March 19th, 2025 | 14:15 CET

Tungsten in the crosshairs – Almonty Industries on the verge of a revaluation like Steyr Motors?

An explosive mix: Raw materials war, defense, and a strategic mine. The geopolitical tensions between China and the USA are intensifying – and an inconspicuous metal is coming into focus: tungsten. Without this critical raw material, there would be no tanks, high-performance ammunition, or high-tech products. But the problem? 90% of the world market is dominated by China, Russia, Iran, and North Korea. The West is dependent – and that is precisely what makes Almonty Industries Inc. (WKN: A1JSSD | ISIN: CA0203981034 | Ticker symbol: ALI) an explosive investment opportunity.

The Company is on the verge of bringing the Sangdong mine in South Korea, the largest tungsten mine outside China and Russia, into production. This is perfectly timed, as China has sanctioned the export of tungsten. The market is under pressure, the US and Europe are rearming – and Almonty could become the key player. Now comes another explosive piece of news: Almonty is working with the powerful US lobbying agency American Defense International, Inc., whose clients include SpaceX, SAP, and the defense contractor Kongsberg. This is a clear signal that Almonty Industries is strategically coming into Washington's focus.

time to read: 2 minutes

|

Author:

Mario Hose

ISIN:

STEYR MOTORS AG | AT0000A3FW25 , RHEINMETALL AG | DE0007030009 , ALMONTY INDUSTRIES INC. | CA0203981034 , HENSOLDT AG INH O.N. | DE000HAG0005

Table of contents:

"[...] We have built one of the largest land packages of any non-producer in the belt at over 440 sq.km and have made more than 25 gold discoveries on the property to date with 5 of these discoveries totaling about 1.1 million ounces of gold resources. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

Mario Hose

Born and raised in Hannover, Lower Saxony follows social and economic developments around the globe. As a passionate entrepreneur and columnist he explains and compares the most diverse business models as well as markets for interested stock traders.

Tag cloud

Shares cloud

Strong ties to US industry – Is a takeover imminent?

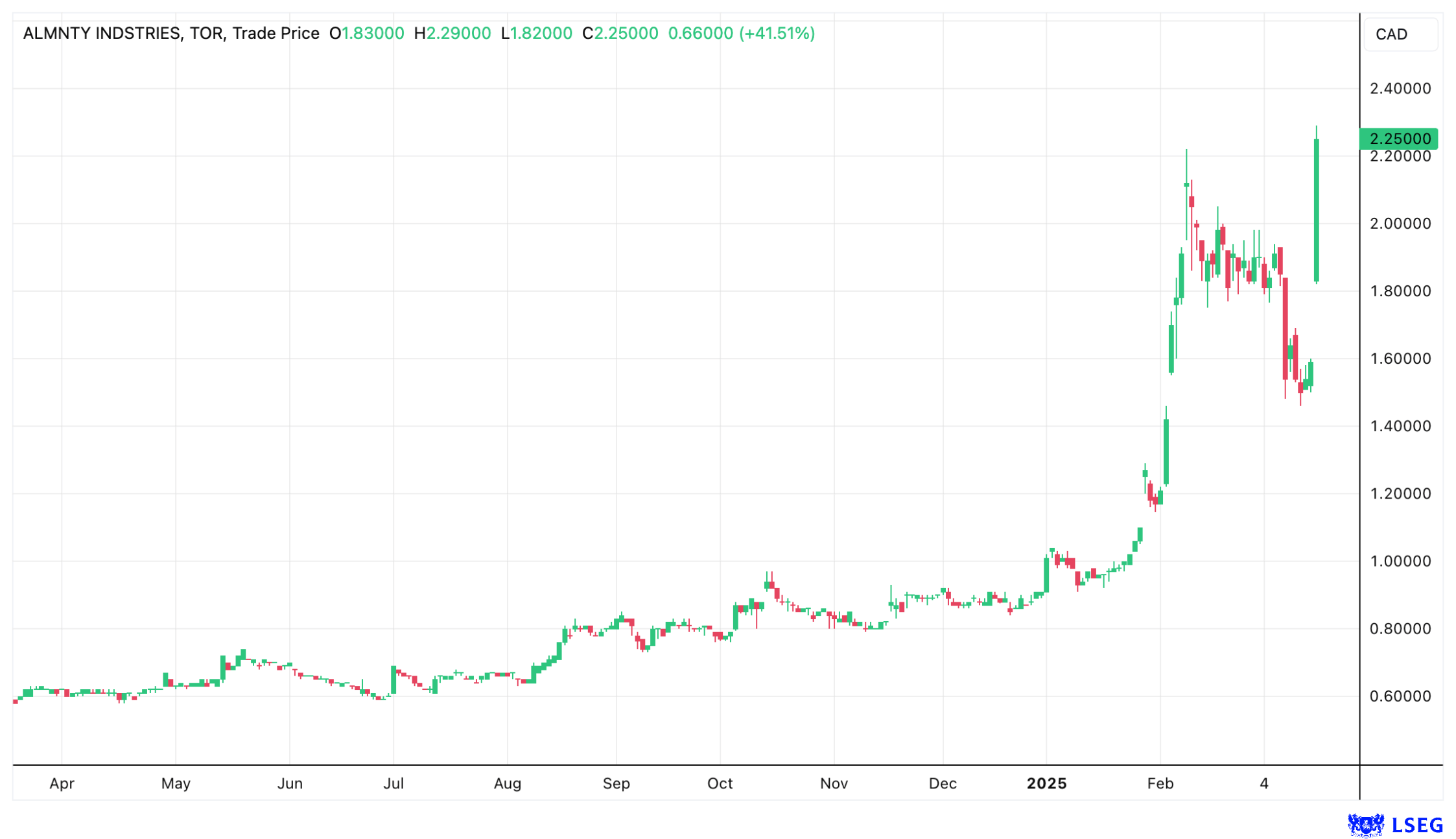

With the recent initiation of the Company's headquarters from Canada to the United States, the question arises: Is Almonty preparing for a takeover by a US company? Or is a revaluation at least on the horizon? A look at the industry comparison shows that Almonty is significantly undervalued.

MP Materials, a US-based company focused on rare earths, currently has a market capitalization of USD 4.3 billion despite a net loss of USD 65.4 million and revenues of USD 203.9 million in 2024. Analyst Peter Thilo Hasler of Sphene Capital forecasts that Almonty Industries (with a market capitalization of around USD 400 million) will generate revenues of CAD 192.5 million and an EBIT of CAD 69.4 million by 2026. He raised his "Buy" recommendation to a target price of CAD 5.20 in February. However, if one were to apply the comparable valuation metrics of MP Materials to Almonty, it would represent a massive revaluation of the Company in the billion-dollar range!

The momentum currently possible in the sensitive defense sector is demonstrated by the shares of Steyr Motors, which have risen from below EUR 15.00 to over EUR 420.00 in the past four weeks – a performance of over 2,700%.

Tungsten – The key to the defense industry

Tungsten is indispensable to the Western defense industry. It is needed for armored vehicles, munitions, and other high-tech military products. With defense spending on the rise in North America and Europe, the crucial question is: Where will the tungsten come from?

The main suppliers to date – China, Russia, Iran, and North Korea – are precisely the countries against which the West is strengthening its defenses. This dependency is a security risk that the US government will not accept. Almonty Industries, with its production in South Korea and Portugal, could play a crucial role in filling this gap.

Strategic alliances: USA or Germany?

Although all signs currently point to close cooperation with the USA, Germany also has a strong interest in Almonty Industries. The financing of the Sangdong mine was secured by the German KfW IPEX-Bank. Germany urgently needs access to tungsten, especially for its industrial and military production. So the question, therefore, is not whether, but when the West will rely on Almonty Industries as a strategic partner. With companies like Hensoldt, Rheinmetall, and thyssenkrupp, there is established defense expertise in Europe with a demand for tungsten – in direct competition with US competitors like Boeing, Lockheed Martin, and Northrop Grumman.

Conclusion: Almonty Industries – An explosive investment opportunity!

The facts are on the table:

- Tungsten is indispensable for defense and high-tech.

- China has restricted exports – the West is looking for alternatives.

- Almonty is bringing the largest tungsten mine outside of China into production.

- The collaboration with American Defense International highlights its strategic importance.

- A takeover or revaluation is imminent.

Those who position themselves now could profit before the masses. The Almonty share (WKN: A1JSSD | ISIN: CA0203981034 | Ticker symbol: ALI) is massively undervalued compared to MP Materials – but that could change quickly. Whoever controls tungsten controls armaments. Almonty Industries could soon play a key role in this global power play.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.