and get to know a stock better before investing," says the columnist.

Commented by Nico Popp

Commented by Nico Popp on January 25th, 2022 | 10:15 CET

BioNTech, Defence Therapeutics, Nordex: Investors must pay attention here!

"Defying cancer" was the headline of the Frankfurter Allgemeine Zeitung a few days ago. The interview was illustrated with the two leading BioNTech heads, Özlem Türeci and Uğur Şahin. The famous German scientists' statement revolved around further projects for BioNTech and the fight against cancer. At the same time, BioNTech's stock, like many other pandemic winners, dropped. What does this mean for investors now?

ReadCommented by Nico Popp on January 24th, 2022 | 10:13 CET

Mini P/E, dynamic growth and ESG profile: Varta, Saturn Oil + Gas, Gazprom

We have associated modern energy sources, such as batteries or even hydrogen, with future investments for years. Indeed, it is extremely appealing to use renewable energies to feed both the power grids and the engines of ships and trucks. But this transformation is a Herculean task. We look at why investors have great opportunities in this regard and which shares are particularly suitable.

ReadCommented by Nico Popp on January 21st, 2022 | 14:10 CET

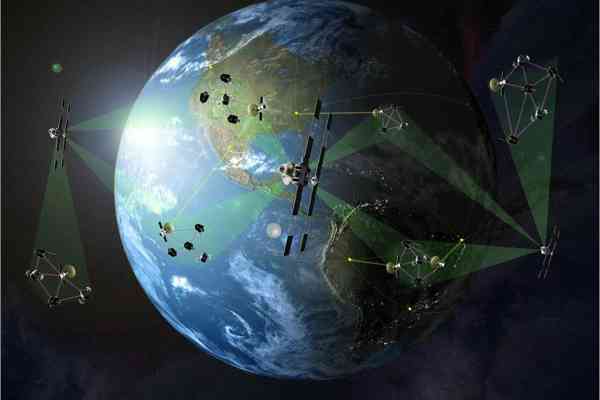

Airbus, Kleos Space, BP: Experience this space visionary live!

Space. Infinite expanses. And almost endless potential for investors. Ever since the super-rich of this earth, such as Elon Musk and Jeff Bezos, have been striving for orbit, space has also been considered a lucrative investment target by investors. To feel weightless as an investor, there are various options between standard and emerging hot stocks. We highlight three titles.

ReadCommented by Nico Popp on January 20th, 2022 | 13:21 CET

Activision Blizzard, CoinAnalyst, Bitcoin Group: Metaverse - the discovery of a new world

Educators and psychologists raised a finger when people stopped leaving their homes more than a decade ago because they were immersed in the depths of the game World of Warcraft. Escaping into parallel worlds could only have disadvantages, they said. In reality, it makes little sense for children, in particular, to lose themselves in virtual fantasy worlds. But the trend is toward a second existence in virtual space. We present three stocks that can profit from conquering the new world.

ReadCommented by Nico Popp on January 19th, 2022 | 14:13 CET

Gold rush in the lithium market: BMW, Yorkton Ventures, Rock Tech Lithium

An entire industry is turning itself inside out. The revolution in the car market will pick up speed in the coming years. As a study by Deloitte shows, sales of battery-powered vehicles could rise from 210,000 in 2022 to 960,000 in 2030. Between 2022 and 2026 alone, market experts expect sales of electric cars in Germany to double. So it is no wonder that a gold-rush mood is already spreading around some companies. We take a closer look at three shares.

ReadCommented by Nico Popp on January 19th, 2022 | 10:59 CET

NEL, dynaCERT, Volkswagen: Will the last be first?

Energy prices are going through the roof. Anyone who has to change their energy supplier these days is in for a surprise. Surcharges of 50% and more for electricity and gas are not uncommon. In this context, questions about the drives of the future are becoming louder again. Although hydrogen also has a high energy requirement, the German Federal Ministry of Economics and Technology promotes green hydrogen as a lower levy under the Renewable Energy Sources Act. Reason enough to take a closer look at some stocks related to hydrogen and mobility.

ReadCommented by Nico Popp on January 18th, 2022 | 10:25 CET

Alibaba, CoinSmart, TeamViewer: Where tech still brings returns

Tech companies are increasingly facing headwinds in China. The crypto market is also currently showing its moody side again. So what is to be done? Is the time for innovative technology over? Here is why investors should move away from seeing only black and white when it comes to technology: Three stocks at a glance.

ReadCommented by Nico Popp on January 17th, 2022 | 12:14 CET

LVMH, Diamcor, Daimler: Luxury is more than champagne, Tesla or S-Class

What constitutes luxury is in the eye of the beholder. For some people, even a terraced house in a major German city is luxury, others focus on leisure, and for others still, it has to be jewelry or diamonds. Even though there are different ideas of luxury, there are companies that perfectly reflect the desire for something special - and are thus suitable as an investment. We present three stocks.

ReadCommented by Nico Popp on January 14th, 2022 | 10:13 CET

TeamViewer, Meta Materials, Deutsche Bank: Do your research and beat the market

Sometimes the technology that everyone has known for years becomes a game changer overnight. That is what happened at the beginning of the pandemic with the TeamViewer software. Sometimes things turn out differently, and innovations are so revolutionary that it takes a while for the market to recognize the potential. We examine three stocks for their innovation potential and explain whether or not the market understands the equity stories.

ReadCommented by Nico Popp on January 13th, 2022 | 11:03 CET

Bayer, First Hydrogen, NEL: This is how innovative investing works!

Innovation pays off - especially on the stock market. That is because innovative products generate price fantasy, which can generate rich returns on the stock market within a very short period of time. In addition to classic trend themes, such as hydrogen, established companies can also score with innovations. We present three stocks and explain whether they offer opportunities or not.

Read