December 3rd, 2024 | 07:10 CET

Year-end rally: DAX high, Bitcoin, or gold? SMCI, Thunder Gold, Dell and SAP under the microscope

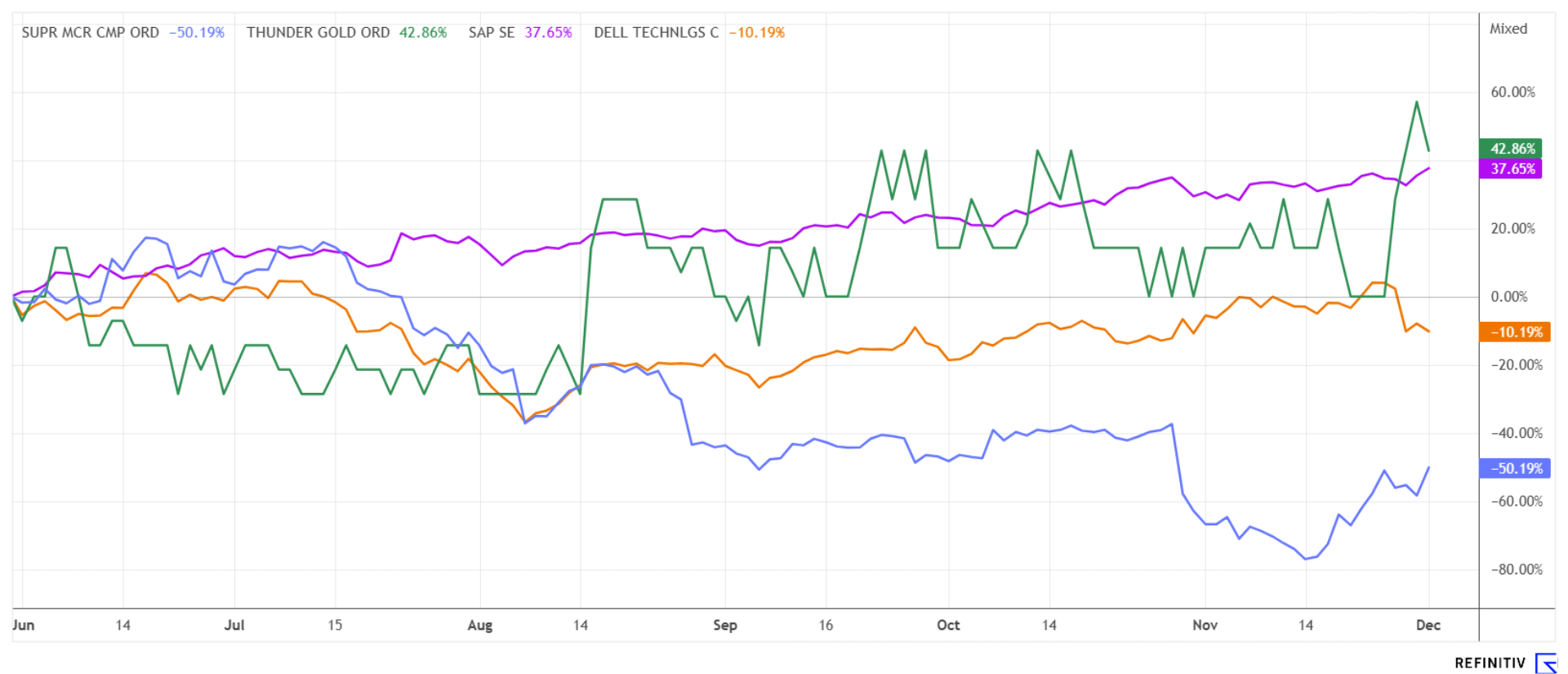

December begins as November ended: New highs on the DAX, high-tech stocks remain in demand, and Bitcoin and gold are consolidating slightly. With only 16 trading days left, now is the time to find the right portfolio structure for 2025. Despite unbridled investor optimism, next year could see a sector rotation that causes the overbought stocks to consolidate and brings long-neglected stocks to the forefront. At Super Micro Computer, many uncertainties are now being put into perspective. Its partner, Nvidia, has not been able to report any new highs since the Q3 figures. On the other hand, SAP is enjoying record growth, having seen one of the strongest rebounds since its founding. What happens now? Here are some ideas for risk-conscious investors.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

THUNDER GOLD CORP | CA88605F1009 , DELL TECHS INC. C DL-_01 | US24703L2025 , SUPER MICRO COMPUT.DL-_01 | US86800U1043 , SAP SE O.N. | DE0007164600

Table of contents:

"[...] We have built one of the largest land packages of any non-producer in the belt at over 440 sq.km and have made more than 25 gold discoveries on the property to date with 5 of these discoveries totaling about 1.1 million ounces of gold resources. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Super Micro Computer – Caution at the curbside

After weeks of uncertainty and a sell-off of almost minus 85%, there was a sharp turnaround yesterday at Super Micro Computer (SMCI). The reason: according to internal investigations, there is no evidence of accounting misconduct at the California-based company. A review by a special committee of the board, which was accompanied by lawyers from Cooley LLP and the auditing firm Secretariat Advisors, found "no evidence of misconduct by management or the board and that the audit committee acted independently". At the beginning of the year, the share price rose by more than 300% and even broke through the USD 1,000 barrier before the 1:10 split in October. Adjusted for the split, the price reached an all-time high of USD 122.90 before falling to USD 17.25 in just a few weeks.

Ernst & Young resigned from its auditing mandate a few weeks ago, leaving SMCI with unaudited financial statements for Q2 and Q3. NASDAQ threatened to delist the Company. Now, BDO has stepped into the auditor gap, and yesterday, it was announced that David Weigand will have to vacate his CFO post. Even though SMCI has now partially rehabilitated itself, the case continues to raise many questions. Speculating on a rebound now is not without risk, as the biggest upward wave is likely to be initiated by hedge funds that have to cover their short positions after the Hindenburg Research report. Only for investors with strong nerves.

Thunder Gold – In pole position for a gold revaluation

Gold is currently consolidating at around USD 2,650. No big deal, say technical analysts, because the precious metal has already gained 31% this year. For European investors, a decent currency premium is added to this gain. American investment banks estimate the target line for 2025 to be between USD 2,850 and USD 3,250. Explorers, developers and producers are positioning themselves for this scenario. Attractive properties in good jurisdictions have been in demand again for several months because the grades are declining worldwide and must be replaced by new, mineable resources. Traditionally, the majors go on a "bride hunt" during times of low valuations.

Thunder Gold of Ontario is developing the Tower Mountain Gold Property, located adjacent to the Trans-Canada Highway approximately 50 km west of Thunder Bay. The 2,500-hectare property surrounds the largest exposed intrusive complex in the eastern Shebandowan greenstone belt, where most known gold occurrences have been outlined within or proximal to intrusive rocks. Last week's news was about the sawn, continuous channel samples at the P-Target within Tower Mountain, which showed an average value of 4.93 g/t AU over 24.87 m, including 9.12 g/t AU over 12.66 m. This represented the longest continuous mineralized interval above a 1.0 g/t AU cut-off in the history of the Tower Mountain Gold Property. Additional samples confirmed grades ranging from 1.28 to 5.44 g/t AU. More than 82% of the reported channel sample intervals assayed greater than 0.30 g/t Au, a frequency rate three times greater than the 40,000 drill core samples collected to date.

Wes Hanson, President and CEO, commented: "The gold sample results show excellent continuity and the results are not distorted by outlier values. The results of the most recent soil samples indicate an extension in a southeasterly direction, as do the rock samples taken during prospecting." Thunder Gold's approximately 206 million shares are currently trading between CAD 0.045 and CAD 0.05. With a market capitalization of just CAD 8 million, the explorer should be able to take off in 2025. Due to the ongoing "tax loss season," the low prices can be perfectly used for medium-term positioning.

Dell and SAP – Good performance, but still interesting

The high-tech stocks Dell and SAP have performed very well this year. Both stocks have gained a good two-thirds of their previous year's level, with results improving from quarter to quarter. At SAP, the cloud segment has finally developed into a cash generator. Analysts on the Refinitiv Eikon platform expect a 9% increase in revenue to EUR 33.9 billion. Profits are expected to grow at the same rate, as significant investment costs at the beginning of the year are no longer a factor. Based on earnings per share of around EUR 5.00, analysts predict significant EPS growth of about 20% annually for 2025/26. The average 12-month price target among the listed experts is EUR 238, not far from the current price of EUR 229. 24 out of 34 analysts recommend the share as a "Buy". So, there still seems to be some room for growth.

Dell Technologies saw a correction from EUR 155 to EUR 82 in the summer, a crash of almost 50%. Dell Technologies is a global leader in the IT and technology industry. It is named after its founder, Michael Dell, who founded the Company in Austin, Texas, in 1984 with USD 1,000 in start-up capital. The Company initially focused on direct sales of computers to customers. Just 12 years later, Dell was one of the first companies to introduce a user-friendly e-commerce platform that allowed customers to configure and order their devices. In the early 21st century, Dell diversified its offerings by adding servers, networking solutions, storage solutions, and IT services to its portfolio alongside PCs. In 2016, Dell merged spectacularly with EMC Corporation, which was, at the time, one of the largest IT deals in history.

Today, Dell Technologies is a global provider focused on innovation, sustainability and supporting the digital transformation of its customers. The topic of artificial intelligence was identified in 2023 as a central pillar of digital transformation, and since then, there has been no stopping the Company's appreciation. The share price increased eightfold, with the valuation reaching over USD 120 billion. After the sharp correction in the summer, it is now on the rise again. Analysts on the Refinitiv Eikon platform calculate an average 12-month price target of USD 152.30. The Company trades at a current P/E ratio of 12 and a price-to-sales ratio of 1. Therefore, buy recommendations clearly predominate.

The stock market is currently making real leaps and bounds. This is understandable, as Donald Trump's re-election brings a good deal of speculation about what is politically on the agenda for the coming year. The high-tech stocks described here still have significant potential, as the megatrends of digitalization and artificial intelligence will continue. Given the excitement generated by the latest drilling results, the small-cap Thunder Gold could also be a good idea.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.