May 20th, 2025 | 07:10 CEST

Where will the biotech winner of 2025 come from? Evotec, Bayer, BioNTech, Vidac Pharma, and Pfizer under stock review

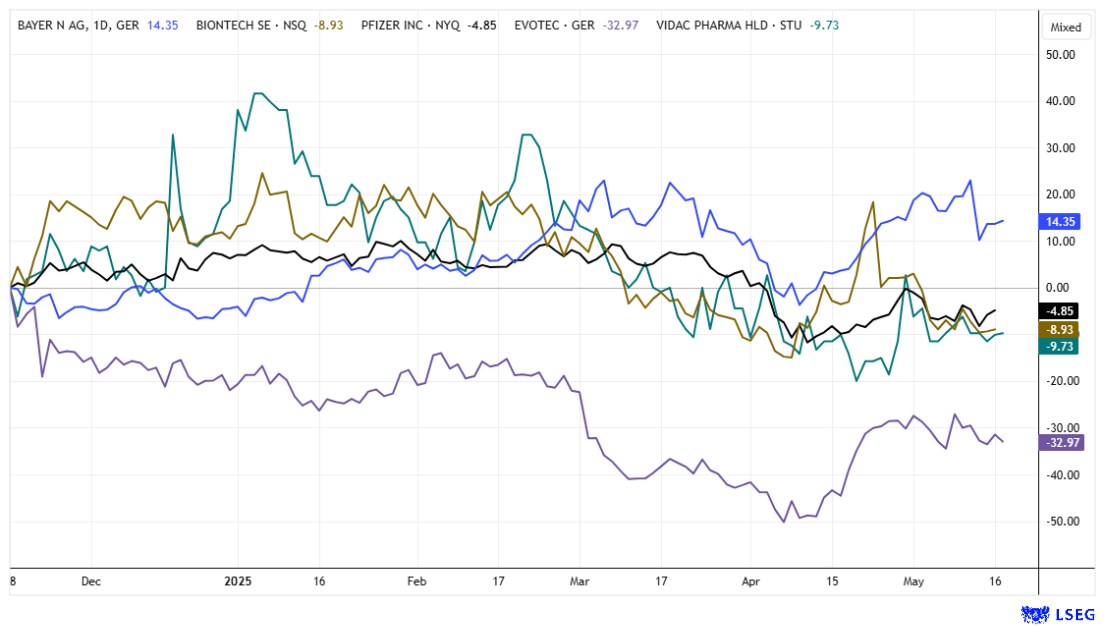

With new announcements coming out of Washington daily, the stock market carousel is spinning faster and faster. The direction is no longer uniformly upward, but deeper corrections, such as those seen in April, offer good entry opportunities. While the DAX 40 index reached a new all-time high yesterday at 23,977 points and has already recorded 27% growth in 2025, the Nasdaq Biotech Index (NBI) has lost a full 7.2% over the past six months. We have examined several interesting sector players and identified both opportunities and risks. In short, careful selection is once again key!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , BAYER AG NA O.N. | DE000BAY0017 , BIONTECH SE SPON. ADRS 1 | US09075V1026 , VIDAC PHARMA HOLDING PLC | GB00BM9XQ619 , PFIZER INC. DL-_05 | US7170811035

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Bayer and Evotec – Always potential for surprises

It is a shame about Bayer and its Crop Science division. Last week, good quarterly results were announced, and the cost-cutting measures that had been introduced seem to be taking effect for the time being. The Q1 report saw the share price rise sharply to EUR 26, but yesterday it was back below EUR 23. Another major lawsuit has been filed against Monsanto in the US. CEO Baumann is now going on the offensive and calling for a quick landmark decision by the Supreme Court that would prevent any individual lawsuits in the future. If the US Supreme Court does not take up the case or rules against Bayer, this could have drastic consequences. In such a scenario, the pharmaceutical and agricultural giant does not rule out the possibility of a Monsanto insolvency. If legally feasible, the legal claims would be transferred to the insolvency estate of the spun-off entity. The Leverkusen-based group would then no longer be liable in matters related to glyphosate. However, lawyers doubt the success of such a spin-off followed by insolvency. Analysts remain cautious but, on average, expect Bayer shares to rise to EUR 27.20 - an increase of 19% from today's perspective. The risk remains high, as US courts are not known for ruling in favor of German companies. It is all or nothing!

Things have also calmed down again recently for Hamburg-based drug discovery specialist Evotec. After overcoming the setbacks caused by long-time CEO Werner Lanthaler, the share price rose from below EUR 6 to EUR 11.50. Profit-taking and subdued Q1 figures caused another sell-off towards EUR 7. The Canadian bank RBC recently raised its price target for the Hamburg-based company from EUR 11.60 to EUR 11.90 and left its rating at "Outperform." Analysts still see a significant margin gap compared to competitors, but expect it to be closed over the next three years. The resulting value potential is almost 70%. Six out of nine experts on the LSEG platform also attest to good entry opportunities with an average target price of EUR 10.90. After profit-taking, the range between EUR 6 and EUR 7 continues to represent an interesting medium-term buyback opportunity.

Vidac Pharma – Full pipeline, low valuation

Vidac Pharma has often surprised positively in recent months. Industry experts are currently awaiting the latest results for the two oncological and onco-dermatological drug candidates VDA-1275 and VDA-1102. They are based on Vidac's patented approach of reversing the metabolism of cancer cells and restoring normal cell function. This would create a new class of cancer treatment and offer many patients a positive outlook. Prof. Max Herzberg founded Vidac in 2012, and development quickly gained momentum. Despite its modest size of only EUR 26 million, the Company is already in the clinical development phase.

VDA-1102 is in advanced clinical trials for two indications: actinic keratosis (AK) and cutaneous T-cell lymphoma (CTCL). In a Phase 2b study, the drug showed complete lesion clearance in 40% of patients and an overall reduction in lesions of 80%. Based on these results, Vidac Pharma plans to conduct another Phase 2b study focusing on patients with advanced AK. This study is expected to be completed by the end of 2025. In a Phase 2a study in patients with mycosis fungoides, a form of CTCL, VDA-1102 achieved an objective response rate of 56%, including complete remission in 22% of patients within 8 to 12 weeks. These results are promising compared to standard therapy with mechlorethamine, which has a complete remission rate of 13%.

In preclinical studies, VDA-1275 demonstrated significant efficacy both as monotherapy and in combination with standard chemotherapeutic agents such as cisplatin and sorafenib. The combination therapy resulted in enhanced tumor reduction compared to monotherapy. In addition, VDA-1275 induced an immune response, including the activation of anti-tumor macrophages and memory T cells, indicating potential to support immunotherapy. Vidac Pharma plans to complete preclinical studies of VDA-1275 by the end of 2025 and then initiate initial Phase 1 clinical trials.

Given the current pipeline, Vidac Pharma's valuation is, in our opinion, far too low. The share price has been hovering between EUR 0.50 and EUR 0.70 for some time. The research firm Sphene Capital issued a "Buy" rating with a price target of EUR 4.90 in summer 2024. The stock is very liquid and can be traded actively in Stuttgart. If Vidac continues to report such strong progress, the share price could quickly multiply.

Pfizer and BioNTech – Weak growth and high costs

Pfizer and BioNTech are currently unable to come up with any arguments in favor of buying their shares. Pfizer (PFE) is undergoing a major restructuring program aimed at reducing costs by USD 7.7 billion by 2027. In the quarterly report, CEO Dr. Albert Bourla explained Pfizer's strategic focus on improving R&D productivity and emphasized a disciplined approach to further developing the Company's pipeline. The Company also highlighted the discontinuation of Danuglipron development as part of its strategic prioritization efforts, while reaffirming its commitment to its cardiometabolic pipeline through internal programs and potential external opportunities. CFO Dave Denton reported Q1 revenue of USD 13.7 billion, impacted by lower Paxlovid sales and Medicare Part D reimbursement changes. Adjusted earnings per share were USD 0.92, supported by initiatives to improve operational efficiency. The full-year 2025 revenue forecast was confirmed at USD 61 billion to USD 64 billion, with adjusted earnings per share expected to reach USD 2.80 to USD 3.00. With a 2025 P/E ratio of 7.8 and a dividend yield of over 7%, the stock is at the lower end of its valuation range in the long term. Jefferies rates the stock as a "Buy" with a price target of USD 32, and 9 out of 25 experts on the LSEG research platform agree with the broker, setting the 12-month price target at USD 28.80.

The Mainz-based biotech company BioNTech has not achieved any significant share price growth in the last 12 months. As of March 31, 2025, it reported a loss per share of USD 1.82, compared to USD 1.42 in the same quarter of the previous year. Investors reacted negatively, sending the BNTX share price down by almost 20% to EUR 82. Yesterday, the share price recovered to EUR 85.5. The results of the ongoing Phase 2-3 studies in cancer research are still pending, but LSEG experts remain more than 70% positive and expect an average price target of USD 133.7. The Company's high cash reserves of around USD 17 billion make it relatively weatherproof.

**The situation in the biotech sector remains tense. Currently, only good results from clinical trials can lead to significant gains. This is precisely the opportunity that a balanced investment strategy offers. Large stocks should be mixed with promising small- and mid-cap stocks for diversification purposes. Vidac Pharma has shown in recent quarters that a price increase can sometimes be as high as 100%. In our opinion, 2025 still holds a few surprises in store.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.