At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories. That it depends thereby less on large names, but on the future potential and whether the market also recognizes these perspectives, was one of its first learnings at the stock exchange.

On these pages, Nico examines current events at listed companies and takes a closer look at companies that are traded under the radar of the market, in addition to well-known securities.

In order to be able to take advantage of speculative opportunities on the stock exchange, Nico not only focuses on a balanced asset allocation of defensive and opportunity-oriented securities, but also on an intact risk management. "In addition to position size and entry in several tranches, investors should also develop a sense of timing and get to know a stock better before investing," says the columnist.

Commented by Nico Popp

Commented by Nico Popp on April 26th, 2022 | 10:19 CEST

Stocks for bargain hunters: Mercedes-Benz, Power Nickel, Netflix

Share prices are falling. The mix of inflation, the war in Ukraine and the Corona problem in China is weighing on share prices. Even positive economic data in the form of a friendly ifo Business Climate Index does not help. For savvy bargain hunters, falling prices in the face of friendly economic data may even be a good sign. If the market exaggerates on the downside, there could be opportunities in quality companies. We take a closer look at three stocks.

ReadCommented by Nico Popp on April 25th, 2022 | 11:51 CEST

Hydrogen becomes marketable: Plug Power, dynaCERT, NEL

The energy transition is a long-term project. There must be no prohibitions on thinking about it. Only about a year ago, representatives of the automotive industry rejected hydrogen. In the meantime, however, a lot has happened. The sanctions against Russia have made energy more expensive, and hydrogen is now increasingly seen as a substitute for gas. In addition, more and more hydrogen projects around logistics projects and trucks are picking up speed. Reason enough to take a close look at the industry.

ReadCommented by Nico Popp on April 22nd, 2022 | 10:06 CEST

Investments of yesterday for tomorrow: K+S, Globex Mining, Netflix

It is better to have and not need than to need and not have - this rightly somewhat hackneyed saying is more topical than ever. Everything is in short supply, whether structural timber, metal fittings or inverters for photovoltaic systems. The first property developers are already reacting and are no longer planning so far into the future for new construction projects. The reason - galloping prices could otherwise eat up the margins. We explain how you as an investor can invest in this phase with the example of three companies below.

ReadCommented by Nico Popp on April 21st, 2022 | 09:27 CEST

Where you can still place your trust: Deutsche Bank, Desert Gold, Newmont

Thorough research, thoughtful consideration, a sense of timing and trust are all necessary ingredients for sound investments. But time and again, companies disappoint their shareholders. Rarely does it get as bad as it did with Wirecard. Often there is a communication crisis, and announcements are just not kept. We present three stocks and analyze: Where can investors put their trust?

ReadCommented by Nico Popp on April 20th, 2022 | 12:04 CEST

Where the music is playing now: BioNTech, MAS Gold, Bayer

Capitalism is the best system when it comes to distributing goods effectively. Supply and demand first make scarce goods expensive and then turn them into a promising business area. That is what happened with vaccines. Today, the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA) is warning of an oversupply of Corona vaccines - two years ago, things looked very different. While biotech stocks such as BioNTech are being penalized, it is important to identify tomorrow's opportunities. Scarcity plays an important role here.

ReadCommented by Nico Popp on April 20th, 2022 | 10:29 CEST

The million-dollar opportunity: Valneva, Edgemont Gold, BASF

No one can see into the future. But investors can estimate which topics will move share prices in the near future. There is not always a connection between what is important and what is played out in the media. Issues such as climate change are timeless but disappear from the front pages from time to time. It is currently a similar situation with the pandemic. We dare to take a look into the future and ask what could move prices this summer.

ReadCommented by Nico Popp on April 19th, 2022 | 14:10 CEST

Hotter than crypto: K+S, Nevada Copper, Shell

While moderate inflation is considered an acceptable accompaniment to a recovery, inflation rates beyond the 7 or even 8% mark are poison for the economy. The first industry associations from the construction sector expect residential construction to slump significantly in 2023. Examples include the Bavarian Housing Industry Association (VdW). According to this, around 86% of housing cooperatives and socially-oriented developers rate the prospects for new construction as "poor" or "very poor". The reasons lie in rapidly rising prices for building materials, which make costing difficult. Accordingly, some craft businesses will no longer accept orders for far in the future to avoid taking risks. China's zero-COVID strategy is also repeatedly causing problems. We present three companies that will be able to deliver in 2023.

ReadCommented by Nico Popp on April 15th, 2022 | 11:58 CEST

Regionalization as an investment idea: BYD, Defense Metals, Rheinmetall

The peace dividend has been depleted. For years, Europe imagined itself in a world without wars. Interdependence and joint trade were supposed to create a world order that would provide stability and balance. But for the past fifteen years or so, this concept has not been running smoothly. First, Putin set foot in Georgia, and later, he annexed Crimea. Since February, it has been clear even to the German government that peace and security will have to be worked hard for again. At the same time, as climate change necessitates action, the world is facing change. We highlight three stocks that could benefit.

ReadCommented by Nico Popp on April 14th, 2022 | 08:00 CEST

Interview NervGen Pharma: "We have a drug with the potential to treat Alzheimer's, MS, spinal cord injury and stroke".

Multiple sclerosis, Alzheimer's disease or even strokes have something in common with spinal cord injury: they damage the nervous system. This makes them all incredibly difficult to treat. But a therapeutic breakthrough finally seems possible. In the 1990s, Dr. Jerry Silver discovered the root cause for why debilitating damage to the central nervous system cannot be repaired. What was a revolutionary discovery at the time is now accepted science. The NervGen team, which has exclusively licensed the technology that came from Dr. Silver’s lab, is now at an exciting time in the development of a potentially paradigm changing milestone, based on his 30 years of important work. The breakthrough could come as early as next year. We talk about NervGen's approach and plans for a Nasdaq listing with NervGen Executive Chairman Bill Radvak.

ReadCommented by Nico Popp on April 13th, 2022 | 18:02 CEST

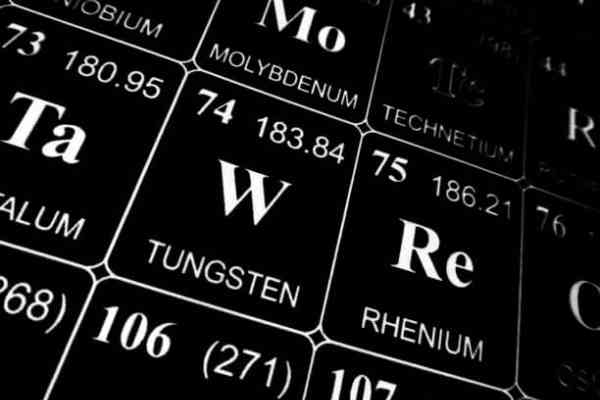

A crisis here, an opportunity there: BASF, Almonty, Plug Power

Quarterly figures and many upcoming annual general meetings will bring to light what has been somewhat abstractly clear for weeks: many industrial companies are in serious danger. Yesterday it became known that the Russian army is said to have sprayed an unknown substance over Mariupol. If it was poison gas, the West would be forced to react. It cannot be ruled out that oil from Russia will be the next to be hit. Just how dependent companies like BASF are on Russian energy recently became clear. We examine three stocks and their opportunities and risks in this market phase.

Read