December 30th, 2024 | 07:05 CET

Will the corks be popping in 2025, too? 100% with BYD, VW, Power Nickel, MicroStrategy and Bitcoin possible

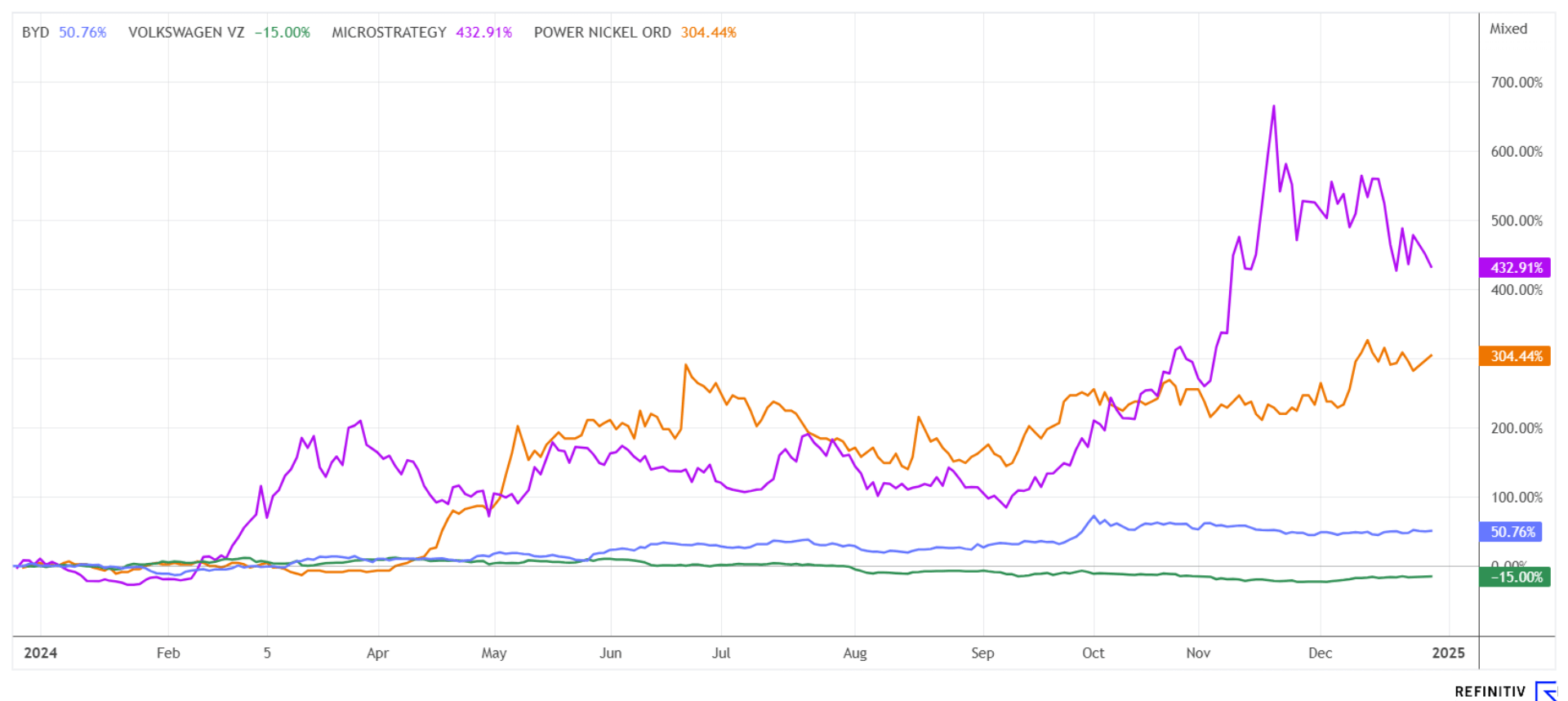

Since the tech bubble of 2000, there has been no year in which profits were so concentrated in just a few sectors as in 2024. Bitcoin, high-tech, artificial intelligence, and armaments were the blockbusters, while other sectors such as biotech, pharmaceuticals and automotive lagged far behind or even ended the year in the red. Nvidia, Tesla, D-Wave, Super Micro Computer, Rheinmetall and MicroStrategy were the protagonists of an incredible spectacle. Now, these stocks have priced in a golden future, in some cases with P/E ratios of over 100, and no one can seriously predict how things will continue here. Historically, the subsequent crash in the three years following the reference year 2000 resulted in losses of over 90%. The important difference: whereas in the past stocks were listed without any fundamental value, today it is predominantly world market leaders in their particular niche. Investors are betting on the fact that there will be no competition in the long term. Where are the opportunities for investors at the turn of the year?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , Power Nickel Inc. | CA7393011092 , MICROSTRATEG.A NEW DL-001 | US5949724083

Table of contents:

"[...] The collaboration with CVMR offers two primary advantages for Power Nickel: We can cover a larger portion of the value chain in the future, and despite the extensive cooperation with all its positive outcomes, we have remained significantly independent. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD versus Volkswagen – Germany faces crucial test

As if from a textbook, the price movements of BYD and VW diverged last year. While BYD gained over 50% after a minor correction in February, the Wolfsburg-based company has lost a full 22% since the beginning of the year. The stock market has thus likely decided who will dominate the automotive market of the future. While Volkswagen faced a decline in revenue of between 5 and 15% in the years 2020 to 2022, only recovering in 2023 with an increase of 12%, BYD achieved continuous growth from around 432,000 to 3.05 million vehicles during this period. BYD has strengthened its market position and expanded its global presence, particularly in the field of electric and hybrid vehicles. In Europe, BYD has only played a significant role since 2024, and the Chinese manufacturer aims to achieve an electric vehicle market share of 5% by 2026. Germany, in particular, is a key market; the coming year will be a real test for the struggling VW Group.

The valuations of the two companies reflect their divergent developments, with BYD's market capitalization now at EUR 98 billion, more than double that of Volkswagen at EUR 45 billion. For those seeking a future outlook: The 2025 P/E ratio for BYD on the Refinitiv Eikon platform is 16.6, while VW is a full five times cheaper at 3.4. However, the results of the restructuring at the Wolfsburg-based company are likely to be decisive for investment success. Around 35,000 jobs are set to be cut by 2030, and three plants are under review. Those who bet on BYD believe in a quick European breakthrough, whereas VW shares have not been available for less than EUR 90 since 2009. It is an interesting situation!

Power Nickel – The top performer with a plus of 288% is adding to it again

Investors in the Canadian polymetallic explorer Power-Nickel can pop the corks. The stock gained over 300% in 2024, with good drilling results suggesting a dream property in Quebec. Blessed with the best mining jurisdiction in North America, the NISK project is progressing at a rapid pace. In an environment of great geopolitical instability, industrial producers are seeking a secure supply of strategic metals. Power Nickel could become an important supplier in the medium term because, with the NISK property, the Canadians have numerous high-grade intersections in a wide range of industrial metals and gold.

The goal for the next few years will be to expand the historic high-grade nickel-copper-PGE mineralization and to secure it with a series of drilling programs. It will be particularly interesting to see what can be found on neighbouring properties in the future. With the results from drill hole PN-24-078, Power Nickel delivered outstanding results of 2.3% to 11% copper equivalent shortly before Christmas. CEO Terry Lynch is confident: "Drill hole 76 was a failure, but 78 was a very good hole. The Lion Zone is extraordinary! We are all excited about the next batch of holes, which includes 79-82. Our success in the western section shows that we have found a working strategy." The 2024 summer drilling success will be remembered by the mining community as one of the most significant discoveries of base metals.

The Company now plans to undertake an exploratory drill program of relatively short drill holes between the Nisk Project and the Lion Zone, using downhole electromagnetic (EM) surveys to guide deeper drilling. Power Nickel expects to complete 30,000 m of drilling across the entire Nisk project by the end of April 2025 and 50,000 m during the year, followed by a metallurgical study. CEO Terry Lynch compares Power Nickel's development to that of the Norilsk Nickel Group, a diversified mining holding company. It is now the world's leading producer of palladium and metallic nickel, as well as a major global supplier of platinum, copper and other metals essential to a low-carbon economy. "One of the challenges is that these discoveries are so rare that there is virtually no way to compare them," the CEO said in one of his last interviews.

The good results and the outlook for 2025 drove the share price up by 20% in December alone. Copper legend Robert Friedland joined as an investor in 2024. With currently CAD 183 million, Power Nickel is becoming increasingly interesting for institutional investors. The year 2025 could, therefore, bring a further revaluation. The research firm Hannam & Partners already sees a 12-month target price of CAD 1.70 – around 90% above the last price.

MicroStrategy – Everything stands and falls with Bitcoin

To stay with the successful stocks, we briefly examine the Bitcoin prodigy MicroStrategy. With the rise of the cryptocurrency to over USD 100,000, MicroStrategy gained almost 700% in the past year. The Company is pursuing an aggressive crypto strategy: since October 2020, it has issued USD 16 billion in shares and convertible bonds to invest in Bitcoin. Despite significant price fluctuations in Bitcoin and its own shares, MicroStrategy, under the leadership of Michael Saylor, remains committed to betting on Bitcoin's long-term dominance. The Virginia-based company now holds 439,000 Bitcoins, roughly 2% of the circulating coins. Furthermore, according to a SEC filing, the Company plans to drastically expand its Class A common shares from around 330 million to 10.33 billion in order to continue its aggressive Bitcoin investment strategy.

The price of Bitcoin is currently very volatile and has recently fallen back from a high of around USD 108,000 to USD 95,000. Founder Michael Saylor firmly believes in the dominance of Bitcoin as an established asset class. However, the 30% discount since the beginning of December shows that issuing shares and debt instruments and exchanging them directly for virtual money is not a one-way street for profits. Over the course of a year, MicroStrategy still has a whopping 400% performance, but anyone who gets the timing wrong is left with nothing. Caution: The current market capitalization exceeds the Bitcoin holdings by almost 100%. Therefore, the opportunities still lie on the short side. This is where the stock market becomes a casino!

The cards will be reshuffled in 2025. While BYD and Power Nickel have a good chance of making further gains, VW must show that the announced restructuring will bear fruit. And Bitcoin investments such as MicroStrategy show that timing plays a major role. The editorial team wishes you a happy new year.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.