At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories. That it depends thereby less on large names, but on the future potential and whether the market also recognizes these perspectives, was one of its first learnings at the stock exchange.

On these pages, Nico examines current events at listed companies and takes a closer look at companies that are traded under the radar of the market, in addition to well-known securities.

In order to be able to take advantage of speculative opportunities on the stock exchange, Nico not only focuses on a balanced asset allocation of defensive and opportunity-oriented securities, but also on an intact risk management. "In addition to position size and entry in several tranches, investors should also develop a sense of timing and get to know a stock better before investing," says the columnist.

Commented by Nico Popp

Commented by Nico Popp on March 30th, 2022 | 10:09 CEST

Turn of the times! Stock winners and losers: Rheinmetall, Ximen Mining, ThyssenKrupp

Disputes surrounding the Ukraine war are taking on various dimensions drawing wide international circles. After China, India's role in the conflict could now also increase. According to reports by Deutsche Welle, there have been lively exchanges between Russia and India in recent weeks. India is seeking a permanent seat on the UN Security Council and has recently begun to buy Russian oil. Cooperation between the two financial systems is also conceivable. That would give Russia access to the capital markets again.

ReadCommented by Nico Popp on March 28th, 2022 | 11:20 CEST

Who profits by it? Shares! Alibaba, wallstreet:online, Steinhoff

Buy, sell or hold? The stock market is sometimes turbulent. The war in Ukraine and its economic side effects, in particular, can cause events to spiral out of control. Investors have to react quickly to limit losses or seize opportunities. We highlight three stocks and explain how they are doing in the current unrest.

ReadCommented by Nico Popp on March 25th, 2022 | 10:03 CET

Now is the hour for endemic stocks: Weng Fine Art, MM2 Asia, Netflix

Especially in difficult times, entertainment is essential. In the 1980s, when two powers armed to the teeth faced off that could have wiped out the world several times over, the entertainment industry boomed. Music and films were celebrated worldwide and scored with a lightness of touch typical of the 1980s. At the same time, the art markets took off - wealthy Japanese and Americans in particular discovered modern art and drove up prices. Despite all the current problems, or precisely because of them: stimulating entertainment could also be high in demand in the 2020s. Why? We explain and introduce three exciting companies.

ReadCommented by Nico Popp on March 24th, 2022 | 11:02 CET

Is this the end for e-car stocks like Tesla? Rock Tech Lithium, Edison Lithium, Volkswagen

More and more e-cars are on our roads, but Handelsblatt sees the e-car boom in danger. What's going on? The leading German medium for business and markets is concerned about the rising prices for battery metals and points, among other things, to the price of nickel, which almost doubled within a few days in March alone. Is there now a threat of a damper on the e-car hype? Or are developments in the sector separating the wheat from the chaff? We take a look at three stocks and explain what they are all about.

ReadCommented by Nico Popp on March 23rd, 2022 | 10:47 CET

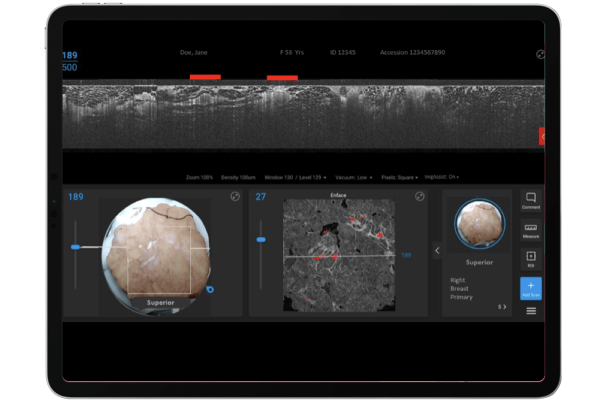

Stocks that change the world: TeamViewer, Perimeter Medical, Nordex

When new technology meets the right opportunity, things can go up quickly for companies. One example is the German company TeamViewer, which already had an established remote desktop solution that many users had heard of when the pandemic broke out. When we moved to the home office overnight but had to use software from the office, it made sense to install TeamViewer. Innovative solutions are also meeting with great demand in other industries. We analyze what this means for investors.

ReadCommented by Nico Popp on March 22nd, 2022 | 11:22 CET

In the right place at the right time: BioNTech, Defence Therapeutics, Bayer

For years, the pandemic has kept the world on tenterhooks. Currently, the epidemic is taking a break, at least in the media. But while the world is looking tautly at Ukraine and more and more refugees are arriving in Germany, the Omicron figures are rising once more. In some cases, the incidence in Germany is over 3,000. Although fewer and fewer people are dying, more people than ever are in quarantine. We look at BioNTech, a typical pandemic stock, and present other exciting investments from the healthcare sector.

ReadCommented by Nico Popp on March 21st, 2022 | 11:15 CET

Shares between expropriation and the new era: Barrick Gold, Triumph Gold, Alibaba

Goldman Sachs has always been considered well-informed and well-connected in investor circles. Even if sometimes a little too much is read into the forecasts of the US bankers, investors should take note of them. Currently, Jeff Currie, commodity specialist at Goldman Sachs, assumes a "perfect upswing" for gold. The price target could be USD 2,500. Goldman sees the precious metal as the "currency of last resort" and points to rising ETF purchases and increasing demand from central banks. We take a look at three stocks and their prospects.

ReadCommented by Nico Popp on March 15th, 2022 | 10:56 CET

TUI, Desert Gold, Deutsche Bank: Uncertainty as an investment opportunity

Only less than a week to go before freedom returns - at least superficially. Those who previously perceived medical masks and testing obligations as repression should breathe a sigh of relief from March 20. Then Germany will also have its Freedom Day. Yet while relief is spreading in many parts of Germany, the conflict in Ukraine is coming to a head. After March 20, the threat to freedom in Europe is likely to be greater than during the most heated federal-state rounds of recent years. We analyze the situation and look at three stocks.

ReadCommented by Nico Popp on March 14th, 2022 | 10:17 CET

Mercedes-Benz Group, Phoenix Copper, JinkoSolar: Learning from history

Investors who kept a cool head after the outbreak of the Corona pandemic in March 2020 were able to enjoy high profits in the months that followed. Immediately after the outbreak began, share prices around the world plummeted. The media proclaimed the end of the economy as we know it. While this was partly true, the markets' conclusions were initially wrong. Instead of economic decline, scarcity determined prices - until today. Even now, the markets are painting a gloomy scenario, right up to the apocalypse. It looks as if supply and demand will ultimately determine prices after all. For investors with a sharp focus and clear understanding, this can be an opportunity. We present three shares.

ReadCommented by Nico Popp on March 11th, 2022 | 10:15 CET

Nordex, MAS Gold, Hensoldt: Shares for the new era

Even if the negotiations between Ukraine and Russia inspire hope, regardless of the interim status, much will change in the coming months and years. The civilian power EU must rethink - in many areas. Gas as a transitional technology can hardly be justified after Putin's war of aggression. Putting national security in the hands of NATO, which is largely supported by the United States, also seems risky - after all, Trump is already preparing his election campaign. In the future, the EU and Germany will have to accelerate climate change and push ahead with rearmament. We present three stocks that could benefit.

Read