October 31st, 2024 | 07:15 CET

Uranium Energy Rally 3.0! Another 100% with acquisitions at Nel, F3 Uranium, Plug Power, JinkoSolar and ARI Motors

Energy policy has become quite complex. The EU sanctions fossil fuels and gold from Russia but leaves out uranium. Why? There is one nuclear energy fan that vehemently opposes it behind the scenes in Brussels: France! Other countries like Poland, the Czech Republic, and Finland have also emerged as followers. Sweden and Romania each have two additional reactors in the planning stage, which the authorities have already approved. So, it is a two-tier society within the EU, which leaves Economic Minister Robert Habeck looking particularly foolish, especially as he secured costly LNG gas from Qatar on a 10-year contract to shut down domestic reactors. More mismanagement is hardly possible. The fact remains: with the renewed demand for uranium, supply will likely struggle to keep up in the coming years. F3 Uranium holds extensive concessions in the largest uranium mining district in the world: the Athabasca Basin. The industry is preparing for the impending supply bottleneck with acquisitions and purchases. Investors have the potential to double their returns now!

time to read: 6 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , F3 URANIUM CORP | CA30336Y1079 , PLUG POWER INC. DL-_01 | US72919P2020 , JINKOSOLAR ADR/4 DL-00002 | US47759T1007 , ARI MOTORS INDUSTRIES SE | DE000A3D6Q45

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Uranium instead of hydrogen – Nel ASA and Plug Power on the sidelines

As recently as 2007, a pound of uranium cost more than USD 140 at times before a long descent in prices began. With the outbreak of the Fukushima disaster in 2011, the mood against nuclear power reached its peak and forced the uranium price even below USD 50. Since the "NetZero" wave, however, it has been rising unchecked because, according to the International Energy Agency, nuclear power is now once again being classified as environmentally friendly compared to fossil fuels. Currently, 439 nuclear reactors are operational worldwide, with 64 more under construction and 88 in the planning stages. This increase of about 30% in uranium demand signals a challenge for the hydrogen industry, as it urgently requires investments to scale effectively.

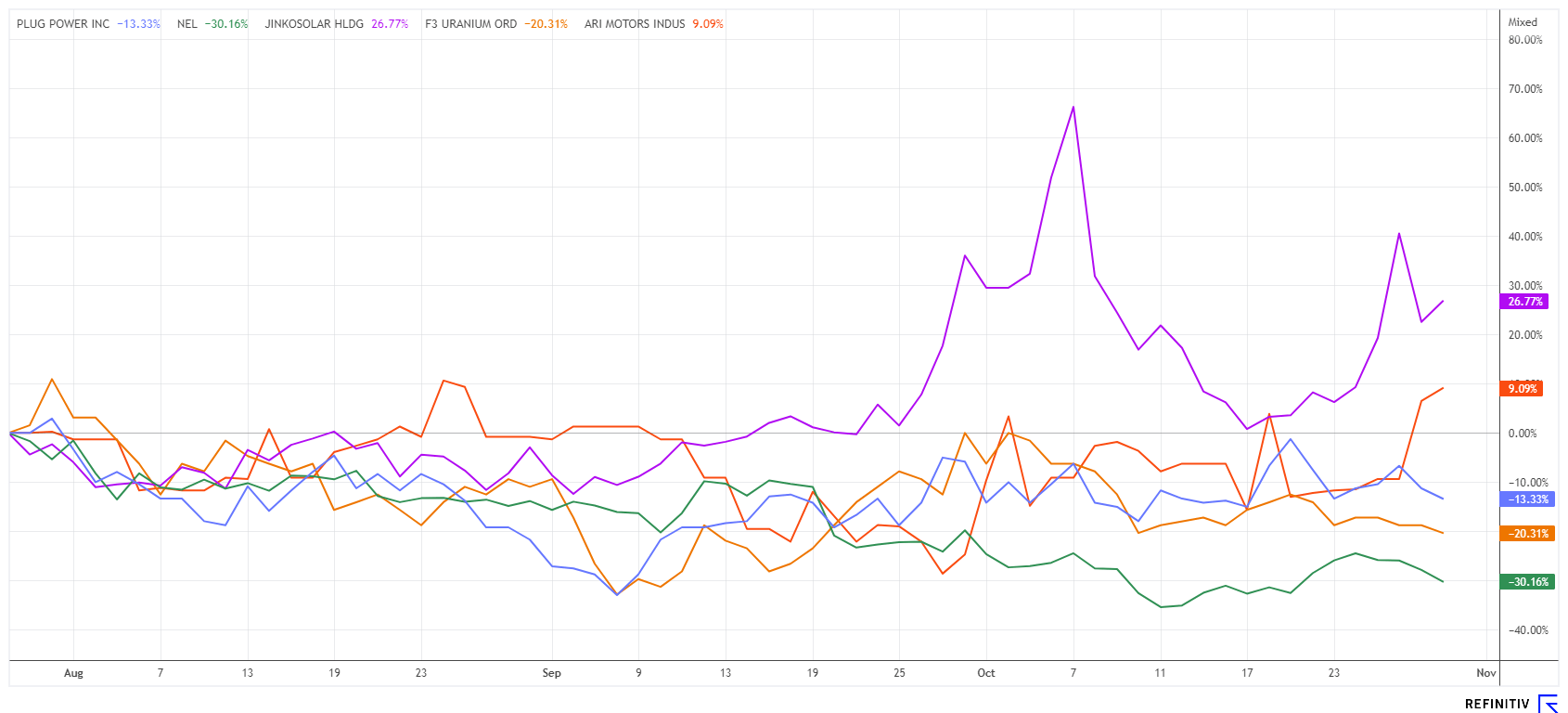

When one thinks of hydrogen, the Norwegian electrolysis pioneer Nel ASA and the US fuel cell specialist Plug Power are automatically on the radar. The usual price-to-sales ratios (P/S) of over 20 in 2021 had sent the H2 industry into a three-year consolidation. The reason: faltering public-sector orders, little private-sector engagement, and the lack of economic competitiveness of current technologies. After an 85 to 95% sell-off in the two stocks, it is now worth retaking a closer look, as the downward slide seems to be at least stopping. Most analysts on the Refinitiv Eikon platform are still negative, but sentiment is beginning to send out positive signals. Chart-wise, Nel ASA should be able to stabilize in the range of EUR 0.34 to EUR 0.37; for Plug Power, the important band is between USD 1.80 and USD 2.20. Currently, we recommend close observation – there is nothing to miss (yet)!

F3 Uranium – The top dog in the Athabasca Basin

The global undersupply of the yellow raw material has established itself in the minds of investors. The spot price of around USD 82 serves as a benchmark, as 80% of production is determined by fixed offtake contracts. However, the large uranium reserves are slowly running out, and after years of low prices, there has not been much investment in new mines. This is now taking its toll, as the sector has been experiencing a structural deficit since around 2018. The recent rise in the price of energy and metal commodities should give uranium a prolonged upward cycle over the next few years.

The Canadian company F3 Uranium is at the forefront of the abundant uranium deposits in the Athabasca Basin. The Company emerged from numerous spin-offs from the former Strathmore Uranium and was part of the well-known Fission Uranium for many years. F3 Uranium is now in the process of developing the newly discovered high-grade JR zone on the PLN property in the western Athabasca Basin. This area of Saskatchewan is fast becoming the next great uranium zone and is home to massive deposits such as Triple R, Arrow, and Shea Creek. The Company currently owns 3 projects in the entire Athabasca Basin and has spun off 17 projects to F4 Uranium.

The Company's management, led by Dev Randhawa as CEO and Chairman, Raymond Ashley as President, and Sam Hartmann as VP Exploration, is the team that founded Fission Uranium in 2012 and made the Triple R discovery at Patterson Lake. The same team also founded Fission Energy, which made the J-Zone discovery at Waterbury Lake in the eastern Athabasca Basin and built Fission into a TSX Venture 50 company. In October 2023, Denison Mines participated in F3 with a strategic convertible loan of CAD 15 million. This deepened the existing partnership.

F3 recently released its results for 13 drill holes from the 2024 program on the PLN property, with some high U3O8 grades. Interested investors are taking the news release as an opportunity to significantly increase their holdings in FUU shares, as the value has now come out of a 7-month consolidation. With a share price of CAD 0.255, the market capitalization is just under CAD 130 million. The cash position of CAD 24 million is also positive, enabling F3 to continue its exploration activities unhindered. The research houses Red Cloud and SCP expect 12-month price targets of CAD 0.60 and CAD 0.75, respectively. A timely recovery in the share price relative to the sector is, therefore, to be expected.

JinkoSolar – Strong expansion announced

The Chinese solar panel specialist JinkoSolar is one of the biggest losers among green stocks in 2024. Persistent margin pressure, falling export figures, and a struggling domestic real estate market are causing trouble for the Company. In Q3, there were further declines, but they were not as severe as analysts had previously estimated. Revenues fell by 23% from CNY 31.83 to 24.58 billion, but total output increased slightly. JinkoSolar has now announced that it will further expand its production capacity worldwide to meet rising demand. In addition to new plants in the US and Malaysia, which are expected to enable high production capacity, the Company is also planning a 10 GW production facility in Saudi Arabia. These expansions are part of a comprehensive strategy aiming to secure a presence in high-growth markets. Investors can likely anticipate a comeback for the stock.

ARI Motors – A small e-mobility specialist is shaking up the industry

Remaining in the energy sector, we turn to a representative of e-mobility. The German specialist for electric-powered small vehicles, ARI Motors from Thuringia, has been on the radar for a short time but is no less successful. Having started out as a pure assembler of Chinese components, the Company is now expanding its product range to include vehicles of up to 350 kg. The trick: ARI Motors is the cost leader in the industry and can use intelligent special solutions to take market share away from established business models. The Sprinter-copy model 1710 is positioned competitively with an entry price of around EUR 45,000, approximately 10% lower than conventional diesel models like the Renault Master and Iveco Daily.

With the e-alternatives, the Thuringian company is fully in line with the trend because public authorities, institutions, property management companies, sports clubs, domestic care, and last-mile service providers, in particular, need cost-effective and economical electric vehicles to comply with the EU's "ESG-CO2 pressure". With a view to 2035, the replacement investments of the next few years are likely to end up to a large extent in e-mobility and, thus, in a growing part of ARI's order books. Currently, ARI has an order backlog valued at EUR 5 million, with projected revenue expected to more than double to EUR 8.4 million in 2024.

ARI shareholders have had little fun in recent months. Since April, the share price of the supplier of low-priced e-vehicles has been in reverse. The low reached just under EUR 0.30 in September, but it has been on a steep upward trend since then. One indication of a change is evident. For months, only between 10,000 and 30,000 shares were traded. Since the beginning of the week, however, it has been rising rapidly with large volumes in excess of 100,000 shares, and yesterday, it rose by another 50% from its all-time low. On the stock exchange, it is assumed that the selling pressure of an existing investor has now been settled off the exchange. This enables the new investors to make decent profits again. With a total of only 10 million shares available and a limited free float, ARI Motors presents an attractive opportunity for speculators and fans of green business models. This scarcity could lead to significant revenue and profit increases for the Company. Additionally, due to its low valuation, there is potential for a takeover by a larger player in the market.

Energy policy remains a major question mark within the EU. Nevertheless, the shares of JinkoSolar and ARI Motors are making noticeable progress. F3 Uranium deserves special attention due to its excellent projects in the uranium-rich Athabasca Basin and the impressive track record of its management. In the hydrogen sector, dynamic investors should maintain a watchful stance.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.