August 19th, 2025 | 07:10 CEST

Ukraine hangs in the balance, and demand for defense remains high! Rheinmetall, Hensoldt, Antimony Resources, and DroneShield in focus

The latest geopolitical tensions and the Trump-Putin summit in Alaska highlight how fragile global supply chains currently are due to high levels of uncertainty—especially for European industry, which is suffering from energy shortages and trade blockades. This situation is reflected in the capital markets, where interest rates are trending upward and risk premiums are increasing. Nevertheless, new record highs are being recorded almost daily. Under pressure from rising commodity prices, Western industrial companies in particular are facing the challenge of realigning their procurement strategies in order to survive in an increasingly fragmented global trade environment. This opens up opportunities for investors who respond flexibly and resiliently to these changes. So which investments should investors focus on to successfully navigate their portfolios through this turbulent phase of global upheaval?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , HENSOLDT AG INH O.N. | DE000HAG0005 , DRONESHIELD LTD | AU000000DRO2

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

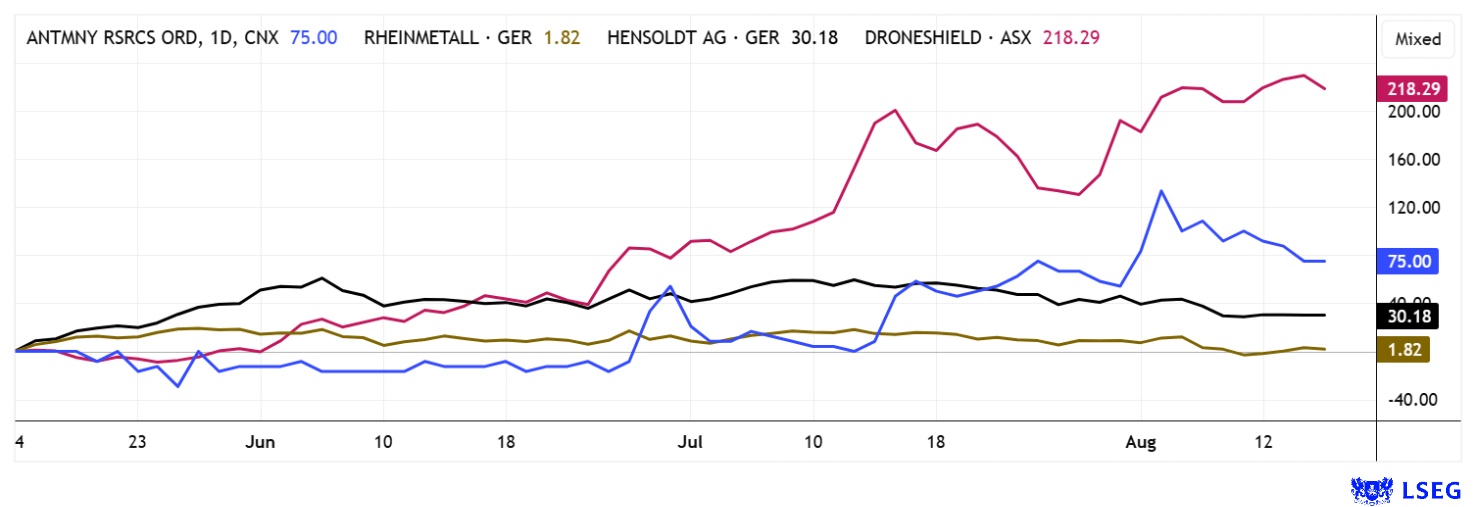

Rheinmetall and Hensoldt – 2025 highs likely already reached

Following the Trump-Putin summit, defense stocks like Rheinmetall and Hensoldt are once again in the spotlight. However, a look at their share price performance to date shows that both companies may have already passed their highs for this year. Rheinmetall fell by around 5% last week alone and is currently trading a good 17% below its all-time high of EUR 1,942. Although the financial figures continue to show strong revenue growth of 8.8% to EUR 2.43 billion in the second quarter, the operating margin and free cash flow were disappointing. Significant funds were invested in increasing inventories, causing cash flow to turn negative. Order intake also declined, and the quarterly figures remained below expectations overall. The record order backlog of EUR 63.2 billion and a declared EBIT margin of 15.5% provide support in the medium term, but uncertainty remains in the short term.

Hensoldt has also shown high volatility recently. After price gains of over 160% since the beginning of the year, there were noticeable setbacks: Last week, the share price temporarily fell below EUR 80 after reaching its 52-week high of EUR 108.80 on June 5. Revenue and order intake are solid, and the associated innovation pipeline for sensor technology and radar systems remains strong. However, development is being driven by geopolitical ups and downs and uncertainty surrounding future arms exports. Earnings per share for the current year are estimated at EUR 1.74, implying a P/E ratio of 50. Analysts on the LSEG platform are becoming more cautious, with an average target price of EUR 91.15. There is little room for growth from EUR 87. Optimism prevails at Rheinmetall. The target here is EUR 2,075, with only ODDO BHF downgrading to EUR 1,650 and "Neutral" last week. Those who are betting on the defense sector in the long term will continue to find stable, technology-driven business models in Rheinmetall and Hensoldt, but the short-term hype could be followed by setbacks for the time being. Not an easy decision – in or out?

Antimony Resources in the spotlight – Rare antimony, great potential

Canadian explorer Antimony Resources Corp. is poised to make a leap onto the geopolitical stage, positioning itself as a potential game changer among Western explorers. The focus is on the strategically important metal antimony. The Company recently secured successful financing: Through the issuance of 17.5 million new shares, a total of more than CAD 4 million was raised for the current exploration and development strategy. The funds will flow directly into the flagship Bald Hill project in southern New Brunswick, which is easily accessible year-round thanks to its location and infrastructure. With the recent acquisition of additional claims, Antimony Resources has further strengthened its position in the area and is now systematically pursuing the expansion and analysis of the high-grade antimony mineralization.

The results from the first exploration drilling phase, consisting of 16 drill holes, represent a real breakthrough. Over 70% of the drill holes proved massive stibnite-bearing ore zones, some containing exceptional antimony grades of up to 28% within substantial zones. The discoveries extend for at least 400 meters to the southeast and are open along strike and at depth. A technical report from 2010 had already pointed to the potential of the area, with an estimated deposit of 725,000 to 1 million tons with grades between 4% and 5.32% Sb. The latest drill results now confirm this assessment and raise hopes for an initial resource estimate in 2025.

The timing could hardly be better. With the current export restrictions from China and geopolitical pressure on the EU and the US to develop independent sources of raw materials, antimony is becoming the focus of industrial and strategic demand. Antimony is indispensable for the manufacture of flame retardants, electronics, batteries, but above all as a key component in the defense sector. Western markets are virtually forced to secure new sources, and Bald Hill has the potential to become one of North America's most important deposits.

The management team, led by CEO Jim Atkinson, is eager to rapidly advance the development of the deposit's potential. Canada's legal certainty, top infrastructure, and open geology make Bald Hill a strategic gem and the stage for a commodity story that captures the spirit of the times. The stock has corrected slightly to CAD 0.21 following the capital increase, with Tradegate pricing it at EUR 0.14. Get in now!

DroneShield – Can the Australians handle this growth?

Australian drone defense specialist DroneShield has established itself as a leading provider in a rapidly expanding market with impressive growth. Its product range extends from mobile, AI-powered detection solutions to fully autonomous systems with radio reconnaissance and automatic defense. DroneShield is also expanding its European production capacity and intensifying its software and AI business to strengthen its entry into civilian markets. In Q2 2025, revenue rose by a sensational 480% to AUD 38.8 million, driven by increased global demand for anti-drone technology in NATO countries and partner countries. With an order backlog of AUD 176.3 million and a sales pipeline of AUD 2.33 billion, DroneShield is well-positioned for further growth.

CEO Oleg Vornik sums up the competition: "We are not competing against other manufacturers, but against the technologies of entire countries." The ambitious goal is to double the pipeline to AUD 5 billion by 2028 and expand the Company's global leadership in drone defense and AI security. The stock has quintupled since the beginning of the year and currently has a market capitalization of around EUR 2 billion. Despite a high 2025 P/E ratio of around 98, DroneShield remains a promising investment for speculative investors. Even price-to-sales ratios above 10 are no longer an obstacle in today's markets - defense specialist Palantir even trades at a ratio of 100. Close your eyes and hope for the best, or steer clear!

Global tensions and supply chain issues are turning strategic raw materials and security technologies into profit drivers. Antimony Resources could close a critical supply gap in antimony with a rapid mine start-up in North America. Rheinmetall and Hensoldt are benefiting from massive defense investments in Europe and the US, while DroneShield is capturing a growing market niche with its drone defense systems. A peer group with a strong strategic setup. Diversification remains the name of the game.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.