At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories. That it depends thereby less on large names, but on the future potential and whether the market also recognizes these perspectives, was one of its first learnings at the stock exchange.

On these pages, Nico examines current events at listed companies and takes a closer look at companies that are traded under the radar of the market, in addition to well-known securities.

In order to be able to take advantage of speculative opportunities on the stock exchange, Nico not only focuses on a balanced asset allocation of defensive and opportunity-oriented securities, but also on an intact risk management. "In addition to position size and entry in several tranches, investors should also develop a sense of timing and get to know a stock better before investing," says the columnist.

Commented by Nico Popp

Commented by Nico Popp on March 10th, 2022 | 05:10 CET

Interview Cardiol Therapeutics: 'We have two potential blockbusters in our portfolio'

In this interview, Cardiol Therapeutics’ President and CEO David Elsley explains the unique selling points of the Company’s lead product, CardiolRx™, an oral cannabidiol formulation pharmaceutically manufactured under cGMP. He explains why the upcoming clinical trials could result in exclusive multi-year distribution agreements, why the financing last November was a good decision, and how major funds from the U.S. currently stand by Cardiol Therapeutics.

ReadCommented by Nico Popp on March 9th, 2022 | 10:06 CET

Is this how Kostolany would invest? BASF, Globex Mining, Gazprom

War only knows losers. On the stock exchange, however, things look a little different. The stock market reflects tomorrow's changes today and ensures the allocation of capital. When money flows from one sector to another, opportunities also arise for investors. Those who bet on the right horse at the right time, win. Those who make the mistake of betting on the high flyers of the past may experience a financial Waterloo.

ReadCommented by Nico Popp on March 8th, 2022 | 06:00 CET

Power Nickel Interview: 'The coming quarters change everything.'

A promising nickel project in Quebec, several gold properties in Canada and Chile, and a license agreement with Teck Resources that could yet provide surprises - Power Nickel's list of activities is long. But the Company is consolidating. As early as the second quarter, historical data is expected to be converted into an updated resource estimate for the flagship NISK project. Shareholders also stand to receive bonus shares later this year. Here is what Terry Lynch, CEO of Power Nickel, has in mind for 2022 and what the Company needs to do to be valued at CAD 800 million instead of CAD 15 million.

ReadCommented by Nico Popp on March 7th, 2022 | 11:54 CET

Linde, dynaCERT, NEL: Time for hydrogen technology

Gas is still flowing from Russia to the West. But the longer the war in Ukraine continues, the more likely it is that even more onerous sanctions will be imposed. In any case, it is clear that the long-term trend is away from Russian gas. Hydrogen suppliers have been profiting for days from the escalation of violence in Ukraine. Transitional technology could also be in demand to reduce fuel consumption and CO2 emissions in equal measure - after all, climate protection must not be neglected despite rising energy prices. We analyze three hydrogen stocks.

ReadCommented by Nico Popp on March 4th, 2022 | 11:32 CET

Stagflation! Here is how stocks could react: ThyssenKrupp, Kodiak Copper, BMW

A flood of money for the defense sector, disrupted supply chains and paradigm shifts in many other areas - the war in Ukraine shows us once again that nothing stays the same. The phrase may have been overused in the pandemic, but current events underscore that as we look to the future, we must prepare for things we would not have thought possible just a few years ago. Also economically. The eurozone is on the verge of a stagflation scenario, i.e. rising prices coupled with falling economic output. The ECB would then be in a dilemma. Stocks could be the only way out for investors.

ReadCommented by Nico Popp on March 3rd, 2022 | 10:44 CET

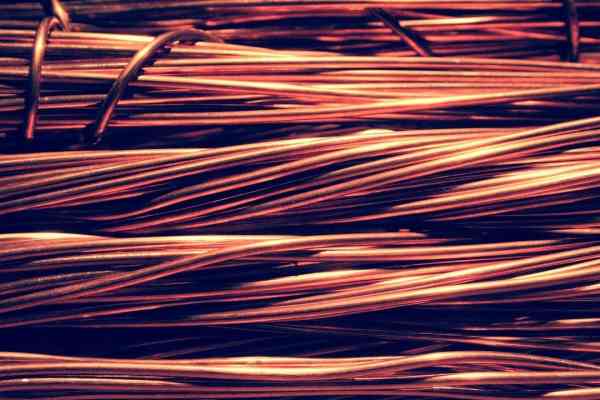

BYD, Nevada Copper, Mercedes-Benz Group: Price shock also at the charging station

The fact that prices at gas pumps are constantly rising is nothing new for drivers. But with the price shock now also looming at charging stations, it is a new experience for many e-car drivers. Providers of charging infrastructures, such as EnBW, Tesla, Enel and Stadtwerke München, have raised their prices in recent months, in some cases significantly: The kilowatt-hour has become between 8% and 82% more expensive. What will happen now?

ReadCommented by Nico Popp on March 1st, 2022 | 10:32 CET

Between war profits and peace dividends: ThyssenKrupp, Memiontec, BP

Since last weekend, the world has been a different place: Germany is pumping EUR 100 billion into a special fund for the German armed forces. In addition, more than the 2% of economic output demanded by the USA for years is to flow into the defense budget in the future. After years of neglecting its own defense, Germany is now back to deterrence. Given the threatening election of Donald Trump as the next US president, such self-help is also urgently needed. We highlight three stocks that are either affected by the Ukraine war or offer a peaceful alternative.

ReadCommented by Nico Popp on February 28th, 2022 | 10:33 CET

Shake-up in the auto industry - who loses, who benefits: Porsche, Altech Advanced Materials, Volkswagen

Porsche's planned IPO created a mood of celebration on the market at a turbulent time. The mood among the Porsche and Piëch families is also likely to be one of expectation. After all, they are to receive a blocking minority and would thus once again have more power over their Company. VW is also hoping for advantages from the IPO of its profitable subsidiary: For example, in investments in electromobility and in the valuation of the entire Group. Here's what the deal means for the companies involved and what the consequences could be for smaller technology providers.

ReadCommented by Nico Popp on February 25th, 2022 | 10:15 CET

Varta, Almonty Industries, NEL: New battery metal and hydrogen hope

Hydrogen is dead; are batteries the future? Not at all! If you talk to industry representatives, it quickly becomes apparent that energy sources for mobility are undergoing rapid change. Batteries that were the ultimate yesterday may be hazardous waste tomorrow. The reason: new material mixtures make batteries in electric cars more durable and better. Investors who back the wrong horse are quickly left out in the cold. Current developments in hydrogen show that even the lamest horse has a chance in the long term. We take a closer look at three shares for you.

ReadCommented by Nico Popp on February 24th, 2022 | 13:13 CET

Delivery Hero, wallstreet:online, SAP: Personnel uprising at digital companies

Nowadays, many of our wishes can be fulfilled with just a few clicks: A delicious food bowl for lunch, the latest action blockbuster or even a promising stock - after just a few clicks, we have obtained our goal. But digital business models are not always self-propelling. We get to the bottom of problems and show where opportunities still lie today. We look at the shares of Delivery Hero, wallstreet:online and SAP.

Read